For now, Wall Street has turned off the shale funding spigot

By Bevo Beaven, Editor, Oil & Gas 360, with Richard Rostad, Analyst

Oil and gas funding is evolving. Initial public offerings, secondaries and follow-on equity raises are no longer an easy-to-turn-on cash spigot that sits ready to fill the bank accounts of public exploration and production (E&P) companies with the millions or billions of dollars the upstream oil and gas companies need to replace declining production.

If you’re an oil or natural gas producer you need to continually drill and develop new acreage at a faster rate than the natural decline curve in order to grow production, replace reserves and build your company’s value.

But starting in Q4 of last year, Wall Street has been loudly shouting “no thanks” to pumping more funds into shale companies. That means companies are having to become attractive to new sources of energy capital.

Since the beginning of the U.S. oil and gas industry, drilling for oil and gas has been financed with private capital, starting with funds from individual lease owner/operators. Going back to the early wildcatters, the guy who had the minerals and the location and wanted to drill a well would raise capital from friends and family members. Next step: raise more money, acquire more acreage, and drill more wells if a well came in.

Scaling operations costs plenty and the target for capital became local banks for loans. Then companies drilled more wells, needing more capital, and when capital needs outgrew bank loans the oil and gas companies began to launch public offerings of shares and offer private placements of their shares to investors and institutions who wanted in.

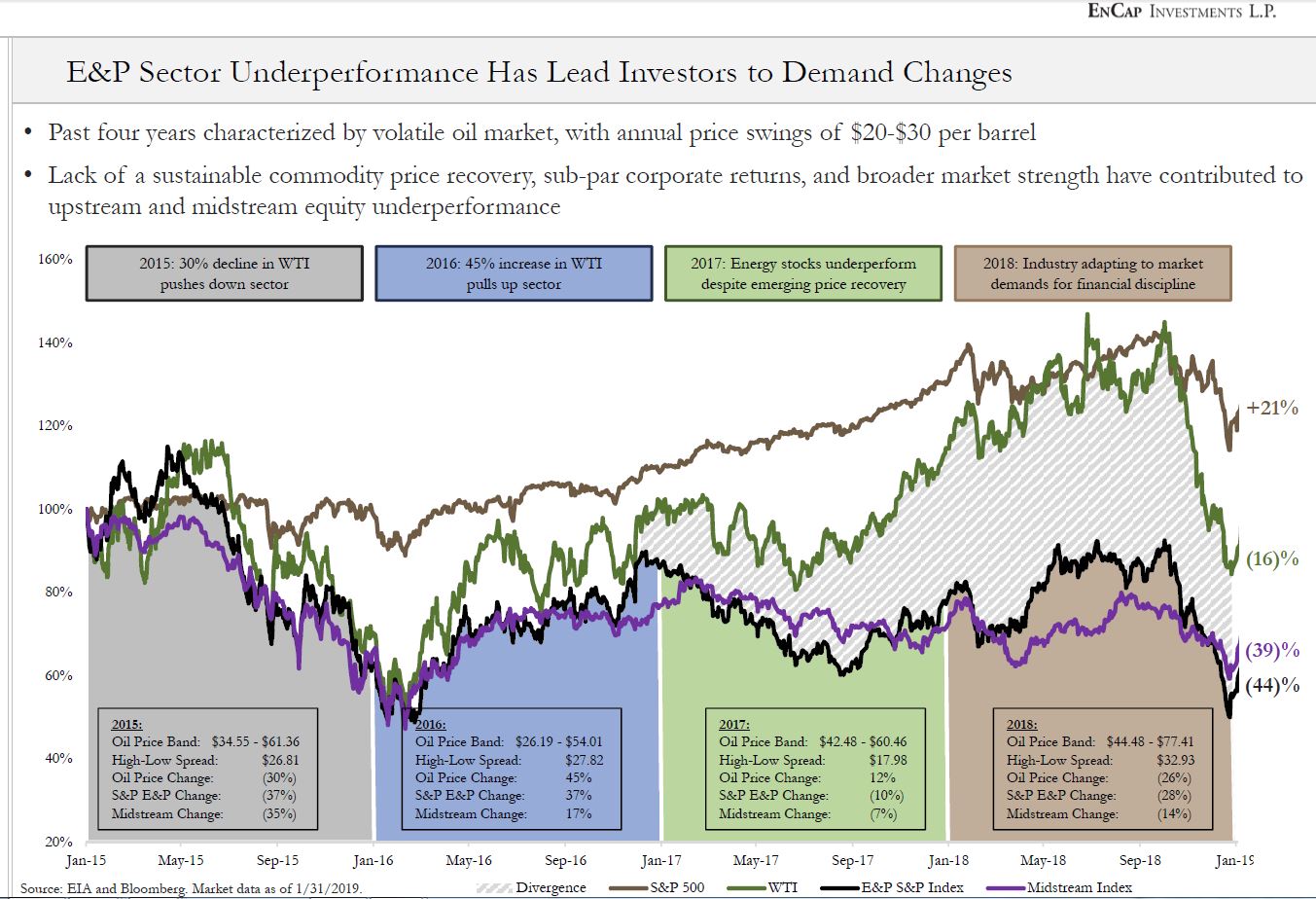

Over the years many oil and gas E&Ps have been launched with private money and then taken public to grow through an IPO or via the ‘back door’ as a reverse merger into a public shell or an inactive public equity vehicle. But during the 2014-2016 downturn the public capital markets severely punished E&Ps with low valuations. An oil price recovery started to show real legs in the second half of 2017, but after a volatile first half prices more or less stabilized during mid-2018.

Then Q4 of 2018 turned bleak for oil company shares, leading to a mass exodus of energy investors from the public equity markets.

Now, public equity investors, tired of the bumpy ride, have turned their backs on the E&P sector. Except one.

Oil and gas funding: an aberration named Buffett

News came out on the last day of April that clearly showed there is at least one investor who believes in the E&P space–strongly. Occidental Petroleum (stock ticker: OXY, $OXY), put out the news that Berkshire Hathaway, Inc. (stock ticker: BRK.A, $BRK.A) had committed to invest a total of $10 billion in Occidental Petroleum to help the company finance its proposed acquisition of Anadarko Petroleum (stock ticker: APC, $APC).

Billionaire investor Warren Buffett, Berkshire’s CEO, has earned a crown in many circles as probably the world’s most savvy public company investor. Buffett is known for taking multibillion-dollar flyers on companies in sectors he believes in, often when other investors are ignoring the sector.

The Berkshire investment in Occidental Petroleum is contingent upon Occidental entering into and completing its proposed acquisition of Anadarko Petroleum (stock ticker: APC, $APC). Clearly Buffett wants Occidental to successfully acquire Anadarko. Anadarko is a large independent oil and gas company with both shale and conventional assets around the world.

[contextly_sidebar id=”WFWMQ1cYzvUq28YYUcaSarLxYnVgi3fl”][contextly_sidebar id=”fj7xwzvBifztTpjUjzq7A4GGZKsnKDKN”]

Occidental reported that Berkshire Hathaway will receive 100,000 shares of Cumulative Perpetual Preferred Stock with a liquidation value of $100,000 per share, together with a warrant to purchase up to 80.0 million shares of Occidental common stock at an exercise price of $62.50 per share.

One of the many dozens of favorite sage quotes from Warren Buffett over his decades of investing goes like this: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” But that’s Buffett and Berkshire, which acts independently, more like a private fund manager running opposite the herd. The infusion worked and Anadarko accepted the Occidental offer over Chevron’s (stock ticker: CVX) offer.

Wall Street as a whole, on the other hand, has retreated from the E&P space.

As the E&P stocks plunged on Wall Street, investors have grown wary of investing in the sector

With cash in the form of public equity from Wall Street drying up, the independent E&Ps have had to go looking for new sources of capital.

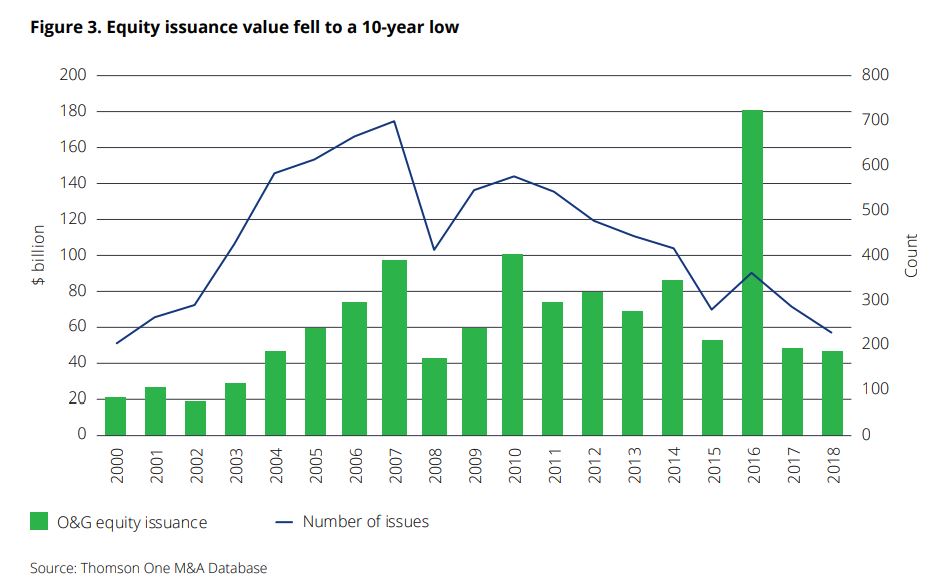

In a story from late 2018 headlined “North American Oil & Gas Equity Raises Have Dried Up in 2018 / Follow-on offerings at lowest point in 15 years, IPOs at lowest in 10 years,” Oil & Gas 360 analyst Richard Rostad observed that “an equity raise is exactly the opposite of what most investors are currently seeking.”

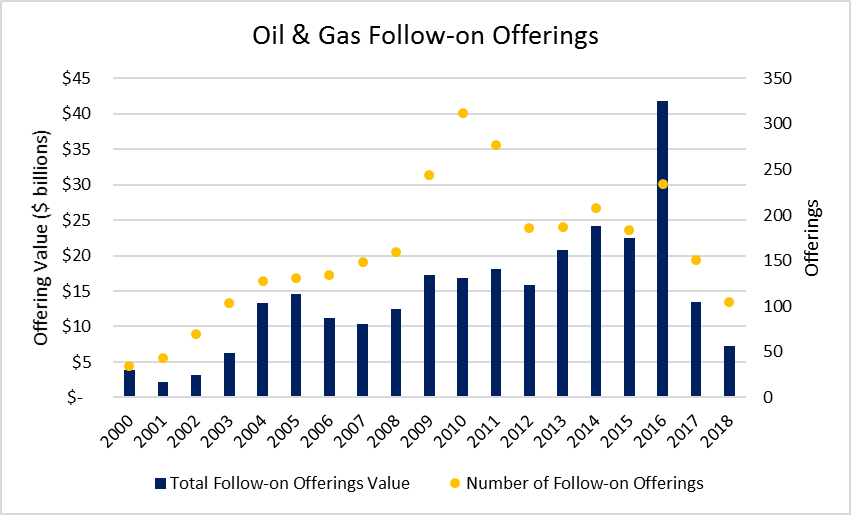

Follow-on offerings reached an all-time high in 2016, when North American oil and gas firms offered a combined $41.7 billion to markets. Equity raises continued through early 2017, as companies dove into the Permian. “However, shifting investor sentiment has stopped the follow-on market in its tracks.”

At only $7.6 billion in 2018, North American oil and gas companies recorded the lowest amount raised by follow-on offerings in 15 years. In 2003 companies raised $6.2 billion. Only 94 equity raises were completed in 2018, compared to 151 in 2017, and 234 in 2016.

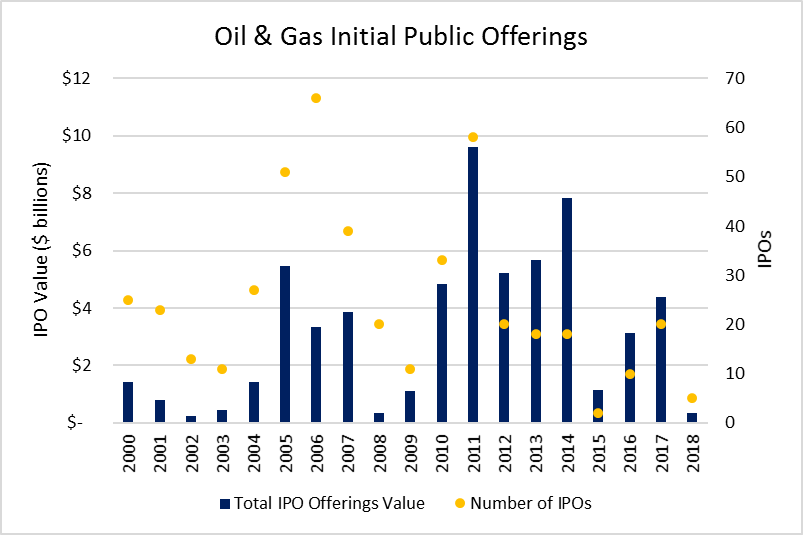

As far as IPOs, only five North American oil and gas companies completed IPOs in 2018, the lowest number since 2015. These firms raised $350 million, the lowest amount raised by energy IPOs since 2008.

