Poorer OPEC nations reeling hardest from oil price slide

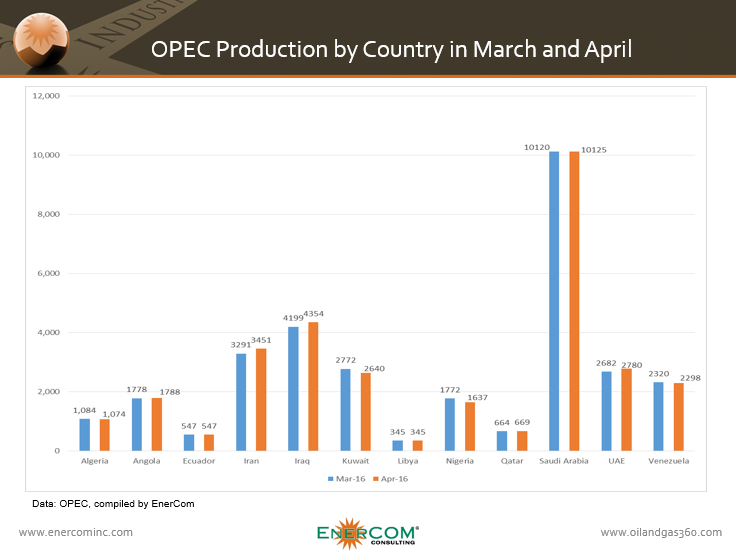

OPEC’s biannual meeting has come and gone, but the group’s objective remains the same: defend market share. While some talks may be underway to set a new production ceiling of 32-32.5 MMBOPD, OPEC’s poorer members have to simply grin and bear the consequences of low oil prices.

Despite oil’s move in the direction of $50 per barrel, many of OPEC’s members are still struggling to balance their budgets, and those outside the wealthy Gulf Cooperation Council are battling the very real problem of total collapse in some cases.

Troubles in Iraq

Iraqi Prime Minister Haider al-Abadi took office in September 2014, shortly before the collapse of oil prices, and just three months after ISIS captured Mosul. Tumbling oil prices only compounded the problems he faces in Iraq, with disagreement over political and economic reforms gridlocking his government. Twice in the past two months, protesters heeding Shiite cleric Muqtada al-Sadr’s call for demonstrations against government corruption have overwhelmed Baghdad’s Green Zone, reports Stratfor.

Troubles in Nigeria

In Nigeria, militant groups in the Niger Delta continue attacks on the country’s oil and gas industry, forcing a decline in production. Under the previous president, Goodluck Jonathan, the Niger Delta grew accustomed to consistent patronage.

With a new leader in office and less oil revenue to go around, that patronage has evaporated. In protest, three militant groups have emerged. The most violent of these, the Niger Delta Avengers, has carried out numerous attacks on oil infrastructure since January. These attacks have contributed to the steep decline in the country’s production, down 37% to 1.4 MMBOPD from 2.2 MMBOPD in the beginning of the year. This, in turn, has made the country’s budgetary strains even more sharply felt, said the Stratfor report.

Nigeria’s new president, Muhammedu Buhari, has met with limited success in cutting back expenses like fuel subsidies, but the move has created political backlash. While he is not up for re-election in the near future, Buhari was ousted as Nigeria’s head of state once before in 1985, and low oil prices continue make a difficult political situation even more uncertain.

Troubles in Venezuela

Perhaps the most severely in need of higher oil prices among OPEC’s members, however, is Venezuela. The country is selling off gold at a rapid pace as it fights of ballooning inflation. Beer, Coke-a-Cola, and many stables are no longer available in the country. The government in Caracas slashed imports and refused to remove currency restrictions or price controls, while blaming the U.S. and other foreign actors for its troubles. With a breakeven price to balance its budget of $121 per barrel, and inflation expected to hit 1,642% next year, the oil price recovery is far from enough to help the South American country.

The cash shortage has left state-owned PDVSA unable to pay for light crude oil imports, which it uses to dilute its heavy crude production for domestic refineries. Seven cargo ships sit offshore in the Caribbean holding some 3.9 MMBO of WTI waiting to offload due to payment delays.

Many of OPEC’s powerful countries, particularly those in the GCC, do not have elections, or face serious political unrest like Iraq, Nigeria or Venezuela, points out Stratfor. OPEC’s long-term policy for dealing with low oil prices – suitable though it may be for countries like Saudi Arabia – does little to assure the leaders of the group’s poorer countries.

“But OPEC is not entirely dead yet,” said Stratfor. “In the likely event of another crisis in the next few years, OPEC will almost certainly rethink its actions to stabilize the market. Moreover, OPEC gives countries a forum to share their views and a chance, however small, to influence policy.”