United States oil production and its diminishing storage capacity may lead to another drop in oil prices, according the International Energy Agency’s (IEA) Oil Market Report for March 2015. The Agency revised its oil demand outlook upward, but the increase was offset by a similar revision on the production side.

U.S. production is expected to average 12.56 MMBOEPD in 2015, up from February’s estimate of 12.41 MMBOEPD, for a total year-over-year increase of 0.75 MMBOEPD. Global demand was revised upward by to about 1 MMBOEPD, an increase of 0.13 MMBOEPD and is expected to average 93.5 MMBOEPD total in 2015.

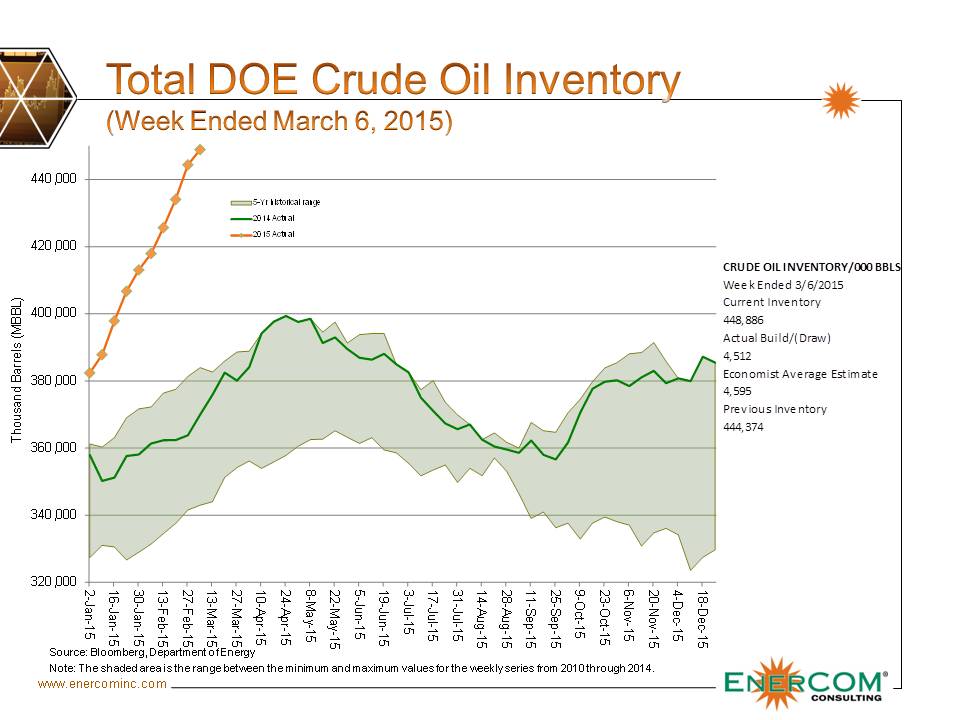

Oil & Gas 360®’s latest Chart of the Week showed the declining rig count in oil plays, but production is maintaining its upward trend even though there are 34% less rigs in action now as compared to December 2014. The Energy Information Administration (EIA) expects domestic production to flatten in April 2015, but companies are diverting sales to future strip prices rather than the current sub-$50 oil market. As a result, the crude oil inventory has ballooned to record levels – more than 66 million barrels have been added since January 2, 2015. Bloomberg’s WTI strip prices for August 2015 declined to $52 from $56 one week ago, but still represent a premium compared to current prices.

Oil & Gas 360®’s latest Chart of the Week showed the declining rig count in oil plays, but production is maintaining its upward trend even though there are 34% less rigs in action now as compared to December 2014. The Energy Information Administration (EIA) expects domestic production to flatten in April 2015, but companies are diverting sales to future strip prices rather than the current sub-$50 oil market. As a result, the crude oil inventory has ballooned to record levels – more than 66 million barrels have been added since January 2, 2015. Bloomberg’s WTI strip prices for August 2015 declined to $52 from $56 one week ago, but still represent a premium compared to current prices.

In the Oil Market Report, the IEA says: “Stocks may soon test storage capacity limits. That would inevitably lead to renewed price weakness, which in turn could trigger the supply cuts that have so far remained elusive. Behind the façade of stability, the rebalancing triggered by the price collapse has yet to run its course, and it might be overly optimistic to expect it to proceed smoothly.”

The EIA provided an update on storage capacity last week, before an additional 4.5 million barrels were stored in the latest inventory update. In the EIA article, the Administration said 60% of storage is now accounted for. At face value, there appears to be plenty of room left, but the East Coast is approaching full capacity and refinery rates are running at all time highs. The Cushing, Oklahoma facility, the delivery point for future contracts, was at 67% capacity – much higher than its 50% capacity in February 2014.

Blood in the Water?

The Organization of Petroleum Exporting Countries (OPEC) has successfully driven down prices, but it has yet to drive down North American production volumes. Its self-touting monthly bulletin believes that next step is right around the corner. In “driving the oil price down, the future of tight oil in North America is now in question, due to the high cost of its extraction compared with the exploitation of OPEC’s conventional crude reserves,” the report said.

John Kemp of Reuters believes OPEC is correct, based on a recent article titled OPEC is winning its battle with U.S. shale. He says, “U.S. shale producers are falling behind in the Red Queen’s Race as the downturn in drilling means that new oil production is failing offset falling output from existing wells.” The Permian Basin is the only region expected to increase month-over-month production in the EIA’s latest Drilling Productivity Report.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.