The only bright spot in 2018, according to a report from Drillinginfo, came from the oilfield services side of drilling and producing—which raised a total of $7.2 billion in the year, up 31% from 2017—supported by a rush of service sector IPOs during a small but opportune window within 2018’s first quarter, when six companies went public and raised a combined $1.88 billion, the energy industry data provider said.

“Not only were there no other IPO boomlets during the year, but those six service companies ended up comprising two-thirds of just nine total IPOs in the energy sector for the year,” Drillinginfo said. “Two of them were SPACs; Pure Acquisition Corp. and Spartan Energy Acquisition Corp and the other was the resurrected Berry Petroleum. After the August 13 Spartan deal, IPO activity ceased for the year.

“In all, IPOs brought in close to $3 billion in proceeds in 2018, not including proceeds from overallotment options, compared with $8.7 billion in 2017. The IPO halt mirrored overall waning equity activity last year, but the fourth quarter slowed to a glacial $3.9 billion in total equity raises across all energy subsectors, off 56% from the year before.”

Where will the cash be sourced to feed the large-scale factory development model for shale?

E&Ps need ready access to enormous amounts of capital to run a business plan that calls for drilling and fracing hundreds or thousands of horizontal wells–paying high day rates for oilfield workers and equipment leases that allows them to drill and complete wells. But today, the go-to source for capital is changing.

With public markets off the table in 2019, where do E&Ps turn for the capital needed to keep their operations chugging? After the market underperformance in Q4 2018, it clearly wasn’t the public markets.

“Upstream, with just $700 million raised from two offerings in Q4, had the worst quarter this decade,” Drillinginfo said. “Also, though seven companies registered during the second half of the year—bringing some hope for more IPOs—market conditions upset valuations and companies pulled their registrations.”

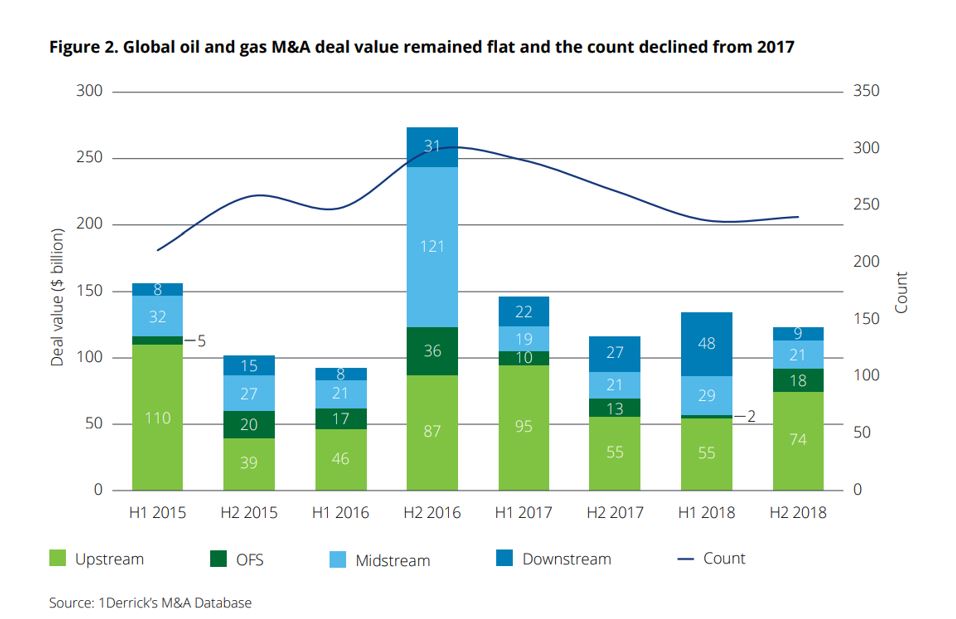

M&A in 2018 failed to realize full potential – thanks to a “context of continued caution”

The United States dominated upstream activity, with its $79.7 billion deal value representing a 26 percent increase year over year and accounting for almost two-thirds of the global deal value, according to Deloitte’s Oil & Gas M&A report for yearend 2018.

“Overall, an industry that was strong in 2018 did not realize its potential for increased M&A activity largely because it remained financially constrained in a context of continued caution. Hopes for a return of confidence were set further back at the end of the year when the oil price dropped, raising fears of a return to volatility. With deteriorating market conditions on the horizon, caution and closed equity markets will likely continue to shape M&A activity in 2019 with the advantage remaining with well-capitalized buyers,” Deloitte said.

Oil and gas funding: a reduction in lending from the banking side

“The most significant change that we saw on this financing side is the dramatic reduction in lending from the banking side,” Pål Reiulf Olsen, senior partner at European private equity firm HitekVision told Forbes in a story about 2018.

Part of the reason is a reaction to the unpleasant aftertaste of a string of energy bankruptcies during the 2014-2016 downturn. Some E&Ps are still working through the process. These bankruptcies were followed quickly by the oil and gas company shareholders pushing hard for debt-reduction and balance sheet strengthening, while at the same time boards paying back shareholders via dividends and share repurchases.

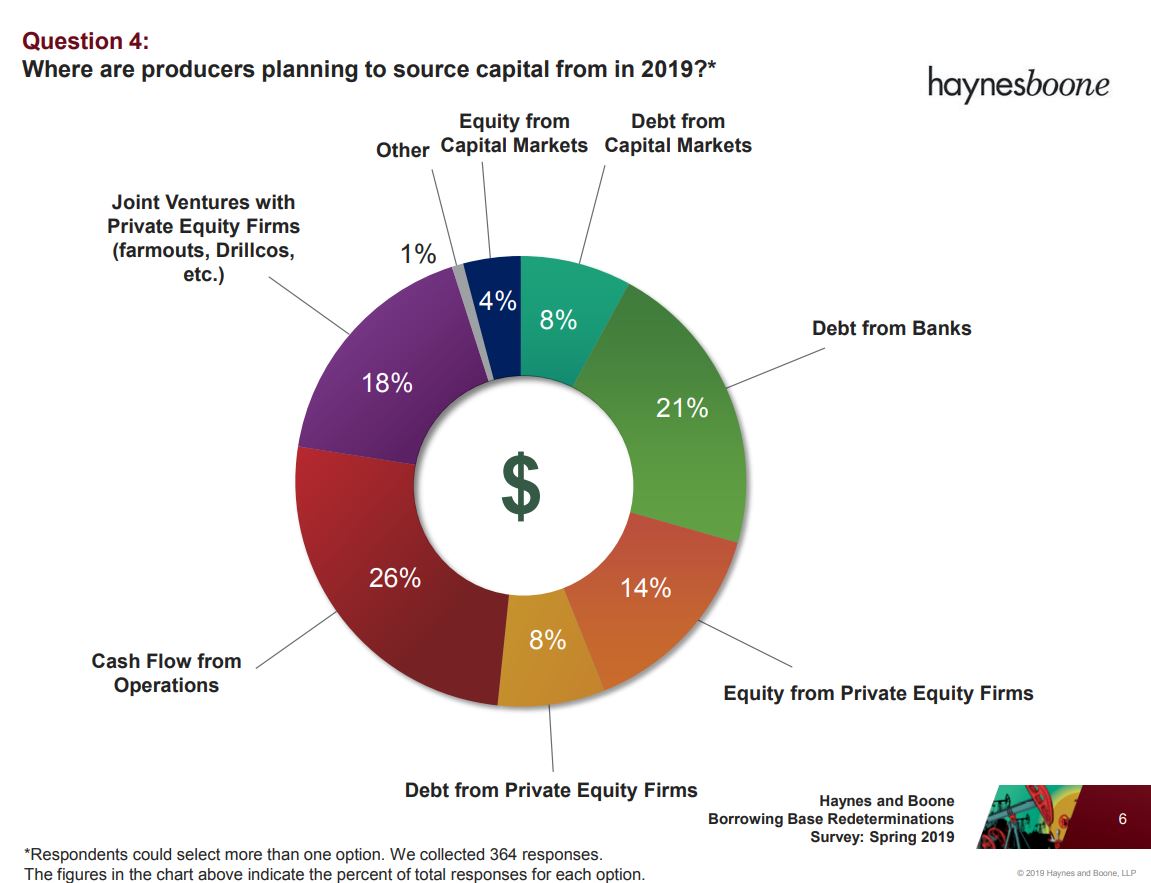

According to the Haynes and Boone Spring 2019 Borrowing Base Redeterminations Survey, “capital markets – both equity and debt – have fallen significantly out of favor as sources of capital.”“Most respondents expect borrowing bases to remain the same or decline just slightly,” Haynes and Boone said. “There is increased interest in 2019 in sourcing capital through joint venture transactions (farmouts, Drillcos, etc.). Though respondents do not expect recent commodity price volatility to cause oil and gas companies to head into bankruptcy, the survey makes clear that 2019 will be a difficult year to monetize oil and gas investments.”

Wall Street’s flight from E&Ps in 2018

At the 2019 NAPE expo, one of the organization’s original founders gave a terrific keynote address, speaking to the topic.

Mike Grimm is a director of Anadarko Petroleum (stock ticker: APC, $APC) and Energy Transfer Partners (stock ticker: ET, $ET). He also co-founded RSP Permian (acquired by Concho Resources in 2018) and served as its chairman and co-CEO.

Grimm said, in his view, the most significant event in 2018 was the change of the upstream business model from a focus on growth to living within cash flow. He said that shale operators concentrated on drilling their tier-one areas and unloaded the tier two assets to generate cash for dividends, buybacks and debt reduction.

Grimm ran down the list of the biggest upstream M&A transactions in 2018. The deals add up to more than $80 billion in deal value:

- BP (stock ticker: BP, $BP) acquired BHP’s (stock ticker: BBL, $BHP) oil and gas assets

- Concho Resources (stock ticker: CXO, $CXO) acquired RSP Permian

- Diamondback Energy (stock ticker: FANG, $FANG) acquired Energen and then Ajax Resources

- Denbury Resources (stock ticker: DNR, $DNR) announced its acquisition of Penn Virginia (stock ticker: PVAC, $PVAC)

- Chesapeake Energy (stock ticker: CHK, $CHK) acquired WildHorse Resource Development

- Encana (stock ticker: ECA, $ECA) acquired Newfield Exploration (stock ticker: NFX, $NFX)

- Cimarex Energy (stock ticker: XEC, $XEC) acquired Resolute Energy (stock ticker: REN, $REN)

E&P companies delivered what investors asked for – but they were negatively rewarded

M&A had roared back in 2018, but as Grimm pointed out, the investment community that had been calling for consolidation in the E&P sector, when the companies responded with those 2018 transactions, Wall Street showed its strong dislike of the bigger deals, delivering 10 to 20 percent blows in share prices soon after the deals were announced.

So where does that leave the oil and gas companies who need to raise capital in 2019?

2019 unfurls a new era in oil and gas finance for shale players

Independent oil and gas companies have entered an era that demands the greatest fiscal care and frugality, with the highest priority given to protecting your balance sheet and obeying board and investor mandates to ‘operate within cash flow’.

Almost half of the Haynes and Boone survey respondents predict commodity prices will impair company efforts to exit oil and gas investments, making divestitures, mergers or IPOs difficult in 2019.

Growing the company through expansive drilling programs or large acquisitions has clearly given way to giving back to shareholders through share buybacks and paying out dividends, plus the mantra to shore up balance sheets and operate within cash flow takes away the going-into-debt option.

But there’s a problem with living off production and not drilling new wells.

In the world of oil and gas, “the decline curve always wins,” to quote Core Laboratories (stock ticker: CLB, $CLB) Chairman and CEO David Demshur, a life-long reservoir and production enhancement expert who frequently points out that fact of nature. Sometimes Demshur says “The decline curve never sleeps.”

