Osage Nation’s desire to continue its legacy of oil wealth is being stymied by the U.S. government; tribe wants oil companies to explore new plays, generate new oil production

Seizing upon economic growth opportunities associated with their tribal lands has been a hallmark of the Osage Tribe’s financial success for the past 208 years. Located in Oklahoma, the Osage Nation has a long history of smart deal making and being expert negotiators.

Seizing upon economic growth opportunities associated with their tribal lands has been a hallmark of the Osage Tribe’s financial success for the past 208 years. Located in Oklahoma, the Osage Nation has a long history of smart deal making and being expert negotiators.

An 1870 treaty with the U.S. government provided that the remainder of Osage land in Kansas be sold and the proceeds used to relocate the tribe to Indian Territory, according to Wikipedia’s history of the Osage Nation. “By their delays in agreeing to removal, the Osage benefited by the change in administration; they sold their lands to the administration of President Ulysses S. Grant, for which they received $1.25 an acre rather than the 19 cents previously offered to them by the US.”

The Osage were one of the few American Indian nations to buy their own reservation, and they retained more rights to the land and sovereignty as a result. Unlike its arrangements with other Native American tribes, in 1906, the U.S. Congress reserved the entire Osage Minerals Estate for the benefit of all of the Osage members. That was the start of the oil boom in Osage County, Oklahoma.

Early oil production from the Osage lands created great wealth for the tribe’s members because the individual tribal members received equal shares of oil and gas royalties earned from production on the Osage land. Their shares are called headrights and they are called headright owners. The headright owners became rich and the E&P pioneers who drilled on the reservation became industry icons—names like Phillips, Getty, Skelly, Marland and Sinclair.

“Production from Osage County alone launched the careers of Frank Phillips, J. Paul Getty, Bill Skelly, E.W. Marland, Harry Sinclair… ,” the American Oil & Gas Historical Society recounts, looking at the impact that oil production on Osage lands had in launching the energy fortunes of America’s earliest oil and gas giants.

Oklahoma: energy hub today

Osage County is located an hour and 18 minutes’ drive from Cushing, Oklahoma, ground zero for benchmark WTI crude oil pricing and delivery, and home to one-fifth of the nation’s crude oil storage capacity. In addition, several of today’s largest independent exploration and production companies and some of the biggest energy infrastructure companies are headquartered in Oklahoma. South of the Osage lands in Oklahoma City are Chesapeake Energy (ticker: CHK), Continental Petroleum (ticker: CLR) and Devon Energy (ticker: DVN). Oil and gas infrastructure giant Williams (ticker: WMB) is headquartered in Tulsa along with midstream and logistics providers ONEOK (ticker: OKE) and NGL Energy Partners (ticker: NGL).

The Osage Nation Reservation describes itself as consisting of approximately 1,475,000 acres “and is otherwise known as Osage County, Oklahoma,” according to the tribe’s website. The Osage Tribe owns all mineral rights located within Osage County and receives an income from all oil and gas found in Osage County. The Osage Nation Campus – the heart of the Osage Nation – is located in Pawhuska, Oklahoma, in the dead center of Osage County.

The Osage Nation has accumulated more wealth from its lands than all of the American gold rushes combined—Oklahoma Historical Society

History.com lays out how Oklahoma’s Osage Indians navigated their fate and collected a fortune by managing and developing their land’s natural resources wisely:

“American negotiators convinced the Osage to abandon their traditional lands and peacefully move to a reservation in southern Kansas in 1810. When American settlers began to covet the Osage reservation in Kansas, the tribe agreed to yet another move.

“In a decision that would eventually make them one of the wealthiest surviving Indian nations, the Osage Indians agreed to abandon their lands in Missouri and Arkansas in exchange for a reservation in Osage County, Oklahoma, in 1872.”

