OPEC expects demand to be around 100 MBOPD lower than last month’s forecast

In its March Oil Market Report, OPEC said it is now forecasting weaker demand for its own crude for 2016. The group revised demand expectations for oil produced by OPEC down by 100 MBOPD for full-year 2016.

“In 2016, demand for OPEC crude is expected to stand at 31.5 MMBOPD, 0.1 MMBOPD lower than last month, and representing an increase of 1.8 MMBOPD over the previous year,” the report read.

OPEC left its demand expectations for global oil growth unchanged at 1.25 MMBOPD over the year to average 94.23 MMBOPD for full-year 2016, 0.19 MMBOPD lower than demand growth last year.

The supply is slowly shrinking

OPEC’s forecast also revised up supply growth from non-OPEC countries, forecasting a supply contraction of 0.7 MMBOPD, 0.1 MMBOPD more production growth than the group saw last month. The increased production was driven mostly by upward adjustments in the fourth quarter data coming out of the OECD, OPEC said in its report.

The group’s own production was down 0.18 MMBOPD in February, according to secondary sources.

OPEC said it continues to see strong demand from the U.S. on preliminary data for 2016. OPEC expects “strong growth in gasoline and jet fuel requirements that is more than offset by sluggish distillate demand (mainly as a result of the overall mild winter).”

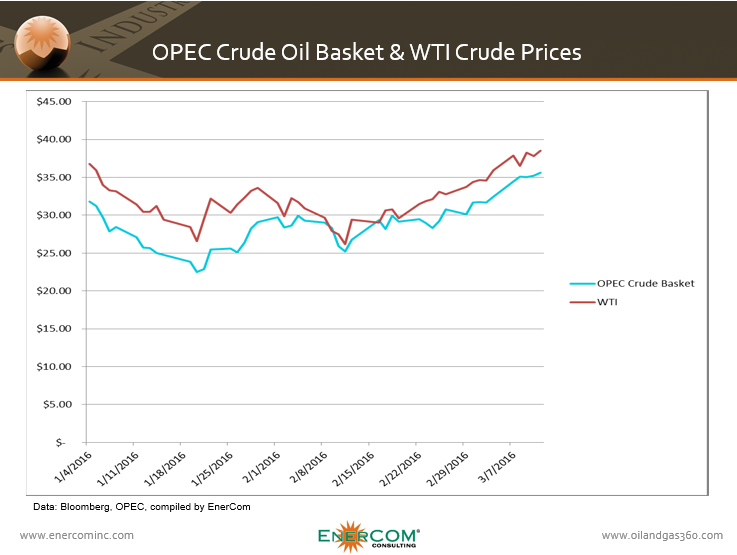

Demand for OPEC’s crude in the U.S. remains as refiners are able to import crude from abroad at a discount to domestic benchmark WTI. The continued import of crude oil from abroad, along with resilient production from U.S. shale, may force storage facilities like those in Cushing, Oklahoma, to expand, or face reaching maximum working capacity by the middle of the year.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.