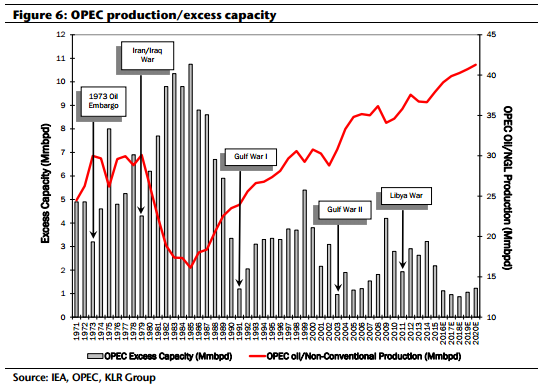

OPEC production expected to stabilize

A recent analyst note from KLR Group indicated that oil and gas markets could balance in 2017 as OPEC production begins to stabilize and U.S. production rolls off. Saudi Arabia’s oil production is expected to stay at about 10.4 MMBOPD, while Iran gradually ramps up production and Iraq’s output moderates.

The crash in oil prices followed OPEC’s decision to continue pumping in order to defend market share, a move in late 2014 that sent the market into a tailspin. KLR expects that Iran will increase production to 3.5 MMBOPD by early 2017, while Iraq’s production will stabilize at 4.4 MMBOPD in 2016-2017. This, in combination with level production from Saudi, should allow markets to rebalance.

With OPEC producing to defend market share, the group will have 1.7 MMBOPD of spare capacity, made up entirely by Saudi Arabia, Iran and Libya. Saudi’s spare capacity will be approximately 0.6 MMBOPD once production stabilizes at 10.4 MMBOPD, while Libya and Iran will have 0.6 MMBOPD and 0.5 MMBOPD of spare capacity, respectively.

U.S. production expected to trough in Q3’17

Adding to the market stability will be a decline in production from the U.S., according to the research note. Supply from the U.S. peaked in Q2’15 at 12.8 MMBOPD, but the rapid decline in the rig count will push liquids production down through 2016-2017.

U.S. production is expected to decline by 0.7 MMBOPD this year, and 0.5 MMBOPD in 2017, before resuming growth. In KLR’s midcycle (2018 onward) estimates, the group anticipates that U.S. production will begin to grow again at a rate of about 0.5-0.7MMBOPD.

The downcycle drove a productivity increase of approximately 20% as operators moved to produce only their most economical assets. This improved productivity will likely start to fall after 2017 as production begins to climb again.

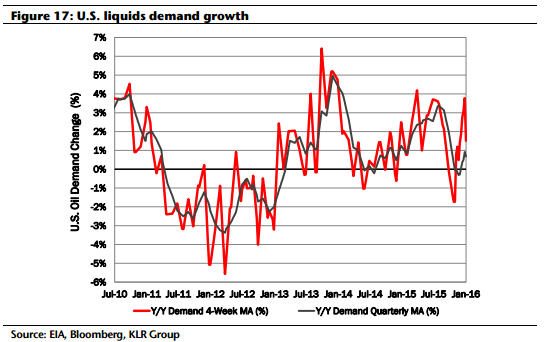

On the demand side, U.S. demand is up about 1.4% from last year on a four-week moving average. Demand growth should continue at a rate of about 0.5% this year to 19.5 MMBOPD driven by low fuel prices, but is likely to moderate once commodity prices begin to rise again.

Oil could go above $80 as production moderates

KLR downgraded its expectations for crude oil prices moving forward, but the group still believes that oil could go above $80 from 2018 forward as markets adjust to supply. The group lowered its 2016 Brent/WTI price estimates by $22.25/$18.75 to $47.25/$46.25. It also lowered its 2017 price deck by $20/$17.50 to $70/$67.75.

Despite the substantially lowered price deck, KLR expects Brent and WTI crudes to reach $86 and $82.50, respectively, by 2018. The “negative supply implication of less global oil resource capitalization is the principal catalyst” for its price target, KLR said in its note.

Demand growth expected to come out of non-OECD countries

The main driver of demand growth continues to be developing economies. Non-OECD countries should see GDP growth of about 4.75% and oil demand growth of 2% per annum through the end of the decade. Developing economies inside the Former Soviet Union are less likely to see the same level of growth, however, as economic recession is exacerbated by weaker oil prices.