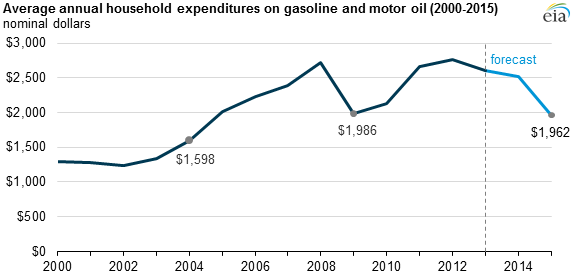

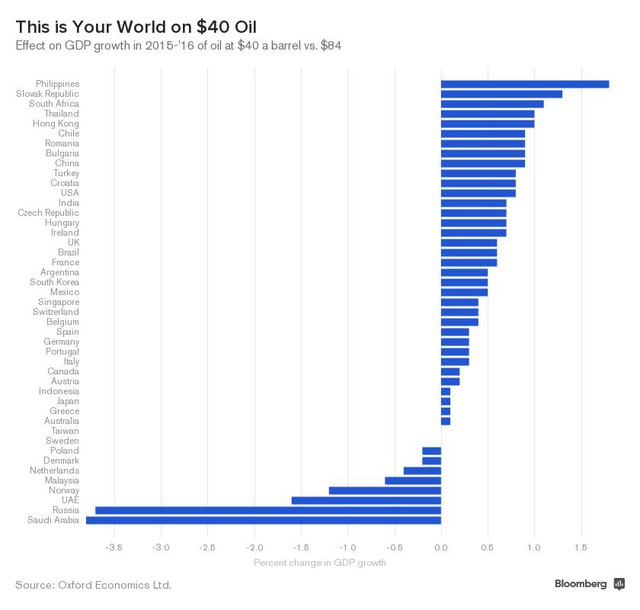

Effects from the oil price slide are being celebrated by the average American consumer. AAA reports Americans may save as much as $75 billion in fuel costs in 2015, or $550 per household, which amounts to the lowest in more than a decade. Oxford Economics projects United States GDP will increase by roughly 0.7% in the new oil environment, while countries heavily dependent on hydrocarbon exports (Saudi Arabia and Russia, in particular) will suffer GDP losses in excess of 3.5%.

Source: Bloomberg

In the oil and gas industry, it is difficult to find a silver lining in the revamped market even though the United States is on track to become the world’s top hydrocarbon producer and crude imports continue to fall. Several E&Ps are cutting back expenditures in 2015, taking a “lay low” approach until prices recover. Guidance reports continue to trickle onto the newswire while others are still evaluating options to navigate the toughest market since the Great Recession. Oil & Gas 360® compiled guidance released by 25 companies and found the average reduction in year-over-year spending is approximately 25%. Layoffs are inevitable – models from the Dallas Federal Reserve show 128,000 direct and indirect energy jobs could be lost by mid-2015. And that’s only in the state of Texas, at prices of $55 per barrel.

“2015 is going to be a tough year,” said Dave Lesar, Chief Executive Officer of Halliburton (ticker: HAL), in an email to company employees. The oilservice giant announced 1,000 layoffs in the Eastern Hemisphere in December, and already mentioned “synergies (read: more layoffs)” if its proposed merger with Baker Hughes (ticker: BHI) is completed. About 700 employees of Ensign Energy Services (ticker: ESI) received such disheartening notices roughly one week ago. The indirect effect has already hit the iron industry – United States Steel Corp. laid off 614 workers from its Ohio-based pipe manufacturing plant on Monday, directly citing the weak market conditions. A proposed liquefied natural gas terminal in Texas, headed by Excelerate Energy, was shelved at the end of 2014.

What Does 2015 Hold?

