Harvey’s effects continue to ripple

With the third quarter coming to a close, companies are beginning to prepare for reporting season. As part of these efforts, companies often update guidance for Q3 and full year production. This is especially pertinent this year, as Hurricane Harvey’s effects impacted operations throughout the country.

Noble Energy (ticker: NBL), Chesapeake Energy (ticker: CHK) and QEP Resources (ticker: QEP) each released updated guidance today.

Noble ups guidance on strong DJ wells

Noble Energy has updated its expected guidance for Q3 2017. Noble reports that expected sales volumes for Q3 have been raised to 352-358 MBOEPD, which represents an increase of 3% or 10 MBOEPD at the midpoint of expectations.

Expected oil volumes rose to a midpoint of 128 MBOPD, up more than 4% from previous guidance of 123 MBOPD. Natural gas volumes are now expected to be 977 MMcf/d, above the previous guidance high of 950 MMcf/d. Expected NGL production, on the other hand, has fallen from a midpoint of 67 MBPD to a midpoint of 64 MBPD.

Noble reports that it has accomplished this increase in expected production without spending above expectations, as third quarter CapEx remains within the original range of $625 to $725 million.

Multiple improvements have led to this guidance increase. The company reports that its DJ Basin production will be higher than expected, due to strong new well performance and a higher oil cut. Better than anticipated pipeline pressures throughout the DJ Basin are also benefitting overall production.

Noble reports that its volumes in Texas are consistent with expectations, despite the effects of Hurricane Harvey. The hurricane mostly impacted third-party downstream operations, which have been counterbalanced by strong well results.

One other major development in Noble’s operations comes from Israel. The company’s Tamar field, located off the coast of Israel, produced more than 1 Bcf/d in July and August. However, planned maintenance last week revealed “minor modifications necessary to the venting system,” reported by Reuters to consist of a crack in an exhaust pipe. This forced Noble to shut the field down to make repairs, which should be completed within the next few days. Noble does not expect this to have substantial impact on planned production volumes.

Israel will be pushing for a quick turnaround, as natural gas from Tamar supplies roughly half of all the country’s electricity needs. According to Reuters, power production has remained stable, but utilities have been forced to use imported LNG, diesel and fuel oil.

Hurricane Harvey forces Chesapeake to revise guidance down

Chesapeake Energy also announced an update to third quarter guidance today. Chesapeake reports that Hurricane Harvey and capital allocation changes mean the company will produce about 542 MBOEPD. While this is higher than the 527.6 MBOEPD the company produced in Q2 (after adjusting for asset sales) is falls short of the expected 550 MBOEPD.

However, Chesapeake reports that delays experienced during the third quarter have been largely mitigated and therefore Q4 production will display significant sequential growth. Overall 2017 guidance has been revised down, but Q4 levels will be in line with previous estimates.

Asset sales, Williston issues pull QEP production down

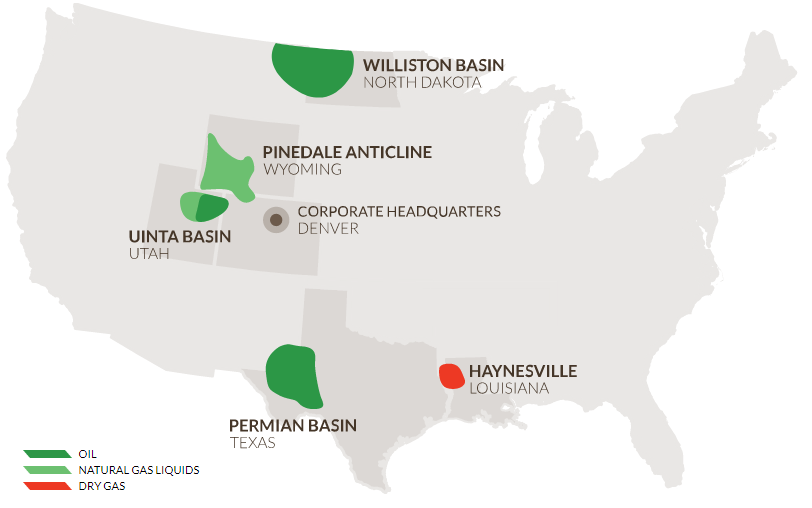

Finally, QEP updated guidance and announced the close of its Pinedale assets today. Current 2017 guidance calls for about 53.2 MMBOE of total production, down from previous estimates of 58.75 MMBOE. QEP reports that this change is due to multiple factors.

QEP removed about 3.3 MMBOE of production from its guidance due to the completed Pinedale sale. The pending Permian Basin acquisition is not expected to have a meaningful effect on 2017 production. In the Williston Basin, production has been affected by the results from a group of pilot wells. These wells were designed to test spacing and productivity of the deeper benches of the Three Forks formation, and have been experiencing higher than anticipated decline rates.

After examining the data available, QEP has determined that the wells are likely producing from overlying formations, rather than the targeted second and third Three Forks benches. In addition, issues in completing several wells led to offset wells being shut in while repairs were made. These wells have since been brought on production, but the delays have impacted guidance. Non-operated production volumes are also expected to drop.

QEP also reports that it will have a one month delay in bringing some Permian wells on production, due to shifts in completion timing related to the evolution of its tank-style completion methodology.