JPMorgan Vice President and Head of Currencies and Commodities Scott Schnipper outlines oil price catalysts just over the horizon

At this month’s Energy Finance Discussion Group in Denver, J.P. Morgan Private Bank Head of Currencies and Commodities Scott Schnipper examined the current forces affecting oil markets and outlined some of the major catalysts facing oil, facets that could have a significant effect on how the market prices oil.

No. 1 is the November OPEC meeting: primarily a downside risk

The most immediate catalyst is OPEC’s upcoming 173rd regular meeting on November 30, when the group will decide if price cuts should be extended beyond March 2018. The market seems to expect that these cuts will be extended, and is pricing that into current trading. According to Schnipper, this means the meeting primarily represents downside risk. An extension of cuts will likely only result in a minor increase in oil prices, but if cuts are not extended the downside could be significant.

Cuts have been ‘somewhat’ successful

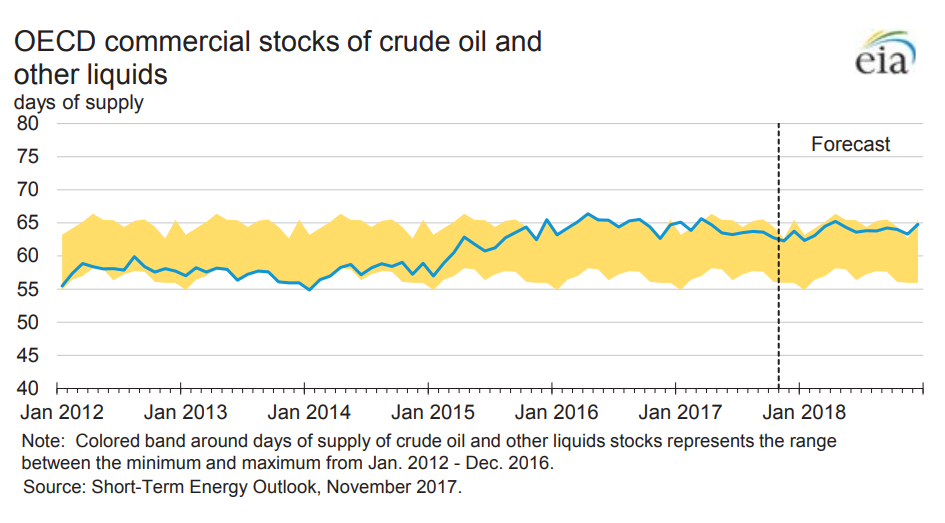

Overall, OPEC’s cut agreement has been somewhat successful, Schnipper told the group. The crude oil futures curve has entered backwardation, which incentivizes the selling down of inventories. Inventories are decreasing, though at a slower rate than expected. Part of this success is due to decreasing exports from Saudi Arabia and Russia, which have taken more than 1 MMBOPD off the market in recent months.

The unclear catalyst: U.S. shale growth

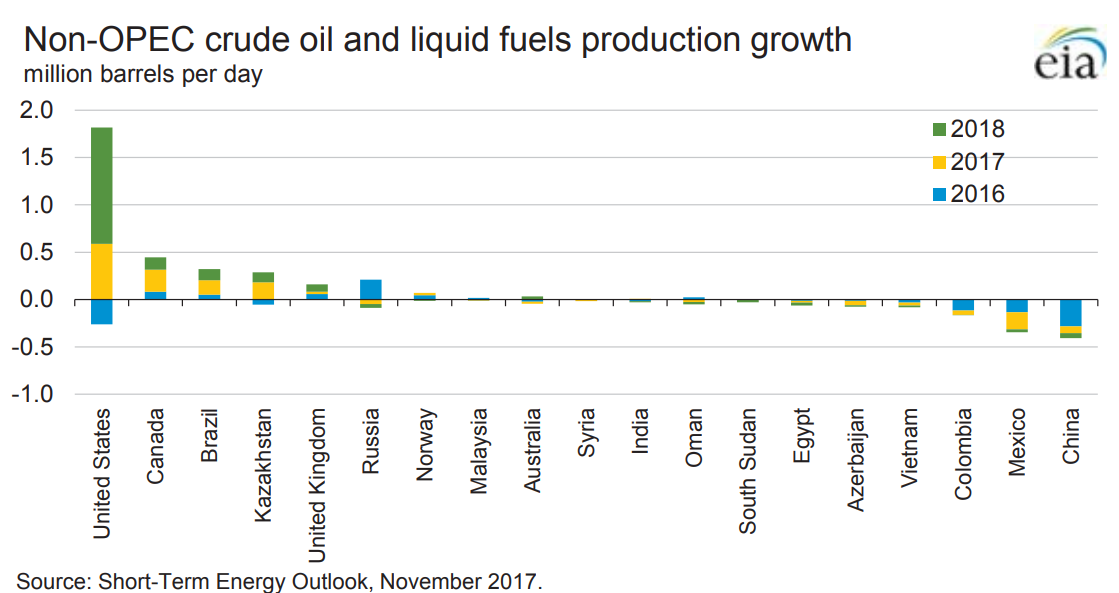

The other main uncertainty in oil prices revolves around U.S. shale. American shale output growth in 2018 is expected to dwarf growth from any other non-OPEC country, the U.S. government has estimated. EIA has predicted shale production to reach 1.2 MMBOPD. Projections for this sort of massive growth have weighed on oil markets, and some U.S. E&P CEOs–chiefly Continental Resources CEO Harold Hamm—have discussed this recently.