And that axiom is especially true in the big shale basins where shale wells enjoy a quick one- or two-year production pop, before steep production declines begin to set in. As oil companies are well aware, production from all oil and gas wells naturally declines as reservoirs drain, and when production drops, so does your revenue.

Unless you’re continually replacing production by drilling and bringing new wells on production, your company’s revenues are going to shrink.

That means the need for capital to replace production—i.e., drill and complete all those new wells—has to be part of the business plan. But if Wall Street is saying ‘No’ to oil and gas companies, and A&D has virtually dried up, then where will the funding come from?

In Haynes and Boone’s recent survey of energy companies and lenders, the firm’s energy group asked respondents where the oil and gas companies will likely turn for capital in 2019.

Cash from operations and JVs with private equity will result in half the capital spent in 2019 according to a recent Haynes and Boone survey of energy company executives and their lenders

Cash from operations and JVs with private equity firms will provide almost half the industry’s capital needs in the year, according to the Haynes and Boone respondents. These two sources accounted for 44% of responses in the survey, compared to 34% in the fall survey.

In the Haynes and Boone survey, private equity as a capital source for producers represents 40% of the responses—either as JVs, farmouts, Drillcos,and equity and debt from private equity firms. Capital markets got only 12% of the responses for capital sourcing.

Oil and gas funding evolves: enter private capital

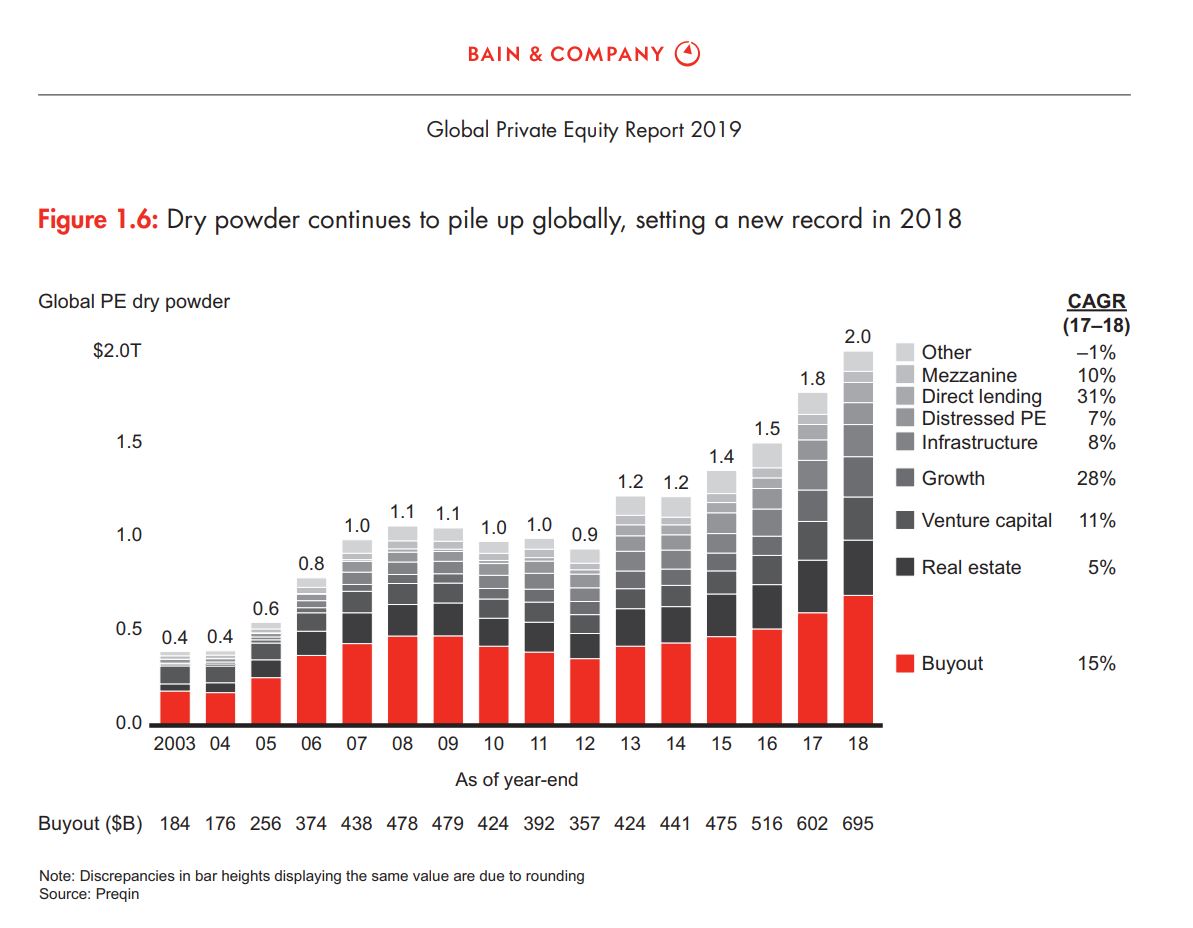

Bain & Company’s Global Private Equity Report 2019 is packed with data analyzing the state of private equity on a macro-scale. “After years of record-level fund-raising, PE funds are awash in capital and face a growing need to put large amounts of money to work,” Bain reports. “Despite the strong pace of investment since 2014, PE dry powder, or uncalled capital, has been on the rise since 2012 and hit a record high of $2 trillion in December 2018 across all fund types.”

According to consultancy Opportune LLC, the U.S. represents approximately 80% of the value of the global private equity deals in the oil and gas sector.

From the oil price crash in mid-2014 up through mid-2017, more than $100 billion was raised by private equity firms eager to acquire energy assets on the cheap, Opportune reported in mid-2017. “During this period, banks turned away from the weakest borrowers and started offloading their loan books. Some U.S. E&P independents were then forced to file for bankruptcy while others quickly unloaded assets to stay afloat.”

Some private equity firms targeted loans and bonds with an eye on seizing ownership in bankruptcy or restructuring while others snapped up assets directly from operators that were short on cash, the consultancy said in its report.

During the downturn in the oil and gas sector, when cost-cutting and debt servicing became the oil companies’ number one priority, the need for operational and growth capital loomed large, and private equity firms were well positioned with ample dry powder to fill that gap.

The same source is available today. Equity financing and raising debt are not at the top of the U.S. E&P capital sourcing list for the time being. In fact, a public oil and gas E&P incurring debt is the last thing investors want to see.

“Clearly public market expectations are changing. Debt-adjusted cash flow per share—that’s what analysts are asking E&P management for in the latest round of earnings calls,” Drillinginfo Senior Director Brian Lidsky, a long-time E&P industry analyst, said at the 2019 EnerCom Dallas oil and gas investor conference in late February.

Lidsky said another factor is that some of the pension funds and endowments have grown weary of lagging values in the stock market for E&P shares along with the volatility that goes with the industry, and some have made the decision: ‘we’re not investing in oil and gas anymore’.

Opportune’s Jim Hansen lays out the landscape of oil and gas finance today

Long-time energy investment banker and oil and gas sector finance expert Jim Hansen spoke to Oil & Gas 360 for an exclusive interview about the shifting capital foundation that traditionally fuels the oil and gas sector.

Hansen is the head of investment banking for Opportune Partners LLC, an independent investment banking and financial advisory affiliate of Opportune LLP. Hansen has more than 40 years of commercial and investment banking experience including as head of the Oil Service Lending Group at Manufacturers Trust Co. and as co-head of its Energy Corporate Finance department. Hansen has worked at Howard Weil, Banc of America Securities, First Albany, Morgan Keegan and Ladenburg Thalmann & Co., working on M&A, public and private equity, convertible preferred, high yield, investment grade debt, private placements, debt restructurings, strategic initiatives and fairness and solvency opinions for both domestic and international E&P companies, oilfield services, pipelines, MLPs and trust issuers.

OAG360: Where do you think things stand right now, and what do you see for the next two, three, four years as far as private capital, investment banking and sources of capital for the oil and gas industry, the E&Ps in particular?

JIM HANSEN: These are interesting times. The E&Ps have to ask themselves, what do you do to posture yourself if you’re an E&P company? I see people stepping back from the latest decline in oil prices to get a longer-term perspective on what it really takes to not only survive but to flourish in this kind of environment.

I think that by and large, the public markets will continue to focus on the larger companies that have scale and free cash flow, which is now the mantra driving most of the research analysts who are high-grading their stock picks. I think it’s a challenge for smaller caps and middle-sized caps to create an environment of free cash flow.

The difficulty obviously is that there’s not a lot of mature conventional-type assets with a lot of these newer companies that have focused on the shale plays. So the maintenance capital expenditure levels may be higher for newer shale companies than they would be for an older company that has legacy assets with a slower decline.

I think there’s a lot of focus, both at the public and private companies, on the fundamental blocking and tackling issues of best internal practices and making sure that operationally and financially, you’ve gotten the company into the best possible shape. Do that first. Then consider your strategic options from there.

But it’s not as easy as you might think because of the operating issues regarding the shale plays.

A lot of folks are concerned about the issues about communication between the parent and the child [wells] and how you set up your AFEs and you target based upon your projected returns and then you find out that there’s delays in the drilling package, so it’s more expensive than you thought and the operating results aren’t as robust as you thought.

Those are difficult parameters to have to live with. Beyond that, you’ve got the whole issue of your marketing, your procurement and everything that goes into streamlining your operating and financial decisions – determining and using best practices.

As much as that’s a goal and objective, I’m not sure that a great deal of the public and private companies can achieve those kinds of metrics as they go forth. However, they’ve got to strive for it, and that’s the key for trying to position the companies for either an exit if you’re a private company, or to improve the valuation if you’re a public company.

OAG360: In your view what’s the state of energy IPOs for 2019, 2020?

JIM HANSEN: I think they’ll be very quiet, if at all. I think that the shale play IPOs will be continued to be delayed. By this I mean the public equity players continue to sort through the various developments as each quarter flows through and people come back with updated analysis of their drilling results. I think there’s plenty of opportunity already existing for people to buy into existing public companies with liquidity as opposed to trying to buy an IPO candidate that has not been tested in the marketplace but may be in an area or geographical or geographic basin that is already well-represented in the public domain.

OAG360: What appetite level are you seeing from institutions for equity placements, private placements, with E&Ps and oilfield service companies and midstream?

JIM HANSEN: I still think there’s opportunity on the midstream side from the private equity standpoint for existing management teams that have delivered on past midstream companies. I would say on the E&P side that there’s very little interest in financing new management teams at the present time.

OAG360: If the price of oil gets back up around $80 or above, has the world changed enough to where they’ll continue to be very diligent with controlling costs, or do you think if oil reaches say $90+ all bets are off, and it starts to feel like 2013 again?

JIM HANSEN: No, I think the world has changed. I think there’s a lot of scar tissue since 2014. People have described it as investor fatigue. I think one of the interesting things I’ve noted in the last couple years is what I would characterize as management fatigue.

There’s a lot of management teams that have gone through the last five years after the 2014 price decline and have done what they think to be an adequate job of creating shareholder value, but at the same time the public investors have moved away from the industry.

It’s extremely frustrating to have tried to create a company that has good upside and has created value but is not getting recognized by the public investors. This is an industry that is characterized by very smart, financially astute entrepreneurial management teams who’ve been backed by very smart financially astute private equity-sponsored firms, but it seems like the last three months have been characterized by more frustration because the industry management teams have not gotten the benefit from positioning their companies in a favorable light.

A lot of people point to decline in the S&P on the energy side going from 15 percent to 5 percent as being a contributing factor. But I think that in very few cases the management teams over the last 10 years, 15 years, have become much more financially astute. And that, coupled with the shale revolution, have positioned a lot of companies in a favorable light. But today, on the public side, it’s been a very frustrating time for the industry. You can look at the metrics that they use to identify how well they’ve done.

They’re at a big discount to where they’ve been in the past, and I think they’re confused as to why they’re not being rewarded in today’s marketplace under metrics that they think would stand up comparatively well in any kind of a price environment, $55 or $60 or $65, but no one seems to want to reward them for that performance.

OAG360: Shifting over just to investment banking, what are the trends you are seeing now?

JIM HANSEN: I would say that the A&D market has slowed, as assets for sale are not flowing as frequently as they have in the past, and that could be to an unwillingness from certain companies to pay cash, and then there’s a lack of financeability to affect an A&D transaction. I believe that over time there’s going to be further exploration on the stock merger side, which has already been prevalent in the public markets.

I do think that it’s much more difficult to affect a stock for stock transaction private to public or private to private company. But I think this will be explored more often by companies trying to create scale to achieve efficiencies.

OAG360: What other trends are you seeing?