The Osage’s ‘underground reservation’

The Oklahoma Historical Society recounts the Osage tribe’s business and financial success like this:

“Already rich from leases of their grazing lands, the Osage grew exponentially more wealthy after the discovery of oil on their lands. In 1895 Henry Foster of Kansas acquired a blanket lease that covered the entire Osage Reservation, more than 1.5 million acres—the ‘Foster lease’.

“Over the next two decades the Osages’ ‘underground reservation’ would produce more wealth than had all of the American gold rushes combined.”

The Foster lease was renewed in 1906 and in 1907 the Osage oil fields produced more than five million barrels of oil. Indian Territory Illuminating Oil Company, the operator, lost its sole rights to drill on the Foster Lease in 1916 and leasing on a competitive basis was begun on tracts of land up to five thousand acres in size on the Osage reservation. The record bid: $1,990,000 for a single, 160-acre tract, the OHS reports.

Osage discoveries go big

“On May 8, 1920, near Bartlesville, the Marland Oil Company completed the Burbank discovery well and the initial discovery produced 150 barrels of oil per day [BOPD] from the Burbank sand at a depth of 2,949 to 3,001 feet.

“Later that year the Roxana Petroleum Company brought in another well at 3,450 barrels per day in the same general area.

“At first the wells were thought to be from separate fields, but as drilling proceeded they were all found to be connected,” according to the OHS. “The field eventually grew to thirty-three square miles located principally in Osage County, but with a small extension into Kay County. The field had its highest production from 1920 through 1924 with twenty million to thirty-one million barrels annually and a peak production day of 121,700 barrels on July 21, 1923.

“Burbank alone produced more than 103 million barrels in 1926. By 1930 more than three dozen Osage oil fields existed, including Avant, Barnsdall, and Skiatook, and from 1901 through 1930, 319 million barrels of Oklahoma crude were pumped from the ground in Osage County.

By 1939, more than $100 million went to Osage individuals from oil and gas development on their lands

“Unlike other landholders, the Osage were able to retain collective ownership of subsurface mineral rights, rather than having to accept allotments to individual owners. Instead, tribal members received ‘headrights’ that assured them an equal share of mineral rights sales equivalent to income from 658 acres,” the OHS reports.

“A headright could not be sold, but an individual could sell his or her surface rights. An average Osage family of a husband, wife, and three children would receive more than $65,000 a year in 1926, and by 1939 Osage individuals had received a total of more than $100 million in royalties and bonuses,” the Oklahoma Historical Society reports. But according to the American Oil & Gas Historical Society (AOGHS) research, “During the height of the drilling boom from 1919 to 1928 northwest of Tulsa, more than $202 million was paid to the tribe in oil and natural gas royalties, bonuses, interest and land rentals.”

“First drilled in 1920, the Burbank field and several others soon became one of the richest in Oklahoma. Phillips Petroleum made a fortune there,” the AOGHS said. “Other petroleum companies got their start in Osage oilfields, including Conoco (originally Marland Oil), Skelly Oil, Carter Oil (later incorporated into Standard Oil), and Gypsy Oil Company (later Gulf Oil).”

More recently, companies working on Osage leases include Devon Energy (ticker: DVN), Constellation Energy (became Sanchez Production Partners-ticker: SPP) and Chaparral Energy LLC.

“The Osage fields were an oilman’s dream,” Jenk Jones Jr. of the Tallgrass National Preserve told the AOGHS. “The oil was a high-grade, with a good conversion to gasoline ratio. It was easily refined, with a very high percentage of kerosene. It was free of sulfur and asphalt.”

U.S. government: Osage produces 200 million barrels by 1938

A 1942 report by the U.S. Department of the Interior Geological Survey details the sub-surface geology and delivers production numbers for the Burbank field.

The Burbank field production peaked in July 1923 at 88,950 BOPD from 1,020 wells, the Geological Survey reported.

By March 1, 1925, less than five years after discovery of the field, “a total of 97,429,751 barrels had been produced, which made the Burbank field the largest producer in Oklahoma up to that date, with the exception of the Cushing field.

