Sale ends Murphy’s 20-year Malaysian history

By Richard Rostad, analyst, Oil & Gas 360

Murphy Oil (ticker: MUR) announced a major divestiture today, selling the company’s Malaysian assets to focus on its Eagle Ford development.

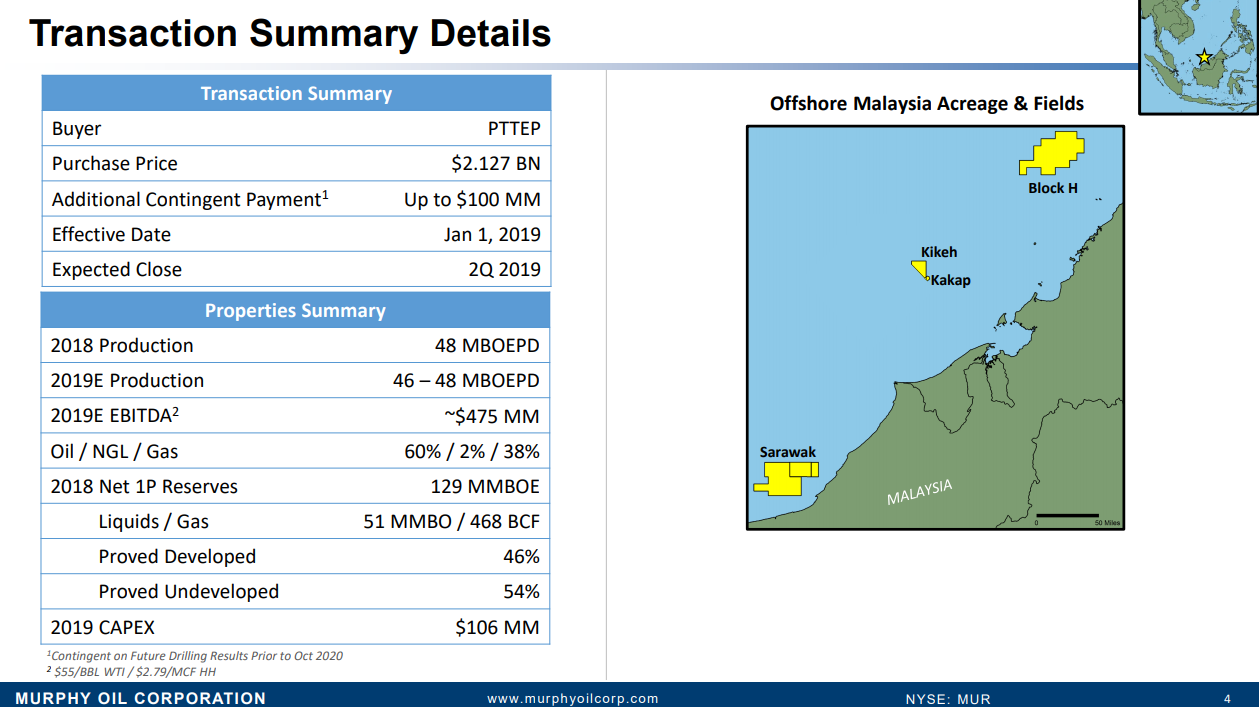

Murphy will sell its entire Malaysian portfolio, consisting of three offshore fields in the eastern portion of the country. These assets produced 48 MBOEPD in 2018 and were expected to produce the same or slightly lower volumes in 2019. The fields hold a combined 129 MMBOE of reserves, over half of which is undeveloped. Murphy planned to spend $106 million in CapEx on its Malaysian assets in 2019, generating $475 million in EBITDA.

Murphy will receive $2.127 billion in cash for its Malaysian assets, plus an additional $100 million if certain exploratory activities generate success. Thailand’s NOC PTT Exploration and Production is the buyer. The deal is expected to close in Q2 2019 and will mark the end of Murphy’s 20-year history in Malaysia.

A purchase price of $2.127 billion equates to $44,300 per flowing BOEPD, significantly above the average valuation seen in recent GOM M&A transactions. Valuations in the Gulf in 2018 averaged $31,000 per flowing BOEPD, so Murphy’s deal valued its Malaysian assets almost 50% higher than GOM properties. The price also equals $16.49 per BOE of reserves, in line with the limited data available from last year’s Gulf deals. Based on Murphy’s 2019 EBITDA forecast, which assumes $55/bbl WTI and $2.79/Mcf Henry Hub, the price equals just under 4.5 times yearly EBITDA.

Proceeds will fund debt reduction, share repurchase, and M&A dry powder

Murphy has already earmarked the proceeds from the sale for several uses. About $750 million will be used to pay down debt, including entirely paying down the $325 million balance on Murphy’s revolver. Murphy will spend $500 million in a new share repurchase program, buying back $300 million in shares this year and $200 million in 2020. The remaining $750 million will go to the balance sheet, potentially funding M&A prospects. Murphy will have over $1.1 billion in cash available, and the company is considering both U.S. deepwater and onshore possibilities.

Divesting Malaysia will increase Murphy’s focus on its U.S. onshore properties, which primarily consist of its Eagle Ford assets. The Eagle Ford will drive most of the company’s five-year growth, with asset-level production expanding by 15% per year. Murphy is currently spending about $700 million in the Eagle Ford per year, a value that will approach $1 billion by 2023.

