U.S. Offshore Drilling Changes Drastically after Sept. 12, 2016 – Part 1

In July an agency under the executive branch of the U.S. government delivered what might be a killshot for a portion of the leaseholders and operators working to extract oil and natural gas from the U.S. outer continental shelf (OCS).

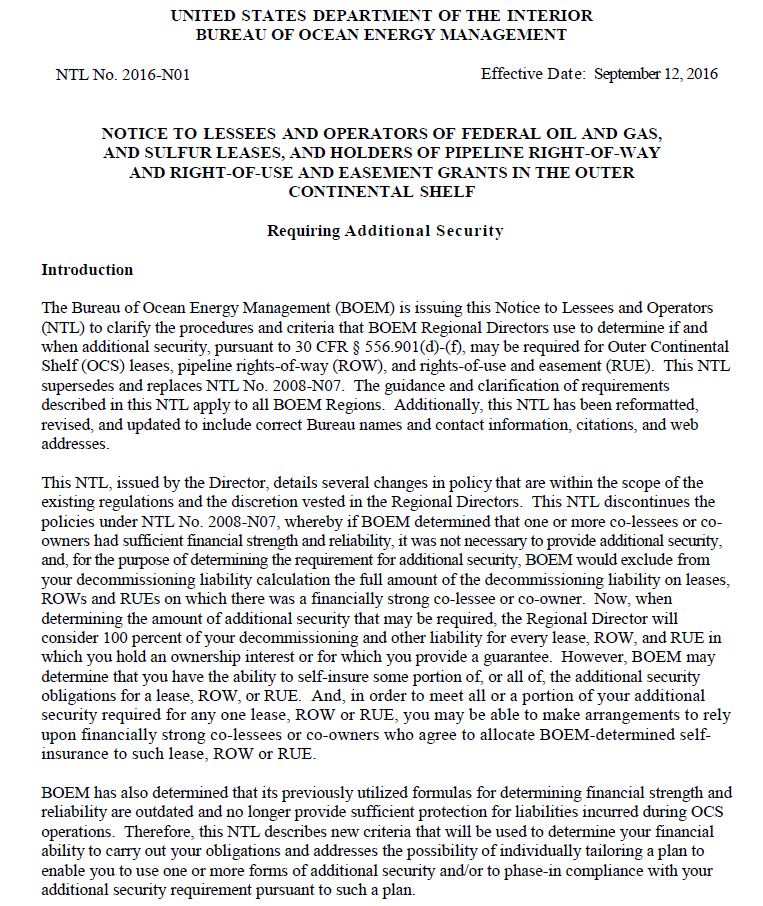

It looks innocuous enough. A memo entitled “Requiring Additional Security” that was signed on July 12 by the director of the Bureau of Ocean Energy Management (BOEM) and mailed to oil and gas leaseholders and operators working in the Gulf of Mexico and other BOEM regions on federal OCS leases. The notice is national in scope and applies to OCS operations offshore from all U.S. coasts—the Gulf of Mexico, Alaska, and the Atlantic and Pacific Oceans.

The lasting impact of this particular notice—known as NTL No. 2016-N01—could be game changing for U.S. offshore oil and gas operators, according to attorneys at several firms who have studied it.

Piling on to an already ground down U.S. oil and gas industry, according to the legal experts, NTL No. 2016-N01 has the capability to financially damage or destroy the independent leaseholders and operators on the OCS. It could push some offshore drillers and lessees into bankruptcy causing significant job loss, further erosion of U.S. national wealth and it could put an end to drilling on the outer continental shelf.

Out of the Deepwater Horizon Disaster Emerge New Financial Requirements

Deepwater Horizon changed everything about offshore drilling. The government geared up to change how it regulates the OCS and it started by revamping the regulating agencies themselves.

“In response to the Deepwater Horizon explosion and resulting oil spill in the Gulf of Mexico, the Obama Administration launched the most aggressive and comprehensive reforms to offshore oil and gas regulation and oversight in U.S. history. The reforms, which strengthen requirements for everything from well design and workplace safety to corporate accountability, are helping ensure that the United States can safely and responsibly expand development of its energy resources,” is how the BOEM web site puts it.

One heavy-hitting aspect of the federal government’s widely publicized regulatory reform initiative calls for increasing limits of liability.

The government’s outdated views on liability were brought to light in a U.S. Government Accountability Office study—GAO-16-40—that was publicly released in Jan. 2016.

According to the GAO report, “Without a more accurate data system, [the Department of] Interior does not have reasonable assurance that it will consistently estimate the costs associated with decommissioning.

“Interior’s procedures for obtaining financial assurances for decommissioning liabilities pose financial risks to the federal government, and Interior is planning to revise its procedures to address these risks but has not finalized its approach. As of October 2015, for an estimated $38.2 billion in decommissioning liabilities in the Gulf, Interior officials identified about $2.3 billion in liabilities that may not be covered by financial assurances. However, these officials were unable to determine the extent to which these data were valid due to limitations with Interior’s data system, among other things.

“Of the remaining $35.9 billion in decommissioning liabilities, Interior held or required about $2.9 billion in bonds and other financial assurances, and had foregone requiring about $33.0 billion in bonds for the remaining liabilities. Interior has procedures that allow it to waive its requirement for a lessee to provide a bond if the lessee passes a financial strength test. Prior GAO work has shown that the use of financial strength tests in lieu of bonds poses risks to the federal government.”

According to the BOEM website, “BOEM has implemented new strategies to hold responsible parties accountable. BOEM has increased the limit of liability for oil-spill related damages from $75 million to approximately $134 million for offshore oil and gas facilities – the maximum allowed under the law – and has established a process for future increases to keep pace with inflation.”

Regulating an Industry by ‘NTL’

To change or amend the rules it lays out for operators, the BOEM issues what the industry calls “NTLs” – Notice to Lessees and Operators. The rules governing operations on the OCS can be altered at any time by the director or a regional director of the BOEM simply by issuing a new NTL. And that is exactly what BOEM Director Abigail Ross Hopper did on July 12, 2016.

What is the Upshot of NTL No. 2016-N01

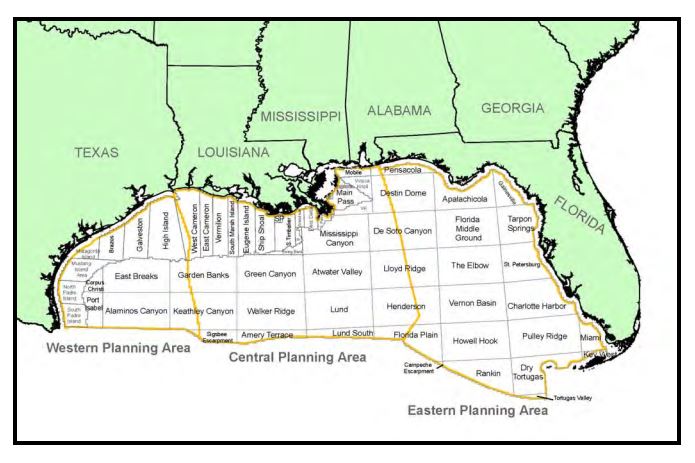

NTL No. 2016-N01 is national in scope. It applies to all Bureau of Ocean Energy Management (BOEM) regions, but the region with much activity and many players is the Gulf of Mexico.