“By the end of 1938,” according to the Geological Survey, “a total of almost 200,000,000 barrels had been produced from the Burbank field; 80 percent of which came from the Osage County part of it. All except a small part of the oil produced from the Burbank pool has come from the Burbank sand, which lies at depths ranging from about 2,700 to 3,000 feet,” the Geological Survey reported.

A new opportunity to find and produce Osage oil next door to the Burbank field

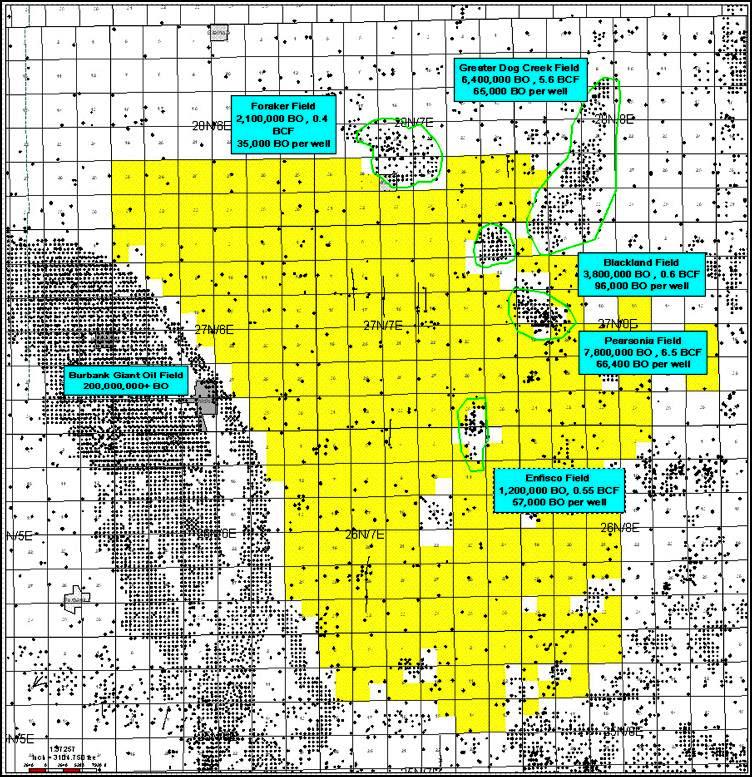

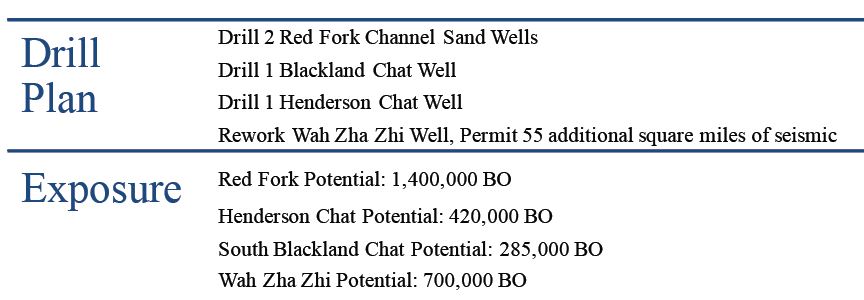

Petro River Oil Company (ticker: PTRC) is ready to kick off a drilling program on the Osage reservation. PTRC has secured a significant leasehold on the Osage reservation along the eastern border of the Burbank field, and it plans to drill four test wells immediately upon receipt of drilling permits.

Petro River’s concession area—which contains known oil fields neighboring the Burbank—has produced in excess of 20 million barrels of oil through vertical well development. Petro River’s business plan is focused on lower-cost conventional resources, as compared to highly capital-intensive shale development, and its Osage concession fits the company’s plan to locate and develop conventional resource opportunities.

The play is strictly conventional. Petro River has mapped out a program for shallow, vertical drilling. No horizontal drilling and no complex completions are required to generate oil production from the Osage concession. And if the resources are proven to be in place, the company is looking at a very low-cost extraction opportunity.