Murphy CEO and President Roger W. Jenkins explained the company’s long-term plan in a conference call today, saying “Over the next 5 years, our plan is to primarily focus on our assets in the Western Hemisphere. Like I said before, we expect to grow production by 8% compound annual growth rate. In terms of the Eagle Ford business, we expect to increase the number of rigs to between 3 to 4 per year for an annual CapEx of around $700 million. We anticipate this plan would deliver a 15% annual growth rate in production for this asset. Furthermore, we believe we have a deep drilling inventory ahead of us. And as we exit 2023, we’ll still have over 1,000 locations yet to go.”

“In onshore Canada, given the natural gas price scenario, we’re deemphasizing the Upper Montney and are limiting our annual capital to $50 million per year in this particular assumptive case. The decrease will only be experienced in the Kaybob post 2019, then drilling will — for lease retention only in 2020 and 2021, with spending between $50 million to $100 million per year. Even with this low CapEx, the Kaybob, Duvernay will still deliver approximately 4% compound annual growth rate in production. However, with Canada, we still believe that both of these assets are great over the long term and there may be some opportunity to increase the level of activity should market conditions improve. “

“In the Gulf of Mexico, we’re planning for capital over the next few years to average approximately $200 million per year. Through a number of currently available opportunities within our asset base, this should maintain our current production level. Within our exploration strategy, more broadly, across geographies, we anticipate drilling around 3 to 5 wells per year with an average CapEx spend of $100 million a year.”

Q&A from MUR conference call

Q: I wanted to ask you a little bit about how you’re thinking about reinvestment for the $750 million that you plan to earmark for, call it, A&D. On our numbers, the Malaysian assets were going to generate just north of the $300 million in free cash flow. So my first question is, what is the profile of the assets that you may be looking for in the U.S. onshore? Are these free cash flowing assets today or more to build inventory depth at Murphy in your U.S. onshore segment?

MUR: What hurts the onshore, to be quite honest, is it’s hard to find a free cash flow-providing onshore asset. It would have to be quite sizable. So it points us to more work in the offshore, quite frankly. When we say onshore, there may be some bolt-on opportunities that have some production that will allow us to increase inventory. But really, Arun, for us is — what we’re proud of is being an oil company. We’re Murphy Oil Corporation. We’re an oil business and we’ve kept a strategy of being able to do offshore work, build a team that’s very successful in doing onshore work. This allows us to look at all kinds of different opportunities. But we are going to be Western Hemisphere focused on all those opportunities, for sure. And that would lead to more Eagle Ford and to Gulf of Mexico from an M&A perspective. So we’re looking for free cash flow accretive assets that do not have declining production profiles, that are available. We do not disclose the ones we’re looking at, but we’re always working that and have been working that very hard for the last couple of years. And we did a major deal just a quarter ago.

Q: One thing I was wondering was what’s different this time. As far as I see, there’s been a potential to sell those assets for many years. What changed in that regard? And I guess I’m really thinking of the M&A market and what was particularly attractive about this deal to you. Secondly, would you be spending more on exploration? And then finally, any further comments — I know you’ve already done this and all that, but any further comments on the M&A market in the U.S. is always interesting? North America, I should say, in your case.

MUR: It just became a situation where the capital allocation in Malaysia versus our Eagle Ford and our Gulf of Mexico — we have a lot of opportunities in the Gulf of Mexico. There are many pent-up things to do in the Gulf. I think there’s a lot of pent-up things to do in our industry in the Gulf since the slowdown in the shale revolution. There’s a lot of workover sidetracks, a lot of things we can do in our business. We have the capital allocation that we were wanting to move this way. We were very sought after that in that region — a lot of our assets are very sought after, and those have been for quite a while. And then going gassier — and our capital allocation going Western Hemisphere was making it go gassier, and our gas reserves there after the sell-down a few years ago was not enormous, to enjoy what I think is a big LNG future down the road, but it’s not robust enough Bcf on our side.

And it’s one of those things, “If you don’t do it now, when are you going to do it?” We have a large ARO there that went to the other bar. And also, the tax change in the United States, our NOL position in the United States and the ability to go from cash taxes to no taxes, if you will, our very limited cash taxes for a long time and all those came to bear. And with a party that was very interested in paying us the appropriate value and a partner that was — party that was interested in taking all of our personnel, it’s just one of those opportunities that I thought I needed to do and just felt strongly about, and we moved forward on it.

20 years with this kind of full-cycle returns are very unique in our business.

And when you hit the home run ball, you got to move on and go somewhere else. So that’s what we’re doing. And on the M&A side, I mean, we’re quite discreet about M&A. We work on lots of opportunities. We really don’t share a lot about it too much. We feel that they are Gulf of Mexico opportunities that fit us, many things we can do to improve, be more efficient, things that we do to tie in infrastructure. There’s a lot of things out there, and we’re going to continue to be diligent about working that.

From an exploration business perspective, we’re really wanting to get this capital into our Eagle Ford and our Gulf project business and to look for — and there are other projects that we might conjoin as well in this industry as well. It’s not about increasing exploration here. The efficiency of the rigs now are so incredible. And our — and while I’m not commenting at all on the Mexico wells, the fastest well ever drilled in Mexico — the last 3 wells we’ve ever drilled are the fastest I’ve seen in my career, and that’s a long career of offshore drilling. And our efficiency’s so great and the execution of the rigs is so good that we don’t need to increase our CapEx.

And this is really about short-term cycle things and keeping that — a lot of bang for the buck in that $100 million. That’s been the real change since 2010 through 2014, is the real bang for the buck for exploration, ownerships, right kind of partners, right kind of working interest, incredible rig ability, incredible team to execute. So I’m not looking to increase that at this time, Paul.