What’s at Stake? Big Numbers from OCS Operations: 650,000 Jobs, 550 Million Barrels of Oil and 1.35 Tcf of Gas—16% of U.S. Production

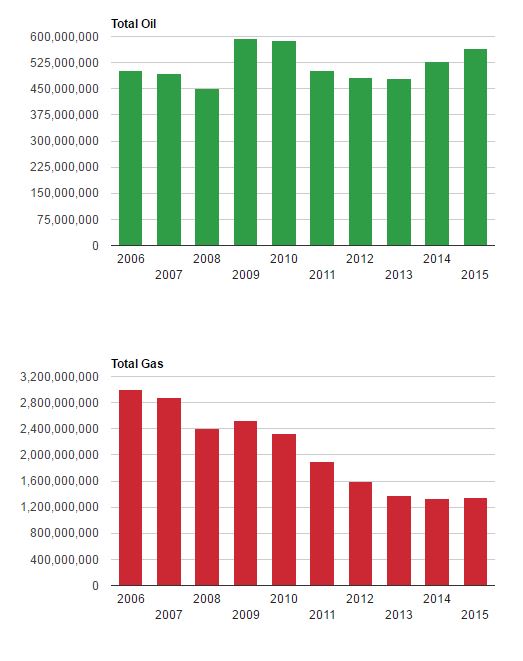

On March 2 of this year, in her statement to Congress, BOEM Director Hopper outlined the tremendous viability and value of OCS oil and gas production to the country (Statement to the House Committee on Natural Resources Subcommittee on Energy and Mineral Resources Mar. 2, 2016):

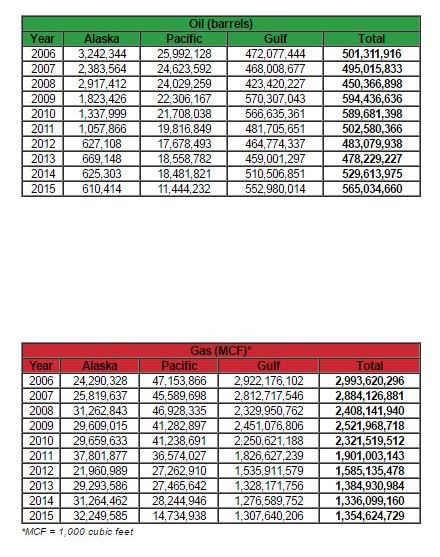

“As of January 2016, BOEM administers more than 5,000 active oil and gas leases on nearly 27 million OCS acres. In FY 2015, production from these leases generated $4.4 billion of dollars in leasing revenue for the Federal Treasury, Land and Water Conservation Fund, Historic Preservation Fund and state governments. The overall level of activity on the OCS related to this production, drilling, and development of new projects is estimated to support employment associated with approximately 650,000 direct, indirect, and induced jobs. In FY 2015, OCS leases provided more than 550 million barrels of oil and 1.35 trillion cubic feet of natural gas, accounting for about sixteen percent of the Nation’s oil production and about five percent of domestic natural gas production, almost all of which is produced in the Gulf of Mexico.”

According to Director Hopper, “In order to better align regulatory requirements with the realities of aging offshore infrastructure, as well as to ensure that lease obligations, such as decommissioning, do not fall to the taxpayer, BOEM is proactively implementing a comprehensive Risk Management and Financial Assurance Program to modernize our regulatory regime.

“[The BOEM] will monitor and track the financial strength of lessees for offshore activities and infrastructure to ensure that BOEM is requiring the proper level of bonding or other acceptable financial risk mitigation measures to protect taxpayers.”

In her pitch to Congress for funding, Director Hopper said, “The requested funds will allow us to fully implement the recommendation of the Government Accountability Office to ‘ensure that BOEM completes its plan to revise its financial assurance procedures’ (Offshore Oil and Gas Resources: Actions Needed to Better Protect Against Billions of Dollars in Federal Exposure to Decommissioning Liabilities (GAO- 16-40)).”

And so NTL No. 2016-N01 Came to be Issued in July 2016; it Takes Effect Monday Sept. 12, 2016

According to Washington, D.C., attorneys Van Ness Feldman LLP, “NTL 2016-N01 represents a fundamental shift in the way BOEM manages risk on the OCS. Once effective, NTL 2016-N01 will require that a company be able to make an annual showing that it has the ‘financial ability to carry out obligations’ on all leases, pipeline ROWs, and/or RUEs. BOEM also will be able to undertake an assessment of a company’s financial ability any time the agency wishes, including when the agency learns of a ‘material or adverse change [in a company’s] financial strength or OCS obligations’ and when the company violates ‘Department of the Interior or other applicable regulations’.”

How will the Rules Change Next Monday for Oil and Gas Lessees and Operators Working under NTL No. 2016-N01

The new BOEM guidelines restrict the ability of a company to rely on the financial strength of co-lessees to avoid additional supplemental bonding requirements, according to Van Ness Feldman LLP’s analysis of it. And supplemental bonding requirements are at the heart of the new guidelines.

“BOEM’s issuance of NTL 2016-N01 is only the latest action by the agency aimed at enhancing financial assurance for OCS oil and gas infrastructure. In August 2015, BOEM published NTL 2015-N04, ‘General Financial Assurance’. With that NTL, BOEM made several key policy changes related to its general bonding regulations. First, BOEM expanded the range of entities to which the general bonding policy applies.

“Whereas, historically, bonding obligations fell only on OCS lessees and operators, NTL 2015-N04 explicitly states that bonding obligations also attach to ROW holders, RUE holders, and geological and geophysical (G&G) permit holders. Second, while an earlier version of BOEM’s general bonding policy allowed an operator to post the bond after lease/plan approval so long as it did so prior to beginning the relevant operational activity, BOEM appeared to mandate that a lessee or operator furnish a general bond prior to approval of the lease/plan.”

“These three actions, while noteworthy, pale in significance when compared to BOEM’s effort to amend its supplemental bonding policy,” the firm said. “One reason for this is that supplemental financial assurance is an area where BOEM’s regulations provide the agency with greater flexibility to change requirements through interpretive guidance.”

“Whereas BOEM’s financial assurance regulations established fixed requirements for general bonds and set general bond amounts at relatively low levels, the supplemental bonding regulations allow the agency more leeway to exercise discretion as to bond terms and amounts.”

No More Risk Sharing on OCS Leases

Van Ness Feldman points out that BOEM will assign 100% of decommissioning and other liability to a company for any lease, pipeline rights-of-way (ROW), and rights-of-use easement (RUE) in which that company has an ownership interest or for which that company acts as a guarantor. “This is a significant departure from BOEM’s previous policy outlined in NTL 2008-N07, in which BOEM allowed risk pooling among multiple companies with shared interest in an OCS lease, ROW, or RUE.”

With issuance of NTL 2016-N01, the method that BOEM uses to calculate financial strength and reliability also changes, according to the firm.

