Oasis Petroleum Inc. (ticker: OAS) reported net income attributable to Oasis of $124.6 million in the fourth quarter of 2017. Fourth quarter 2017 results included a benefit of $171.9 million due to the recently enacted Tax Cuts and Jobs Act.

For the full year of 2017, Oasis reported net income attributable to Oasis of $123.8 million.

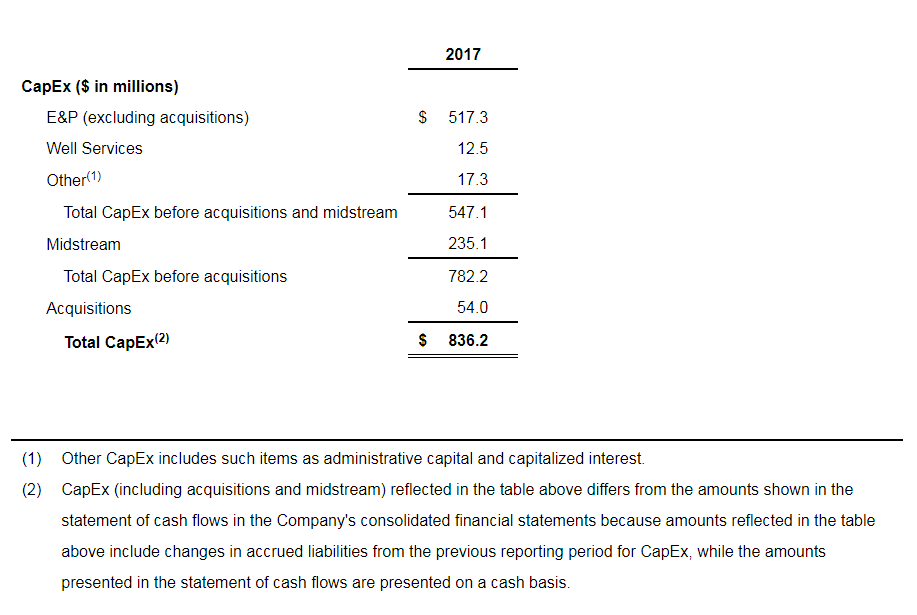

The company produced 73,207 BOEPD on average in Q4 2017 and produced 66,144 BOEPD on average in 2017. During 2017, Oasis completed and placed on production 88 gross (58.3 net) operated wells while investing $517.3 million of E&P capital expenditures – these expenditures exclude acquisitions, other capital and midstream capital.

CEO Nusz provides a broad update

“We successfully grew production 31% while spending within cash flow on the E&P side of the business,” said Thomas B. Nusz, Oasis’ chairman and CEO. “We have supplemented our highly economic Williston Basin asset with the Forge acquisition located in the best part of the Delaware Basin. The depth of our core inventory increased organically in the Bakken and through our accretive Permian acquisition. We now have approximately 18 years of core and extended core inventory at our 2018 completion pace, which is economic at or below a $45 WTI oil price. In 2018 and 2019, we expect this capital efficient inventory to drive 15-20% production growth within cash flow on the E&P business.”

“Our well services and midstream businesses continue to be critical complements of our E&P operations. We introduced a second fracturing crew mid-year 2017 and successfully completed the IPO of OMP in September,” added Nusz. “Oasis funded its midstream capex in 2017 through OMP IPO proceeds of $132.1 million distributed to Oasis and capital spent at OMP of $105.6 million. Our midstream business has numerous highly attractive midstream investment opportunities in 2018, both in the Williston and potentially in the Delaware, all of which we expect will generate strong returns and will be built within 4-5x EBITDA multiples. Oasis plans to invest $235 million to $275 million in midstream capex in 2018, of which $72 million to $90 million will be funded by OMP in 2018 and the balance is expected to be funded over time through OMP via drops.”