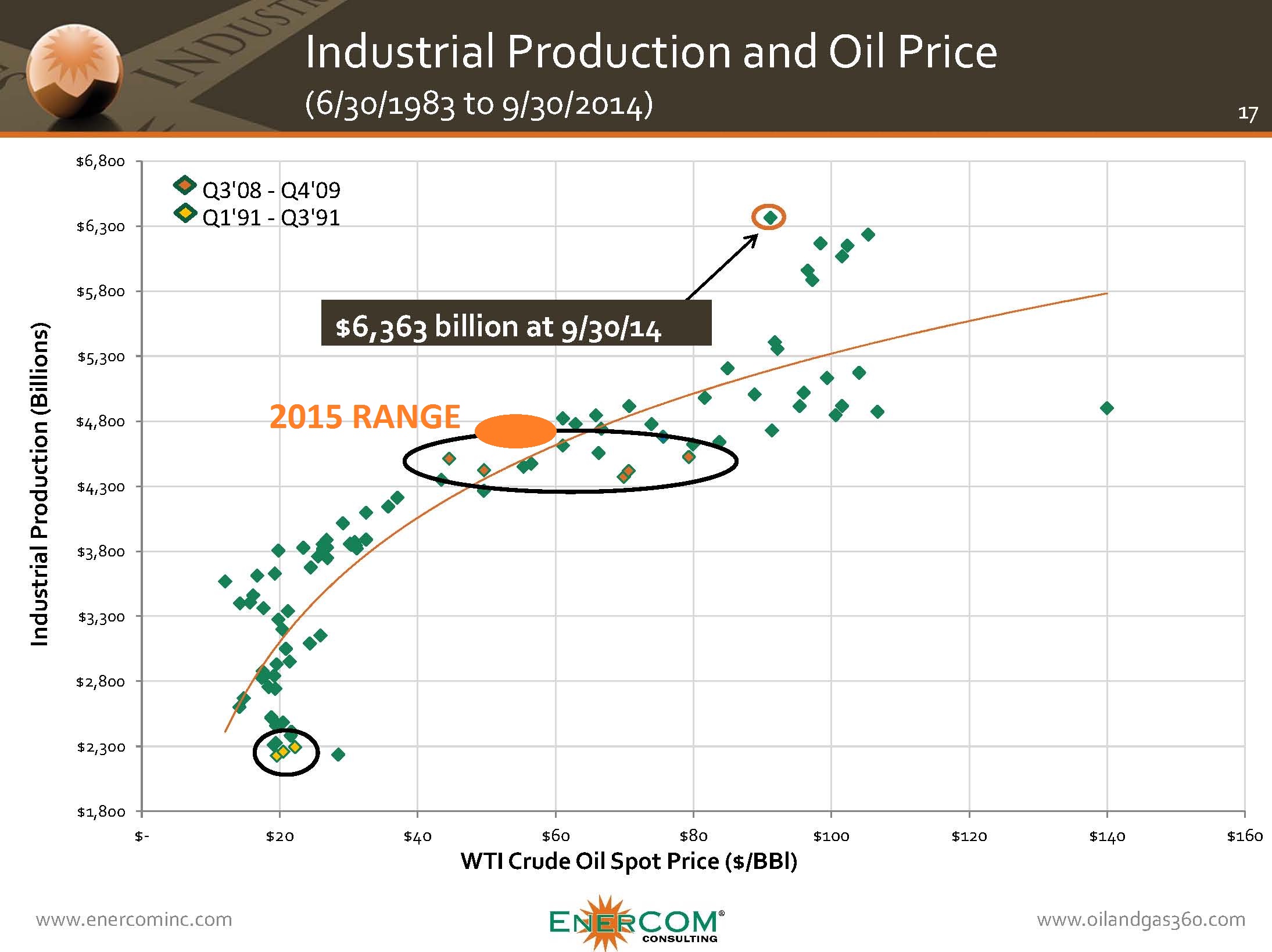

EnerCom, Inc. compiled metrics comparing trends of industrial production in relation to oil price in our latest monthly report. Assuming a 25% reduction in Q3’14 industrial production (which would equate to approximately $4,770 billion) and a West Texas Intermediate (WTI) price in the $50 to $60 range, the result is in line with our price model, as seen to the right. The estimated range for 2015 is also near the trends seen in the last oil crisis of 2008.