According to Philadelphia’s Morgan Lewis law firm, “Qualified self-insurance will, in practice, be more limited than the coverage of the prior exemption guidelines, which allowed for decommissioning liability to be as much as 50% of a company’s net worth; the new guidelines limit self-insurance to 10% of a company’s tangible net worth.”

Which Companies will be able to Comply?

The question comes up: will the U.S. government’s new financial rulebook which companies must follow in order to drill on the Gulf of Mexico OCS be impossible to comply with for anybody other than a major or super-major oil company after next Monday?

“No longer will BOEM presume financial strength where a company can demonstrate a net worth equal to or greater than $65 million, cumulative decommissioning liability less than or equal to 50 percent of net worth, and a certain level of production or debt to equity ratio,” says Van Ness Feldman. “Instead, BOEM will now undertake a far more scrupulous look into a company’s fundamentals, looking at the following five criteria:

- Financial capacity – BOEM will require that a company be able to demonstrate both short-term financial capacity and long-term financial capacity “substantially in excess” of current and future lease obligations. To prove this capacity, a company must be able to demonstrate that it exceeds minimum thresholds for a number of financial criteria, including: Cash Flow from Operations/Total Debt; Earnings Before Interest and Taxes (EBIT)/Interest Expense; Return on Equity; Total Debt/Capital; and Total Debt/Equity. BOEM has established benchmarks for each ratio, which are available athttp://www.boem.gov/Benchmark-for-Each-Ratio/.

- Projected financial strength – Under this criterion, a company must be able to demonstrate that the estimated value of its existing OCS production and proven reserves substantially exceeds current and future lease obligations.

- Business stability – Where a company can show that it has maintained continuous OCS or onshore operations and production for a period of five years or more, BOEM will find that the company satisfies the business stability requirement of NTL 2016-N01.

- Reliability – BOEM will base reliability upon a company’s credit rating from Moody’s or Standard and Poor’s, or upon the company’s trade references.

- Record of compliance – BOEM will review a company’s record of compliance to see whether BOEM or BSEE has assessed civil penalties to the company or any of the company’s affiliates or subsidiaries. BOEM also will: (i) undertake a review to ensure that the company is in compliance with BOEM and BSEE lease, plan, and permit terms and conditions; (ii) check to see whether the company has been cited for non-compliance with other federal requirements for operations on the OCS; and (iii) ensure that the company has no outstanding debts to the government from the non-payment of rents, royalties, inspection fees, etc.”

No More Waivers

In key areas where operators were previously granted waivers, NTL No. 2016-N01 “eliminates waivers of supplemental bonding previously available to companies meeting certain standards for financial capacity and reliability, and substitutes a more limited self-insurance scheme instead,” said Morgan Lewis.

“BOEM previously granted waivers of supplemental bonding for a lease, ROW, or RUE if BOEM determined that one or more of the co-lessees or co-owners of the applicable OCS asset met its tests for sufficient financial capability and reliability. Similarly, BOEM also excluded from the decommissioning liability calculation the full amount of the decommissioning liability on leases, ROWs, and RUEs on which there was a financially strong co-lessee or co-owner.” Both of these have been eliminated.

Under NTL No. 2016-N01, “when determining whether a company needs to provide supplemental bonding, BOEM will consider 100% of a company’s decommissioning liability for every lease, ROW, and RUE in which a company holds an ownership interest. …

“Under NTL No. 2008-N07, BOEM previously granted waivers to companies demonstrating (a) a net worth equal to or greater than $65 million, (b) cumulative decommissioning liability less than or equal to 50% of such net worth, and (c) a certain level of production,” said Morgan Lewis.

The former policy of granting of waivers is over, according to some of the legal experts that Oil & Gas 360® conferred with.

The amounts that companies had to put up for supplemental bonding were relatively low. The Minerals Management Service (MMS) would estimate the plug and abandonment and decommissioning costs and ask the operator to put up a surety bond in that amount. The regional director could issue a waiver if certain metrics were met: size of the company, capitalization, oil and gas holdings in the gulf.

“It was a rather low hurdle,” one attorney characterized it.

Tailored Plan: 360 Days, instead of Four Years to Comply

To implement the new guidelines set forth in NTL No. 2016-N01, BOEM will send a letter notifying a subject company of the additional security requirements now required and the time period in which they must be provided.

“Additional security for properties may be submitted through a ‘tailored plan’ that allows the company to provide the additional security over 360 days,” Morgan Lewis said. “In contrast, NTL No. 2008-N07 allowed for periods of as long as four years to fund supplemental bonding requirements. Sole liability properties may not be phased-in.”

What could happen to independent Operators in the GOM?

Operators who are unable to meet the new supplemental bonding requirements could be forced to sell those assets to the larger companies, effectively restricting competition to compete for leases and develop Gulf of Mexico (GOM) deepwater assets. If a company is unable to find a buyer, the BOEM could order the company to immediately decommission its assets, according to Van Ness Feldman.

What happens if the cost of decommissioning its OCS assets exceeds the company’s net worth and forces the company to declare bankruptcy? If the bankrupt company’s general bond and supplemental bonding are insufficient to decommission its OCS wells, then the government will go after other parties in the lease, RUE or ROW chain of title. “Where it is unable to secure decommissioning from smaller companies, the government can be expected to pursue any prior owner with ‘deeper pockets,’” Van Ness Feldman says.

Another attorney who spoke to Oil & Gas 360® said that the Bureau of Safety and Environmental Enforcement (BSEE) is presently updating all of the estimates of the costs for plugging and abandoning (P&A) wells in the Gulf of Mexico OCS. He believes the effect of significantly higher P&A costs on supplemental bonding requirements will be staggering, including shutting in segments of the gulf, companies going bankrupt and truncation of available players in the market.

“I think it’s going to come home to roost a lot sooner than some people think,” the attorney told Oil & Gas 360®. “On September 13th there will be a host of notices going out,” he said.

A Precursor Action, before NTL No. 2016-N01

Stone Energy (ticker: SGY) in March of 2016 received notice letters from BOEM stating that BOEM had determined that Stone no longer qualified for a supplemental bonding waiver under the financial criteria specified in BOEM’s current guidance to lessees. The notice letters required that Stone provide significant supplemental bonding relating to our abandonment obligations.

Following receipt of the notice letters, Stone met with and proposed a tailored plan to BOEM for financial assurances relating to our abandonment obligations, which provides for posting some incremental financial assurances in favor of BOEM.

In May Stone announced that it “has an aggregate of approximately $230 million posted in surety bonds in favor of BOEM, third party bonds and letters of credit, all relating to our offshore abandonment obligations. On May 13, 2016, Stone received notice letters from BOEM rescinding its demand for supplemental bonding with the understanding that Stone will continue to make progress with BOEM in finalizing and implementing our long-term tailored plan.”

Q&A for NTL No. 2016-N01 – Aug. 10, 2016, Houston, Texas

In August, the BOEM hosted workshops in Houston and New Orleans to clarify operators’ questions about the new NTL. Below is the republished Q&A from the agency’s Houston workshop – 52 questions and answers.

