All four basins are competing very strongly. That’s a great problem to have – Tillman

Q3 highlights

- Total production excluding Libya averaged 371,000 net BOEPD, up 6% sequentially and above top end of guidance; 23,000 net BOEPD from Libya

- U.S. resource play production increased 12% sequentially, averaging 227,000 net BOEPD; oil up 14% sequentially

- Eagle Ford production of 101,000 net BOEPD up slightly

- Bakken production grew 20% sequentially to 59,000 net BOEPD; five Hector wells averaged 30-day rates of 2,380 BOEPD (85% oil)

- Net loss of $599 million, or ($0.70) per diluted share

- Net operating cash flow of $564 million

- Anticipated full-year 2017 free cash flow neutrality, including dividends and working capital

U.S. E&P

Eagle Ford

Marathon Oil Corporation President and CEO Lee M. Tillman said that Eagle Ford production was up from Q2, despite the impacts from Hurricane Harvey. He also said, “Through three quarters of the year, Eagle Ford’s 90-day cumulative well production was tracking 15% above last year’s, while maintaining flat completed well cost.”

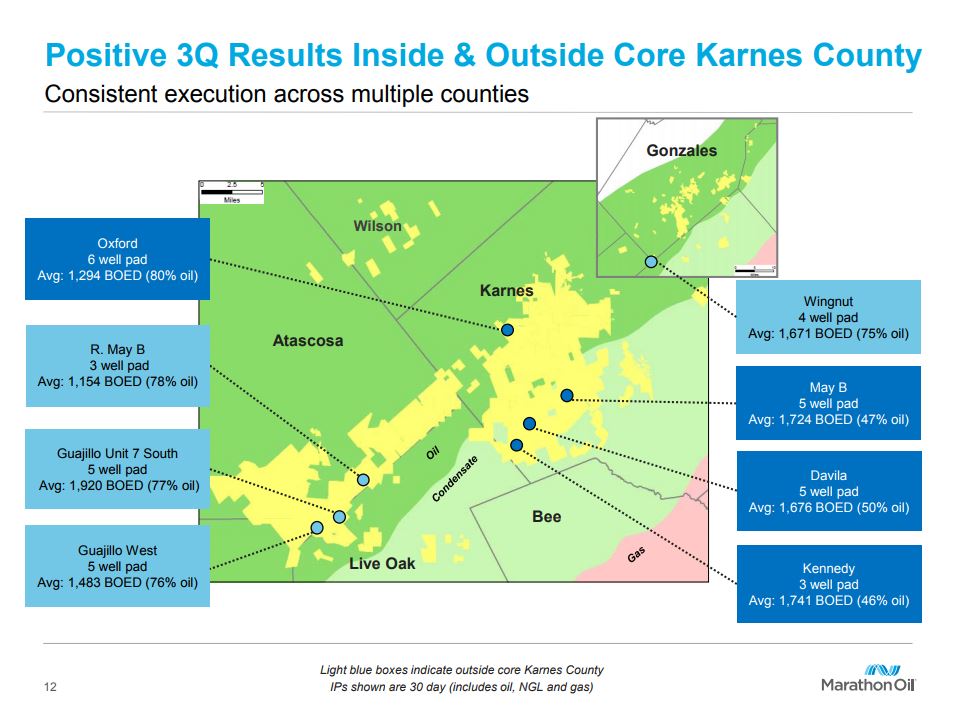

The Guajillo South five-well pad averaged 30-day initial production (IP) rates of 1,920 BOEPD (77% oil) with 6,100-foot laterals. Marathon brought 36 gross company-operated wells to sales in Q3.

Bakken

Commenting on the Bakken, CEO Tillman said, “This year’s program is performing even above the step-change improvement we saw in 2016. The five Hector wells we brought online during the quarter are beginning to put their productivity on par with our Myrmidon area.”

The Clarice Middle Bakken well in the Hector area set an industry record for the best 30-day oil rate in the Williston Basin with 2,785 BOPD (3,285 BOEPD, 85% oil). The next Hector pad is much farther to the East, and 24-hour test rates from the first two wells were 5,900 and 2,650 BOEPD.

Marathon brought 20 gross company-operated wells to sales in Q3, including eight in West Myrmidon, seven in East Myrmidon, and five in Hector.

Oklahoma Resource Basin

Marathon brought 15 gross company-operated wells to sales, and an early test of the Osage in Kingfisher County resulted with a 30-day IP of 850 BOEPD (55% oil) with a 4,700-foot lateral. The Landreth, a STACK Meramec leasehold well in the volatile oil window in Blaine County, had an average 30-day IP rate of 2,420 BOEPD (59% oil) with a 4,600-foot lateral. Overall, the Oklahoma Resource Basin increased production by 18% sequentially to 58,000 net BOEPD.

Northern Delaware

- Production averaged 9,000 net BOEPD; two Wolfcamp X-Y wells (both 4,600-foot laterals) had 30-day rates of 2,020 BOEPD (67% oil) and 1,500 BOEPD (69% oil)

- Added fourth rig in October

Q4 production guidance

- S. E&P production available for sale to average 255,000 to 265,000 net BOEPD

- International E&P production available for sale, excluding Libya, is expected to be within a range of 120,000 to 130,000 net BOEPD

Conference call Q&A

Q: It appears all your unconventional basins are competing for capital here, as are individual focus areas within the basins. I know you have strategic priorities in terms of holding and testing PayRock and Delaware acreage in 2018. But could you walk us through the 2018 strategic priorities and then the broad rank of basins where incremental CapEx dollars could flow?

