Largest draw since September 2016

Crude oil prices soared today, reaching prices not seen since late 2014. Today’s buying was driven largely by a historic draw on inventories announced by the DOE this morning.

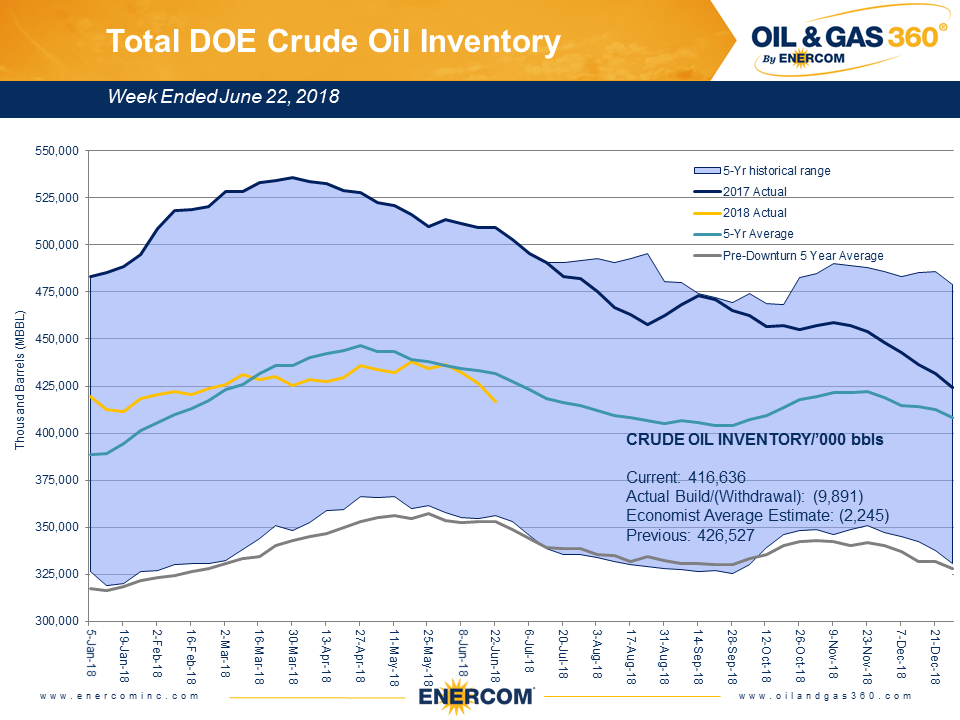

Crude oil stocks fell by 9,891 MBBL last week, a decline well beyond what was expected by analysts. According to Bloomberg, analyst predicted a draw of 2,245 MBBL, so the actual draw was more than four times expectations.

Largest weekly refinery demand ever plus 3 MMBOPD oil exports both set all-time records

This week’s draw was the largest since September 2016, and is the third-largest in the past five years. Refineries worked at record pace last week, demanding 17.8 MMBPD of crude oil, the largest weekly refinery demand ever.

Refineries are also displaying rarely-seen levels of utilization. The EIA reports American refineries have 18.6 MMBPD of capacity, and utilized 18.1 MMBPD, so refineries are currently running at 97.5% of capacity. This is the highest utilization level since July 2005.

Exports also contributed to the strong demand level, reaching a major milestone in the rise of American crude exports.

The U.S. exported 3 MMBOPD last week, a first for the nation. The previous all-time high in crude exports was 2.57 MMBOPD, set in early May. It is likely that the U.S. cannot sustain exports of 3 MMBOPD, but instead this is the result of several major tankers leaving port simultaneously.

The Louisiana Offshore Oil Port (LOOP) may have loaded a supertanker in the past week, significantly increasing weekly exports. This has been known to affect export levels in past weeks, and many of the previous record exports this year have corresponded with a shipment out of LOOP. The LOOP facility is located in deeper water offshore that can accommodate hips with the draft of supertankers that can’t navigate shallower depths of existing ship channels and port facilities.

Further large draws may be coming, as summer demand corresponds with supply disruptions. The temporary shutdown of Syncrude’s oil sands project will take 360 MBOPD offline through July, so a major source of oil for the North American market has been disrupted.

Markets reacted very strongly to today’s news of the draw, and oil prices increased sharply.

WTI has risen nearly $5/bbl in the past two days, reacting first to the API’s inventory report on Tuesday and then the EIA’s report today. Prices reached $73/bbl in intraday trading on Wednesday. It’s the first time oil has traded at that price since oil dropped from above $100 per barrel in the first half of 2014 to a low in the $30 per barrel range in 2015. The late 2014/2015 crash was spurred by an OPEC policy announcement on Thanksgiving Day 2014 that it would maintain higher production levels.