ONEOK has laid enough pipe to go from Dallas to NYC five times and it’s not nearly enough.

The current state of the United States oil and gas industry is indicative of a foot race between two Olympic athletes. In lane one is the upstream division, in lane two is the midstream. The stadium is packed – standing room only, actually. The runners take off, and runner #1 is off to a tremendous start. In fact, he’s headed to a world record. But runner #2 was slow out of the gates, and now his counterpart is restraining his speed in order for his teammate to catch up.

Such is the current state of the shale boom.

The United States may have just become the world’s top hydrocarbon producer, but the sudden rush of fossil fuels has overwhelmed the midstream market. Pipelines in the Northeast are operating at near full capacity of Marcellus gas, and producers in the Bakken were flaring off as much as 30% of its natural gas due to pipeline constraints and unfeasibility.

ICF International estimates $641 billion is needed in infrastructure through 2035 in order to fully handle the oncoming production of oil and natural gas.

ONEOK Investing Big in Infrastructure

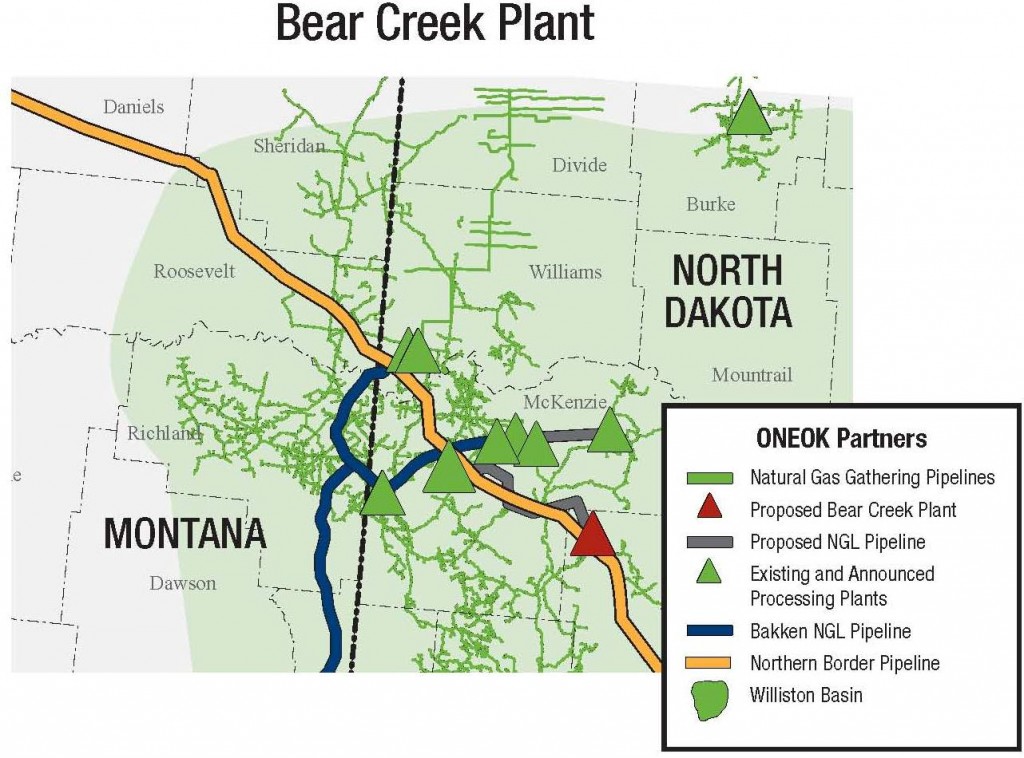

ONEOK Partners (ticker: OKS), the Master Limited Partnership (MLP) of ONEOK, Inc. (ticker: OKE), is the largest pipeline operator in the Williston Basin and plans on investing more than $6 billion from 2010 to 2016 in order to address the growing need for infrastructure. The company has targeted the Bakken, Powder River Basin and Mid-Continent regions as its focus.

Below are a series of construction announcements from the company since 2012:

- April 4, 2012: Announces intent to spend $1.5 billion to $1.8 billion in the Bakken from 2011 to 2014.

- April 9, 2012: Announces intent to build 1,300 mile crude pipeline from the Bakken to Oklahoma. Also announces an additional $1 billion in backlog projects. Places expenditures for growth estimates at $2.8 billion to $3.5 billion through 2014.

- April 19, 2012: Announces $350 investment for gas processing plant in Oklahoma. Revises capital expenditures, saying between $4.7 billion and $5.7 billion will be spent on infrastructure through 2015.

- July 26, 2012: Revises expenditures again, saying $5.7 billion to $6.6 billion will be spent through 2015. New projects include a Bakken NGL pipeline, an ethane splitter in Mont Belvieu and the Garden Creek Plant II in McKenzie County, North Dakota.

- August 26, 2013: Announces investment of $440 million to build in the Powder River Basin. Expenditures revised downward to $5.2 billion to $5.6 billion through 2015, but mentions $2 billion to $3 billion in backlog.

- November 19, 2013: Expenditures through 2016 placed at $6.0 billion to $6.4 billion. Roughly half will be directed towards the Williston Basin, including the construction of a new gas plant and the expansion of a NGL pipeline. The plant will be the sixth build in the region since 2010.

- December 2, 2013: Increases guidance and dividends due to higher than expected cash flow. The new dividends are 25% higher than originally announced, with a 53% increase in 2014.

- April 24, 2014: Announces completion of $1 billion in capital growth projects located in the Mid-Continent, including the NGL expansion and ethane splitter mentioned in 2012.

- July 24, 2014: Announces intent to expand a gas plant in the SCOOP play, places expenditures through 2016 at $6.4 billion to $6.8 billion. More than $400 million will be invested in the SCOOP.

- July 30, 2014: Increases expenditures to more than $7.0 billion through 2016. Announces increased buildout plans in the Bakken, which will involve $4.0 billion of investment.

- August 26, 2014: Completes Garden Creek II gas processing plant in North Dakota, on schedule. Project began in July 2012. Refines expenditures to between $7.0 billion and $7.5 billion.

- September 22, 2014: Raises expenditures again, this time to $7.5 billion to $8.2 billion. Backlog is listed at $3.0 billion to $4.0 billion. New projects are announced in the Bakken and Powder River Basin.

In its latest release, ONEOK said 11 new natural gas plants have either been completed or are in the process of completion since 2010. Eight of the plants are in the Williston Basin, and the company anticipates it will have 11 times the processing capacity of 2010 by 2016.

Its footprint in the Williston has also increased drastically: in the time span of the news releases listed above, the company has grown from 3,500 miles of pipelines across 2.2 million acres to 6,500 miles of pipelines spread across three million acres.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.