Global oil demand at 99.3 MMBOPD; Venezuela a question mark on the supply side

Global oil demand growth is accelerating, according to a new report by the International Energy Agency.

The IEA revised 2018 oil demand estimates upward to 99.3 MMBOPD, up 100 MBOPD from last month’s estimate.

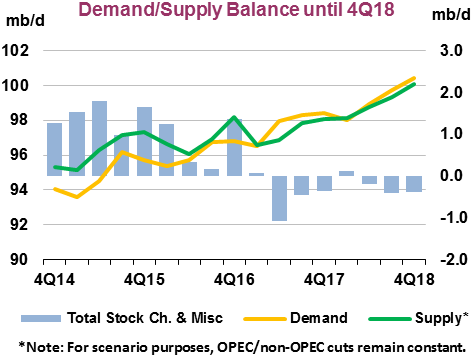

This means the IEA expects demand will grow by 1.5 MMBOPD in 2018, compared to demand growth of 1.6 MMBOPD in 2017. While this does represent strong demand growth, it is overshadowed by non-OPEC supply growth. The IEA expects significant expansion from U.S. shale will boost non-OPEC growth to 1.8 MMBOPD, compared to 760 MBOPD in 2017.

OECD oil inventories rose in January, the first rise in seven months. However, the increase was only half the usual level, suggesting OPEC’s cuts are still draining stocks. Cushing inventories reached their lowest level in three years.

Despite this strong U.S. shale growth, the IEA predicts the global oil market will be in deficit for most of the year, though not to the degree seen in 2017. However, this assumption may not hold true.

With oil inventories approaching the five-year average, OPEC’s original target when the cuts were announced, some nations are considering ending the cuts. OPEC may need to switch its metric for cut effectiveness, and has already began expressing inventories in terms of “days of demand.” Moving away from the five-year average is justified, though, as 2015 and 2016 saw massive inventories. Today’s five-year average is skewed by several years of record inventories, which make large stocks appear normal.

Venezuela could be disruption to supply

The other possible disruption to oil markets has been much in the news, the continued struggles of Venezuela. The IEA notes that the South American producer is “highly vulnerable to an accelerated decline. If this occurred, and other producers did not increase output to compensate, the oil market would be tipped “decisively into deficit.”