JIM HANSEN: It’s amazing—the aspect of what’s happening in the United States—the amount of production that has come out of the shale producers and will continue to come out of those shale producers will change the dynamics of the oil markets for years to come.

OAG360: The other thing that’s interesting is the big oil companies saying “we’re going all in Permian now” with BP and Exxon recently announcing gigantic production forecasts from their Permian operations. These giants are going to start taking over some of the smaller guys’ properties.

JIM HANSEN: Yes. We expect to see that this year, and everybody’s talking about the potential merger activity between the majors and some of the larger independents. We’ll see if that occurs. It’s certainly a topic of conversation around the oil patch right now.

OAG360: Are you seeing that in other basins or you think it’s mainly in West Texas?

JIM HANSEN: Right now, I’m only hearing about it in the Midland Basin – that seems to be the primary area of discussion.

Private capital or private equity?

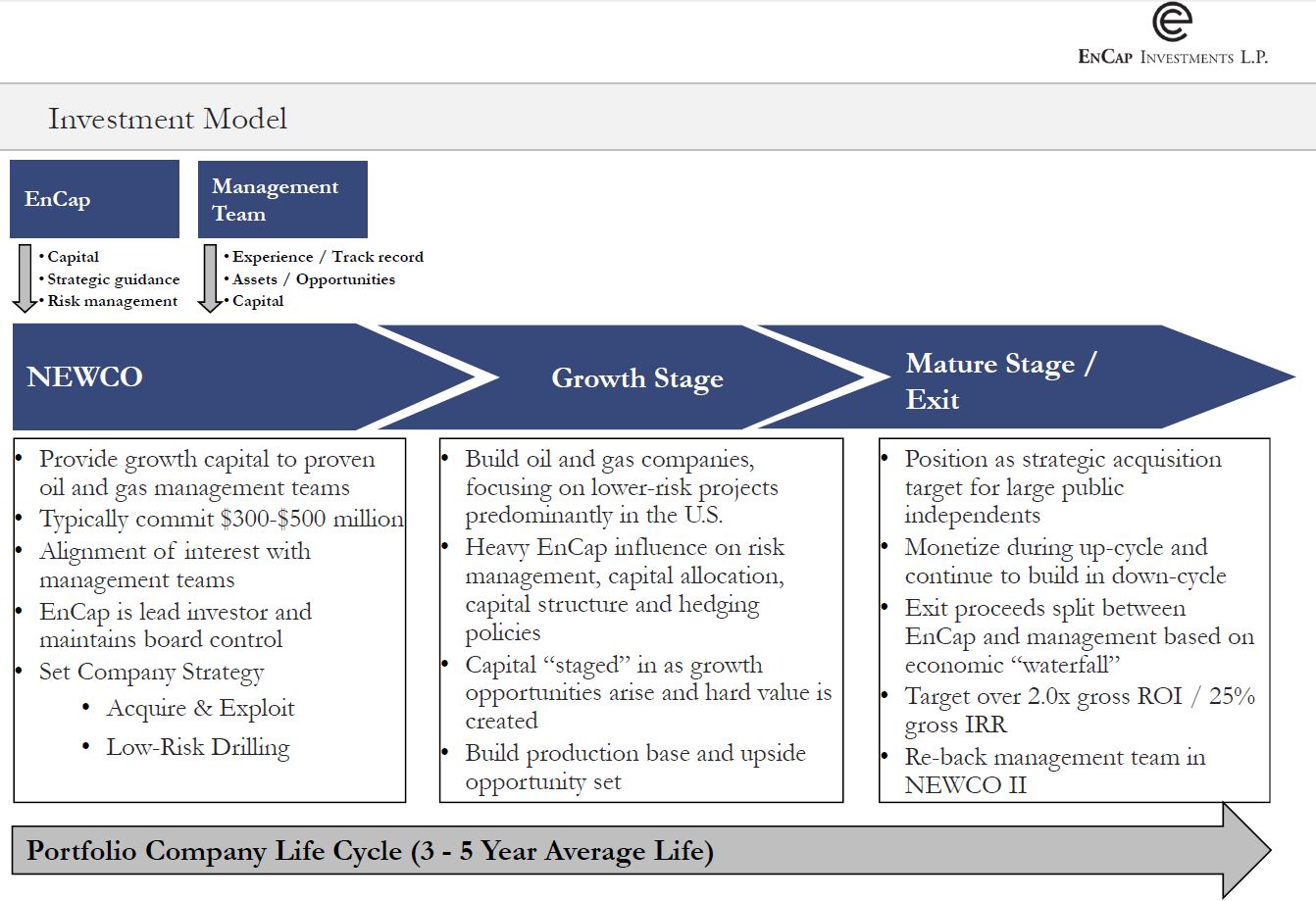

The name private equity (PE) denotes with many people a specific model where a group of partners raises funds from outside investors, each fund being tied to a particular sector like energy, tech, pharma, heavy equipment. The funds raised are used to make private transactions in that sector—purchase companies or assets, bring together a management team with a track record in the particular industry to grow the acquired assets, and the fund then cashes out within a window that’s generally around three to five or six years. But in recent years, private equity for oil and gas has become a catch-all phrase which includes different kinds of private capital investments and asset management schemes.

Besides the firms operating within a traditional private equity model, other “hybrid PE firms” like Aethon Energy and Fleur de Lis Energy are becoming substantial players in the private capital space. We call them hybrid because they raise private capital through in-house funds and they allocate the capital to company-managed oil and gas development teams that drill and develop the assets the fund buys.

Aethon is a combination of operator and private equity firm. “I’d say ours is more of a ‘growth private equity’ approach to oil and gas, as opposed to venture capital and lands, stepping out doing our own gas exploration,” is how Aethon Co-President Gordon Huddleston explained his firm’s strategy to Oil & Gas 360.

Fleur de Lis Energy (FDL) runs on a similar model. The firm describes itself as a returns-focused energy investment manager and private E&P operator that makes direct investments in oil & gas properties in the United States. It also manages and develops the upstream assets that it acquires. FDL calls itself “a full-service oil and gas operator.” So are these firms private equity fund-raising entities or oil and gas operators?

A private capital firm operating the usual PE business plan is Pelican Energy Partners. Pelican specializes in the oilfield service side of upstream.

Pelican Energy Partners describes itself as “a highly specialized private equity fund led by a group of experienced energy service professionals focused on making strategic investments in energy services and manufacturing companies. The principals have combined their own capital with that of other energy services and E&P executives to form Pelican Energy Partners, which is managing approximately $563 million of equity capital,” Pelican reports.

“We create value by partnering with seasoned management teams to grow outstanding businesses.” That describes the traditional private equity business model: raise the funds, buy assets or a company, put together a management team, nurture the team, grow the investment, exit through a sale of the company or taking the company public.

Private equity – perspectives and definitions differ

Finance career website ‘Mergers & Inquisitions’ defines private equity as “an umbrella term for different types of investments in private companies or in publicly listed companies that will become private as a result of the investment. That’s what the “private” part refers to – we’re not dealing with investments in the stock of public companies here. The bulk of the investing is done through private equity funds, which are investment schemes,” M&I said. “PE funds are managed by a General Partner (GP) – the firm itself and everyone who works there – and funded by several Limited Partners (LPs) – pension funds, banks, insurance companies, high net worth individuals, etc. – anyone who has enough cash to invest,” M&I says.

Investopedia defines private equity as “an alternative investment class and consists of capital that is not listed on a public exchange. Private equity is composed of funds and investors that directly invest in private companies, or that engage in buyouts of public companies, resulting in the delisting of the public equity.

[contextly_sidebar id=”A0uliw7feCUyCi3yHjx9ATGcEI8Dip0U”]

“Since the basis of private equity investment is direct investment into a firm, often to gain a significant level of influence over the firm’s operations, quite a large capital outlay is required, which is why larger funds with deep pockets dominate the industry.” Investopedia defines private-equity’s two critical functions as: (1) deal origination/transaction execution, and (2) portfolio oversight.

“As for deal origination, in a competitive M&A landscape, sourcing proprietary deals can help ensure that the funds raised are successfully deployed and invested.

“PE firms believe they have the ability and expertise to take underperforming businesses and turn them into stronger ones by increasing operational efficiencies, which increases earnings. This is the primary source of value creation in private equity, though PE firms also create value by aiming to align the interests of company management with those of the firm and its investors.

“By taking public companies private, PE firms remove the constant public scrutiny of quarterly earnings and reporting requirements, which then allows the PE firm and the acquired firm’s management to take a longer-term approach in bettering the fortunes of the company.

“One popular exit strategy for private equity involves growing and improving a middle-market company and selling it to a large corporation (within a related industry) for a hefty profit. The big investment banking professionals typically focus their efforts on deals with enterprise values worth billions of dollars. However, the vast majority of transactions reside in the middle market ($50 million to $500 million deals) and lower-middle market ($10 million to $50 million deals). Because the best gravitate toward the larger deals, the middle market is a significantly underserved market.”

According to James Chen, CMT, director of trading and investing at Investopedia and former head of research at Gain Capital (NYSE: GCAP), “Private equity comes with its own unique riders. First it can be difficult to liquidate holdings in private equity because, unlike public markets, a readymade order book that matches buyers with sellers is not available. A firm has to undertake a search for a buyer in order to make a sale of its investment or company.

“Second, pricing of shares for a company in private equity is determined through negotiations between buyers and sellers and not by market forces, as is generally the case for publicly-listed companies.

“Third, the rights of private equity shareholders are generally decided on a case-by-case basis through negotiations instead of a broad governance framework that typically dictates rights for their counterparts in public markets.”

[contextly_sidebar id=”SSKUOApncvwt4kilaoPBL7hGqvSQjd4T”]Working with a traditional private equity firm, the fund’s investors can get involved in large-scale asset development or a company buyout. “That’s creating opportunities for private energy startups—often led by former division managers in major oil companies that want to be CEOs of their own outfits—to snap up these properties and start drilling. But in order to do that, they need capital,” sumarized PitchBook’s Anthony Mirhaydari.

It’s true that private equity has played an ever-increasing role in capitalizing the U.S. energy space since the beginning of the oil downturn in 2014, “but that doesn’t mean it’s easy money,” the Houston Business Journal said.

Executives from EV Private Equity and Pelican Energy Partners told the newspaper that in a typical year they might invest in two percent or fewer of the companies they consider, “not counting the ones who never find their way in front of the firms.” In other words, the odds are long.

“Inventory is high in sponsor-backed companies that will be looking for exits in the next couple of years,” PwC’s Rob McCeney told the Houston Business Journal in the interview. “That’s combined with continued fundraising that will put broadly that same investor class in a position to continue to deploy capital.”

Drillinginfo, in its February 2019 Energy Capital and Market Data & Trends Report, discussed the idea of private equity looking for exits. Drillinginfo’s report tallied approximately 500 E&P companies that are PE portfolio companies. Sixty of those were formed in 2018. As a side note, of the 500 E&Ps backed by private equity, 155 of them, almost a third, are focused on the Permian Basin.

