Chairman of Iran’s oil contracts restricting committee Mehdi Hosseini said that Iran has selected 45 oil and gas projects to show international companies at a conference that will be in London in December 14-16. Hosseini said that Iran would present the projects alongside the finished versions of its new oil contracts, reports Bloomberg.

“We will define projects in the oil and gas sector as much as feasible and necessary since we believe this sector will bring wealth and economic development,” Hosseini said. “As far as this conference is concerned, we have defined around 45 projects which include exploratory blocs at varying development costs.”

Iran may give companies two to three months to decide whether to bid on the projects, he added. “The exact length will be decided by the time of the conference.” Following the conference, Iran will begin asking companies to bid.

New contract model hopes to attract more investment

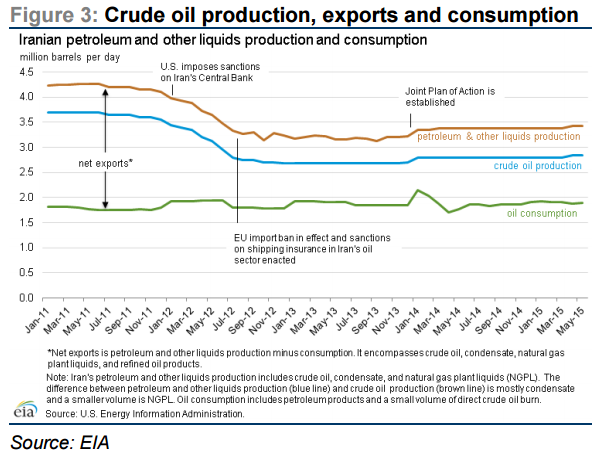

During his interview in Tehran, Hosseini said that Iran hopes to increase its crude production to 5.7 MMBOPD, which is 0.7 MMBOPD higher than the country’s oil minister Bijan Zanganeh said the country hopes to reach. Even to make it to the 5.0 MMBOPD mark, the country will need $280 billion of foreign investment to revitalize its oil and gas sector.

One of the ways Iran hopes to attract international oil companies (IOCs) is through its new Iranian Petroleum Contracts (IPCs). Iran’s laws do not allow for foreign ownership of natural resources, making more traditional production-sharing contracts impossible. “They cannot change the law, but what they have done with the new IPCs is to take a service contract and make it function like a production sharing contract,” Dr. Iman Nasseri of FGE, an international energy consulting group, told Oil & Gas 360® during an exclusive interview.

The final version of the new IPC will not be made available until the London conference, but Nasseri said the draft versions he has seen so far are promising.

“The developers of upstream resources will be paid a service fee per barrel of oil produced, but they have made that fee variable,” he explains. “The fee will change based on the amount of production, whether the project is offshore or onshore, and other factors will also contribute to determining how much the IOC will receive for its services.” By tying the contract to services provided by the IOC, rather than production coming out of the ground, the IPCs hope to attract investors without violating Iranian law.

“We consulted with almost all medium and major oil companies over our contractual contents and projects,” Hosseini said. “And the feedbacks have been positive.”

“The hope with the new IPCs was to make Iran more attractive than Iraq, Brazil or the United Arab Emirates,” said Nasseri.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.