NEW YORK – Oil prices edged up on Wednesday after U.S. crude in storage grew less than expected and gasoline inventories dropped, but hundreds of new coronavirus cases reported in Asia, Europe and oil-producing countries in the Middle East limited gains.

Source: Reuters

Brent crude was rose 12 cents to $55.07 a barrel by 10:48 a.m. EST (1548 GMT), while U.S. West Texas Intermediate (WTI) crude was up 33 cents at $50.23 a barrel.

U.S. crude oil stocks grew by 452,000 barrels in the week ended Feb. 21 to 443.3 million barrels compared with analysts’ expectations in a Reuters poll for a 2 million-barrel rise, while gasoline and distillate inventories fell, the Energy Information Administration said. [EIA/S]

“Energy markets have responded positively to the smaller-than-anticipated build,” said Ryan Kaup, a commodities broker at CHS Hedging. “However, coronavirus has kicked market sentiment to the floor.”

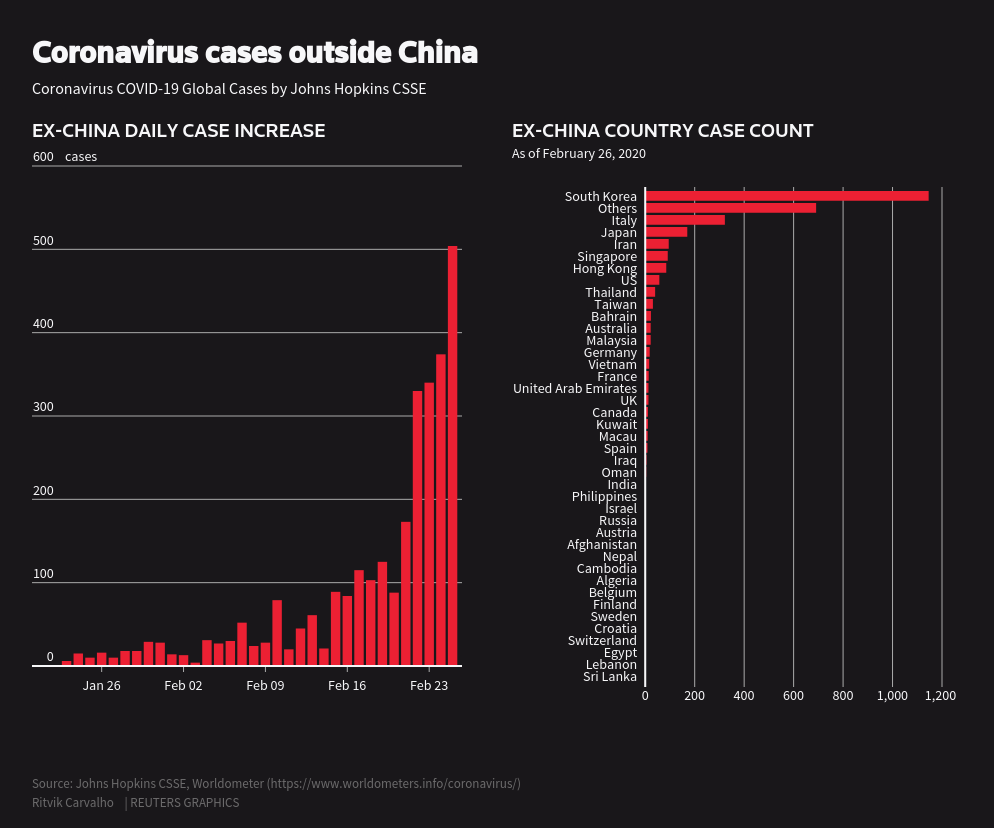

Pandemic fears intensified as authorities around the world battled to prevent the spread of coronavirus, which has now been found in about 30 countries.

World stocks tumbled for a fifth straight day, while safe-haven gold rose back towards seven-year highs and U.S. bond yields held near record lows after governments and health authorities warned of a possible pandemic. [MKTS/GLOB]

The World Health Organization’s (WHO) chief said while the sudden rise in novel coronavirus cases was “deeply concerning”, the virus could still be contained and did not amount to a pandemic.

President Donald Trump said he will hold a news conference on the coronavirus at 6 p.m. (2300 GMT).

(Graphic: Coronavirus spreads outside of China- here)

Goldman Sachs cut its 2020 oil demand growth forecast to 600,000 barrels per day (bpd) from 1.2 million bpd, and lowered its Brent forecast to $60 a barrel from $63.

“We see oil prices improving through the year, assuming demand begins to normalise in 2H20,” it said, referring to the second half of the year.

Germany’s economy is nearing stagnation due to the coronavirus outbreak, the DIW economic institute said on Wednesday.

Oil prices were also supported by hopes for deeper output cuts by the Organization of the Petroleum Exporting Countries and its allies including Russia, a group known as OPEC+.

Saudi Arabia’s energy minister said on Tuesday he was confident that OPEC+ would respond responsibly to the spread of the virus.

OPEC+ are due to meet in Vienna over March 5-6.

“Yet there is no guarantee that buyers will emerge out of the woodwork even if OPEC+ further tightens the oil spigots,” said Stephen Brennock of oil broker PVM.

The International Energy Agency’s (IEA) outlook on global oil demand growth has fallen to its lowest level in a decade, IEA Executive Director Fatih Birol said on Tuesday.