Financial Assurance NTL Questions & Responses

- How will “ownership interest” be computed? Will it be proportionate to actual interest and what will it apply to, record Title, Operating Rights, both? Specifically, would like for BOEM to affirmatively state that with respect to a lease in which a company only owns undeveloped operating rights (i.e. no operating rights in producing intervals or in infrastructure located on the lease), that company will have no bonding obligations with respect to that lease. The best example of this scenario is when a company only owns operating rights below the deepest depth ever developed on the lease. The rules and regulations do not provide clarity on this point, but BOEM should be willing to affirmatively confirm this position.

ANSWER: BOEM will not compute ownership interests. Record Title owners will need to negotiate with their coRecord Title Owners and Operating Rights Owners to determine which portion of the additional security coverage each company will post, adding to 100 percent coverage. Based on 30 CFR 556.605, an operating rights owner is only liable for obligations arising from that portion of the lease to which its operating rights appertain and that accrue during the period in which the operating rights owners owned the operating rights.

- Article III of page 5 of the NTL says that BOEM will “notify you in writing, through your designated operator” of the amount of additional security required, and that the designated operator is required to coordinate with the lessees to provide the amount of additional security for each lease. How will this work? After all, it is possible that one co-owner could obtain self-insurance, while another needs to provide additional security, and so forth. How does BOEM perceive this to work? Can BOEM clearly state who is in the chain of title? Can BOEM clearly outline in these notice letters which assets are assigned which liability and to whom? Can BOEM exclude liability assignment of assets currently under negotiation between operators until negotiations are complete? If not, how can BOEM handle these assets under active negotiation?

ANSWER: BOEM is interested in obtaining 100 percent coverage of the liability on the Lease. It is up to the designated operator and co-lessees to negotiate how responsibility for that coverage is handled. It is also the responsibility of the Designated Operator to provide an appropriate consolidated response to BOEM.

- A single lessee in a lease with co-lessees may be providing BOEM with additional security through the tailored plan approach for one or more leases. How will lessee’s phased-in compliance with their tailored plan impact other lessees on a lease where BOEM has determined additional security is required? Different lessees may have different plans for when they will phased-in their additional security on a jointly owned lease. How will BOEM manage this?

ANSWER: BOEM is developing system enhancements to track all the various forms of financial security outlined in the new NTL including phased-in security. However, BOEM will seek the assistance of designated operators in managing a consolidated response from all lessees on a lease to ensure that a total of 100 percent coverage of the liability assessed on a given lease is provided.

- On Page 2 of the NTL, the first sentence in the last paragraph states: “You are responsible for ensuring that all obligations….for every lease…in which you have an “ownership Interest”. What does this mean? Is this simply confirmation of the “in-solido” (joint and several) liability of all co-lessees? It suggests that the liability for additional security will not be proportionate to working interest. Please clarify.

ANSWER: BOEM will not request additional security based on working interest percentage. BOEM only requires that 100 percent of the liability on the lease is covered, and it is up to the owners to negotiate between/among themselves to determine the percentage of coverage they will each provide.

- What are BOEM’s current values for Market Average Financial Ratios?

ANSWER: The 2014 Market Average Financial Ratios are currently posted on our website. The ratios for 2015 will be updated and will be posted on the website shortly.

6. BOEM plans to evaluate a lessee’s financial ability to carry out its present and future obligations annually to determine whether the lessee must provide additional security and, if so, how much additional security the lessee must provide.Will BOEM establish a set schedule for these annual meetings or will BOEM contact each lessee and schedule a meeting at BOEM’s discretion?

ANSWER: BOEM will not hold annual meetings but will conduct annual reviews to evaluate a lessee’s financial ability to carry out its present and future obligations. Upon receipt of BOEM’s evaluation result, a company can request a meeting with BOEM to discuss.

+ How long after the annual meeting can a lessee expect to receive a demand letter?

ANSWER: A Lessee can expect to receive a demand letter within 60 days after BOEM conducts the annual review of a lessee’s financial ability to carry out its present and future obligations.

+ If a lessee owns multiple leases, will BOEM issue a demand letter for each lease, group of leases, field or some other grouping?

ANSWER: The standard practice, which will be continued, is that BOEM sends demand letters to the Designated Operator for Leases, RUE Holders for RUEs, and ROW Holders for ROWs. The Designated Operator, by virtue of its Designated Operator status, has taken on the responsibility of acting for the lessees, and it must coordinate with the lessees to respond to a demand for additional security.

How far in advance of these annual meetings will BOEM request updated financial information from the lessee?

ANSWER: Since BOEM will be conducting annual reviews to evaluate a lessee’s financial ability to carry out its present and future obligations on information a lessee submits and other information in BOEM’s possession, it is prudent for the audited financials to be submitted to BOEM as soon as available. Historically, BOEM has required audited financials by July 1.

+ With a public company, will BOEM wait to request updated financial information and schedule the annual meeting until after the annual reports are published?

ANSWER: BOEM will use publicly available financial information on public companies, and private companies will need to submit their audited financials or trade references as soon as available. Historically, BOEM has required audited financials by July 1 and has granted extensions for companies with fiscal years ending on a date other than December 31. BOEM intends to continue these practices.

+ Realistically, how often does BOEM plan to review a company’s liability and financial capability?

ANSWER: At a minimum, BOEM intends to annually review a company’s liabilities and its ability to carry out its obligations. However, other actions on a lease (like a transfer of interest) can prompt a financial review, which will be done on a case-by-case basis.

- If a lessee does not have audited financial statements but its parent does, will BOEM look to the parent’s audited financial statements to determine the Financial Capacity of the lessee? If not, why not? (e.g. The BP entity that paid for the April 2010 Gulf of Mexico loss of well control event was not the BP entity that owned the interest in the Macondo lease.)

ANSWER: No, because BOEM does not want to have to determine whether the parent company is responsible for the liabilities of the lessee for the performance of the lease obligations. However, the parent company can provide a third party guarantee, depending on its financial strength.

- In reviewing the Financial Capacity financial criteria of a lessee, will BOEM hold fast to the minimum thresholds established for the nine ratios, or will BOEM use the thresholds only as reference point in its decision process?

ANSWER: BOEM will use the thresholds established for each ratio to evaluate financial capacity. In order for a lessee to pass this criterion, the lessee must exceed the minimum thresholds for five of the nine financial ratios that determine Financial Capacity. http://www.boem.gov/Financial-Capacity/

- In BOEM’s assessment of financial ability, what weight will be given to the five criteria? Is one more critical than another?

ANSWER: The five criteria are not weighted. BOEM does not consider one criterion to be more critical than another. All five criteria are taken into consideration to determine a lessee’s financial ability to carry out its present and future obligations.

- Under Projected Financial Strength, how will BOEM define what is meant by “significantly in excess of existing and future lease obligations ….” in assessing this criteria? How much in excess (e.g. a percentage or numerical amount)?

