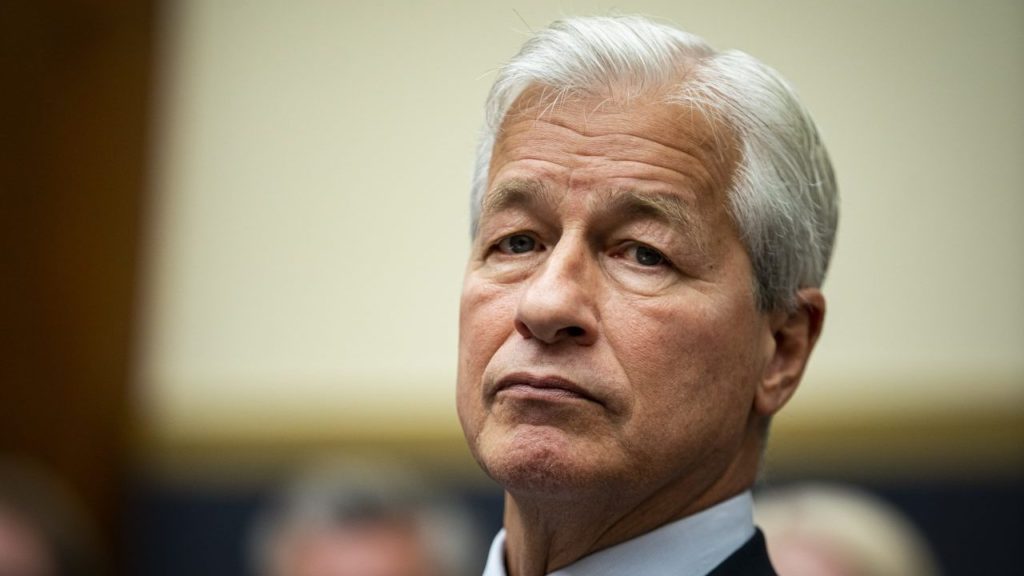

Jamie Dimon, the chief executive of JP Morgan, called on the U.S. oil industry to boost crude production to make up for OPEC+ cuts that could cause a severe shortage in the global oil market.

“In my view, America should have been pumping more oil and gas and it should have been supported,” Dimon told CNBC, adding “America needs to play a real leadership role. America is the swing producer, not Saudi Arabia. We should have gotten that right starting in March.”

Dimon also noted that the oil and gas supply problem is a long-term one and it is interfering with global energy security and even the energy transition by extending dependence on coal.

Meanwhile, the Energy Information Administration reported that the number of drilled but uncompleted wells in the U.S. shale patch in August had fallen to the lowest level since records began in 2013.

This is seen as a good signal because it means that drillers are not leaving a lot of wells uncompleted but are completing them and beginning production. The total of completed wells for August stood at 969 in August, up from a low of 253 in June 2020.

Despite these encouraging signs suggesting production growth, the industry itself remains guarded. The latest Dallas Fed survey, for instance, revealed that many executives in oil and gas are bracing up for a recession, contributing to their problems with cost inflation and supply chain challenges.

The Dallas Fed’s oil and gas industry index fell to 33.1 points from 66.1 points from the second to the third quarter of the year, and its uncertainty index soared threefold to 35.7, Reuters reported last month.

“Our outlook remains positive, but is becoming more uncertain given continued monetary and fiscal tightening coupled with persistent inflationary pressure,” one of the respondents in the Dallas Fed survey said.

By Irina Slav for Oilprice.com