Oil at highest price since 2014, gas at 13-month high

Oil inventories approaching five-year average, NatGas below 5-year

Oil and gas inventories have been making waves this week, with both commodities generating major headlines.

Oil inventories fell this week, dropping by 1,071 MBBL. This marks the tenth-straight week of falling oil inventories, the longest drop on record. The previous record of nine weeks was set in July 2016 and matched in August 2017. Inventories have fallen by a total of 47.4 MMBBL in the past ten weeks, making it the second largest sustained decline behind the 51.4 MMBBL drop in August 2017.

The inventory draw has gone a long way toward accomplishing OPEC’s goal of returning stocks to the five-year averages. In November, when the current draw began, inventories were 14% above the five-year average. The most recent data indicates inventories are only 4% higher than the five-year average, meaning the “return to normalcy” is progressing well. For reference, in February 2017, when inventories peaked, stocks exceeded the five-year average by more than 40%.

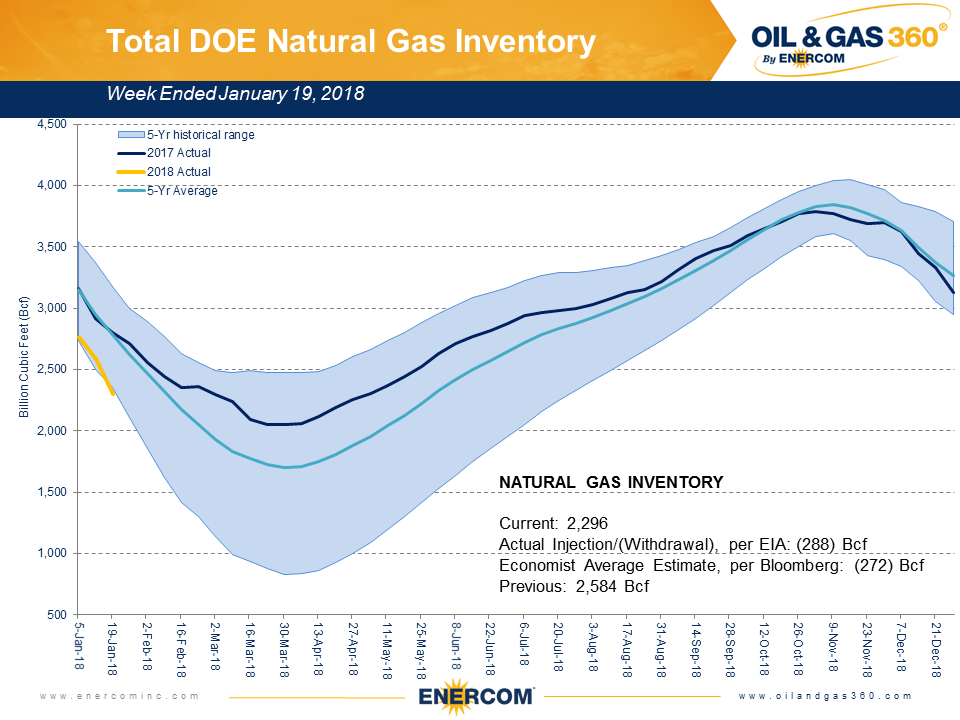

Gas inventories below five-year range

Natural gas inventories are also falling rapidly, driven by recent weather. Inventory data released today indicated stocks fell by 288 Bcf in the past week, the fourth large draw in a row. Unlike oil inventories, gas stocks have not been fighting a glut, and actually began the winter draw slightly below average. The recent large draws, therefore, have pushed stocks to 2,296 Bcf, which is below the five-year range. This situation is in large part the result of the large nor’easter which chilled much of the northeast in early January. In the first week of January inventories dropped by a record-breaking 359 Bcf.

Overall gas inventories are 17.5% below the five-year average, but stocks in the South Central region are even lower. Salt storage in the South Central region are currently 45.1% below the five-year average, and less than half of the level seen at this time last year.

Continued winter weather is likely to keep gas stocks below the five-year average for the remainder of the draw season, a prospect confirmed by analyst estimates for March inventories. According to Bloomberg, the average analyst predicts inventories will be 23% below the five-year average at the end of March.

Oil at highest price since 2014, gas at 13-month highs

These inventory draws have translated into prices, as each commodity has received a boost in the past month. WTI is currently trading just below $66/bbl, after reaching $66.66 in intraday trading. Oil prices have risen by $11/bbl in the past ten weeks, and are at the highest point since 2014.

Gas prices have also risen sharply on the cold weather and inventory draws, reaching a 13-month high of $3.62/MMBTU in intraday trading yesterday. Gas prices have been rising sharply since before Christmas, when prices bottomed at $2.60/MMBTU.