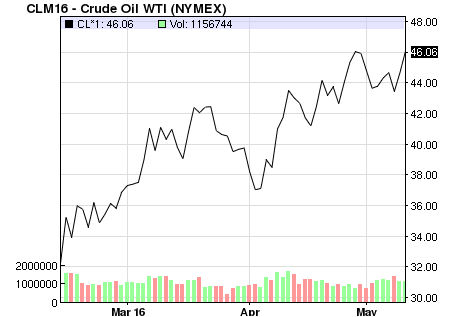

Crude oil inventories fell 3.4 MMBO during surprise week-over-week draw

Crude oil inventories fell today, giving markets a pleasant surprise, and sending WTI prices up above $46 per barrel.

Economist expected a small build for the week ended May 6, 2016, with the average estimate at 80 MBO. The numbers released by the DOE today showed a draw of 3.4 MMBO, a stark contrast to last week’s inventory report, which showed a build five times larger than what was anticipated.

WTI was down slightly this morning ahead of the report, but quickly made gains following the news of the inventory draw. As of 1:58 p.m. EST, WTI crude oil was up 3.3% to $46.15, while Brent crude was up 4.0% at $47.35.

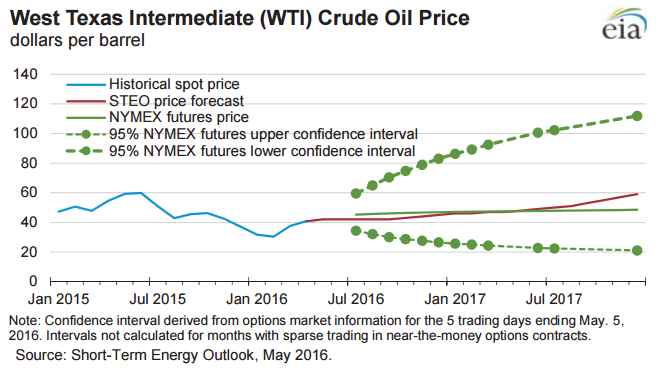

Adding to positive sentiment around oil prices, the Energy Information Administration yesterday increased its price forecast for both WTI and Brent crude. In its Short-Term Energy Outlook, the EIA said it expects Brent crude to average $41 per barrel this year and $51 per barrel next year, $6 per barrel and $10 per barrel higher than in its estimates last month. The agency expects WTI to “average slightly less than Brent in 2016 and to be the same as Brent in 2017.”

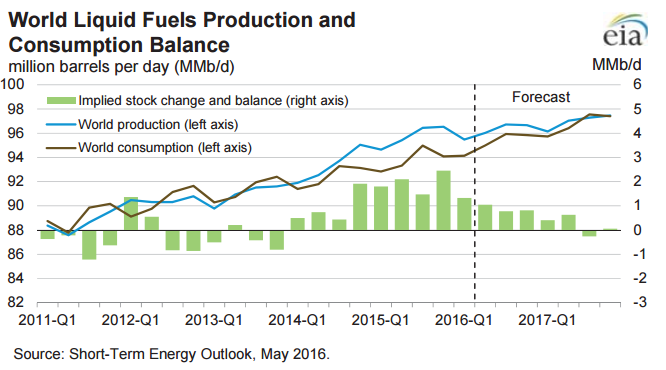

EIA revises demand higher for 2015, sees further demand growth coming

Along with expectations of higher oil prices, the EIA said in its report that demand last year was stronger than previously reported, and that the agency expects to see demand grow even faster than it forecast in its April forecast.

For 2015, the EIA believes that consumption of petroleum and other liquid fuels increased by 1.4 MMBOPD, 0.1 MMBOPD higher than the agency reported last month. The upward revision in consumption was thanks in large part to revisions in global consumption data in China and India.

The EIA estimates that China’s consumption grew by more than 0.4 MMBOPD in 2015, driven by increased use of gasoline, jet fuel and hydrocarbon gas liquids (HGLs). India consumed 0.3 MMBOPD, 0.1 MMBOPD higher than previously estimated, mainly in transportation, coal mining and industrial activities. The higher growth was partially offset by downward revisions in Europe.

Global consumption of oil and other liquids should grow by an additional 1. 4 MMBOPD this year as well, reported the EIA, and 1.5 MMBOPD in 2017. Demand growth for 2016 and 2017 were revised up 0.3 MMBOPD and 0.2 MMBOPD, respectively, from April.

“Many of the same drivers that prompted revisions to 2015 demand growth rates are expected to continue affecting demand in the forecast period,” the EIA said in its outlook. China’s consumption is expected to increase by 0.4 MMBPD both this year and next as demand for HGLs increases. Transportation will continue to drive higher levels of consumption in India, where the EIA expects year-over-year growth of 0.3 MMBOPD in both 2016 and 2017.