Marathon Oil Corporation President and CEO Lee M. Tillman: We’re still in the process of fully integrating 2017 performance data into our capital allocation optimization. Much of the data we’re sharing in the third quarter, we’re still building in to our forward-look. And as we go through our, I’ll call it, four-basin optimization, we want to make sure that we’re using the absolute best, not only technical data and productivity data, but also cost data, so that our decisions are driven by a return focus, and that’s really within that, I’ll call it, discretionary bucket.

The strategic objectives really are pretty consistent with the ones that we talked about for 2017, and they really revolve around in those limited areas now, which are the STACK and Northern Delaware, where we have leasehold requirements. Those, of course, will be at the very top of that list. The continued work on delineation in both the STACK as well as the Northern Delaware, and then finally, the infill pilot work that is ongoing, really not only in the STACK, but even starting in the fourth quarter in Northern Delaware. Those, in my opinion, are really that element of our program that’s strategic in nature that we want to drive, because that’s really setting the tone and the cadence for the business in the future.

Within the discretionary program, it’s going to be all based on where we believe we can generate those highest risk-adjusted returns, and that’s where the integration of a lot of this new data is going to be essential and vitally important, so that we make the correct calls on that development program, if you will. And you’re right, all four basins are competing very strongly. That’s a great problem to have, to have that type and level of opportunities. And that work really is what we’re doing currently. And more to be revealed clearly next year, where we’ll get into basin-by-basin capital allocation.

Q: Can you give us an update as to what proportion of Bakken acreage you now believe is de-risked?

CEO Tillman: What I would say is that although we’re really encouraged with the Hector results, we still have a limited number of pads. We shared some 24-hour IPs from this Far Eastern pad and that really stepped us across the play, but we still have some work to do in between kind of where we know we have good well control, which is where the initial pads were. Also, we still need to kind of test that further to the South as well, not just to the East.

We’re beginning to migrate a material amount of the Hector inventory toward Tier 1. So, I don’t have an acreage percentage for you. But as we move through and get a little bit more well control across that full 115,000-ish acres, I think we’ll be in a much better position to share more quantitative metrics with you around what does that inventory truly look like going forward.

In regard to capital allocation, because of the oil weighting, because of the capital efficiency of these wells, without a doubt, they have moved considerably in the priority order for capital allocation, particularly the Myrmidon, that very geologically advantaged area. But the Hector results that we’ve seen, particularly in the pads that we’ve drilled, are even crowding the Myrmidon performance. So, we feel really good that those are going to be near the top of our capital allocation priorities.

Q: Would you potentially be in a disposal mode in order to focus down the asset base on where you are improving most rapidly?

CEO Tillman: Bakken and Eagle Ford continue to surprise to the upside. You just have to look at the well results and the capital efficiency that’s being generated within those two basins. I think within the Oklahoma Basin we still view the 340,000 net acres that we have as a tremendous high-return growth engine for the company going forward. I think we’re still just in the very early days.

As for the development of the STACK, we’re still in very much of a leasehold, delineation, and pilot mode there. And so, we should expect some variability of results. But I wouldn’t extrapolate the variability in results to mean that we don’t remain very keen on the development of that and bringing it up to a similar standard of efficiency that we’ve observed in our more mature basins.

Northern Delaware is an even further kind of upstream from a development standpoint. And there, we’re really just getting started. I think we’re starting very fast there. I was just out in the field a few weeks ago. When I look at the efficiencies that are already being generated on the drilling and completion side, I’m very pleased how rapidly we’re coming up the learning curve there. And I think now, it’s just a question of getting some more at-bats, continuing to generate the types of results that we’re starting to see this quarter.

We’re going to be very focused on continuing to try to further consolidate our significant position there. But we’re very – very confident in the Northern Delaware as an area that’s going to demand more capital, certainly going forward into 2018. Case in point, we picked up a dedicated frac crew at the beginning of this quarter and – as well as just added a fourth rig there.

Q: My question goes to some of the productivity gains that you’ve been talking about both in the Bakken Hector area and others. Can you just talk to where, in your four key plays, you think recovery rates of oil in place are and what you see as the scope for further productivity gains over the next couple of years?

Marathon: We think what is compelling about the resource plays, and to some extent, the four-basin nature of our portfolio is that we’re able to quickly leverage things we learn in one asset to another. And the Eagle Ford has been kind of been our high-activity basin for the past several years and it’s where we often pilot and trial new technologies or operational efficiency gains such as a larger drill pipe and offline cementing.

We’re able to use machine-learning techniques to optimize that and drive higher uptime through upset periods or through artificial lift optimization. We’re now transferring that to other basins. So, we should not be surprised to see continued efficiency gains going forward. The rate of change in the Bakken has certainly been the most dramatic, and in terms of extending this integrated workflow that we trialed and tested in Myrmidon in 2016, pushing that down into Hector now with the same workflows and very impressive results.

Northern Delaware has seen a very high rate of change as well. We’ve seen that as one of the catalysts for us getting in at the time we did, and we’re now able to employ our completion designs combined with our facility and engineered flow-back structures. And that is becoming evident in the types of wells that we released there in Eddy County, the two Wolfcamp X-Y wells.

So, from a recovery standpoint, we’re dealing with a lot of different reservoirs across these basins and we’re still in the optimization mode. So, it’s difficult for us to quantify for you a single number or a single rate of change. But certainly, from a returns-focus and a value-focus, which is really where we’re driving our teams and our business, this is all moving towards the positive.