ANSWER: BOEM’s is measuring projected financial strength by taking your proved developing producing (PDP) reserves valued using the PV10 or FMV method. 30 CFR §556.901(d)(1)(i) states “Projected financial strength significantly in excess of existing and future lease obligations based on the estimated value of your existing OCS lease production and proven reserves for future production” http://www.boem.gov/Projected-Strength/

- What is the current minimum “Credit Rating” for the Reliability Criteria? What is the current minimum “Credit Rating” to allocate your self-insurance to sole liability? How often will it be revised?

ANSWER: A lessee should have an Investment Grade “Bond Rating” to obtain self-insurance. Investment Grade is Moody’s Baa3 or S&P BBB-. The minimum credit rating that a party must have to be allowed to apply its self-insurance to sole liability properties will be A3 (Moody’s) or A- (Standard and Poor’s). http://www.boem.gov/Reliability/

- In computing “Projected Financial Strength”, how will production be valued? Reserve estimates, discount factor used, ARO (present value allowed) etc.?

ANSWER: BOEM’s is measuring projected financial strength by taking your proved developing producing (PDP) reserves valued using the PV10 or FMV method. http://www.boem.gov/Projected-Strength/

- The explanation of EBIT/Interest Expense on the website says “measures the company’s ability to pay interest on outstanding debt”. Every bank in the industry measures this financial covenant as EBITDA/Interest given that DD&A is a huge non-cash item on every E&P balance sheet. EBIT/Interest is not a relevant measure in the oil and gas industry; however, EBITDA/Debt would be. In fact, with all of the impairments taken in 2015, 90 percent of the industry will record negative earnings this year making this measure not applicable. Unless changed to EBITDA or EBTIDAX this metric has no bearing on a company’s ability to pay interest on outstanding debt.

ANSWER: The benchmarks were developed taking into account actual industry performance for EBIT/Interest so companies are not being penalized for having DD&A excluded in the metric. (e.g. the benchmarks were based on EBIT so using EBITDA would be an apples to oranges comparison) In other words, we are not interested in the absolute size of the ratio but in its relative size, compared to the same ratio of the industry. In any case, BOEM will be evaluating and modifying the ratios on an annual basis and may make adjustments at that time.

- Return on Assets and Return on Equity are metrics used to measure the performance of large public companies, usually without huge non-cash expenses. These metrics have no relevance to private oil and gas companies which this NTL primarily addresses. Because of large DD&A charges and periodic impairment expense caused by highly fluctuating oil and gas prices, earnings is often meaningless to private oil companies focused on cash flow. Much more relevant metrics would be Cash Flow ROA and Cash Flow ROE that measure true profitability.

ANSWER: The benchmarks were developed taking into account actual industry performance for ROA and ROE so companies are not being penalized for having small or reduced returns (e.g. the benchmarks were based on actual ROA and ROE of the oil and gas industry). In other words, we are not interested in the absolute size of the ratio but in its relative size, compared to the same ratio of the industry.

- Can a parent company provide a Third Party Guarantee for a subsidiary with audited financials?

ANSWER: Yes

- What financial data and what format does BOEM require for their assessment of tangible net worth?

ANSWER: Audited Financial Statements, PV 10, and Ratings Moody’s SP&, Trade references

- BOEM will no longer waive bonds automatically based on the combined financial strength and reliability of co-lessees or operating rights holders, but will permit lessees qualifying for self-insurance to share it with co-lessees and operating rights holders. How will this work from a BOEM perspective and from a lessee perspective?

ANSWER: One or more qualifying lessees can provide their self-insurance for all or part of the liability on that lease. Any percentage of the total per-lease liability not covered by the self-insurance of a qualifying lessee can be provided in other types of financial instruments. The combination of all these forms of financial assurance must equal 100 percent of the liability on the lease.

- If BOEM determines a lessee has the ability to use self-insurance, the lessee must notify BOEM of the amount of self-insurance he or she will allocate to each lease, ROW, or RUE in which the lessee has an interest and whether it is the lessee’s intent for such self-insurance to cover the interests of other parties holding interests in those leases, ROWs or RUEs. How will this administrative work with BOEM?

ANSWER: BOEM is developing system enhancements to track all the various forms of financial security outlined in the new NTL including self-insurance.

- If a company is eligible for self-insurance, what are the factors that determine 1% – 10% self-insurance range?

ANSWER: The 5 Criteria per 30 CFR 556.901(d)(1)

- Will Letters of Credit be accepted?

ANSWER: Yes

- Can a company use multiple instruments to satisfy its financial security?

ANSWER: Yes

- What are the ramifications to an operator who is unable to successfully “coordinate” the posting of security from/with a co-owner?

ANSWER: Each lessee is jointly and severally liable. BOEM is interested in 100 percent coverage, and it is up to the lessees to negotiate with one another and decide what portion of that liability will be posted by each lessee. However, if 100 percent coverage is not received by BOEM, the Regional Director may assess penalties under 30 CFR 550, subpart N; request BSEE to suspend production or other operations in accordance with 30 CFR 250.173; or initiate action to cancel the lease, pursuant to 30 CFR 556.1102.

- In the event an operator goes bankrupt, prior to forcing the relinquishment of the lease and going to the predecessor operator to fulfill decommissioning obligations, can the predecessor operators have the ability to assume the lease operations and not just the decommissioning liability? If no, can BOEM recognize the bonding obligations as belonging solely and exclusively to the parties who actually own an interest in the development and production? Does BOEM intend to require additional financial security from predecessor-in-title companies in the event the current designated operator is unable to satisfy BOEM financial security requirements?

ANSWER: It is first up to the court to determine how a debtor transfers its lease interests like any other assets, but BOEM approval of an assignment is also required. BOEM is not in a position to require such an assignment or to avoid the processes of the court. BOEM regulations require that the interests of all record title lessees and operating rights owners be covered by financial assurance. The holders of the leases/working interests are the entities that must maintain bonding/financial assurance, and that requirement is not changed by the filing of a bankruptcy.

- How does BOEM plan to address situations where there are predecessors in title with accrued liability but the current defaulting lessee has drilled wells and installed facilities after BOEM approved the assignment of record title into the defaulting lessee. If the defaulting lessee has no other co-owners in the lease with them, the previous record title owners are held responsible for the decommissioning liability accrued during their ownership in the lease prior to approval of the assignment into the defaulting lessee but are not responsible for any liability accrued after the assignment is approved. How will BOEM handle these situations?

ANSWER: If that lessee defaults where there are facilities or wells for which there is no prior lessee with liability, BOEM will require forfeiture of the security and make arrangements for the required work to be done.

- To prevent double/triple financial security coverage, will BOEM consider bonding to a predecessor-in title as security towards subject leases?

ANSWER: Subject to Regional Director approval, the BOEM Regional Director may consider accepting bonding to a predecessor-in-title as security towards a subject lease. The Regional Director may consider acceptance based on the following:

- Whether the bond is a dual-obligee bond, naming BOEM as an additional obligee; or

- Whether a dual-obligee rider is made a part of the bond, naming BOEM as an additional obligee; or

- Is any consideration given for a project that is not expected to be abandoned for 20+ years? Since the abandonment risk is so low in the first years of the project, can a nominal amount be assessed in the early years? Can this life-cycle liability model apply to sole liability assets? Can this life-cycle liability model apply to non-sole liability assets?