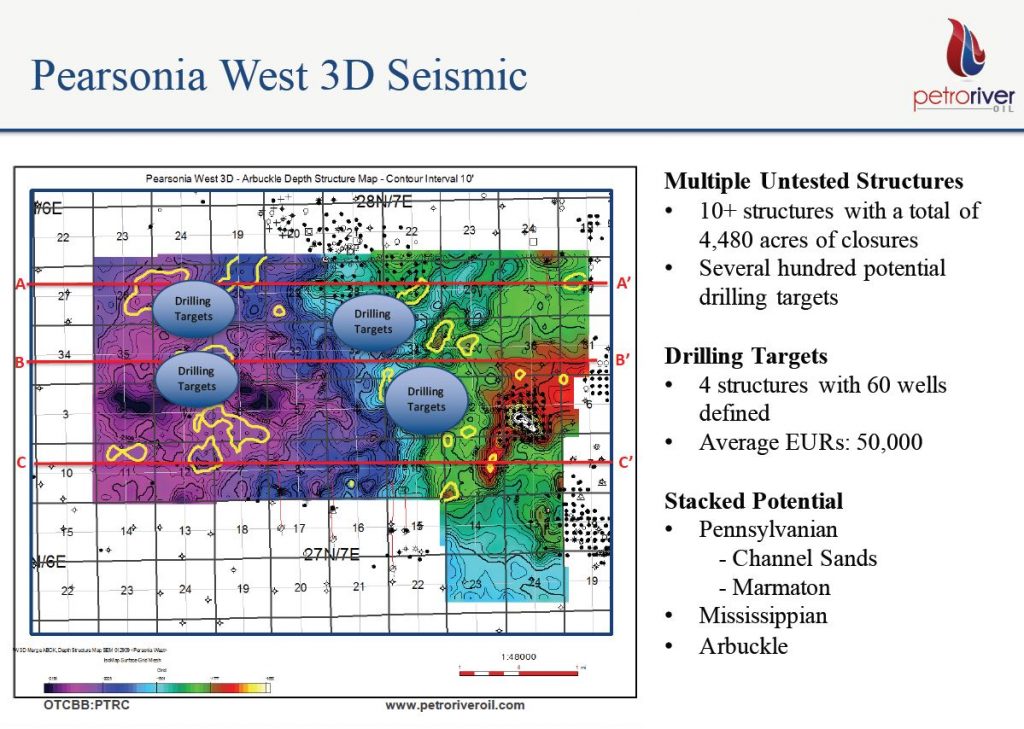

Petro River’s science team has injected a valuable technology into its Osage equation—3D seismic. The company’s access to 3D seismic technology will become an important tool to pinpoint the continued development of the oil fields adjacent to the Burbank field. Longer term, Petro River hopes to shoot an additional 55 square miles of 3D seismic on the concession beginning in 2017.

