BHI, GE, Shell, Halliburton make, wrap deals

Baker Hughes-GE complete $32 billion mega-deal; combined business began trading today under new symbol: BHGE

Baker Hughes, a GE company (ticker: BHGE) completed its combination of GE Oil & Gas with Baker Hughes Inc.

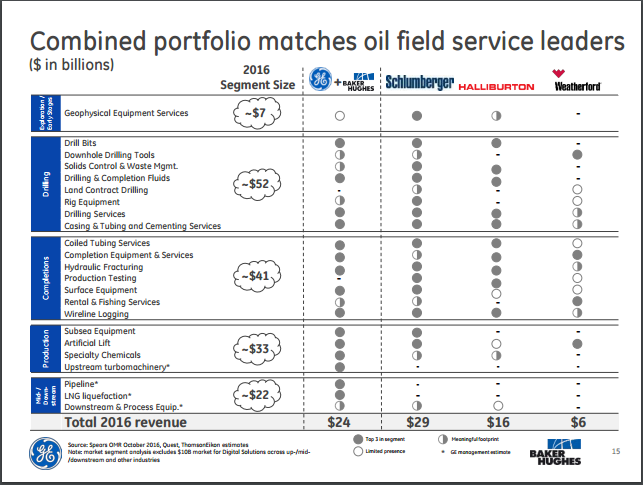

The combined company becomes the world’s second largest oilfield services company, fitting between Schlumberger at the top of the list and Halliburton, which drops to the No. 3 position. Measured by headcount, Schlumberger has 100,000 global employees, Baker Hughes, a GE company, has 70,000 employees and Halliburton has 50,000.

Class A common stock of Baker Hughes, a GE company began trading on the New York Stock Exchange under the symbol BHGE today. In connection with the completion of the transaction, BHI has been delisted from the NYSE. Baker Hughes shareholders will receive a special one-time cash dividend of $17.50 per share and 37.5% of the “New” Baker Hughes, with GE shareholders holding the remaining 62.5%.

GE Chairman Jeff Immelt is serving as chairman of BHGE. Martin Craighead, former chairman and CEO at Baker Hughes, is Vice Chairman of the Board. Lorenzo Simonelli is president and CEO of Baker Hughes, a GE company. Simonelli formerly headed GE Oil & Gas.

“The transaction assumes a slow recovery, really $45 to $60 per barrel through 2019, and this seems reasonable,” GE chairman and CEO Jeff Immelt said on a conference call when the deal was first announced.

“Disruptive change is the oil and gas industry’s new normal,” BHGE CEO Simonelli said in a press release today. “We created BHGE because oil and gas customers need to withstand volatility, work smarter and bring energy to more people. Our offering is further differentiated from any other in the industry across the value stream and enables and assists our customers in driving productivity, while minimizing costs and risks.”

Jeffrey Immelt, chairman and CEO of GE said BHGE plans to focus on accelerating the extension of the digital framework “in ways oil and gas customers have never seen before.”

The integration of the Russian businesses will be completed upon receipt of Russian regulatory approval, GE said.

The combined companies encompass about 70,000 employees, operations in more than 120 countries with four product companies—Oilfield Services, Oilfield Equipment, Turbomachinery and Process Solutions, and Digital Solutions—and 24 product lines and segments, GE said in a news release.

BHGE plans to operate from dual headquarters in Houston, TX and London, UK.

Halliburton grows submersible pump footprint with acquisition of Summit ESP

Halliburton Company (ticker: HAL) said it is adding Summit ESP, a provider of electric submersible pump (ESP) technology and services, to its artificial lift portfolio. The transaction was announced today.

Halliburton Company (ticker: HAL) said it is adding Summit ESP, a provider of electric submersible pump (ESP) technology and services, to its artificial lift portfolio. The transaction was announced today.

Tulsa-based Summit has more than 500 employees in 30 locations across North America. Halliburton has 50,000 employees.

Shell buys Texas power company MP2

Shell Energy North America (SENA), part of Royal Dutch Shell (ticker: RDS.A) said late last week it plans to buy MP2 Energy LLC (MP2). Shell said it expects to close the acquisition in Q3 2017.

Shell Energy North America (SENA), part of Royal Dutch Shell (ticker: RDS.A) said late last week it plans to buy MP2 Energy LLC (MP2). Shell said it expects to close the acquisition in Q3 2017.

MP2 Energy manages power plants, delivers retail power to end-use customers, and masters all other aspects of the power markets like asset management, commodity hedging, solar installation and offtake, wind and distributed generation.

SENA and its subsidiaries trade and market natural gas, wholesale power, environmental and risk management products. SENA sells retail energy to large commercial and industrial customers on the west coast of the U.S. With the acquisition of MP2, SENA said it gains capabilities in Texas and throughout the eastern U.S. SENA’s customers include large commercial and industrial users, retail energy companies, local gas distribution companies, electric utilities, independent power producers, oil and gas producers, municipalities, and rural electric cooperatives.

MP2 will continue to be managed by the existing MP2 management team as a wholly-owned subsidiary of Shell Energy North America, Shell said in a statement.

Analyst Commentary

Regarding the Halliburton acquisition mentioned later in this story, Wolfe Research said in a note:

This morning, HAL announced the acquisition of Summit ESP, a leading provider of ESP (electrical submersible pumps) and surface pumps in North America (NAM). The addition of Summit, who is the 2nd largest NAM ESP company, will take HAL’s global market share in artificial lift to 4% from 2%, making it the 6th largest player, while adding 2-3c / $30-40mm to our current ‘18 EPS / EBITDA estimate of $1.58 / $3,870mm (Consensus = $2.54 / $5,189mm). Reiterate OP rating and $49 YE18 PT.

WR Estimated Summit Valuation of $500-600mm . According to Spears & Associates, Summit’s 2016 revenue was ~$180mm, more than doubling Halliburton’s global exposure to artificial lift (HAL ’16 revs = ~$125mm, per Spears & Associates). In 2019, we estimate Summit revenue of $270mm, so applying a normalized EBITDA margin of 20% would assume $54mm of EBITDA. Applying a 9-11x multiple to this EBITDA implies HAL paid $500-600mm for Summit.

Summit ESP info. Summit ESP offers ESP related products and services (28 service centers across US & Canada), with 8,000 installed ESPs and 44 patents. Currently, service centers and manufacturing are located in Texas, Oklahoma, Rockies/Bakken (US & Canada sides), Alberta, Alaska and one manufacturing facility in California.

Emphasis on expanding production services. HAL has telegraphed a desire to deepen its production services offering, especially in artificial lift and production chemicals. The failed acquisition of Baker Hughes would have filled these portfolio gaps. Post the deal breakup, HAL has looked to the M&A markets to fill voids in artificial lift while pursuing organic expansion on the chemicals side. In addition to Summit, recall that HAL is also pursuing an acquisition of Novomet, a slightly larger, Russian-based artificial lift company (‘16 revs = ~$290mm) with ~50% exposure to Russia. HAL is still awaiting a ruling from Federal Antimonopoly Service of Russia.

Artificial lift market is top heavy. The global artificial lift market is concentrated, with the largest two competitors (SLB [OP] & BHGE [OP]) combining for 51% of the market and the next largest competitor (WFT [PP]) accounting for 14% the market. HAL/Summit will combine for ~4% of the market and be the 6th largest competitor (see Exhibit 2/3). We believe HAL will continue expanding artificial lift both organically and inorganically.