Permian Basin E&Ps WPX, Concho to cash in on transaction

Oryx plans to “aggressively grow our footprint in the Permian Basin”

“Oryx is the most attractive private Permian midstream asset Stonepeak has evaluated”

Affiliates of Quantum Energy Partners, Post Oak Energy Capital, Concho Resources (stock ticker: CXO, $CXO), WPX Energy (stock ticker: WPX, $WPX) and other investors announced today that they have entered into a binding agreement to sell substantially all of the assets of Oryx Southern Delaware Holdings LLC and Oryx Delaware Holdings LLC to funds managed by Stonepeak Infrastructure Partners for a cash purchase price of approximately $3.6 billion.

Stonepeak Infrastructure Partners is an infrastructure-focused private equity firm with over $15 billion of assets under management in Houston, New York, and Austin.

In a statement Stonepeak said it sees the Oryx crude oil transportation services as its way to capitalize on the coming Permian Basin production growth. Stonepeak pointed out Oryx’s scalable in-place infrastructure, large geographic footprint and unique customer diversification.

Oryx will retain its name and continue to be headquartered in Midland, Texas. Its leadership team, led by Brett Wiggs and Karl Pfluger, will remain in their current roles and are investing alongside Stonepeak in the transaction, the groups said in a press release.

What Stonepeak gets: the largest privately-held midstream crude operator in the Permian Basin

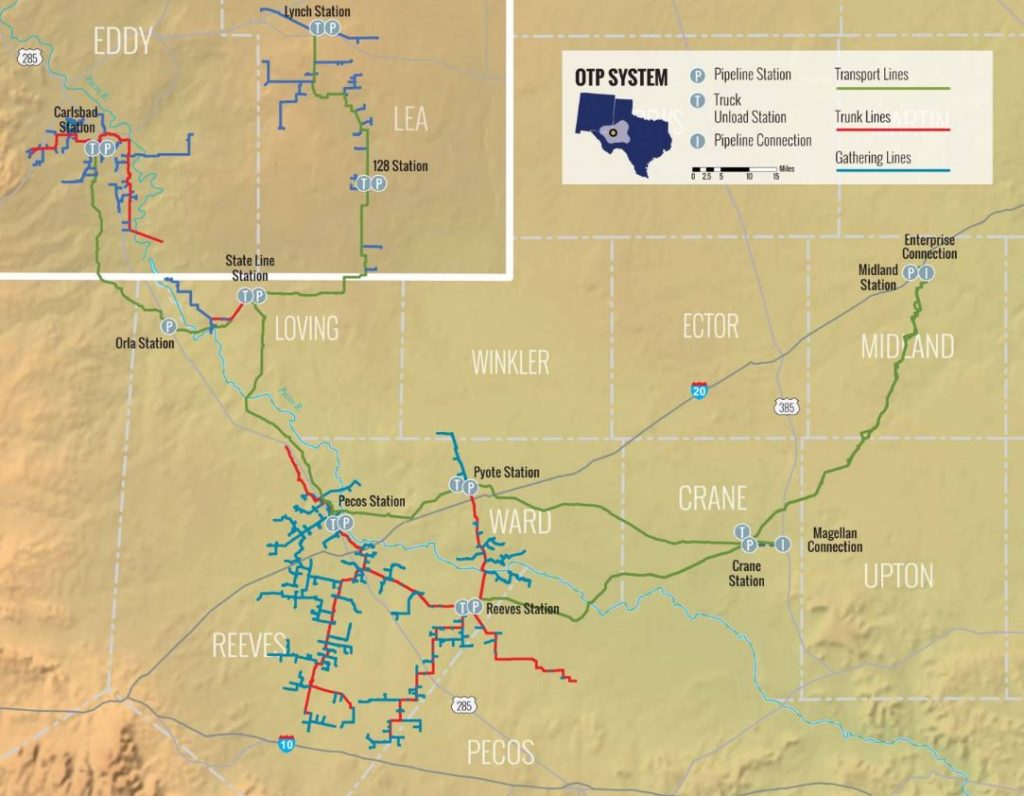

Oryx pipeline system:

- Supported by 20 contracted producer-customers, providing approximately 900,000 dedicated acres.

- Current aggregate delivery capacity of 650,000 barrels per day, expected to increase to 900,000 barrels per day by early 2020.

- Only purpose-built “batch-able” system in the Permian to allow for segregation and sourcing by quality.

- Currently operating 500 miles of oil transportation and gathering pipelines and 1,170,000 barrels of oil storage capacity.

- Constructing an additional 680 miles of transportation and gathering pipelines and 910,000 barrels of storage capacity to become operational by mid-2019.

- Footprint in 8 counties in Texas and 2 in New Mexico’s core Delaware Basin, the most economic and long-lived drilling resource in the United States.

