Gazprom faces obstacles to financing $11 billion project in current market – Fitch Ratings

Russian gas giant Gazprom (ticker: OGZPY) may not have the financial strength to follow through on the construction of its Nord Stream 2 project, according to a report from credit ratings agency Fitch. According to the rating agency, Nord Stream 2 may hurt the company’s commercial and financial performance, reports Natural Gas Europe.

“The original Nord Stream was funded by project finance. We believe raising multi-billion dollar project financing for Nord Stream 2 in the capital markets would probably be much harder now,” said Fitch. “This is because Western sanctions have significantly hindered international funding to Russian corporations, even those not directly sanctioned.”

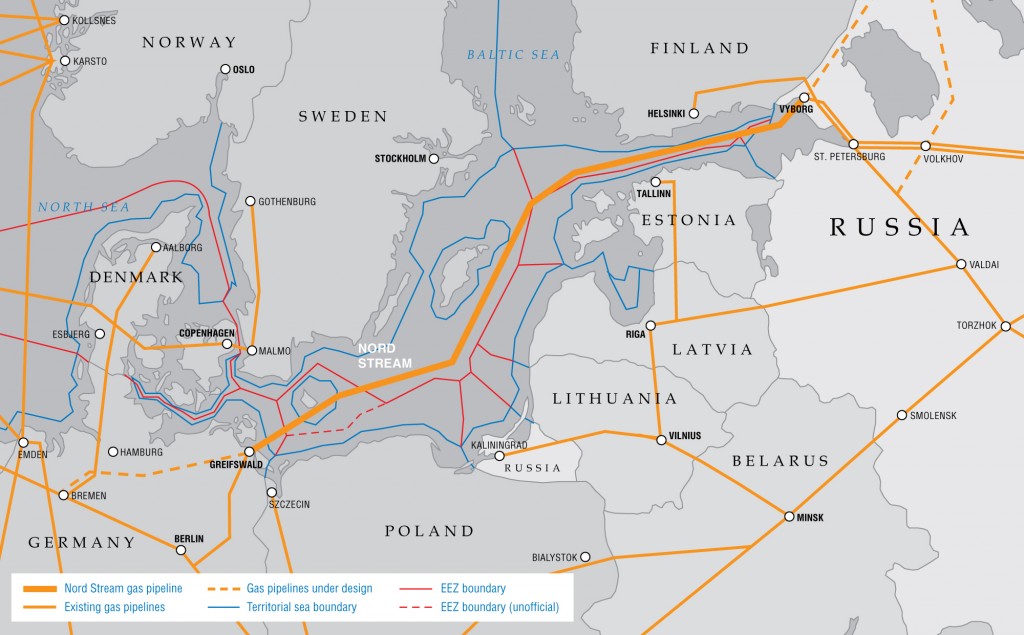

The Nord Stream 2 project would add a third and fourth line to the existing Nord Stream project, which has a capacity of 55 billion cubic meters per year, according to Gazprom. The Nord Stream project runs under the Baltic Sea from Portovaya Bay near the city of Vyborg, 1,224 km (about 760 miles) to the German coast near Greifswald. The project is made up of a partnership of Gazprom (51%), E.ON (15.5%; ticker: EOAN), Wintershall (15.5%), Gasunie (9%) and GDF Suez (9%).

The additions of the third and fourth lines would double the total capacity of Nord Stream, bringing total capacity to 110 Bcm per year. The companies’ interest in the Nord Stream 2 project would be identical to the first two lines of the project. Nord Stream provides gas to Germany, the U.K., the Netherlands, France, Denmark and other European states.

“Weak gas prices and demand, plus high capex mean Gazprom would not be able to fund its capex share from internally generated funds,” said Maxim Edelson, senior director of corporates at Fitch Ratings. Considering the projects estimated €10 billion ($11.1 billion) price tag and Gazprom’s 51% interest, the Russian gas giant would have to pay €5.1 billion ($5.7 billion) for its share of the project. “If project financing were not available it would therefore have to try and borrow directly to fund its share of the pipeline projects’ costs, but this too would be difficult and potentially expensive in the current funding environment,” said Edelson.