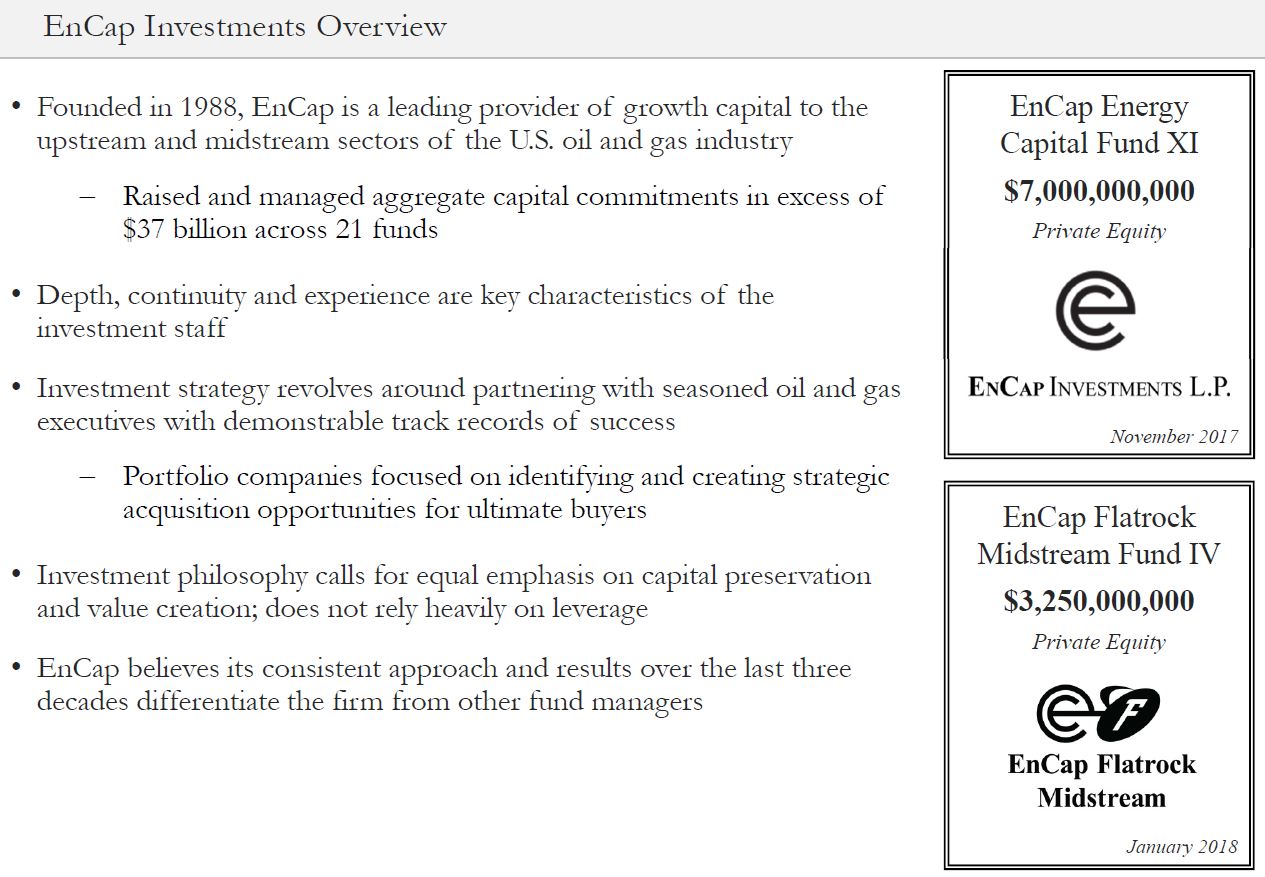

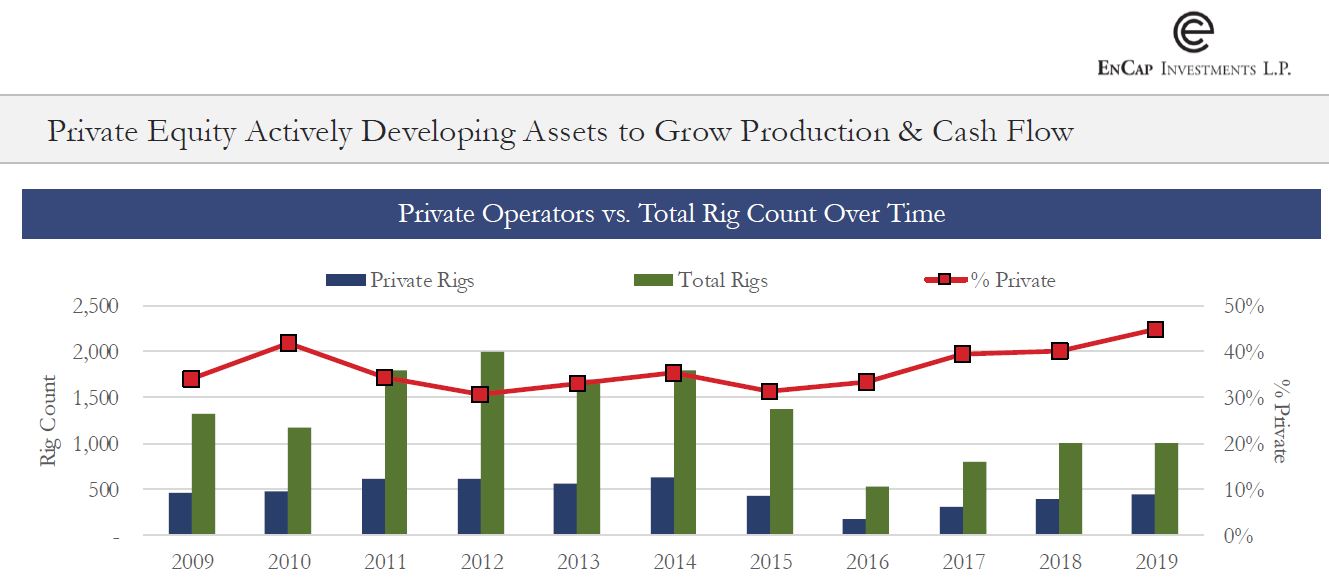

One large energy-focused private equity firm that works within a traditional model is EnCap Investments L.P. EnCap was founded in 1988.

The role of private equity in the oil & gas industry is evolving

Looking at Trends to Watch in 2019, Hart Energy spoke with Cliff Vrielink, co-managing partner of Sidley Austin LLP’s Houston office and co-leader of the law firm’s global energy practice.

“Historically, Vrielink said, private equity saw its purpose as building and then selling, either to public companies or larger oil and gas independents. That is still happening, he said, but now private equities are developing creative strategies. They are also looking to provide capital to big companies, examine their pools of assets and figure out a structure like a joint venture to ensure that the assets can be developed without becoming a drag on that company.

“We’ve seen some situations where the CFO and the financial team think, ‘I don’t want to get public equity because it’s too dilutive, I’m limited on how much leverage I have but I don’t want to sell this asset and maybe there’s a way to partner with one of these strategic investors’,” Vrielink said. “That’s something that we’ve seen quite a bit and we’ll continue to see a lot,” Hart reported.

“The traditional industry view was long-term,” reports Steptoe & Johnson in a whitepaper published by Bloomberg entitled When Worlds Collide: Results of the Rise of Private Equity as the Funding Source of Choice for American Oil and Gas Developers. “Traditional energy investors were seeking to acquire, to develop, to produce, to market product, and to hold projects for the long term. [But] the investment paradigm of many of the new [private equity] funds, by contrast, is decisively short-term. That shorter-term focus is accompanied by a targeted ROI.”

Sharon Flanery, head of the energy and natural resources department at Steptoe, said, “With private equity, it’s all about pinpointing the hurdle-rate.” Meaning the minimum rate of return for an investment to be considered viable. “Because private equity is so sensitive to rate of return, deal timing is critical,” Flanery said.

Return of the drillco

Drillcos have long been thought to be one of the most harmless ways to finance and can be a good problem solver for companies that want to develop projects without risking their cash flow, Drillinginfo said in its recent report. “Unlike a standard joint venture deal with two operators, the drillco structure brings a financial backer together with an E&P. The partner commits a flow of cash tranches to cover development costs for a pre-defined project in a specific area, most recently the US’ hottest shale plays.”

Most often these days, the money comes from private equity firms, Drillinginfo said. “After emerging from bankruptcy in 2017, Chaparral Energy set up a drillco with Bayou City Energy, California Resources Corp. with Benefit Street Partners, Earthstone Energy with IOG Capital, Tailwater-backed Pivotal Petroleum with Vortus-backed Canyon Creek Energy, and SandRidge Energy with an undisclosed investor.”

“The most prominent drillco of late is the $620 million deal that The Carlyle Group signed with Diamondback Energy last fall,” Drillinginfo says. “In that deal Carlyle will fund up to 85%, or $527 million, of the cost to develop the E&P company’s San Pedro leasehold in Pecos County, Texas, over five years.

“A typical component of a drillco structure calls for, for example, Carlyle’s working interests in the project to largely revert to Diamondback upon achieving certain production benchmarks.” Hitting the milestones ensures that the E&P gets the next tranches of financing.

“Carlyle also funded a $400-million drillco with EOG Resources to develop the Marmaton assets in Oklahoma last June. Performance-based financing with a timeline vs. a hugely dilutive equity-based financing during a sluggish market? The choice for many companies looking to develop their shale assets may soon become very clear.”

The Hybrid Private Capital Firms – Fund or Operator?

Fleur de Lis Energy

“There’s no better time for us to be in the market than when one company buys another and the buyer is trying to decide what’s core and what’s non-core” – FDL Senior VP Chris Holley

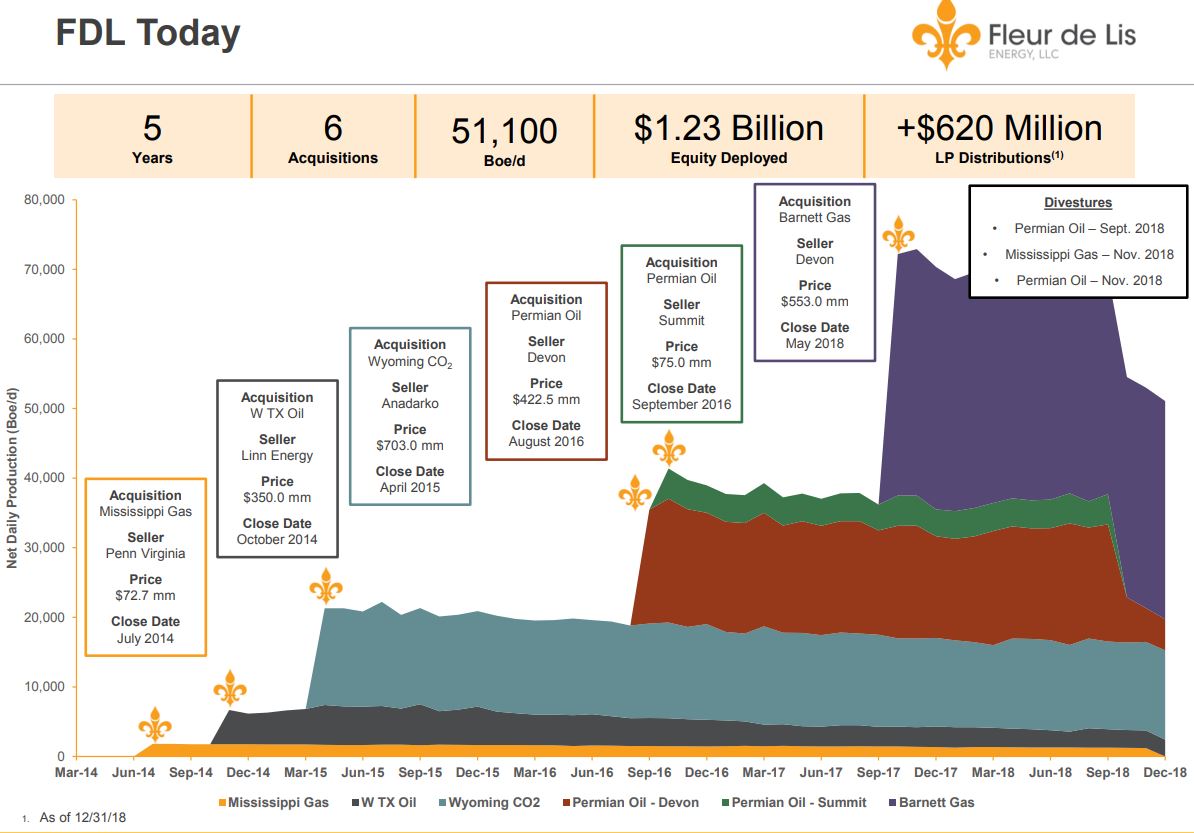

Dallas-based Fleur de Lis Energy, LLC (FDL) is part of the group that we’ve tagged ‘hybrid’ PE firms. On its home page, FDL describes itself as a returns-focused energy investment manager and private E&P operator that makes direct investments oil & gas properties in the United States. FDL has operations in three basins, with $2.1 billion of capital deployed across six transactions. The firm reports production of 70,400 BOE per day. The company pays out quarterly distributions to investors.

“In FDL’s four-year history, our team has drilled 15 unconventional wells in the Permian, executed on a major CO2 expansion in the Rockies, and reduced LOE on average by 20% over prior operators, all while paying back over $200 million in distributions to our partners,” the company said.

FDL’s team is fully stocked with professionals from Merit Energy, ConocoPhillips, KKR and other oil and gas companies and financial institutions. FDL Senior VP Chris Holley gave a presentation at the EnerCom Dallas oil and gas investor conference in February.

Holley described FDL as “a fund and an operator.”

“We didn’t want to go the route of private equity; we want to direct invest. We see value in LOE, marketing—there are lots of ways to win on an asset.” FDL says the firm has field employees in Texas and Wyoming.

FDL is currently in market raising a direct invest fund with a target of $700 million. In February the firm closed its Founders’ Class with a total commitment of $100 million.