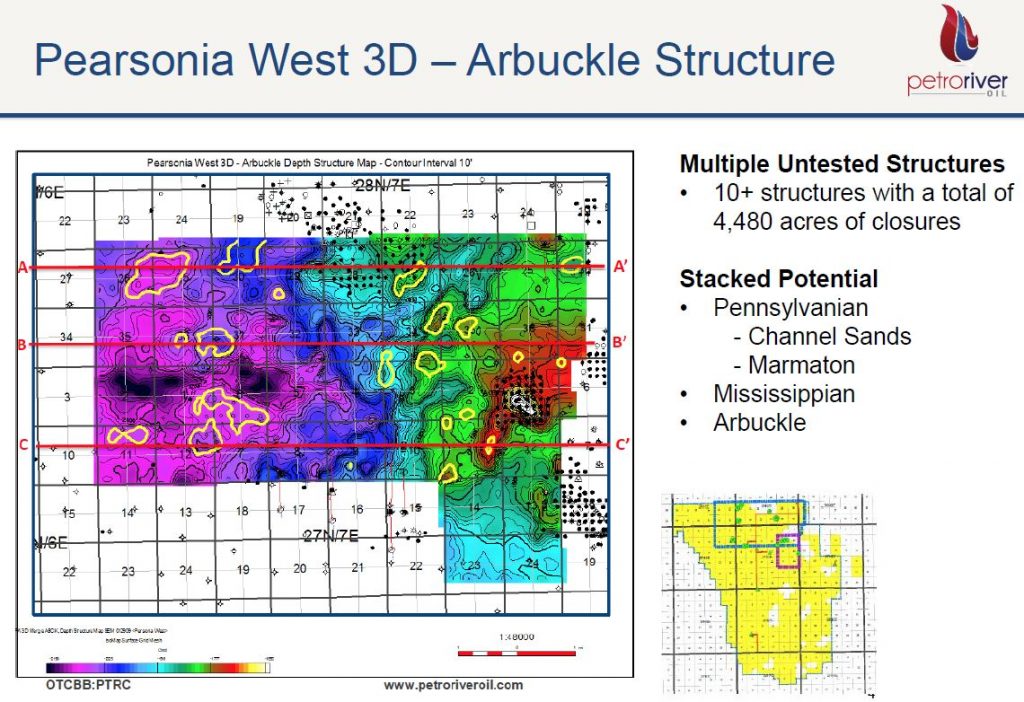

By reprocessing the 3D seismic data that was previously shot on its properties, Petro River has located and is targeting a number of conventional geologic structures that it believes are prospective for further oil production from its Osage lands just east of the Burbank field.

Osage County – Petro River’s Pearsonia West concession

Petro River’s Pearsonia West Concession includes 106,500 contiguous acres centered on the structural trend of the Pearsonia-Blackland-Foraker fields. The company’s recently completed reprocessing of 36 square miles of proprietary 3-D seismic data acquired in two phases in 2007 and 2009 has indicated multiple structures with closures ranging from 80 to 1,000+ acres—4,480 acres of structural closure.

The stacked and locally productive reservoirs that are prospective on the concession include Arbuckle, Mississippian, Red Fork, Skinner and Marmaton deposits. The new seismic processing will allow for greater imaging of porosity developments within the carbonates and edge resolution of identified and undrilled Pennsylvanian shoe-string sand deposits, according to the company.

Petro River’s exploration team, led by company president Stephen Brunner, believes the shallow drilling and low risk drilling environment will allow economic, vertical exploitation of the resources even at sub-$30/barrel oil prices.

Brunner, who was former president & CEO of Constellation Energy Partners (which became Sanchez Energy Partners (ticker: SPP)), has a rich background in Oklahoma oil and gas in Osage County. Continental had concessions on the Osage Nation lands and Brunner was involved in drilling more than 300 wells in Osage County. Brunner has eight years working with the Osage Nation Minerals Counsel, the tribal governing body that has been charged with administering and developing the Osage Mineral Estate since 1906.

Petro River’s technical partners include Scott DuCharme of Performance Energy, who has drilled 500 wells in Osage County and has 30 years of work with the Osage Nation Minerals Council, and Shane Matson of Blue Jacket Energy, who has drilled 100+ wells in northern Oklahoma.

Petro River Chairman Scot Cohen said the technical team and partners working with the asset have together drilled over 1,000 wells in the area with an 85% success rate, including some of the highest performing wells of the past decade.

Osage drilling program is self-funded

“We are in the process of permitting now for the initial test which will involve drilling four wells into four structures that we identified with the reprocessed seismic,” Cohen told Oil & Gas 360®. “This is a conventional play with multiple producing horizons, for which we are completely self-funded.”

Cohen said the idea is to de-risk four structures that were identified by the reprocessed seismic, and then launch a 60-well conventional drilling program into the play. “Our short-term goal is to get 20 wells done as soon as we can get permits.”

“Where we have a structure, the plan is to drill into it and drain it,” Cohen said. “It’s a pretty basic conventional plan that comes out of the reprocessed 3D seismic data we have.” Cohen said the exploration team believes they have up to 500 locations on the concession.