Inventory and leasehold

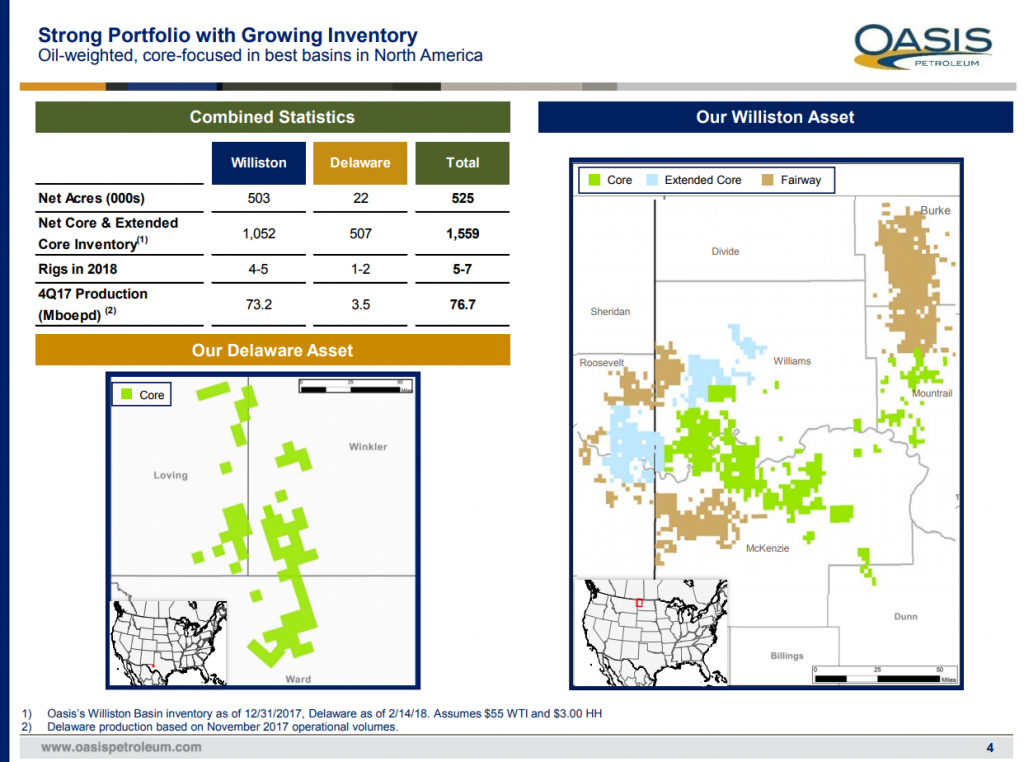

In late 2017, the company acquired approximately 22,000 net acres in the over-pressured oil window of the Delaware Basin. The acquisition closed on February 14, 2018.

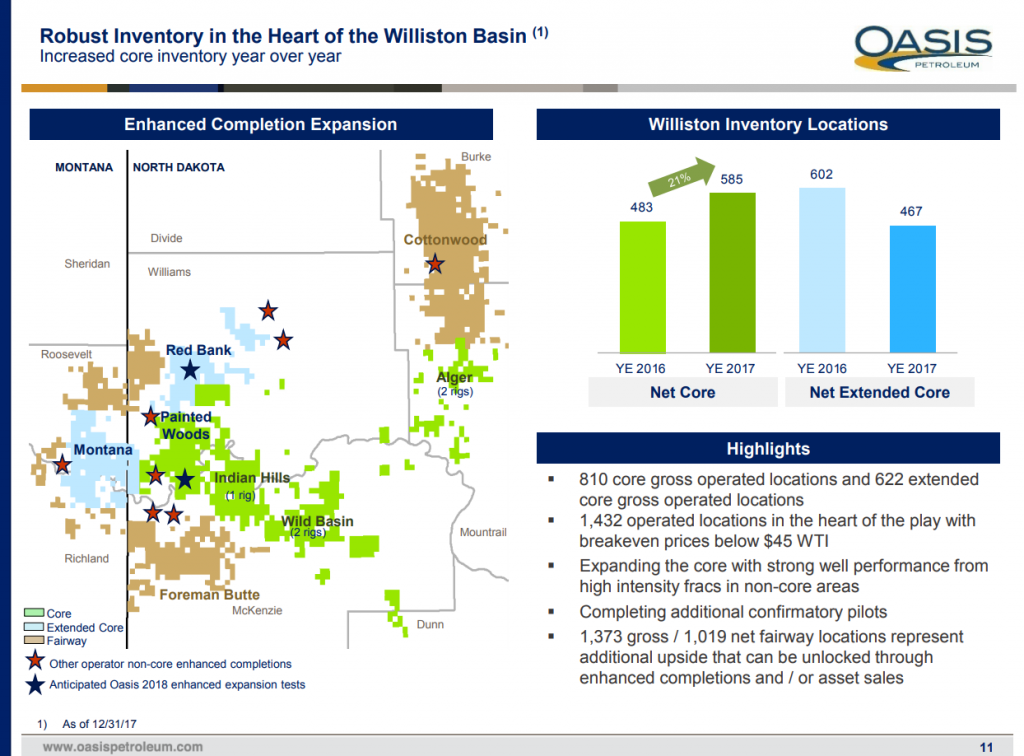

Oasis’ total inventory increased to 2,578 net locations, of which 1,092 net locations are considered core. Core net undeveloped locations increased by 126%, from 483 net undeveloped locations at December 31, 2016 to 1,092 net undeveloped locations. Of the company’s 1,092 core net locations, 585 are in the Williston Basin and 507 are in the Delaware Basin.

Oasis ended the year with a leasehold position of approximately 503,000 net acres in the Williston Basin, and, as of February 14, 2018, with a leasehold position in the Delaware Basin of approximately 22,000 net acres.

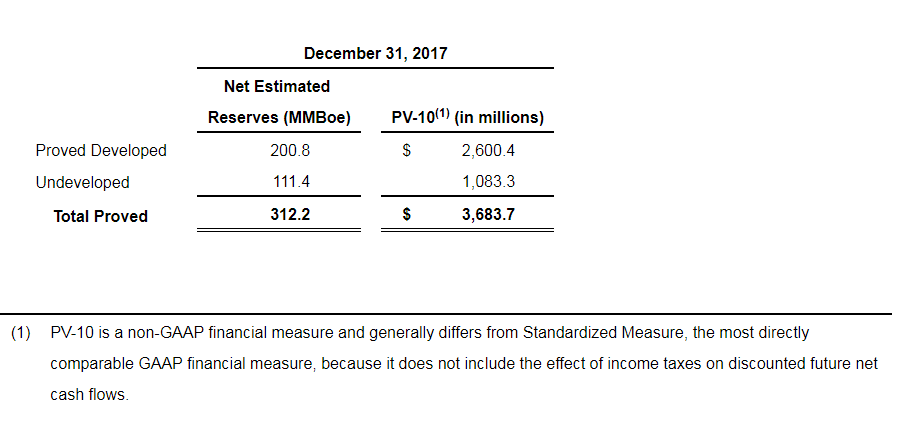

Reserves

2018

- Total E&P capex plan of approximately $815-$855 million, excluding acquisitions

- Williston Basin – $700-$730 million

- Delaware Basin – $115-$125 million

- Completing approximately 100 to 110 gross operated wells with a working interest of approximately 73% in the Williston Basin and approximately six to eight gross operated wells with high working interest in the Delaware Basin in 2018