Budget layouts and capital expenditure plans for 2016 are trickling onto the newswires, with EQT Corp. (ticker: EQT), Noble Energy (ticker: NBL) and PDC Energy (ticker: PDCE) all unveiling their plans within the week. To date, the plans are mirror images of 2015: less spending, more production.

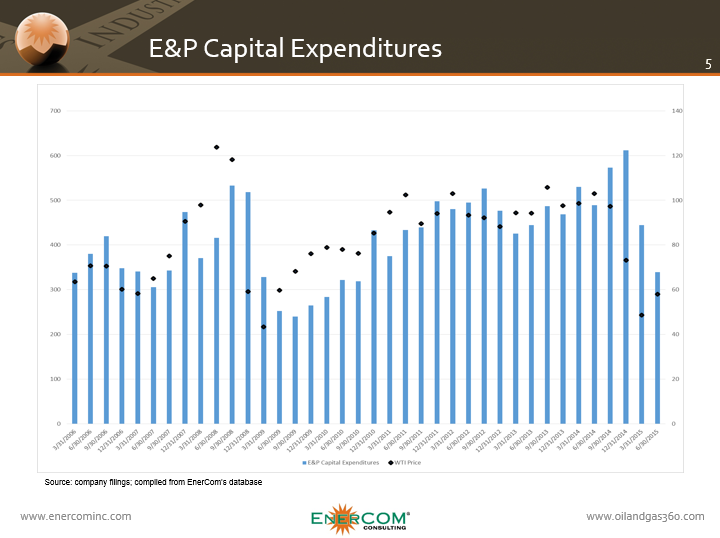

Spending for 2015 was significantly below 2014 levels. Based on EnerCom’s E&P Weekly Benchmarking Report, the average 2015 capex (on a trailing twelve month basis) decreased by 15% in Q3’15 compared to the prior year’s period. It’s worth mentioning that the majority of companies have scaled down spending as the year has progressed, so Q4’15 levels should show an even greater amount of decline. RBN Energy believes year-over-year spending declines will exceed 40%.

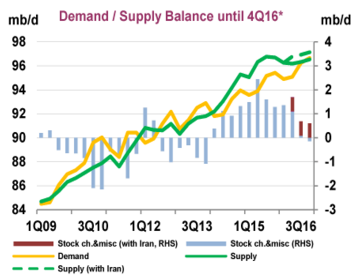

Despite the lower spending activity, global crude supply has not balanced with demand, leading into what appears to be an equally tumultuous 2016. But how much lower can spending levels really drop?

A lot, if you were to ask Claudio Descalzi, Chief Executive Officer of Eni SpA (ticker: E). The leader of the Madrid-based E&P believes 2016 will essentially be a repeat of 2015, a year in which spending declined by roughly $200 billion. Rystad Energy reported worldwide spending was down by $180 billion in the first nine months of 2015 alone, and believes the number will reach $250 billion by year-end.

Is the V-Shaped Recovery Coming into Play?

“What is worrying me is not the price of today; it is what is happening in the industry,” Descalzi said to Bloomberg at the COP21 climate change conference in Le Bourget, France. “[The spending cuts] can create in the mid-term an imbalance between supply and demand.”

What Descalzi is referring to is, in a sense, an overreaction from the market that can result in spending declines overshooting their targets and taking out too much product from the market, leaving sudden availability on the demand side. That results in a sharp shift to the latter in the supply/demand equilibrium.

Core Laboratories (ticker: CLB), a leader in production enhancement and reservoir description, has advised the market of the phenomena since the commodity downturn began. The “V-shaped recovery,” as management explains, could happen as early as 2016 due to the significant pullback on investments.

Core Laboratories (ticker: CLB), a leader in production enhancement and reservoir description, has advised the market of the phenomena since the commodity downturn began. The “V-shaped recovery,” as management explains, could happen as early as 2016 due to the significant pullback on investments.

CLB management says a combination of factors will contribute to the recovery, including; U.S. production has rolled over, the supply/demand imbalance is tightening, the Middle East is already producing at maximum amounts, we’re in the early innings of the shale boom and decline curves from shale will ultimately spur a rapid investment to meet demand.

Speculation is Rampant

Descalzi and Rystad Energy aren’t quite as optimistic as Core Lab – they both vaguely expect the price rebound to occur within a matter of years. Although spending is down sharply, Rystad still believes another 60 offshore rigs need to be pulled from the market to help level the imbalance. About 40 have been removed to date, and some have managed to stay in action due to day rates that have dropped by more than 60% in certain cases. Layoffs on the offshore and oilservice sides, sadly, have been massive.

“A new shortage of crude is likely to come a few years down the road,” said Jarand Rystad, Managing Partner of Rystad Energy, in the report. “When this happens, the oil service capacity will not be there to support the growth at the pace needed. There is then a risk that we will face a new era of steep cost inflation which again will drive up oil prices too much and negatively impact the global economy.”

Speculation on when that price recovery actually occurs is anybody’s guess, but the only real “certainty” of 2016 is that domestic oil production will, in fact, fall. The Energy Information Administration expects 116 MBODP of domestic production to come off the grid in January, with average 2016 prices estimated to be around $50/barrel.

“The embedded declines from the withdrawal of capital spending could really kick in throughout the course of 2016,” said Tom Petrie, Chairman of Petrie Partners, in an interview today with CNBC. “That’s when you’ll start to see a real change in inventory, most likely in the second half of 2016.”

Inventories remain near record highs even after a withdrawal today – the first in more than two months. Inventory levels in Cushing, Oklahoma (the primary storage facility for future spot prices) reached a record last week, and the U.S. has increased the location’s storage capacity by 25 million barrels since 2011.