“Now we’ve got the targets”

Oil & Gas 360® spoke to Stephen Brunner about the company’s Osage County project. Brunner, whose team has worked on wells in Osage County for decades, said his view of the field changed dramatically when he saw the reprocessed 3D seismic showed multiple target formations, both Pennsylvanian and Mississippian-aged. “I never saw the channel before, but now we’ve got the targets.”

“The structures are very well defined. Within our concession there have been over 20 million barrels of oil produced from Chat type wells. The Burbank field, which abuts our concession, has produced over 200 million barrels from the Red Fork channel sand,” Brunner said.

Cohen estimates the cost for the four-well program to de-risk the initial identified structures is going to be approximately $400,000-$450,000.

“Investing less than a half million dollars to prove up what could be 2.5 million barrels of oil…that’s a pretty good use of capital.” Cohen told Oil & Gas 360®. “And that’s just the first 1,600 acres of almost 4,500 acres of closure—just in the first 3D area.” Cohen said the company is hopeful it will have permits in hand and can hit the ground running on the play in Q1 2017. “We have a team and a rig in place, we just need the drilling permits.”

Permitting on federal lands has been a slow process under the current administration, Osage go to Washington offering solutions

The Osage Nation has been vocal about getting the U.S. government to speed up oil and gas permitting on its reservation. In March of 2016, a delegation of tribal councilmembers testified before the U.S. House of Representatives Appropriations Committee, Subcommittee on Interior, Environment and Related Agencies, chaired by Oklahoma Congressman Tom Cole.

The Osage councilmembers testified as follows: “Congress called us Headright Owners. Each Headright Owner had one share of royalty from the production of oil and gas in the Osage Minerals Estate. The Osage Minerals Estate has been producing oil since 1896, making it one of the oldest fields in the United States. Our Minerals Estate contains proven reserves. In 2015, it was estimated that our Headright owners would receive about $13.6 billion in royalties from 2012 to 2027. That’s about $1 billion a year.

“We also face some challenges that are unique just to the Osage. First, like other tribes, energy production on our lands is limited by a lack of staff, expertise and resources in the Bureau of Indian Affairs’ (BIA) Osage Agency office. Without the BIA staff or expertise to keep up with the energy industry, we are not able to fully utilize our resources to benefit our Osage Headright owners. For example, we estimate that the BIA averages more than a year to approve a simple workover permit. As you might know, a workover permit only approves maintenance for an existing oil or gas well. You can imagine the delays for permitting a new well.

“The BIA needs far more than the $5.9 million requested in the President’s budget to manage the oil and gas development at Osage and across Indian Country. The BIA needs ten times this amount. When you compare the BIA’s budget to the $187 million requested for the BLM, it’s no wonder that the Government Accountability Office found that the BIA management hinders in energy and needs sweeping changes.

“Second, unlike other tribes, the 1906 Osage Allotment Act creates special legal requirements for leasing on our lands. For example, leasing on the Osage Minerals Estate is especially excluded from the Indian Mineral Leasing Act. Instead, the Interior follows Osage specific regulations, and the BIA is the only agency involved in approving oil and gas permits in our Minerals Estate. The BIA does not get any help from BLM or the Office of Natural Resources revenue like other Indian Reservations. The Osage Minerals Council also has unique responsibilities, but our funding is limited as well. We currently manage the Estate with an annual drawdown from royalties that should be distributed to the Headright owners. This is an unfair burden on the Headright owners and is not enough funding for effective management of the Estate.

“We respectfully request that you increase the BIA’s Natural Energy budget and we request $4 million in direct funding for the Osage Minerals Council, so that we can effectively manage the Osage Minerals Estate for the benefit of Osage Headright owners and the entire region. “Thank you for the opportunity to testify.”

Continuing the Osage legacy of wealth from oil

In the Osage Nation Minerals Council Newsletter, Fall 2016 edition, the call for scholarship applications points to the importance of oil and gas to the Osage people.

