OPEC agreed to cut production for the first time in eight years, according to a delegate briefed on the matter that Bloomberg spoke with under conditions of anonymity.

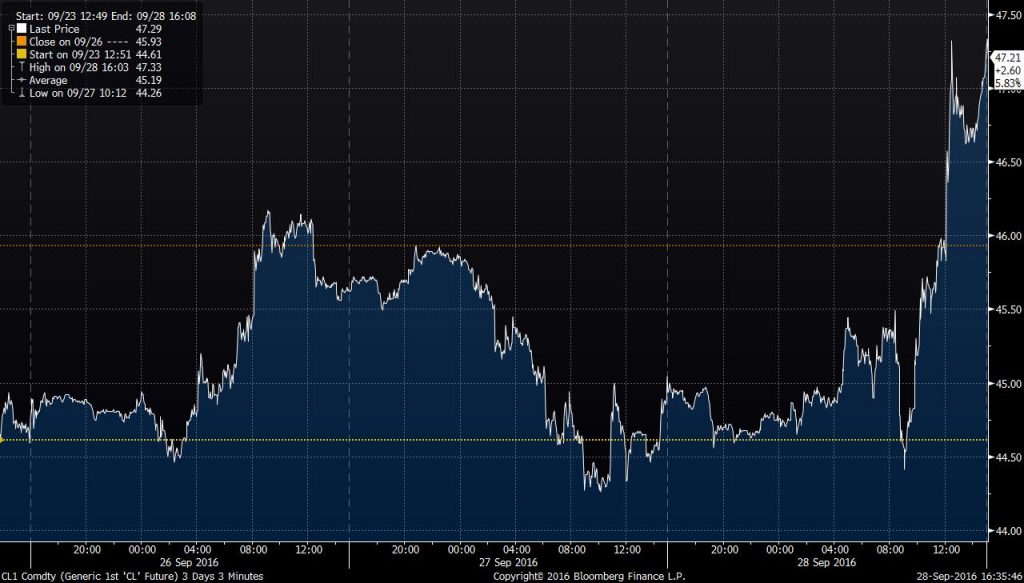

The news shot oil prices up more than $3.00 to a high for the day for WTI of $47.45.

Sources that asked to remain unnamed due to the sensitivity of the issue said the group agreed to drop production to a range of 32.5-33.0 MMBOPD. The group reported producing 33.2 MMBOPD in its August report, meaning that OPEC would cut, at most, about 0.7 MMBOPD under the new agreement.

While some members of the group will have to cut production, Iran will not have to freeze its output, Iran’s Oil Minister Bijan Namdar Zanganeh said following a meeting in Algiers. OPEC will not decide targets for each country until its next meeting at the end of November.

“The cut is clearly bullish,” said Mike Wittner, head of oil-market research at Societe Generale SA in New York. “What’s much more important is that the Saudis appear to be returning to a period of market management.”

Iran turns the tables on Saudi Arabia

Following Saudi Arabia’s plans to defend market share and let oil prices fall, the kingdom said it had the reserves to wait for production to fall. Production proved resilient however, and as Saudi Arabia began asking for a production freeze deal, Iran appeared more prepared to allow lower prices to persist than its neighbor in the Persian Gulf.

After the lifting of international sanctions, Iran began to benefit from increased crude oil exports, even as prices remained well below their previous highs. Saudi Arabia will suffer a fiscal deficit equal to 13.5% of gross domestic product this year, compared with one of less than 2.5% of GDP for Iran, the International Monetary Fund estimates. The IMF says the Saudis need oil close to $67 a barrel to square the books. For Iran, it’s lower, at $61.50.

It appears that Iran may have finally won concessions from Saudi Arabia, with the Islamic Republic free to continue increasing production as other OPEC members freeze, and even cut their output.

Even as OPEC discusses limiting its own production, Russia, which took part in the negotiations, but does not appear to be a part of the final deal, continues to increase its own production. The country pumped 11.1 MMBOPD in September, according to preliminary estimates, up 0.4 MMBOPD from August, and breaking the old post-Soviet record.

After a two-year flirtation with free oil markets, the deal in Algiers signals a “return to supply management,” said Yasser Elguindi, a director at consultancy firm Medley Global Advisors, who is in Algiers monitoring the OPEC meeting. “This is a case where lower volume from Saudi Arabia will mean higher revenues if prices go up”.