ANSWER: BOEM will use the liability estimates provided by BSEE. As with current regulations and practices, there are opportunities for companies to fund financial assurance over time (phased-in). These requests should be proposed as part of a tailored financial plan. Phased-in additional security can be applied to Non-Sole Liability Properties at the discretion of the Regional Director.

- As a lessee conducts more activities on the lease, (i.e. drill another wells or P&A a well) will we be expected to update our plan at that time, or is this done once a year?

ANSWER: Prior to approval of new activity, financial security will be required either through an amendment to an existing tailored financial plan or posting of a new financial security (e.g., a bond).BSEE will assess new activities at the permit stage and will re-assess after P&A and site clearance documentation has been processed. The lessee will be responsible for contacting Risk Management Operations Group (RMOG) to update their tailored financial plan if applicable.

- What happened to moving the Decommissioning Liability posting requirement from the Exploration Plan to the APD? (OOC Comment: There is continuing dialog with the region that BSEE/BOEM is moving forward with this.)

ANSWER: BOEM and BSEE are working closely to enable companies to provide financial assurance in association with APD submittals and prior to approval of the permit.

- Why would a change in designated operator potentially trigger a review of the financial information covering the lessees in a lease when the decommissioning liability is not changing?

ANSWER: While the decommissioning liability may not change, BOEM may perform an assessment of financial capacity of the operator to honor the existing financial commitments associated with the lease.

- If the lessee disagrees with any decommissioning estimate provided to BOEM by BSEE, what will be the mechanism available to the lessee to challenge the BSEE estimate? During the challenge period, will the lessee be required to post supplemental security based on BSEE’s estimate? When an asset is decommissioned how will BOEM make timely adjustments to financial liability? Our current understanding is that bonds do not expire even for non-payment of annual premiums and that bonds do not expire unless BOEM notifies the surety, is this correct?

ANSWER: The lessee can submit evidence to BSEE, such as third-party estimates, and BOEM will consider pending disputes as part of the tailored financial plan negotiation process for Non-Sole Liability Properties. Ultimately, BOEM will rely on BSEE’s resolution of the disputed decommissioning liability estimate to determine the required amount of additional security. For Sole Liability Properties, the BSEE estimate for liability must be posted when demanded.

- Since BOEM is going to use BSEE’s estimates when determining each company’s liabilities, will BOEM revise the decommissioning liability estimates if a company can demonstrate where BSEE’s estimates are not correct, for example, if we know a well has been P&A’d but BSEE still shows it as “drilling” or “T&A’d”? What is the process for BOEM to address the decommissioning liability errors versus updates? What is the BOEM/BSEE data management process for cost updates on estimated asset liabilities? With BSEE’s pending liability model update, what is the timeline and associated process for new assessed value challenges?

ANSWER: The company should demonstrate the variance to BSEE. BOEM relies on the BSEE liability estimate to determine what facilities require decommissioning.

- If, at any time, a lessee may request a reduction of their additional security requirement for one or more leases, the lessee must submit appropriate evidence and supporting materials to the Regional Director for their consideration. Can BOEM give us examples of what it will consider as “appropriate supporting material” to be submitted? How much time will BOEM take to make a decision to reduce the additional security amount?

ANSWER: Appropriate material may include new information about the financial condition of the company or the completion of decommissioning work. If it relates to matters within the expertise of BSEE, BOEM will request a report from that bureau.

- On RUE’s & ROW’s for which the holder can demonstrate the existence and degree of co-ownership, will that company be “responsible” for 100 percent of the decommissioning or will it be apportioned proportionately to the co-owners?

ANSWER: Regardless of the number of owners of ROWs and RUEs, BOEM will only require the provision of security for 100 percent of that liability and it is up to those parties to determine how to share the costs.

- If there is a dispute between a lessee and BSEE as to the decommissioning liability estimate BSEE has assessed associated with a lease, ROW or RUE, will BOEM defer action on requiring supplemental security on the disputed lease, ROW or RUE until the dispute has been resolved?

ANSWER: BOEM will consider pending disputes as part of the tailored financial plan negotiation process. Ultimately, BOEM will rely on BSEE’s resolution of the disputed decommissioning liability estimate to determine the required amount of additional security.

- How will disputes with the self-insurance allocation determination with BOEM be handled?

ANSWER: Please set up a meeting to discuss this issue with BOEM

- BOEM has granted significant variances from the requirements mandated in the new NTL to companies who have worked a “tailored” plan. While we applaud BOEM for working with us, none of their current “exceptions” have been formally included in this NTL. Since the lessees plans are renewed annually, the entire industry will depend on a continuance of the exceptions on a year to year basis. How will BOEM insert predictability and certainty into its discretion when reviewing and approving tailored plans?

ANSWER: The tailored financial plans will not be renewed annually, but monitored on a continual basis to ensure agreed upon deadlines are met.

- If we already have assessed on ROWs and have existing sureties in place, can we release all sureties and start a tailored plan from scratch?

ANSWER: Before BOEM will approve the release of an existing surety in place to cover decommissioning liability, another acceptable form of financial assurance must be in place and approved by BOEM. BOEM will review the lessee’s entire property portfolio when determining which, if any, sureties can be released and replaced. Under no circumstances would BOEM release a surety bond on an inactive property.

- How will BOEM maintain internal control to make sure BOEM is equally applying what other companies are doing?

ANSWER: BOEM is developing system enhancements to track all the forms of financial security outlined in the new NTL. The tailored financial plans will be monitored on a continual basis to ensure agreed-upon deadlines are met.

- Three out of four colesses provide financial assurance. Why will the order go to Designated Operator instead of the fourth colesse that is non-compliant?

ANSWER: BOEM is interested in obtaining 100 percent coverage of the liability on the Lease. It is up to the designated operator and co-lessees to negotiate how responsibility for that coverage is handled. The order will go to the Designated Operator because it is the agent with full authority to act on the lessee’s/operating rights owner’s behalf, and to fulfill the lessee’s/operating rights owner’s obligations under the OCS Lands Act, in compliance with the terms and conditions of the lease, laws and applicable regulations. BOEM is looking at the lease as a whole, and will not make a determination of which individual lessee is non-compliant. BOEM may provide the designated operator written or oral instructions in securing compliance with the additional security requirement.

- If the Record Title owns no Operating Rights interests, who will be looked at to financially cover lease?

ANSWER: BOEM will look to the owners of both Record Title and Operating Rights interests, as the lessees (or owners) to provide required additional security for a lease. BOEM will notify them through the Designated Operator. It is up to the lessees to negotiate amongst themselves who financially covers what. A party with only Record Title and a party with only Operating Rights interests are equally liable for decommissioning. BOEM is only concerned with the lease being covered, and is not concerned with who covers what portion of it.

- Can PV10 increase self-insurance above 10%?

ANSWER: The PV10 value of PDP Reserves cannot act to allow a lessee to use self-insurance at a level greater than 10% of the lessee’s tangible net worth. According to the NTL BOEM does not increase the percentage above 10 percent, however it can add BOEM may, however, add up to 25 percent of the PV10 value of PDP Reserves to the amount of Tangible Net Worth, hence increasing the base to which the percent of self-insurance is applied. Therefore, if one’s tangible net worth is increased by the addition of the PV10 value of PDP Reserves, 10% of that increased net worth would still be 10%, but would be a greater actual numerical amount.