Concho to collect $300 million at closing after repayment of Oryx debt

Concho said in a separate press release that it owns a 23.75% equity interest in Oryx and will receive approximately $300 million at closing after repayment of Oryx’s outstanding borrowings.

In February 2018, Concho received a $157 million distribution related to a recapitalization of Oryx. The sale proceeds from Oryx combined with the earlier distribution total approximately $457 million, representing a 10-times multiple on invested capital of approximately $45 million since December 2015.

Concho’s President Jack Harper said, “Our investment in Oryx supported the continued growth of our assets in the Southern Delaware Basin with secured transportation for our production and improved oil price realizations. This sale represents an excellent return on investment for our shareholders. A strong balance sheet underpins our ability to execute a resilient high-margin growth and returns strategy, and we will use the proceeds of this sale to further strengthen our balance sheet by repaying borrowings on our revolver.”

This transaction is not expected to impact oil price realizations or transportation costs as Concho’s existing gathering agreement remains unchanged, Concho said. Upon closing, the net cash proceeds from the transaction will be used to repay borrowings outstanding on Concho’s credit facility.

WPX to receive approximately $350 million net proceeds for its 25% interest in Oryx II

Upon close, WPX expects net proceeds of approximately $350 million for its 25 percent equity interest after adjusting for debt financing related to Oryx II.

In addition, WPX expects to save approximately $40 million in planned equity investments for the balance of the year due to the sale, WPX said in a separate press release. WPX is retaining its contractual rights as a shipper on Oryx and plans to deploy proceeds from the transaction to its balance sheet.

WPX also is reevaluating the timetable for its plan to return capital to shareholders, originally targeted for 2021. Projected free cash flow from WPX’s operations in 2019 may accelerate action, with a decision expected in the latter half of this year.

“WPX’s opportunistic approach continues to create significant value for shareholders and generate handsome returns on our capital employed,” said Rick Muncrief, chairman and chief executive officer. “We secured flow assurance and ownership interests in critical midstream projects in the Delaware Basin before constraints ever occurred. That strategy also has protected the pricing for our production in the basin,” said Muncrief.

The Oryx system is a regional crude oil pipeline transport network that supports the Northern Delaware Basin. It consists of more than 500 miles of pipe that include a significant presence in the Stateline area of Texas and New Mexico. Oryx II is one component of the overall system, WPX said.

The Oryx II transaction is WPX’s second midstream monetization this year. WPX already closed on the previously announced sale of its 20 percent equity interest in WhiteWater Midstream’s Agua Blanca natural gas pipeline system. WPX remains a shipper on that system, as well, the company said.

WPX invested approximately $125 million in its equity positions in the Oryx and Whitewater midstream systems, primarily in 2017 and 2018. The investments generated approximately half of a billion dollars in net proceeds this year, pending the close of the Oryx II sale.

“I extend our sincere congratulations to the Oryx management team and their financial sponsors at Quantum Energy Partners and Post Oak Energy Capital for their highly successful project,” Muncrief added. “We look forward to working with the new owners as a shipper on this valuable infrastructure.”

Closing is expected to occur in the second quarter of 2019, subject to customary terms and conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act.

Barclays, acting through its investment bank, advised Stonepeak Infrastructure Partners on the transaction. A Barclays-led arranger group including Goldman Sachs, RBC Capital Markets, and Jefferies LLC have provided a $1.5 billion Term Loan B in support of the transaction, which will include a refinancing of the existing Oryx Southern Delaware Holdings, LLC facility and consolidation of Oryx Southern Delaware Holdings LLC and Oryx Delaware Holdings LLC (collectively, “Oryx”) into a single Borrower.

Jefferies LLC and Citi acted as financial advisors to Oryx and its sellers.

Shearman and Sterling LLP and Vinson & Elkins LLP served as legal counsel to Oryx. Stonepeak was represented by Hunton Andrews Kurth LLP and Sidley Austin LLP with regards to the transaction, and Simpson Thatcher & Bartlett LLP, its fund counsel. Latham & Watkins, LLP represented the lender group.

Brett Wiggs, CEO of Oryx, commented, “As we begin our next chapter and new partnership with Stonepeak, we look forward to the operational and capital support they will provide our team as we continue to aggressively grow our footprint in the Permian Basin.”

Dheeraj Verma and Garry Tanner, Partners at Quantum Energy Partners, said, “This business is a great example of how our combined upstream and midstream expertise can translate into significant value creation for our portfolio Stonepeak Infrastructure Partners to Acquire Oryx Midstream.”

Jack Howell, Partner and head of Stonepeak’s energy business, said that “Oryx is the most attractive private Permian midstream asset Stonepeak has evaluated and we view it as a strategic platform and a core North American crude infrastructure asset.

“Our critical focus will be on continuing to provide Oryx’s diversified customer base with best in class service offerings to accommodate their growing production while also pursuing new commercial opportunities across the value-chain.”