Holley said FDL has a very robust hedging strategy that locks in their return. “We are hedged through payout.” Holley said they tell their PE partners, direct invest partners and royalty partners: “We are highly confident we won’t impair any of your capital.”

Holley said the company has grown quickly from “five guys in a temp space to two floors and 300 people.” Even so, FDL says the firm has one of the leanest cost structures amongst its competitors – $1.20 G&A/BOE.

“When you look at our reserves, we’re really agnostic when it comes to oil or natural gas. We look at the asset itself, and when we see one we like we make a run at it,” Holley said.

As to investment philosophy after closing an acquisition, Holley said, “We like to see ourselves buying and holding for 10 years—developing the asset—cash-flowing the asset. We want our hands on the asset the day after close: accounting, marketing, operations. We like to rip the Band-aid off early and get after it.

“There’s no better time for us to be in the market than when one company buys another and the buyer is trying to decide what’s core and what’s non-core,” Holley said.

FDL says it expects the majority of assets on the market will be non-core public assets and it is anticipating that the firm will review about $2.9 billion worth of assets in 2019. You can almost hear the cash register ringing for the FDL investors.

As Wood Mackenzie analyst Benjamin Shattuck said to Reuters recently, “When capital discipline is higher on the priority list, it’s very attractive to monetize.”

Aethon Energy

“We’ve got six rigs running right now and we’re going to continue to add to that” – Aethon Energy Co-President Gordon Huddleston on Aethon’s Haynesville Shale operations

Dallas-based Aethon Energy is another of the ‘hybrid private equity’ firms that we spoke to for this report. Aethon raises private capital for its funds, and it manages the drilling and production of its assets—as the operator, with around 100 of its own employees in the field.

Aethon was founded by Albert Huddleston in 1990 to acquire, operate, and develop onshore oil and gas properties with asymmetric return characteristics. Since inception, Aethon says it has managed over $1.6 billion in oil & gas assets on behalf of family and institutional capital.

Oil & Gas 360’s Richard Rostad interviewed Gordon Huddleston, Aethon Energy partner and co-president, about the firm’s business model and how the firm allocates private capital. In a deal worth $735 million, Aethon acquired QEP’s Haynesville assets in late 2018, adding significantly to its footprint in the Haynesville Shale play. Oil & Gas 360® published a story about the Aethon/QEP Haynesville transaction in December 2018.

[contextly_sidebar id=”KTD3JM8KND1IW30rQARaycqz5jGomHLX”]

Oil & Gas 360 interviewed Gordon Huddleston about Aethon’s business model and private capital for oil and gas funding at the end of January.

OAG360: We’d like to get a more general view of how you guys have seen the industry, how you operate as a private firm. Could you talk briefly about the founding of Aethon? What’s the investment philosophy of the firm?

Aethon Energy Co-President Gordon Huddleston: Aethon was founded in 1990 and it’s really built to pursue contrarian and asymmetric types of risk opportunities within the oil and gas space. And I think something that’s a little unique is this: as an owner-operator, we look for opportunities where we can do lower risk development and buy assets that the industry has overlooked that have potential upside. And find ways to create value from that standpoint.

I’d say ours is more of a “growth private equity” approach to oil and gas, as opposed to venture capital and lands, stepping out doing our own gas exploration. It’s kind of a nuance there.

OAG360: How would you differentiate Aethon compared to your standard private equity firm? Is it philosophy, business model?

GH: The big difference between most private equity firms in our space and ourselves is that we are an owner-operator. So we have 130 people in Dallas, 100 people in the field. We are both a private equity firm and an independent E&P oil and gas company. That gives us several advantages – (a) it reduces the overall fee structure for our investors, and (b) it gives you a lot more control and insight into what’s going on because you’ve got that full suite of staff you can lean on. That’s been very helpful.

And the oil and gas industry has evolved. It’s moving from more of a venture capital-style rank exploration business, into more of a true development business—over a short period of time.

And that is more of a grind and it’s harder to do, harder to execute. But I think that’s where firms like Aethon can really shine because our teams are used to managing very large-scale development programs with very large budgets, and I think that’s a real differentiator. It’s really not as easy as many other companies try to make it look.

OAG360: How do the ideas, the assets and deals, come to you? What’s your process for evaluating the opportunities?

GH: We have several different ways that we source deals. Primarily we develop in-house our own technical ideas around various basins—opportunities that we think are interesting. We do that from a top-down process. Then we go look in those basins for opportunities that meet that criteria.

One of the nice things about our industry is that there’s a lot of public information about who owns what and what’s going on with the asset, depending on if it’s developed or undeveloped.

That allows you to target specific areas and talk to those owners, the existing owners, or maybe if it’s not leased, you’re talking to the actual mineral owners. But in any case, for instance on our latest deal that we completed, the QEP transaction [EDITOR’S NOTE: Aethon bought QEP’s Haynesville assets in 2018], we’ve been working on that opportunity for more than two years. I think just staying in front of people is generally the best way we’ve found to find opportunities.

OAG360: A lot of the leg work goes into a deal long before you show up in a press release.

GH: It’s kind of like telling your neighbor with a house you’re interested in: “If you ever sell it, let me know before you list it.” You’ve got to get in front of people.

OAG360: Aethon has been around since 1990. You have seen all sorts of trends in commodity prices, high and low oil and gas regimes. What’s the difference in how you look at investments during, for example, a downturn compared to when prices are starting to recover or if they’re on the high side?

GH: I think that obviously can present a buying opportunity. Certainly, other people’s financial indigestion creates a buying opportunity. I think in this recent downturn of price – it hasn’t been very long on the crude side, so I believe it’ll take quite a bit longer until you see people having to make some divestments or accepting kind of a new price regime in terms of what they’re willing to sell assets for.

But I think in general, depending on what pricing is doing, we tend to hedge at least five years or in some cases longer. That helps lock in our underwriting and try to remove some of the volatility that the commodity pricing creates.

And traditionally, I think we’re looking for opportunities where we can be a low-cost producer who, given a fungible commodity, there’s no real differentiation other than at the end of the day, depending on where you’re delivering to. But you ultimately try to deliver the commodity at the lowest price, in our case in Henry Hub, taking all the various steps into account.

So I think that’s where we look for certain assets that meet that criteria. That’s what really insulates you when pricing goes down. You want to be the last person to have to shut-in production and stop development.

OAG360: Are there any specific plays that Aethon prefers to look at? You have extensive assets in the Haynesville, but any others? Are you primarily gas-focused, or is it kind of whatever opportunities come your way?

GH: We’re hydrocarbon-agnostic. We’re just looking for the right opportunity. We definitely like crude and would be interested and have been looking at opportunities in other basins. Obviously, the Permian and Delaware are very attractive. We’ll see how over the next couple of years that development goes. That’ll be partially dependent on pricing, whether or not there are going to be opportunities there.

There are always opportunities to consolidate. We’ve had that opportunity in the Haynesville. We like the regional proximity to demand. That was very attractive to us and also just the amount of transport options you have there. It was very robust.

But I think at the end of the day, we don’t have a preference. But we do like the long-term macro story on natural gas.

As you’re transitioning into the lower-carbon-type future, we think it’s a fuel that’s going to play a large part of the future demand, from an energy standpoint in the U.S. and globally. From that standpoint it makes a lot of sense to us.

OAG360: Aethon talks about minimizing the downside. Is that primarily going into well-understood fields, or is that minimizing commodity price exposure, or what’s the philosophy there?

GH: Obviously risk management is arguably one of the most important things in our industry. We really try to box risk in, and whether that’s looking at our transport of the commodity, trying to de-risk that, whether it’s pricing through using hedges to try to eliminate that volatility including hedging your future development programs, and then you have a service cost and trying to lock that pricing in, and vertical integration – you’re always trying to get to that lower cost, be the low-cost producer.

And then I think, lastly, certainly, understanding the reservoir and the characteristics of the rock, given that if you were going to go lock in all those other components, you’d better have confidence in your ability to produce hydrocarbons at a certain rate and price, based on flow design and completion.

I think it really all fits together.

But to your question, it certainly is dependent on your ability to project some sort of consistent outcome from your development program. That really requires you to have a well-understood reservoir, at least internally. While industry may have a different view, I think it’s really critical that internally, we have a consensus and that we’re confident in our ability to develop and produce those volumes.

OAG360: You’ve got a lot of levers that you can pull.

GH: It’s a unique business. I’m sure Macy’s would love to lock in their winter 2019 sales for Christmas, but it’s just not the way that works.

OAG360: What are your own investors, the investors in Aethon, looking for when they’re evaluating your investments? What are the criteria that you usually hear about?

GH: I think they want to see confidence in the development program and how well understood the type curves and production profile of that reservoir is. That’s generally where, when you’re underwriting these types of assets, that’s obviously where a lot of the value discussion lies.

And then certainly, thinking about exits, thinking about just longer-term strategic concerns, whether it’s transport, differentials, just trying to understand what externalities could impact the investment. That’s partially because our investors tend to have a longer-term view, which is great, and they make great partners from that standpoint. It means that they’re more focused on what can happen in year six to ten rather than in the next six months.

OAG360: What would you say is the profile of your typical investor?

GH: It’s typically anywhere between 25 and 100 million dollars-plus, whether it’s insurance, pensions, endowments. We’ve had a number of different types of people, including obviously high-net worth individuals, larger family offices. It’s kind of a wide range, but it’s generally people that are looking for a lower-risk way to invest in oil and gas with a lower fee structure. And that’s what has been our general selling point for people.

We’re really trying to hit a lot of singles and make it a long inning as opposed to going after some grand slam.

OAG360: Does Aethon have dry powder? Are you looking for additional deals, or do you plan to develop what you’ve got right now and see where it goes in the next few months and years?

GH: We’re looking for more acquisitions. We’re working on a couple right now and hopefully we will be able to get a couple more done here in 2019. I think there’s a lot of opportunity, as we were talking about earlier. Some of the smaller firms maybe aren’t set up for large-scale development, and so they look to exit and various consolidation opportunities become available in virtually every basin.

Pricing is at a pretty good spot because we’ve seen a lot of the public companies – they have a lot of inventory. They’re under pressure from Wall Street to stay within cash flow. And so a lot of larger acquisitions at this point in time, especially where the high-yield markets are, those are going to be challenging. That’s our main competitor when we look at opportunities, between that and other private equity.

And when I think about other private equity – we tend to get relatively close from a valuation standpoint. Our cost to capital is relatively similar and so that’s an easier, I would say, “competitor” as opposed to a public company that has both other equity as well as sometimes a lower cost debt financing.

We’ve got six rigs running right now and I think we’re going to continue to add to that. We’re looking forward to developing the assets we have and hopefully making some additional acquisitions in the future.

Private equity deals dominate the midstream marketplace

Looking at the activity of private equity firms in the oil and gas midstream, Alerian analyst Stacey Morris reviewed some of the key transactions during the past several years and asked the question: What are the implications of private equity exits?

Morris points out that PE investments tend to be held for a number of years and then exited through a sale or an IPO. Median holding periods for buyouts were approximately five years in 2016. Things can change in three years.

Southcross Energy Partners (SXE), whose GP is two-thirds owned by PE firms EIG Global Energy Partners and Tailwater Capital, announced it was being acquired by American Midstream Partners (AMID) in a deal that would have formed a $3 billion partnership. American Midstream’s sponsor is an affiliate of PE firm ArcLight Capital Partners. The announcement came in Nov. 2017, but half way into 2018, Southcross terminated the transaction. Some deals don’t make it all the way, but many more do.

Medallion Midstream Gathering & Processing, which had Midland Basin crude transportation assets and was 51%-owned by The Energy & Minerals Group, was purchased by Global Infrastructure Partners, another PE firm, in Q4 of 2017.

[contextly_sidebar id=”x85yN7qRODCQGvLHvc81tMrAdtMA1V13″][contextly_sidebar id=”FFqE5oqbVHxehG9xztXJcL82rUIrPzTJ”][contextly_sidebar id=”tG6CWnYzL3Y48duS6BZbntGAyWgdLAzp”][contextly_sidebar id=”ZI259jpOeHwQ5Mr46DPb1Ot5F0UjlKna”][contextly_sidebar id=”Ib1wiJJCpKkorcA4Rfd5somnTW0fFV3R”]

In a report dated March 4, 2019, Oppenheimer looked at the current landscape in the midstream sector. Since the start of 2019, private equity funds have invested nearly $5 billion in energy midstream infrastructure, the firm reports. Specifically, $3.3 billion was invested in a partial equity stake in Tallgrass Energy LP (stock ticker: TGE, $TGE) and $1.6 billion was invested in a partial equity stake of Bakken midstream assets owned by Targa Resources Corp. (stock ticker: TRGP, $TRGP).

