A lot of core, an electron microscope, and complex completions

When Mark Williams began his lunchtime talk at last week’s AAPG national convention, except for a few knives and forks clinking plates you could have heard a pin drop.

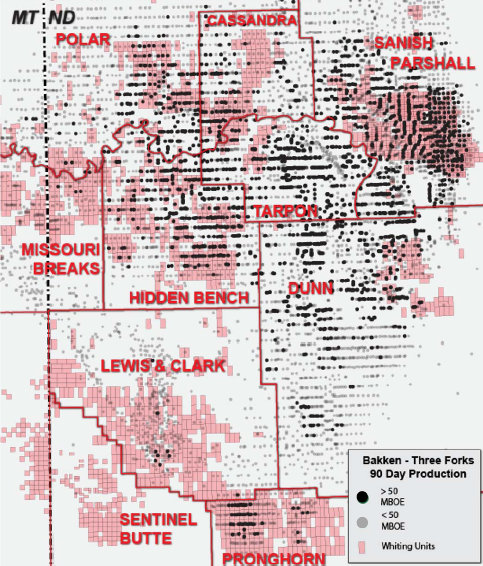

The full room, packed with about 200 of Williams’ fellow geologists and other industry pros who trekked to Denver with 6,000 other AAPG attendees, soaked in Williams’ detailed account of his company’s foray in the Williston basin, from the earliest head-scratching days all the way to where Whiting Petroleum Corporation (ticker: WLL) is today—the basin’s largest producer.

As senior VP of exploration and development for Whiting, Williams oversees the company’s upstream activity and capital budget and leads Whiting’s efforts to identify, quantify and develop unconventional oil reservoirs. Williams has degrees from the University of Utah and the Colorado School of Mines.

Bakken

After recounting the early development of unconventional resources in North America, Williams focused on the Bakken and shared details from his personal knowledge of the Williston basin, walking the audience through technical aspects of basin geology, detailed analysis of different plays in the Williston, his company’s exploration methodology, the high value returned by their detailed reservoir analysis, a discussion of Whiting’s most successful completion techniques and the overall management of one of North America’s most significant oil resources.

He described geologists’ early attempts to identify the source rock, and understand the maturity and expulsion characteristics in the Bakken. Williams said Whiting was leasing in the Williston between 2004 and 2006. “The advent of hydro-fracturing and multistage completion technology kicked off the Williston basin” development boom.

Core is King

“Whiting’s hallmark in the Bakken is acquiring our core,” Williams told the audience. He described core libraries that reside on several floors of the company’s Denver headquarters. “We have a voracious appetite for core.”

Williams discussed how his company gained an understanding of the play from looking at their core and that of other operators willing to share information and core samples.

He discussed the leap forward Whiting took when it acquired, for a fraction of the cost to drill one well, a scanning electron microscope that allowed their geologists to gain knowledge from “detailed mineralogy down to two nanometers. You can get a true 3D representation of your reservoir.” Williams discussed how the electron microscope allowed them to see and measure the flow patterns of the micro pores in the plays they were drilling. “After that it became the engineers’ play–to figure out how to make this reservoir work better.”

Complex Completions

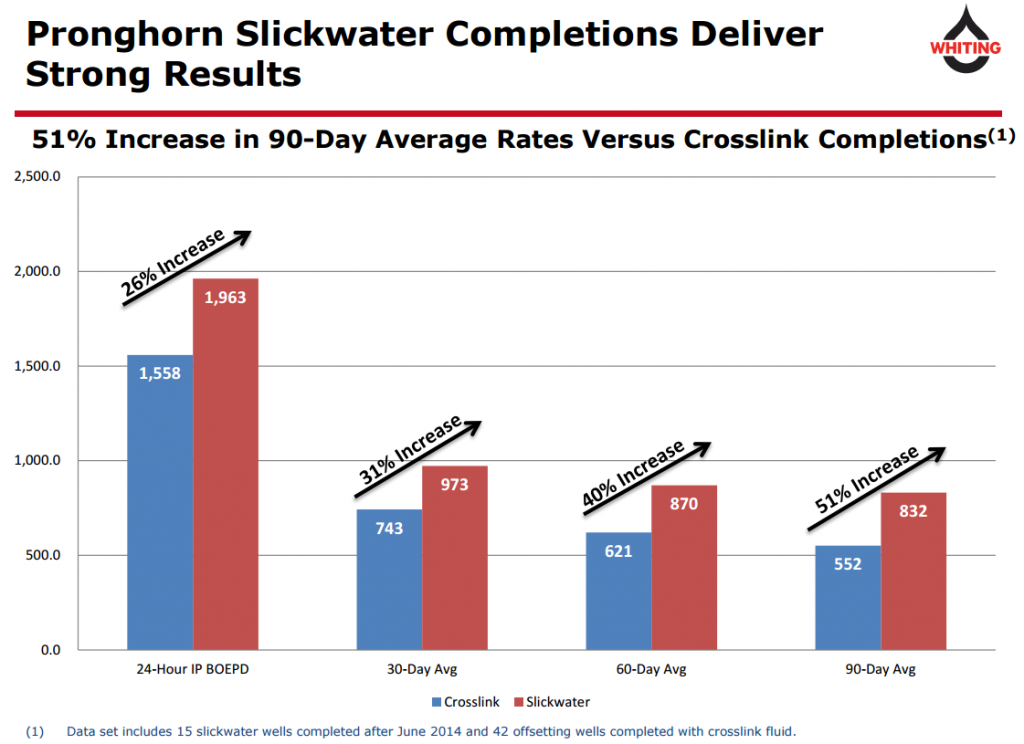

“We really had to sharpen our pencils with respect to how to do the completions,” Williams told the audience. His presentation spent considerable time discussing how from 2011 – 2013 Whiting did plenty of experimenting on how to best complete the wells. He said they did a lot of packer completions before 2012, but between 2012-2014 they began using cemented liners and slickwater fracs. “We saw a significant uplift with slickwater fracs,” but he emphasized that every completion could be customized, and that completions in the Bakken are different from the Three Forks formation.

He said that one thing they found to be consistent was a “firm, strong correlation between higher volumes of sand and better production … which means higher volumes of water, higher horsepower and using slickwater to move the proppant, and keeping the sand in suspension using small proppant size.”

Williams said with the evolution of completion techniques and their increasing level of complexity, that the company has increased the number of stages, increased the number of entry points, and they’ve learned how to “break the reservoir into smaller pieces.”

Whiting’s completion evolution in the Williston is as follows:

2012: Sleeves and Packers with 90 perf clusters, or entry points

2013: Cemented Liners with 720 entry points

2014: Slickwater with 960 total entry points

During the Q&A, Williams discussed managing water needs and how the company learned it could cut water costs to $1.50 per barrel, down from $4.00. Other cost cutting efficiencies included reducing the number of drilling days all the way down to just 8-9 days per well.

Another question asked how much oil they ship by rail. Williams said about 30% – 35% goes by rail and 65% – 70% by oil pipeline.

What’s Next for the Bakken?

“There are something like 10,000 horizontal wells in the Bakken – we might see re-fracs as the next big opportunity,” Williams said.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.