Lonestar Resources, (OTCQX: LNREF, ASX: LNR), an oil and gas company with assets in the Eagle Ford and Bakken shales, reported its Q4’14 earnings on February 2, 2015. The Fort Worth-based E&P reported several company records despite the challenges associated with one of the most difficult quarters many producers have seen in years.

Q4’14 Results

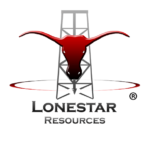

Lonestar averaged net volume of 5,816 BOEPD (87% liquids) in Q4’14, which represents respective increases of 25% and 54% compared to Q3’14 and Q4’13. EBITDAX reached $27.3 million in Q4’14 along with net income of $25.4 million, which are quarter-over-quarter increases of 17% and 33%. In the earnings release, LNR management credited the gains to the performance of new wells in its central Eagle Ford position.

Hedges resulted in an unrealized gain of $14.1 million in the quarter, and the company increased its hedge position for 2015 to cover 2,496 BOEPD for an average strike price of $88 per barrel.

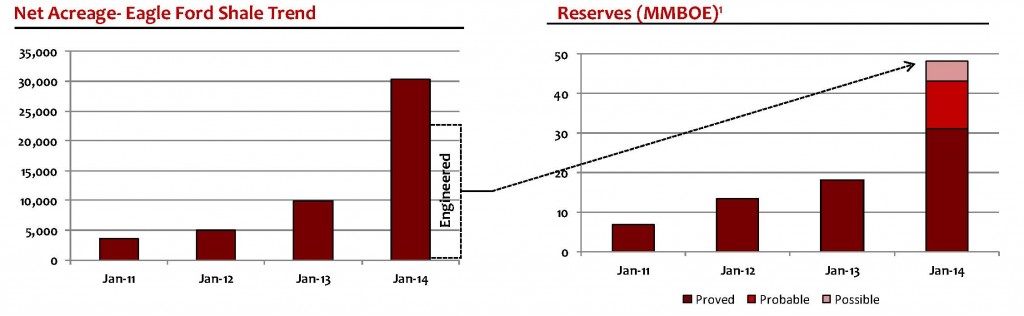

The company also reported its reserves, as determined by independent consultants, totaled 31 MMBOE – an increase of more than 70% from its 2013 year-end results of 18.2 MMBOE. The assets hold a PV10 value of $705.8 million. For a full reserve report, click here to be directed to Lonestar’s complete reserve update.

Position and Gameplan

The company has doubled its acreage position on a year-over-year basis since its inception in 2012, and now holds net acreage positions of 30,306 Eagle Ford acres (100% ownership) and 34,163 net Bakken acres (52,559 gross). The Bakken has tested light oil, but all production is currently being pumped from the Eagle Ford. Tests and analysis of its Poplar West assets in Montana have revealed an estimated 420 drilling locations and is intended to be developed through a farm-out process.

In light of the current commodity environment, LNR is electing to drill 15 gross wells with one operated rig in 2015. In a conference call following the release, Frank Bracken III, Managing Director of Lonestar Resources, said only two of the wells are obligated for completion, meaning the company can drill the remaining 13 at its discretion. Production guidance for 2015 is expected to be in range of 5,700 to 6,100 BOEPD, which is essentially flat compared to Q4’14 production. EBITDAX guidance for full-year 2015 is projected at $84 to $95 million, which is consistent with averages from 2H’14.

Based on recent results, the company’s banks confirmed an increase in the borrowing base to $150.0 million from $108.8 million. The company currently has $100 million in excess liquidity and expenditures for its drilling program are expected to range from $74 to $83 million. The company is actively seeking to expand its stake in South Texas. In the call, Bracken III said: “We are engaged in acquisition discussions across each of our regions, and all of our prospects are generally bolt-on opportunities. I expect the floodgates to open following our credit redetermination in the spring, but we’ve been bombarded with opportunities in recent weeks. You don’t want to overextend too soon, but I’d be disappointed if we don’t have a tuck-in acquisition to discuss in our next call.”

Eagle Ford Update

In the western region, LNR initially deferred completion of its three horizontal Gerke wells but flowback is expected to commence within the next seven days. Well costs are projected at $4.9 million apiece. Three additional wells are currently being drilled to depths of 8,000 feet and fracture stimulation is expected to commence in March 2014. The western trend accounts for approximately 60% of all of LNR’s production.

LNR’s central region holds the company’s deepest wells drilled to date, with its three Harvey Johnson horizontals reaching average true vertical depth of 9,710 feet at completed net costs of $6.8 million (50% working interest). The wells are out-producing type curves in their first 60 days of production and three more wells are planned to be drilled on acreage that is “immediately contiguous” the first three. Two additional laterals are expected to be drilled in its newly-acquired Pirate Area acreage in the upcoming year.

The eastern trend in Brazos and Robertson counties were the beneficiary of three new wells in the most recent quarter. Keep an eye on results from Apache Corporation (ticker: APA), a large cap E&P who recently placed an estimated 10 wells into production nearby LNR’s Brazos operations.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.