Despite trimmed budgets, smaller workforces and less exploration activity, domestic production is still expected to rise in 2015. The increase will come even with less rigs in the field. John Kilduff, Founder of Again Capital, believes as many as 200 more rigs will vanish from United States oil patches within the next couple months. “In the long term chart, I see a base of around $40 to $42 per barrel, but if that gets taken out, I can see us falling back to the 2009 low of $33 per barrel,” he said in an interview with CNBC.

“This is the corollary I’ve been trying to make. Natural gas prices collapsed and have stayed down. That’s because more has come online and more infrastructure was built out despite the low prices. The Saudis, far and away, are going to be the last ones standing in this. The implosion is going to be the fracers and the Canadian companies.”

The United States rig count fell to 1,811 in BHI’s latest release on January 5, 2015 – the lowest since Q2’13 and 13% below the average of Q3’14. As a reference case, consider this: in Q3’08, the U.S. rig count was 2,306. By Q2’09, the count had dropped by 57%, to 995 rigs, after oil prices were cut in half during Q3’08 to Q4’08.

North America’s Operations not the Only Casualty

Saudi Arabia’s price reduction is not a uniform idea within the Organization of Petroleum Exporting Countries (OPEC). In fact, some of the cartel members, including Venezuela and Algeria, have publicly called on the kingdom to raise prices back to the $100+ level we saw in the summer. “OPEC, as a cartel, is pretty much broken,” said Francisco Blanch, head of global commodities for Bank of America, in an interview with Bloomberg. “This is a long term game for the Saudis,” he added, saying OPEC members are currently producing with their sole respective interests in mind.

The strain of Saudi oil extends far past United States shale and smaller OPEC members. The kingdom is implementing great pressure on its longtime rivals of Russia and Iran, both of whom currently have a hand tied behind their backs due to Western sanctions. Iranian officials made some terse comments regarding the Saudis in recent parliament sessions. Amir Mousavi, a former IRGC diplomat and director of Iran’s Center for Strategic and International Studies, recently warned, “Saudi Arabia’s move is a suicidal step in the struggle against Iran in the region.”

Iran plans on cutting its oil exports to 1 MMBOPD, according to the country’s oil minister. The nation produced 2.77 MMBOPD in December 2014.

Russia, meanwhile, is undeterred by sanctions and produced a post-Soviet record of 10,667 MMBOPD in December. Russia’s oil minister expects output to be maintained and believes oil prices will eventually recover. The Saudis themselves had tough words for Russia, with Saudi oil minister Ali al-Naimi telling The Financial Times that Russia “doesn’t deserve a market share.”

Putin and Russia have stayed the course, finding alternatives to its sanctions by finding new trading partners. A landmark deal with China was finalized in November and involves moving 2.4 Tcf per year for the next 38 years at a price of $9.92 to $11.33 per Mcf. In his annual press conference, Putin assured his countrymen that “A positive turn and emergence from the current situation are inevitable,” even though the ruble has fallen 45% against the dollar since sanctions were first imposed. China has offered additional financial assistance for Russia if necessary.

During a speech given at Columbia University today, January 7, 2015, former Russian Deputy Minister of Energy and founder of the Institute of Energy Policy, Vladimir Milov, said that he thought Russia was on a dangerous path. “This year will be the first when we start to experience significant decline. The situation is still manageable, but the people in power [in Russia] make one systemic mistake after another.”

Naimi and the Saudis are offering no relief in the price slide, even if producers outside OPEC want to coordinate a production cut. “If they want to cut production they are welcome,” he said. “Certainly Saudi Arabia is not going to cut.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.