- If a company owns their own P&A company, can that help with self-insurance and tailored plan?

ANSWER: While ownership of a P&A company is not considered when determining self-insurance, it could factor into tailored financial plan negotiations, at the discretion of the Regional Director. However, BOEM will continue to use BSEE’s decommissioning liability assessment.

- Can you explain the specific criteria for eligibility for self-insurance?

ANSWER: Self-insurance is determined by the five criteria set forth in 30 CFR section §556.901 (d) and BOEM’s application of these criteria is explained in detail in the NTL-2016-N01, as well as on our webpage http://www.boem.gov/Financial-Discussion/ .

- Will there be new guidelines for parent guarantees?

ANSWER: BOEM will be reviewing all financial instruments for clarity and effectiveness. Parent Guarantees, also known as Third Party Guarantees, will be included in BOEM’s review. A parent company that intends to provide a guarantee for an affiliated entity will be evaluated based on the criteria in § 556.905, and not based on the criteria in § 556.901.

- Is the 10% applicable to parent guarantees?

ANSWER: If a parent company intends to provide a guarantee for a subsidiary, that parent is held to the 25% cap in § 556.905(a)(3).

- Is there room for discussion with the sample guarantee document online?

ANSWER: The current sample guarantee available on BOEM.gov is an example of the terms BOEM will consider when reviewing proposed guarantees. Those terms can be changed. BOEM will work with a company and consider the terms of each guarantee submitted for review. A guarantee must meet the criteria set forth in 30 CFR § 556.905. The current sample guarantee document can be found here: http://www.boem.gov/Model-Third-Party-Agreement/

- Can you elaborate on criteria compliance for record of compliance?

ANSWER: The regulation stipulates the fifth criterion to be “Record of compliance with laws, regulations and lease terms.” The term “record of compliance” can have a very broad interpretation. Infractions are recorded for a variety of reasons, some are minor, and others are more serious, such as operating and safety violations for which BOEM or BSEE may issue an Incident of Noncompliance (INC) or assess civil penalties. BOEM may also consider other infractions, such as SEC violations, legal claims against the company or its management team, allegations of fraud, suspension from stock trading, etc. The intent of this criterion is to review the operating history of a lessee to understand whether there are serious compliance issues pending or if it has a satisfactory record of compliance. Therefore, the analyst will concentrate on more serious infractions, using his/her best judgment. For further information see http://www.boem.gov/Record-of-Compliance/

- Will BOEM require bonds until Decommissioning Trust Agreement (DTA)/escrow is fully funded?

ANSWER: BOEM will accept bonds until an escrow is fully funded.

- Do we still require start-ups to have a minimum of 5 years’ experience?

ANSWER: BOEM’s financial evaluation and self-insurance determination will take into account your business stability “based on five years of continuous operation and production,” as stated in 30 CFR § 556.901(d)(1)(iii).

- Will BOEM allow companies to access the funds in the DTA/escrow to perform the actual decommissioning work?

ANSWER: Subject to BOEM Regional Director approval, the terms of a Decommissioning Trust or Escrow Agreement may provide a procedure for withdrawing funds in the event a portion of the decommissioning obligations has been performed. Withdrawal of funds requires written approval from the Regional Director, which may be given only after the decommissioning obligation has been performed and signed off by BSEE.

- How is BOEM/BSEE going to address the multiple ownership issue on RUE/ROWs? Currently BSEE assigns 100% of the liability to the ROW/RUE holder even though there can be multiple companies who benefit from the ROW/RUE.

ANSWER: The RUE/ROW Holder is 100 percent liable for any Structures, Wells, and Pipeline Segments assessed under the RUE or ROW authority. If there are any Third Party (Collateral instruments) between the RUE/ROW holder and the multiple companies benefitting from the ROW/RUE, these agreements may be submitted for Regional Director consideration as evidence of acceptable financial assurance.

- The Benchmarks appearing on BOEM’s Risk Management webpage have been changed, why is this?

ANSWER: BOEM has stated that the Benchmarks would be updated yearly (no later than September 1) to reflect market conditions. The benchmarks are built using a five year moving average, as such, we have dropped off the financial ratios of the oldest year (2010) and added the most recent (2015) to the five year average. In addition, we have adjusted the financial ratios to reflect the definitions appearing in the appendix of the Additional Security NTL.