Problems in the E.U.

Relations between Gazprom and the company’s largest customer, the European Union, have deteriorated over increasingly tense political ties, and accusations from the E.U. that Gazprom abuses its position in the European market. The E.U.’s Antitrust Regulator has accused Gazprom of using its dominant position in the market to impose territorial restrictions, charge unfair prices to some E.U. members and leverage its position in the market to obtain unrelated infrastructure commitments from some customers.

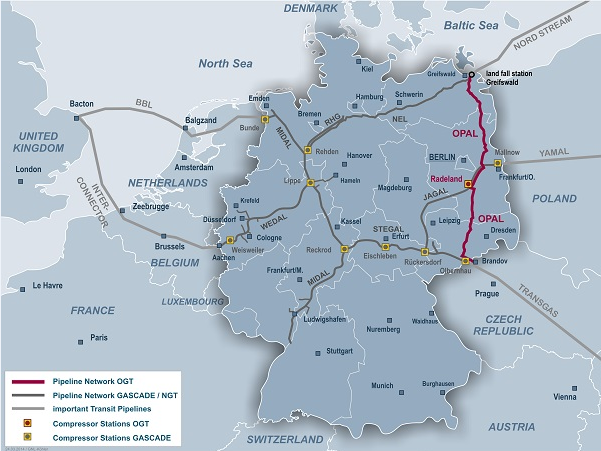

Key members of the E.U. have frustrated Gazprom by not allowing it to run full capacity on its pipelines to Europe. Over the last couple of years, Nord Stream I has been operating near 55% capacity because of restrictions against Gazprom’s usage of the OPAL pipeline, which carries Nord Streams gas into Germany.

Gazprom is exploring using several different tactics in order to improve its relationships with the European market, including sales of its gas through auction. Traditionally, Gazprom’s gas contracts have been linked to oil prices, a formula the company has fought to maintain despite calls from purchasers to participate in the spot market, but the recent downturn in oil prices has made the long-term, oil-linked contracts much less profitable. The first set of auctions was held earlier this month, with the goal of selling a total volume of 3.24 billion cubic meters (114 billion cubic feet).

One reason for the auction was to increase flows of natural gas through the OPAL pipeline under different ownership, said Jonathan Stern, chairman of gas research at the Oxford Institute for Energy Studies. If the auction does not prove fruitful, Gazprom can argue that no third parties want to use the pipeline and therefore the commission’s position on maintaining Gazprom’s usage under 50% is illogical.

Gazprom also sent a draft settlement proposal to the European Commission to end the antitrust case yesterday, as the deadline to reply to antitrust accusations fast approaches. The company has until September 28 to respond to the antitrust regulator.

“We hope to discuss this proposal with the representatives of the commission in the near future in order to come to a settlement agreement,” Gazprom said in a statement. The company added that it still plans to send a separate response addressing the antitrust case.

“It’s hard to know whether the European Commission will accept Gazprom’s preemptive offer,” said Alec Burnside, an antitrust lawyer at Cadwalader, Wickersham & Taft LLP in Brussels. “Ms. Margrethe Vestager (Commissioner of the European Commission’s Competition Board) has shown a very strong determination to move some cases forward.”

More than bad relations

Another major factor that could potentially affect the expansion of the Nord Stream project is the decline in the price of natural gas, said Fitch. The ratings agency forecasted that Gazprom’s natural gas prices will fall another 15% from current levels, while sales volumes grow steadily.

Gazprom’s exports of gas abroad have fallen 8% in the first half of 2015 when compared with the same time period last year. With foreign sales accounting for two-thirds of the company’s revenue, lower exports are a serious issue for the company.

Compounding issues is lower production overall. In June, Gazprom’s output fell to a record low of 24.7 Bcm, 19% lower than the same month in 2014. In the first half of the year, Gazprom’s gas production dropped by 12.9%, according to a report from Sberbank CIB, a Russian investment bank. Sberbank expects falling revenues to be partially offset by the devaluation of the ruble, which allows the Russian company to exchange the dollars it receives for its oil for more of the Russian currency.