“The introduction of the scholarship application reminds us that in 1871, the Osage moved to what is known as the Osage Reservation of Oklahoma. Prior to that move …Wah-Tiah-Kah traveled south from our Kansas lands to determine for our people if this was wise and the boundaries of which it would encompass. Wah-Tiah-Kah walked the land; as he did so, he envisioned his grandchildren prospering. He knew this was good and that Wah-Kon-Tah had blessed the land for the Wah-Zha-Zhi.

“The purpose of the scholarship program is to provide incentive, encouragement and financial assistance to Osage applicants pursuing higher education in oil and gas related fields. The scholarship application states, ‘We honor Wah-Tiah-Kah, for without his wisdom, we would not have the oil that has sustained the Osage for over 100 years.’ By these scholarships, the Minerals Council hopes to help maintain and promote good stewardship over this great gift from Wah-Kon-Tah.”

Osage Nation Minerals Council Chairman Everett Waller is willing to fight to increase and protect oil production on Osage lands

Everett Waller, chairman of the Osage Nation Minerals Council, is one Osage tribal member and a former Bureau of Indian Affairs employee who is doing everything in his power to remove the federal agency’s roadblocks to new drilling on Osage lands. He has already won some legal battles and he has others pending.

Oil & Gas 360® spoke to Everett Waller earlier in December about his efforts to get permitting moving much faster at the BIA. Waller is very outspoken about his responsibility to protect the Osage Nation Mineral Estate from any person, place or thing that might hinder oil and gas development on tribal land, and to continue the Osage Nation’s legacy of prosperity from oil and gas located on its lands. Waller sees the fight for permits as his personal duty, the single thing that will sustain future Osage generations.

Oil & Gas 360® exclusive interview with ONMC Chairman Everett Waller

OAG360: The Osage have enjoyed tremendous prosperity from oil and gas production over the years. The Osage leaders were very smart when they set things up with the U.S. government more than a century ago. For instance, in November 2016, when the Bureau of Land Management (BLM) issued its final rule on flaring on federal and Indian lands, it said the final rule will apply to all oil and gas produced from the federal or Indian mineral estates—except the Osage Tribe. What is it that sets apart the Osage?

Waller: We are the only tribe that has our own Code of Federal Regulations. That was established for just our section alone, Part 226. It encompasses all the custodianship of our trustee—the Department of Interior. The BIA has a contract, but the actual federal law is with the Secretary of Interior, only, and the BIA enforces it. Other [tribes] fall under BLM, U.S. Fish and Wildlife and the National Park Service—but we are a one stop shop.

We’re not like other tribes because our element is 1.94 million acres; we ceded 900 million acres and then purchased this property in the late 1800s. We were identified at that time under the Code of Federal Regulations through the department of interior and we were very well with that, until the last few years.

We’ve run into some efforts by our trustee [the Department of Interior] where they are trying to work on their regulations, but our Third Mineral Council took them to task and we won a federal court case on Aug. 15 that allows us to take care of our regulations the way we see fit as representative of the owner.

The White House has a green initiative and that works everywhere but here—I’m in a federal wind farm fight as we speak; we’re going to have to go to the Supreme Court. And I don’t think that Duke Energy would like everyone to know that they’re out here stomping on a little Indian tribe.

Federal law demands that we are consulted on every event, every federal law change, etc., and to do it where we feel confident, it’s not just a consultation check box where you leave us and then you do what you want. Our treaties from 1904 on have been fought with blood, sweat and souls and I’m here to represent those people and that’s exactly what I’m going to do is protect their interests and my children’s interests as an American Osage Headright owner and landowner. Our kids deserve the gifts that we received from our parents that kept them all these years. With the federal over-regulatory, we took them to court, but we’ll never get back the barrels we lost on production. In the heyday we were [producing] over 200,000 barrels; in the modern era we were at 60,000 and now we’re looking at a 12,000 barrels production per day. And that is what’s staggering.