“Private equity has invested more than $20 billion since the beginning of 2018 in midstream assets in the public space at cash flow multiples of 12x-15x according to RBC Capital Markets. Meanwhile, current valuations for public MLP and midstream companies average just 10.5x.

“While the current depressed valuations of public midstream equities reflect tepid interest from public investors, large recent investment by private capital suggests these long term-focused investors are encouraged by the outlook for midstream. Domestic midstream assets are generally underpinned by fee-based cash flows and poised to benefit from visible production growth in the near and long term.”

And continued U.S. oil production growth seems assured for the time being, albeit growth is forecasted to come at a slightly reduced pace in 2H 2019 and going into 2020, based on independent oil and gas company CapEx reductions announced for 2019.

Oppenheimer said, “Until public midstream multiples recover to more normalized levels, we believe public midstream companies will continue to sell non-core assets to help finance higher-returning new investment opportunities. It also appears that private equity remains ready to continue to take advantage of the sector’s cyclical weakness.

“With an estimated $193 billion of infrastructure-focused private capital still to be invested and more than 200 infrastructure-focused funds currently in the market looking to raise an additional $200 billion, there appears to be ample potential demand for such assets. [Source: Q4 2018 Preqin Private Capital Fundraising Update (January 2019)].

It may not be as sexy as upstream, but midstream has deep-pocket PE backers and a constant flow of deal activity — “retail investors may be missing the opportunity that private capital recognizes in the public midstream space”

“Although we welcome private capital’s investment in the midstream space, especially as an important source of liquidity, we believe retail investors are missing the opportunity that private capital recognizes in the public midstream space,” Oppenheimer said.

Private equity capital continued to surge into the midstream space in Q1 2019. Blackstone (stock ticker: BX, $BX) announced its Blackstone Infrastructure Partners would acquire 44% of Tallgrass Energy (stock ticker: TGE, $TGE) and 100% of Tallgrass’s general partner. On March 11, the transaction closed. The price paid: $3.3 billion in cash.

Commenting on the sale to Blackstone, Tallgrass President and CEO David Dehaemers said on a conference call, “Blackstone is a large open-ended fund dedicated to infrastructure with deep access to capital. It’s also a firm that takes the long view and builds to last. We like to think they have deep value view of Tallgrass. We believe all these attributes bode well for Tallgrass as we continue our transition from what began as a high growth MLP into an established large midstream infrastructure company.”

When Tallgrass announced fourth quarter results and 2019 guidance, the release emphasized where management and Blackstone intend to take the company. “Tallgrass expects to generate approximately $1 billion in adjusted EBITDA and $800 million in cash available for dividends. Tallgrass intends to grow dividends by 6% to 8% in the year and maintain dividend coverage of over 1.25x,” the firm guided.

Blackstone reported that as of YE 2018 its private equity arm had $130 billion in assets under management and $44.4 billion in dry powder, and 250 private equity professionals to help out. Blackstone lists Cheniere Energy, Alta Resources and LLOG Exploration as some of its energy investments. Blackstone Group, the parent, describes itself as the largest alternative investment firm in the world, specializing in private equity, credit and hedge fund investment strategies.

Advice to young bankers who want to break in to PE: look to midstream

Mergers and Inquisitions publisher Brian DeChesare writes career movement advice for young energy bankers and he recently talked about opportunity in energy private equity, making some interesting observations about the oil and gas industry during an interview with a PE firm analyst.

“Most people are drawn to the upstream segment because it seems sexier than midstream, downstream, or oilfield services, and it’s where some of the biggest deals take place. That’s mostly accurate: You will work on more equity, debt, and M&A deals if you focus on upstream companies, even if commodity prices have crashed.

“However, it’s often better to focus on midstream deals if you want to break into private equity, for several reasons:

- Energy PE recruiting is very specialized – midstream PE funds recruit mostly bankers with significant midstream deal experience.

- Few people understand MLPs and the different tax and legal structures in-depth, so you set yourself apart if you’re an expert in this area.

- Many analysts who work on midstream deals work with only one large company for their entire time in banking. As a result, they become experts on that single company, which is a big selling point in PE interviews.”

Oil and gas funding: PE is investing in every kind of oilfield infrastructure

The private equity funds are also getting involved in the oilfield by investing in the newer infrastructure industries that have developed in synch with rapid production growth that is occurring in many basins, none more so than the Permian. A great example is water handling.

Once managed individually by energy producers, the job of supplying, collecting and disposing of water is a rising cost for drillers, and it has spawned a $34-billion a year business in the U.S. that has lured investors including TPG Capital, Blackstone Energy Partners LP and Ares Management Corp. to back these firms, according to a March 2019 report by Reuters entitled “Wastewater – Private Equity’s New Black Gold in U.S. Shale.”

“Raising cash at a time when the industry is under pressure to restrain spending and improve returns has also fueled the trend” toward selling water assets, “prompting some producers to cash in on their water projects,” Reuters said.

Huge demand, huge importance of water delivery and disposal to E&Ps

Speaking during a panel discussion held at the Permian Basin Water in Energy Conference in Midland, Texas, Gabriel Collins, Baker Botts Fellow in energy and environmental regulatory affairs at the Baker Institute for Public Policy’s Center for Energy Studies, described water midstream—the sector of companies who own and manage the infrastructure to store produced water and transport it to other locations, such as saltwater disposal wells (SWD) or other frac sites for reuse, via pipeline—as a sector that will help the region stay competitive, the SPE reported in April in its Oil and Gas Facilities publication.

[contextly_sidebar id=”Fugx82RhUPr6zb89HMv39F7dCD2y4r4U”]

Collins said the Permian region can expect at least 4 million BOPD of incremental growth in produced water volumes by 2021. “The costs of moving such mass are a problem, but water midstream companies have positioned themselves to take advantage of the possibilities borne from this problem,” he said.

“If M&A activity picks up, billion-dollar valuations for water midstream companies in the near future could become a reality”

Water midstream companies are another means to help control costs for operators who do not want to build their own pipeline networks. Instead of investing further in SWD, building their own infrastructure to transport produced water, or having more trucks on the road handling increased volumes, operators can have someone else handle their water at a fixed cost, Oil and Gas Facilities reported.

“One of the nice things about putting water in a midstream system with a long-term contract is that you’ve basically fixed a service cost in a largely inflation-resistant way. I think that’s a special opportunity to not have to do that with pressure pumping and other things that can fluctuate wildly along with the commodity prices,” Collins said.

In December, Hess Corporation sold some of its water assets for $225 million for some of its water handling assets from a joint venture with Global Infrastructure Partners, while Halcon Resources got $200 million in up-front cash from WaterBridge Resources plus up to $125 million over time by selling its water infrastructure assets.

In a 2018 Forbes article, Pål Reiulf Olsen, senior partner at HitecVision, said that as a private equity investor based in Europe, his firm has not noticed any change in the demand for the product that they provide and in the investment of oil and gas. “There is absolutely no reduced appetite for investment in oil and gas, but investors want to see returns. If they can generate attractive yield returns in oil and gas, they will invest,” Olsen told Forbes.

PE bring two key items to the table: plenty of available cash and speed of execution

Opportune EMEA Transaction Services Leader Mauro Fiorucci summed up the pure private equity path to success like this: “Private equity success does not come from industry expertise but instead from knowing a good opportunity when they see one and being ready to pounce when the majors are running out of steam and the traditional sources of funding are drying up.”

“What private equity firms lack in operational and technical capabilities they make up with available cash and speed of execution,” Fiorucci said.

Private equity has stepped up to bat, and the innings are getting significantly longer

Bloomberg reported during Q4 2018 that, “For private equity, the game plan for cashing in on the U.S. shale boom is shifting from quick flips to long-term commitments, according to one veteran energy investor.

“With big, publicly traded drillers less eager to spend on acquisitions, private explorers that once counted on being gobbled up in three to five years are having to recalibrate, Howard Newman, chief executive officer at New York-based investment firm Pine Brook, said in an interview last week. Investors may now need to stick around for a decade of drilling and development before companies reach ‘full value’, he said.

“Your challenge really is to optimize the play, rather than just find the play,” said Newman, whose firm manages $6 billion in investments, with stakes in oil and gas ventures from Texas to Oklahoma and Canada. “You should be prepared to take it all the way through to development.”

“With the shale business maturing beyond its early, land-rush years, energy exits have gotten harder for private equity. Public drillers who’d once served as natural acquirers now face pressure from their own investors to rein in spending.

“You have to build a business that will generate earnings and cash flow, rather than just inventory that you can sell to somebody,” Newman said. “Fundamentally you have to look at a project and say, ‘Can I get this to a point where its full-cycle economics justify my putting money into it?’”

“Holding onto assets for longer is the polite way of saying that the PE groups have few options and are in a holding pattern,” according to Drillinginfo’s Energy Capital Market Data & Trends report.

Drillinginfo said that of the 500 aggregate upstream companies held by U.S. private equity groups, “some have stayed well past their point of nourishment and are ready to exit. But to where?”

“Three- to five-year-old companies are usually ready to go, but public E&P buyers are not biting, going back to our earlier point about the unclear outlook for IPOs. A banker quoted by Forbes told the magazine that for the oilfield service sector, PE groups’ valuation expectations of 6X-8X EBITDA do not match buyers’ offers in the 3X-5X range.

“Carl Tricoli, a managing partner at Denham Capital, told the Houston Chronicle that PE firms will have to focus on ‘squeezing cost efficiencies and productivity gains from the oil fields they invest in’.

It’s a relatively new role for PE groups. “You’ll see more private equity money going into drilling wells. The next iteration will be, instead of taking and selling the acreage, you might see us holding onto the acreage longer, and that’s where efficiency gains come. How do I change my estimated ultimate returns? How do I affect the cost structure in a more meaningful way? That’ll happen over the next three to five years.”

Public equity vs. private equity in oil and gas: a review of the playing field for oil and gas funding – where it stands today

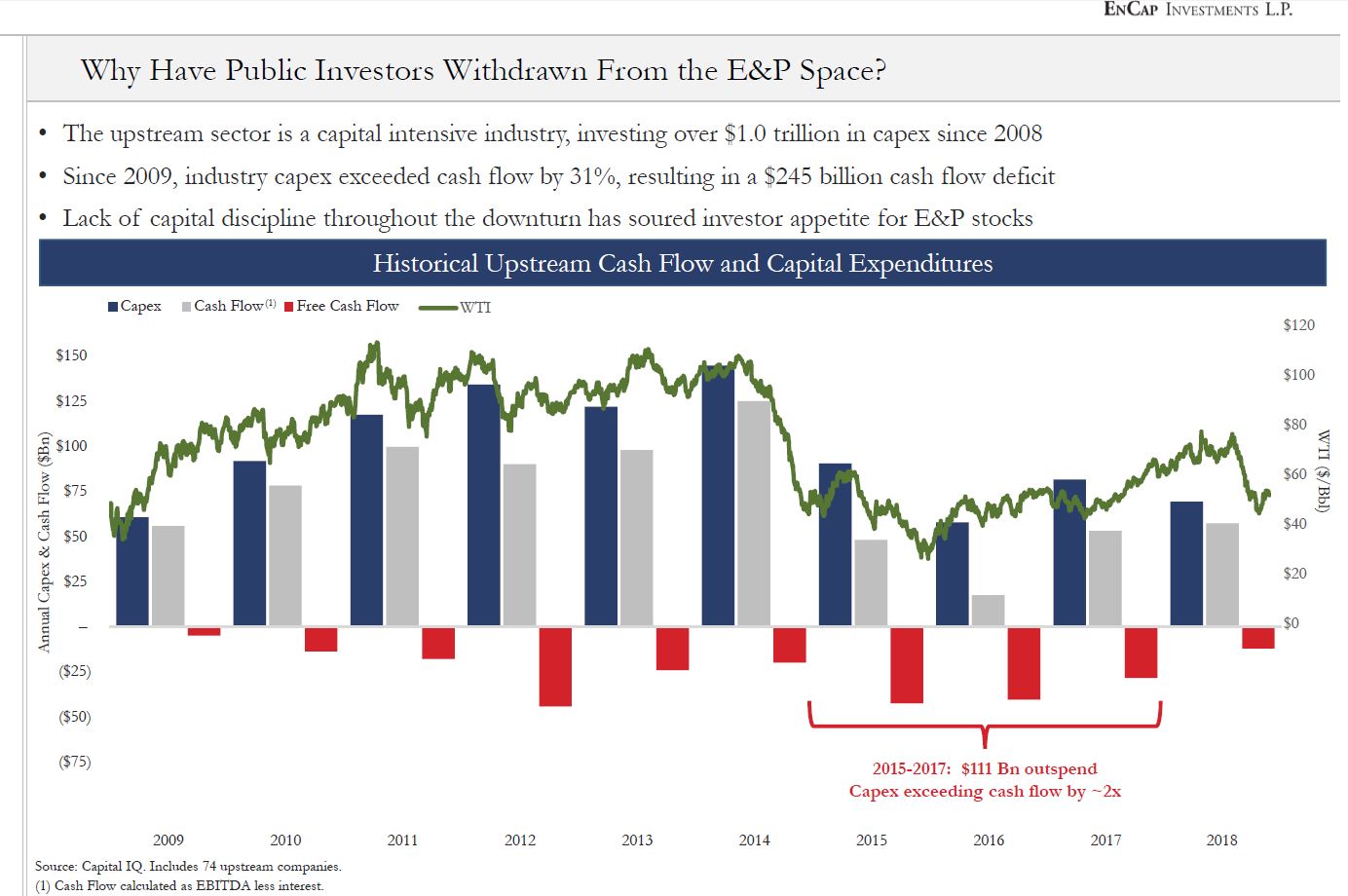

EnCap Investments Partner Jimmy Crain delivered a presentation recently entitled “Shifting E&P Investor Sentiment and Implications for Private Equity.” Crain’s audience was the Energy Finance Discussion Group at the Denver Athletic Club main ballroom on April 9, 2019. The grand ballroom was packed.