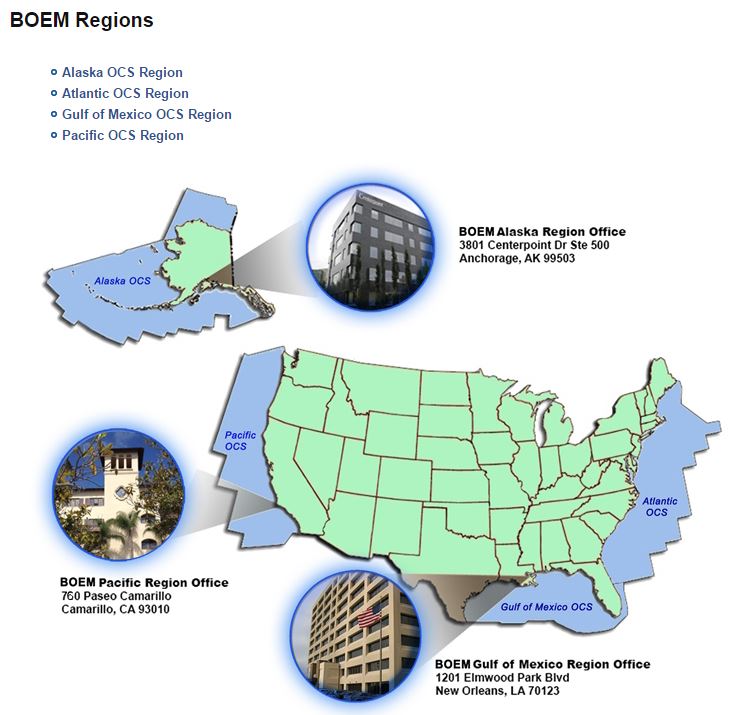

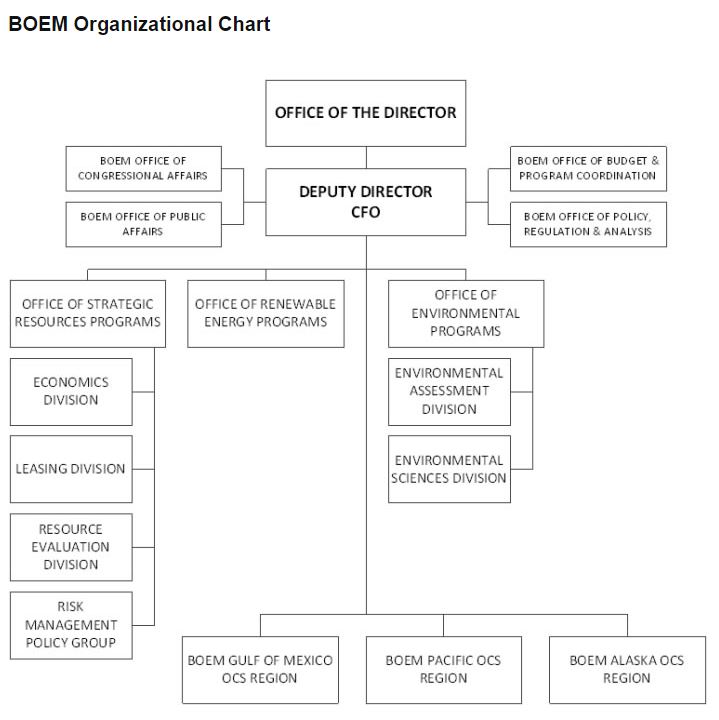

Reforming the Agency Structures that Manage the OCS after Deepwater Horizon

The federal Minerals Management Service (MMS) was renamed Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) to more accurately describe the scope of the organization’s oversight. In 2011, in the place of the former MMS – and to replace BOEMRE – the government created “three strong, independent agencies with clearly defined roles and missions. MMS – with its conflicting missions of promoting resource development, enforcing safety regulations, and maximizing revenues from offshore operations and lack of resources – could not keep pace with the challenges of overseeing industry operating in U.S. waters,” according to the BOEM.

“The reorganization of the former MMS is designed to remove those conflicts by clarifying and separating missions across three agencies … .”

On October 1, 2011, the new Bureau of Ocean Energy Management (BOEM) was created. BOEM is responsible for managing development of the nation’s offshore resources in an environmentally and economically responsible way. Functions include: Leasing, Plan Administration, Environmental Studies, National Environmental Policy Act (NEPA) Analysis, Resource Evaluation, Economic Analysis and the Renewable Energy Program.

Also on October 1, 2011, the new Bureau of Safety and Environmental Enforcement (BSEE) was created to enforce safety and environmental regulations. Functions include: All field operations including Permitting and Research, Inspections, Offshore Regulatory Programs, Oil Spill Response, and newly formed Training and Environmental Compliance functions.

BOEM Defines its Stance on OCS Lease Sales

BOEM’s Approach to Federal Lease Sales Offshore U.S.A. was made clear in Director Hopper’s statement to the U.S. Senate May 19, 2016:

Alaska

In Alaska, the 2017-2022 Proposed Program continues to take a balanced approach to development, utilizing the targeted leasing strategy set forth in the 2012–2017 Program by identifying one potential sale each in the Beaufort Sea (2020), Cook Inlet (2021), and Chukchi Sea (2022) Planning Areas. As a result of comments received on the DPP, including Governor Walker’s request for an earlier Beaufort Sale, BOEM is considering moving the Beaufort Sea sale to 2019. Similar to the 2012–2017 Five Year Program, BOEM will continue to use a scientific approach to information and stakeholder feedback to proactively determine, in advance of any potential sale, which specific areas offer the greatest resource potential while minimizing potential conflicts with environmental, subsistence, and multiple use considerations. Sales will be tailored to offer areas that have significant resource potential, while appropriately weighing environmental protection, subsistence use needs, and other considerations.

Atlantic

After an extensive public input process, the sale that was proposed in the DPP in the Mid- and South Atlantic area has been removed from the program. Many factors were considered in the decision to remove this sale from the 2017-2022 Program including: significant potential conflicts with other ocean uses, such as the Department of Defense and commercial interests; current market dynamics; and opposition from many coastal communities.

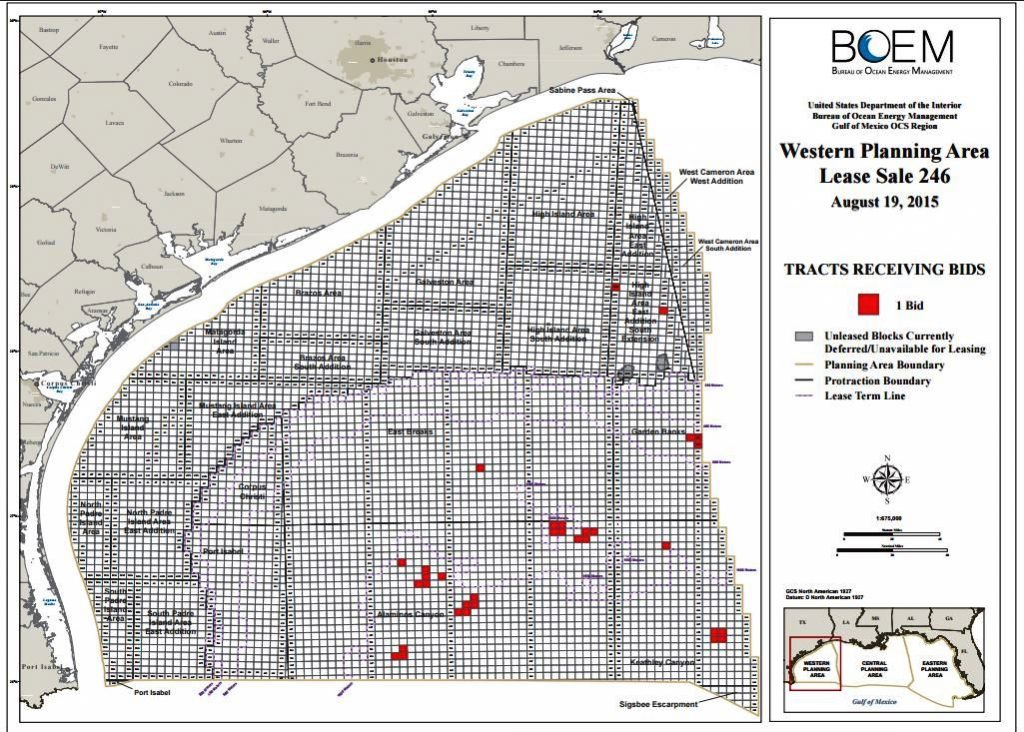

Gulf of Mexico

The Proposed Program includes ten sales in the Gulf of Mexico – one of the most productive basins in the world – where resource potential and industry interest are high, and oil and gas infrastructure is well established. The proposal includes a new approach to lease sales by proposing two annual lease sales that include the combined Western, Central, and Eastern Gulf of Mexico not subject to moratoria. To provide greater flexibility for investment in the Gulf, this shifts from the traditional approach of one sale in the Western Gulf and a separate sale in the Central Gulf each year. BOEM will review comments received on this approach, and if the traditional approach is preferred, BOEM can revert back to the traditional separate planning area model for sales in the 2017-2022 Five Year Program.

Pacific

As in the DPP, no lease sales in the four planning areas off the Pacific coast were included in the Proposed Program for potential oil and natural gas leasing consideration. The exclusion of the Pacific Region is consistent with the long-standing interests of Pacific coast states and comments received on the RFI.

Next Installment

Oil & Gas 360® will look at the effects of the new BOEM rules from companies operating on the outer continental shelf in the next article in this series. Meantime, the BOEM provides a directory of operators on GOM OCS leases.