When you set the shale bar high

The EIA’s preliminary weekly estimates of production are consistently higher than the later monthly estimates, suggesting that overestimation may be occurring. If U.S. shale output does not reach the heights predicted by the EIA, as most analysts expect, crude oil prices will see a boost from the reduced supply. Growth of 1.2 MMBOPD, for reference, would mean U.S. growth would reach levels not seen since 2013, when oil prices were around $100/bbl.

Chinese teapot demand growth slowing

On the demand side, Schnipper is slightly more pessimistic, predicting lower demand growth in 2018 than in 2017. Chinese “teapot” refineries are not likely to undergo as much of a buying spree next year, meaning the world’s largest oil importer may demand less of the commodity in the coming year.

However, emerging markets prospects are reasonably good, meaning demand from those areas are likely to be robust. In addition, Schnipper does not see any major “recession warnings” in U.S. markets currently, suggesting major demand-side decreases are not waiting on the horizon.

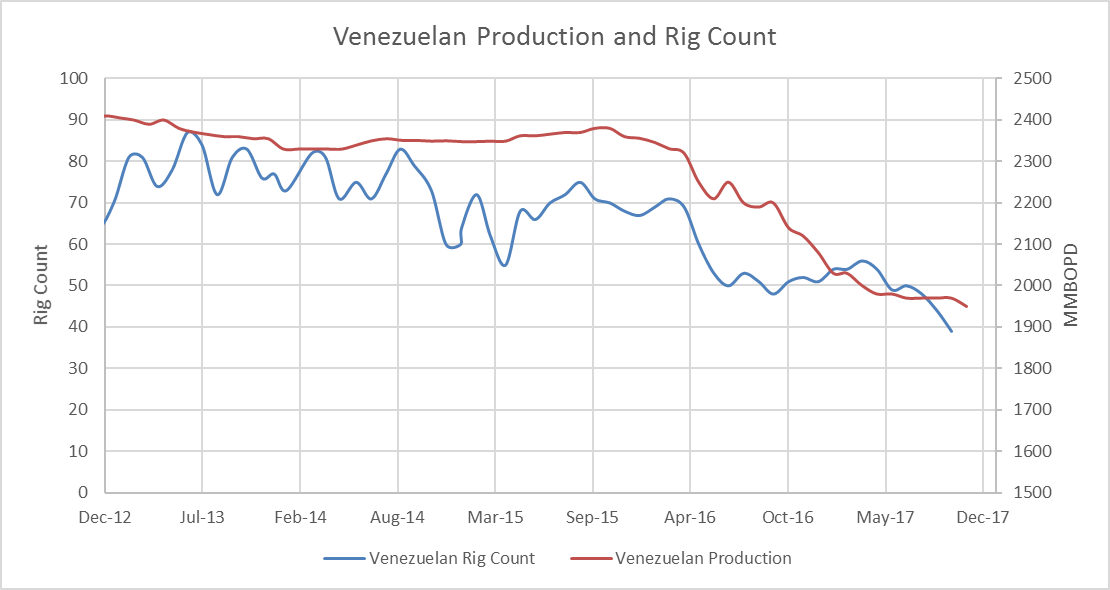

Resurgence of geopolitical risk: Venezuela, Saudi Arabia risk providing price boost

Schnipper also addressed one of the main trends in recent weeks, the rise of geopolitical risk. Events in Venezuela, Nigeria, Iraq and Saudi Arabia have all contributed to a rise in oil prices. According to Schnipper, this represents the resurgence of geopolitical risk as a major factor in the oil market. In 2015 and 2016, market oversupply and massive inventories insulated traders from such risks, but the gradual decline in inventories has made these factors relevant again.

Venezuela represents one of the largest sources of geopolitical risk currently, as the default process is likely to cause disruption in the country’s oil production. Output from the country has fallen in recent months, and may drop further if a quick resolution to the current situation is not achieved.

Saudi Arabian arrests have also rattled markets, as a new anti-corruption push claims its first victims. The country has hauled in many powerful princes and ministers, including Alwaleed bin Talal, a move that is “like arresting Warren Buffet or Bill Gates in the United States,” according to the former U.S. ambassador to the country. The government has frozen the assets of many citizens, amounting to hundreds of billions seized. While likely not the reason for the arrests, this sum could go a long way toward restoring Saudi cash reserves, which have fallen since the oil price crash.