Steel, aluminum tariffs take effect March 23

When Shell (ticker: RDS.A) released its 2018 LNG Outlook in late February, the global oil and gas major said that surging global LNG demand could lead to possible shortages in the Mid-2020s. Shell said based on current demand projections, it sees a potential for a supply shortage developing in mid-2020s, unless new LNG production project commitments are made soon.

But right now, at least, there is no shortage of natural gas being produced by the U.S.

The shale boom is back in full swing in Q1 2018. Even at today’s moderate natural gas prices, U.S. gas producers are drilling and producing more gas than ever.

EIA estimates that U.S. dry natural gas production averaged 73.6 billion cubic feet per day (Bcf/d) in 2017. The agency forecasts that natural gas production will average 81.7 Bcf/d in 2018, which would set a new record.

LNG export – global market for U.S. gas

The U.S. LNG export industry, still in the nascent stages, is highly capital-intensive, with projects needing to pay for multi-billion-dollar export plants. Only two U.S. export facilities have been completed and are now exporting LNG to the global market—Cheniere Energy’s (ticker: LNG) Sabine Pass and Dominion Energy’s (ticker: D) Cove Point, which just loaded its first export cargo earlier this month.

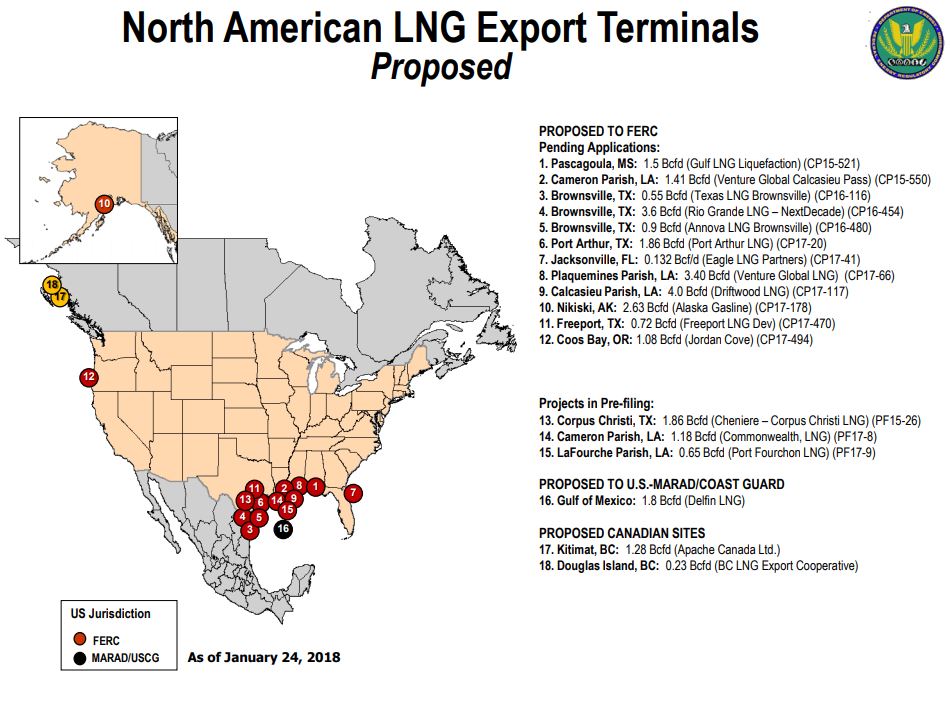

A number of other projects are now in or just beginning construction. Others are seeking financing and approaching FIDs, while others are going through permitting and the EIS process with FERC, early in the approval process.

The fledgling U.S. gas exporting industry is not in favor of new tariffs that would suddenly raise the construction costs of these huge multi-billion dollar projects in a substantial way, according to an LNG trade group.

LNG trade group outlines steel sourcing for LNG plants – for the White House; says some specialty steel not available from U.S. steel companies

In a letter to President Trump, an LNG trade group warned of cost effects of the administration’s 25% steel tariffs on LNG plant construction and new pipeline construction to bring the source gas to the plants for liquefaction and export.

“We urge you to define national security in a way that does not include steel that is vital to the U.S. oil and gas industry in general and U.S. LNG exporters in particular,” the letter from Fred H. Hutchison, president & CEO of the Washington, D.C.-based LNG Allies read.

The group outlined five kinds of steel used in the construction of LNG plants:

- Rebar for concrete – often sourced from the United States

- Structural steel for framing – imported from China, India, Turkey, and Korea

- Cryogenic steel rebar for the outer shell of LNG storage tanks that must withstand extreme temperatures – “This steel must be imported from two specialty manufacturers because no U.S. companies are certified”

- Piping, including a special alloy – imported from several countries.

- Nickel plate steel for the LNG tank inner liner – imported because the sole U.S. manufacturer has limited production capacity.

Gas pipelines use imported steel

Hutchinson point out that U.S. LNG projects “depend upon massive pipelines to move the natural gas from producing fields to the coastal export facilities, and we support the position articulated by the American Petroleum Institute on this matter:

“U.S. pipeline construction and repair activity rely heavily on imported finished goods and imported parts and intermediate materials used for domestic manufacturing of (1) line pipe; (2) fittings; and (3) valves. In recent years, 72% of the steel used in line pipe was imported (excluding slab; 77% including slab). Half of these imports of steel used in line pipe come from countries on which the United States has already levied anti-dumping or countervailing duties.”

Hutchinson pointed to stiff competition in global LNG markets from gas exporters in Australia, Qatar and Russia and how steel tariffs will raise construction costs for new plants and pipelines and reduce U.S. competitiveness. “Increased construction costs resulting from additional steel tariffs, quotas, or other measures could threaten the economic viability of U.S. LNG projects, potentially costing thousands of jobs and billions in export earnings and economic growth.”

The letter said that U.S. LNG export facilities that have currently reached final investment decision will reduce the trade deficit by $24 billion per year, an amount that could double if new U.S. LNG project costs allow them to move forward.

The group said fewer U.S. LNG exports could result in “U.S. natural gas production being “shut-in” with negative effects on America’s own energy security.”

The Houston Chronicle reported this week that Tellurian said U.S. steel tariffs could elevate the costs of its $15.2 billion Driftwood LNG export terminal that’s in early construction phase on the Gulf coast.

The LNG export promise became a reality in early 2016 when Cheniere Energy (ticker: LNG) started commercial liquefaction and export operations from its Sabine Pass project. Exporting U.S. natural gas has offered hope for U.S. gas producers in the Marcellus and other large resource basins that have tremendous gas reserves waiting to be produced and sold.

LNG projects in the pipeline

Kinder Morgan’s (ticker: KMI) Elba Island LNG export project says its initial liquefaction units are expected to be placed in service in mid-2018, with final units coming on line by early 2019. The Freeport LNG project is expected to begin operations at its Quintana Island terminal in late 2018 or early 2019. Sempra Energy’s (ticker: SRE) Cameron LNG expansion project in Louisiana is looking at a projected 2019 date. Sempra has proposed another LNG liquefaction and export project in Port Arthur, Texas. Cheniere is looking to expand Sabine Pass and the company’s Corpus Christi export terminal is presently under construction with possibly late 2018 as a date to begin liquefaction operations. Tellurian’s (ticker: TELL) Driftwood LNG project in southern Louisiana is looking for a FID in late 2019, with operations targeting 2023.