Acute need: 6 new pipeline projects under construction + 19 awaiting approval could add 3.5 Bcf/d capacity in 2015

The United States natural gas boom, spearheaded by the expanded development of the Marcellus Shale, has boosted the country to become the world’s top natural gas producer. Reports from the EIA show production from the Marcellus has increased, on average, by 280 MMcfe/d by month since 2007. Below the prolific play lies another giant: the Utica Shale. The Utica, although deeper than the Marcellus, is believed to hold a resource base of 15.7 Tcfe of recoverable resources, according to the Energy Information Association’s (EIA) 2012 Annual Energy Outlook. The United States Geological Survey estimated the region holds as much as 38.2 Tcfe of recoverable gas and spans six states in the northeast.

ICF International (ticker: ICFI) projects total gas production in the region to reach 34 Bcf/d by 2035, according to its Q2’14 Detailed Production Report. The target number would represent an increase of 36% compared to projected production of 25 Bcf/d in the company’s Q1’14 report. ICF also increased the estimated ultimate recovery (EUR) of wells from both plays, with the Marcellus increasing to 6.2 Bcf from 5.2 Bcf (19% higher) and Utica wells to 3.3 Bcf from 2.5 Bcf (32% higher).

The Detailed Production Report projects the rise in EURs due to improvements in drilling technology. The new technology will lead to closer laterals and faster drilling times. In all, a total of 2,550 wells are expected to be completed in the region annually, including 2,050 in the Marcellus and 500 in the Utica. The report from the previous quarter estimated total 2,045 well completions, with the Marcellus and Utica accounting for 1,750 and 395 wells, respectively.

Capacity Increases Necessary

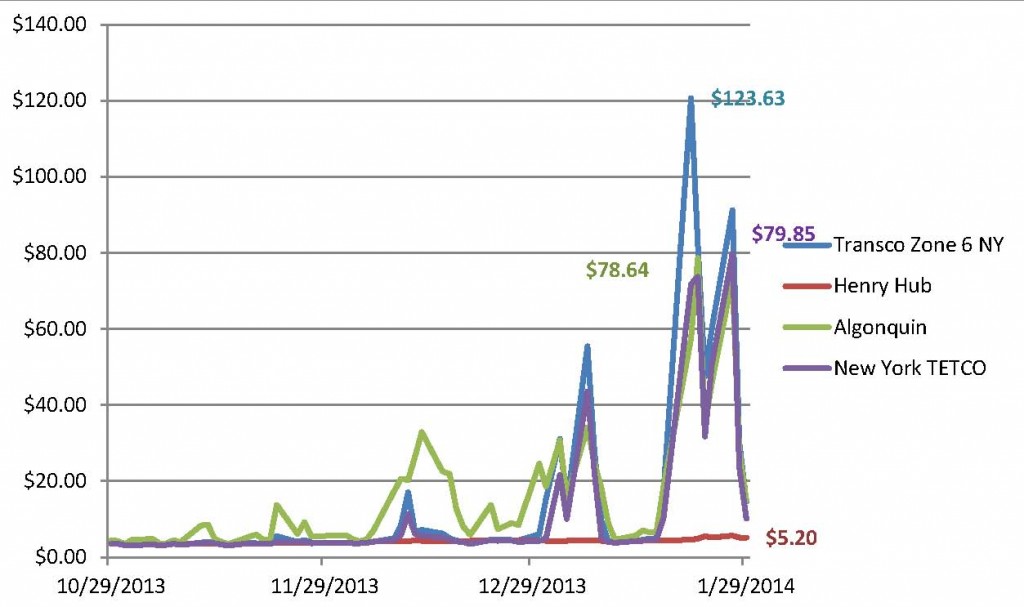

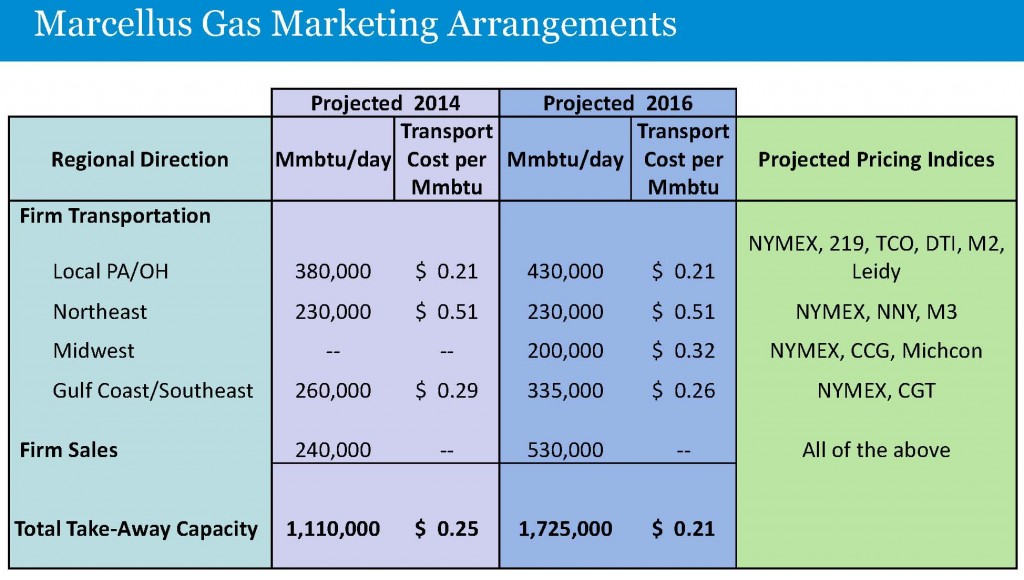

Increased production, however, must be equaled with increased takeaway capacity. The Marcellus has grown so rapidly that infrastructure has struggled to keep pace – the Algonquin pipeline to New England, for example, was operating near maximum capacity in 2012. The harsh winter wreaked havoc on gas pipelines, catapulting spot prices in the Northeast to more than 20 times the Henry Hub price. The constrained gas markets from winter have affected natural gas storage levels to this day, and are currently 31% below the five-year average. As of November 2013, six new pipeline projects were under construction and an additional 19 were in various stages of the approval process. The EIA expects the expansions to add 3.5 Bcf/d of capacity by 2015.

Source: RRC June 2014 Presentation

The Oil & Gas Journal reports that Greg Hopper, Vice President of ICF International, said the spread between oil and natural gas prices has made natural gas liquids (NGLs) more valuable than dry gas. The Marcellus and Utica have higher amounts of NGLs compared to more traditional gas plays like the Barnett and Haynesville. As a result, exploitation of the Marcellus/Utica continues to rise while production of other gas regions continues to fall.

The ethane and propane components of NGLs add to the infrastructure strain. Ethane, in particular, is being rejected due to transportation limitations and remains in the pipelines. Companies like Range Resources (ticker: RRC) are diversifying their market portfolio to increase sales. Range has developed a market based purely off of ethane and has contracts in place to distribute 75 MBOEPD of ethane production to three different LNG hubs across North America. Once operational, the pipelines will provide a 25% cost uplift as opposed to selling the gas as a BTU, said RRC management.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.