Crain began by discussing the turmoil of public equity investment in the E&P space during the past five years.

“If you were an energy equity [institutional] investor in 2016 – 2017, and you made some of these big bets that were made in ’16, you potentially lost your job or things didn’t go well for you,” Crain said.

“Watching some of the equity issuances that were going on at the time, in my view there were companies that were raising capital at $40-oil that had no business raising capital even at $100-oil.”

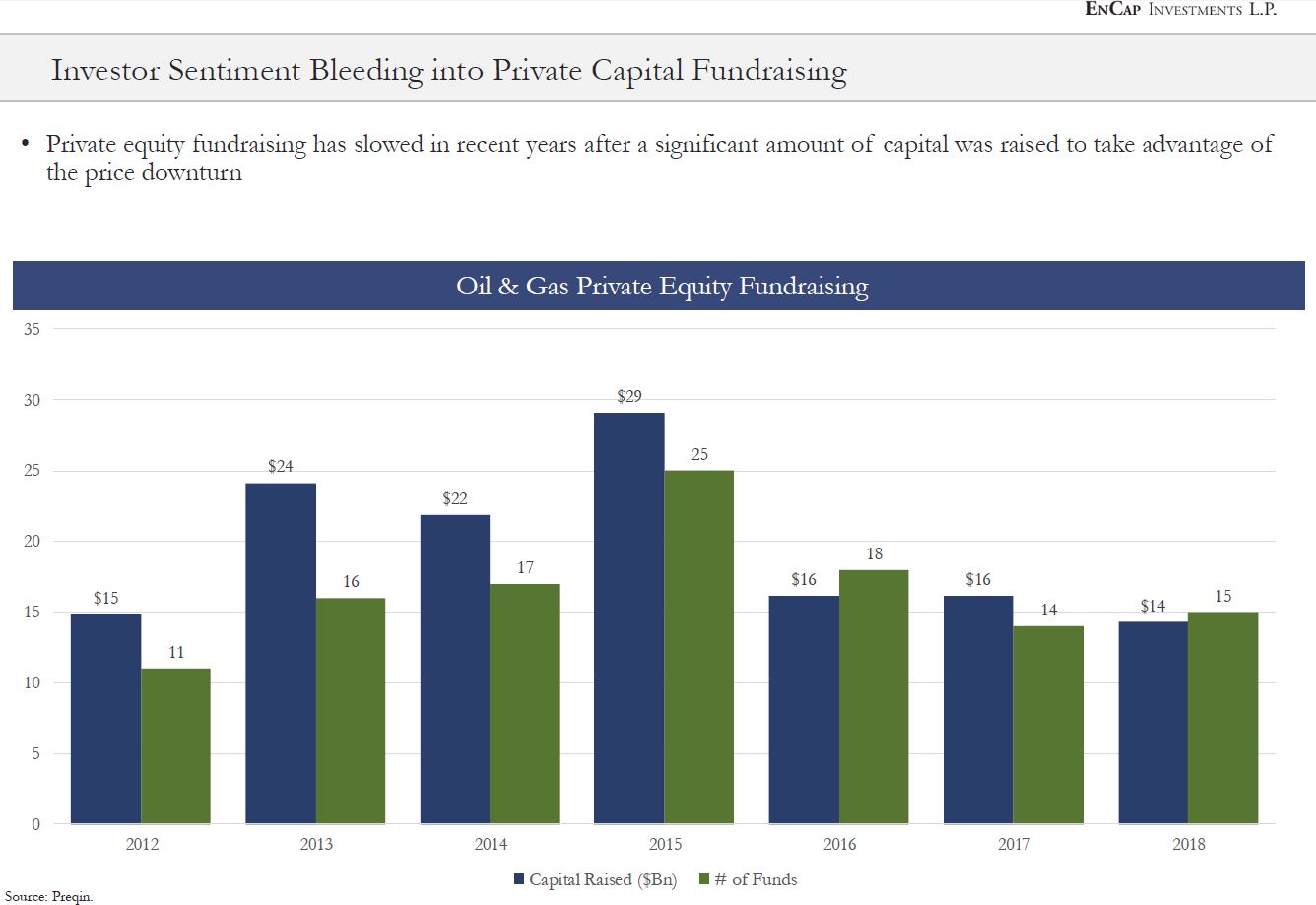

“The industry’s capital outspend literally doubled the cash flow during 2015-2016,” he said. “Our relative capital investment didn’t resize for our revenue stream,” Crain said, speaking about the oil and gas E&P industry, his specialty. As a result, “capital has left the energy space.”

Investor sentiment for public equity bleeds into investor sentiment for private equity

“What we see is that investor sentiment from public equity does bleed into investor sentiment on the private equity side,” Crain said.

“We’ve raised a whole lot of capital in the last decade plus, and I can tell you anecdotally, my friends who are out there trying to raise capital right now are saying ‘it’s tough and it’s taking longer than it has before’.” Crain said it’s important for public equity to reach the valuation it deserves, because “private equity and public equity are linked to one another very closely.”

On the business model of private equity, Crain said, “Our job is to buy things, grow things, sell things. And there’s a lot of transactions that go into that. We look at what percentage of the asset buys [taking place in the market] are private equity buys.” He said historically they are about three percent. But in 2018 he said the proportion of buying that’s been done by private equity-backed companies is going up. “Makes sense because they are the only people with cash,” Crain said.

Crain asked what the more difficult environment and longer sales cycle means for hold time for private equity? He agreed that the timeline has lengthened directionally, “but I’m not willing to say that it’s fundamentally shifted to a seven- to nine-year timeline.”

Crain said, “the A&D market for E&P is effectively dead.”

“That makes it hard for us to sell companies and therefore hard for us to return capital to our investors. If we give them money back, it’s a lot easier when we ask them for more money. But when we don’t give them money back, they are reluctant when we ask them for more money.

“So, if we can sell companies and return capital to them, they will continue to invest in our space. But if we sit here with a dormant A&D market, then they’ve got a lot of exposure on the private side to how much they want to make without line-of-sight to liquidity coming back,” Crain said.

“At the end of the day, our job is to build something that ultimately is very valuable—to build assets that are accretive on a cash flow basis. Our goal is to build an asset that has a really large net asset value that [a buyer] can grab and put into their portfolio.”

The clear objective of private equity is “to build something that you know you can sell,” Crain said. And trying to sell a billion-dollar asset portfolio, or a piece of one, in a dead A&D market is not a quick or easy task.

But there’s still a match because the private equity firms and the private capital ‘hybrids’ have the capital, and E&P companies that aren’t able to fund CapEx within their operating cash flow need it to keep drilling wells and growing production and reserves.

In its excellent “Oil & Gas Mergers and Acquisitions Report—Yearend 2018 Unrealized Potential” Deloitte said the following about Private Equity’s place in the oil and gas funding universe:

“In the absence of public acquirer interest, private equity’s shale strategy in 2018 shifted from a flipping strategy to longer investment hold times and strategic optimization with a view to generating cash flow.

“Many private equity firms are focusing on the consolidation of their portfolio companies and the development of organic growth, in partnership with carefully selected management teams.

“Private equity-to-private-equity transactions became more common. Private equity firms also started pursuing larger asset deals through consortium bids in the form of joint ventures or acquire-and-divest structures, which provide a means for private equity partnerships with majors to work around closed equity markets.

“Some private equity firms, as well as hedge funds, and other investors new to the oil and gas industry sought in 2018 to push for unconventional oil and gas industry consolidation, bringing their activism to bear on a sector where most producers were still spending more than they took in even as oil prices peaked.

“Activist investors were behind the year’s second- and fourth largest deals, respectively, BHP Billiton’s sale of its US onshore shale assets to BP and Energen’s sale of itself to Diamondback Energy. However, a wave of consolidation failed to materialize in the face of resistance from the management teams of the sector’s mostly small and midsize companies,” Deloitte said.

Next “wave” of M&A gets a late start

Maybe the predicted “wave of consolidation” is starting late — in spring 2019. One E&P M&A deal is not exactly the definition of a wave, nonetheless Chevron (ticker: CVX) uprooted the eerily quiet U.S. exploration and production M&A landscape on April 12, when it announced it would acquire Anadarko Petroleum (ticker: APC).

The total deal value is calculated at $50 billion, making it the third-largest U.S. oil and gas transaction in history, and the largest since Exxon (ticker: XOM) purchased Mobil in 1998. [contextly_sidebar id=”us4rVB11UQndutfxJNx7wDDl1Q0jDU8t”]

Chevron’s acquisition of Anadarko, if it closes, will make Chevron an official oil giant: the third-largest non-NOC oil and gas producer in the world, just behind Exxon and Shell (ticker: RDS). Exxon produced 3.8 MMBOEPD in 2018, while Shell produced 3.7 MMBOEPD. Chevron and Anadarko combined produced 3.6 MMBOEPD.

But hold the train. Occidental Petroleum (ticker: OXY) kicked off a bidding war for Anadarko on April 24th. [contextly_sidebar id=”ToK8cLbDObaWfonrJBjRraYC4wp7tlNH”]

Oxy is offering $76 per share for Anadarko, split evenly between cash and equity. Based on April 23rd closing prices this represents a $38 billion offer. Including debt the deal is valued at $57 billion. If this deal closes, it would further solidify Oxy as the largest producer in the Permian, a crown that would go to Chevron if the supermajor acquired Anadarko.

To repeat what Fleur de Lis’s Chris Holley said at the EnerCom Dallas 2019 oil and gas investor conference there’s no better time for a private equity firm to be in the market “than when one company buys another and the buyer is trying to decide what’s core and what’s non-core.”

“Everybody’s talking about the potential merger activity between the majors and some of the larger independents,” Opportune’s Jim Hansen told Oil & Gas 360 weeks before the Anadarko-Chevron-Oxy offer announcements. “We’ll see if that occurs. It’s certainly a topic of conversation around the oil patch right now.”

Private equity, ‘hybrid’ private equity and other incarnations of private capital are sitting on a significant bank of available capital with investors and the private equity partners eager for the firms to locate and invest in excellent oil and gas assets at bargain prices. And that evolving piece of the oil and gas funding universe will welcome a new flow of deal activity for private equity, rolling off of a consolidation wave, if one develops.

Private equity firms with energy portfolios

- ArcLight

- Bayou City Energy

- Blackstone

- Blue Tip Energy

- Blue Water Energy

- BlueRock Energy Partners

- The Carlyle Group

- Chiron Financial

- CSG Investments, Inc.

- Denham Capital

- EnCap Investments

- Energy Trust Partners

- First Reserve

- Five States Energy Capital

- Intervale Capital

- Kayne Anderson

- Kimmeridge Energy

- Lime Rock Management

- Natural Gas Partners

- Old Ironsides Energy

- Parallel Resources Partners

- Pearl Energy Investments

- Pelican Energy Partners

- Petro Capital Securities

- PetroCap

- Pine Brook Partners

- Post Oak Energy Capital

- Quantum Energy Partners

- Riverstone Holdings

- Sage Road Capital

- Scout Energy Partners

- Tailwater Capital

- Talara Capital Management

- White Deer Energy

The “hybrids”