And that is the problem right there—permitting.

OAG360: Who controls the permitting on the Osage property?

WALLER: The Bureau of Indian Affairs. I’ve asked to do the permitting ourselves and they’re not going to allow it. We are a federal entity; I cannot turn this over to a state court or a state entity; it has to stay federal because we didn’t make a deal in 1905 with the State of Oklahoma. This allotment was done just before the state was brought into the Union. The Osage predate the State of Oklahoma.

And we’re the only tribe that pays a gross production tax.

I have sued the United States government for the billions of mismanagement. The Government Accountability Office published a report on the Bureau [of Indian Affairs] in 2015 entitled “Poor Management by BIA Has Hindered Energy Development on Indian Lands.”

Whatever their excuses are, there is no statute of limitations. Whatever I have lost for myself or my children, we’re going to get it back for our grandkids.

I’m in a global market. The United States government gave us this right and now we’re having to work through certain issues with them. Our trustee literally sent the letter out when oil was $100 a barrel and stopped our drilling. We have to be competitive in this global market. Whether it’s a barrel, a hundred barrels, a thousand barrels or 100,000 plus, the permitting takes too long. You [meet all the] requirements and you wait, but yet a wind farm can get category exclusion. They are held out from all other counties, so [the wind farm] found a home here, and my trustee did not do the due diligence or file legislatively to stop it. Where was my federal government then?

OAG360: If companies want to apply for drilling permits what is the time frame now?

WALLER: Some permits have taken two years. It’s time to look at it a little differently. It’s time to ask what is the effect of this on my headright owners? That’s my job. We have weathered a lot of issues—the Osage Minerals Council on behalf of headright owners. Oil is going to go up. The drilling is going to come back to us.

We’re going to use the new 3D technology just like they’re going to use on the old fields in Texas. The projections there are through the roof. I have some of the largest dome caps in the world here, and if we can find one out of the three they predict are here, we’re going to be in business. I’m going to have all workovers ready to go, and if we have to, we’ll go to court to get the permitting done. I believe the new technology is going to bring us new production, and that’s going to be the key to survival here.

“We’re in the oil business”

In an interview with Oklahoma’s NPR network’s State Impact in 2014, Waller discussed the proposed wind farm whose transmission lines would cross the Osage Nation’s land. Waller discussed the tribe’s opposition to the proposed project because of the project’s large footprint, presence of transmission lines and electrical equipment on the surface that might interfere with oil and gas development. “It’s not the alternate energy or the wind energy, anything of the fact. I have a job as chairman of the Minerals Council to protect my shareholders. This is a business. We’re in the oil business.”

New leadership at the Department of Interior could bode well for oil and gas permitting on federal lands

The coming change in senior leadership at the Department of Interior could be a first step toward moving Everett Waller’s vision forward in 2017.

U.S. Congressman Ryan Zinke, appointee for Secretary of Interior; Photo: United States House of Representatives

President-elect Donald Trump announced the appointment of Montana Congressman Ryan Zinke as U.S. Secretary of the Interior this week. Zinke is a 20-year Navy Seal commander with a degree in geology and an MBA in Finance. According to ABC News, while campaigning for his House seat, Zinke was focused on management of federal lands, energy independence and strengthening the economy.

If confirmed, Zinke would provide final oversight for the Bureau of Indian Affairs (BIA), the Bureau of Land Management (BLM), the Bureau of Ocean Energy Management (BOEM) and the Office of Natural Resources Revenue (ONRR), all of which are agencies responsible for oil and gas permitting and management on federal lands.

Waller wants to make certain that producers are able to generate as much oil and gas royalties as possible from production on Osage lands to carry forward his founders’ foresight that natural resources would sustain upcoming generations of Osage.

Petro River CEO Scott Cohen agrees. “Once we get this project going, we hope Petro River Oil will become one of the Osage Nation’s most important sources of income,” Cohen told Oil & Gas 360®.

Petro River’s corporate profile is available here.