Legacy Enters East Texas, More Acquisitions to Follow?

Legacy Reserves LP (ticker: LGCY), a master limited partnership (MLP) with an exploration and production focus, announced significant additions to its growth plan in separate news releases on July 6, 2015.

Legacy Background

The MLP has historically been a very active player on the acquisition market, completing seven deals in 2014 and 16 in 2013. As oil prices went south, management said it would remain active on the M&A front by utilizing its liquidity, which was $591 million at the time of its Q1’15 earnings release.

The liquidity was aided by a 43% reduction to its annual distribution – a move that many analyst firms believed was necessary in the current commodity environment. In an April 2015 note, Raymond James estimated the cut saved LGCY around $70 million on an annual basis. “We now model the company will generate a distribution coverage ratio of 1.17x and 0.80x in 2015 and 2016, respectively, not leaving much room for error next year.” To avoid this risk, Raymond James expected Legacy to complete an acquisition within the year to provide added cash flow.

Fulfilling Acquisition Promise

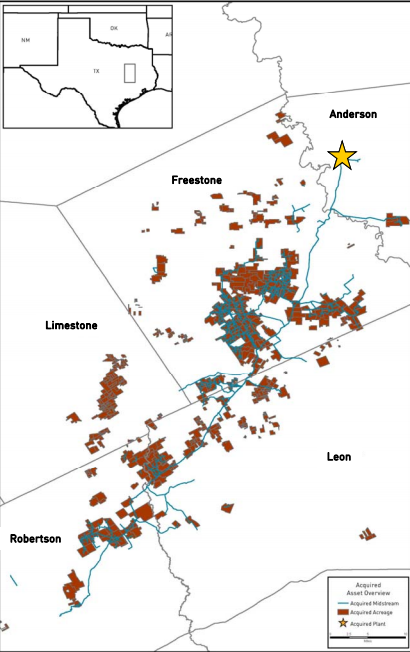

For $440 million, the Midland-based company purchased 89,000 net acres in the gas window of East Texas from affiliates of Anadarko Petroleum (ticker: APC) and Western Gas Partners (ticker: WES). The assets hold estimated proved reserves of 420 Bcfe (100% gas) and estimated Q3’15 production of 70 MMcfe/d (83% hedged through 2019). The forecasted reserves-to-production ratio extends more than 16 years, and 95% of the acreage is classified as proved developed producing. Infrastructure is in place, consisting of 567 miles of pipelines and a 502 MMcfe/d processing plant with access to five markets. LGCY management expects the assets to deliver $60 million of cash flow in the next 12 months.

“This acquisition represents a material entry into East Texas, a region we have wanted to enter for several years due to its long-lived, low-decline, low-cost nature and high potential for bolt-on acquisitions,” Paul Horne, Legacy’s President and Chief Executive Officer, in a conference call following the release. “These high-quality assets combined with the upside optionality of recompletions and a contango gas-curve make this a very attractive acquisition for us.”

LGCY’s borrowing base increased to $975 million from $700 million in accordance with the transaction, leaving the company with $426.3 million of liquidity pro forma the acquisition.

Permian Agreement

The MLP also announced an operating agreement with TPG Special Situations Partners (TSSP) for the development of approximately 6,000 net acres on LGCY’s Permian assets. Management mentioned the assets were offering a 30% rate of return in the current price environment. As part of the terms, TPPS will fund 95% of the horizontal development plan in exchange for an 87.5% working interest. Once TPPS reaches a 1.0x return on investment, its working interest will be reduced to 63% until it reaches a 15% internal rate of return benchmark. Subsequently, its working interest will be reduced to 15% after the benchmark is reached.

Legacy estimates 150 horizontal drilling locations are available across its 6,000 acres (15% of its total Permian acreage) and are prospective for the Bone Spring, Spraberry and Wolfcamp formations. TSSP holds the right to participate in future development of the Delaware and Midland Basins under the same structure.

An estimated $700 million will be required to carry out the program. TSSP has already committed $150 million for the first year of development and will involve a two to three rig system. Overall, TSSP manages more than $12 billion of capital.

“The structure also materially improves our maintenance capital provision giving implied development costs of less than $1 per Boe to Legacy,” said Horne. “This is an asset level structure. They’re essentially a working interest partner, so it has no impact to our capital structure and will not dilute our equity holders in any way.”

Moving Forward

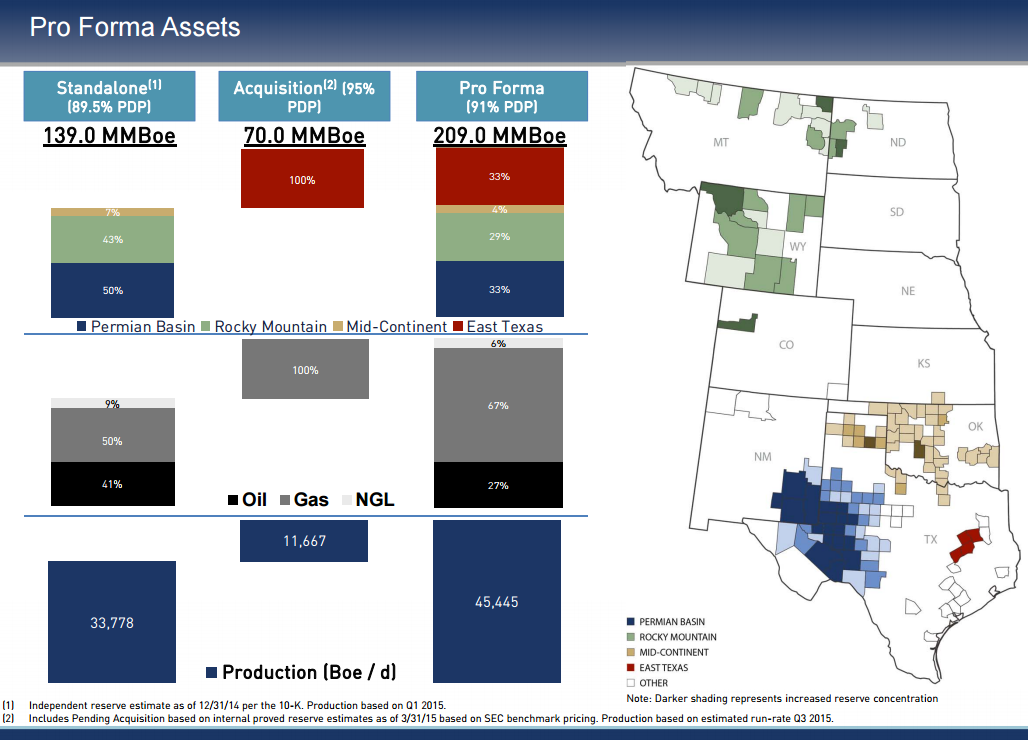

The East Texas purchase made a significant impact to the company’s production and reserve amounts, with the segments increasing by 50% and 34%, respectively. Legacy’s pro forma volumes are 45,445 BOEPD on its 209 MMBOE of reserves.

Raymond James believes, hypothetically, that with $500 million in acquisitions both this year and next, Legacy’s distribution will grow in 2016. “We project the company’s distribution coverage will average 1.25x in 2015 and 1.54x in 2016, even getting as high as 1.89x in Q4’16.”

Despite the sizeable purchase, Horne pledged more acquisitions are on the way. “We are looking at over $400 million of availability, and so we’re not done.”