In November’s “Energy Industry Data and Trends,” EnerCom Consulting’s monthly report to subscribers that was issued Nov. 14, the analysts looked closely at well economics as management and directors of oil and gas companies across the industry prepare for board meetings. No question, the season’s hottest topic is what to do with capital budgets for the coming year.

The EnerCom November report highlighted nine notable E&Ps that have already cut their 2015 spending plans, but it also pointed out three who are either standing their ground or increasing investment: ExxonMobil (ticker: XOM), Concho Resources (ticker: CXO) and Synergy Resources (ticker: SYRG).

XOM reaffirmed its guidance at “just shy of $37 billion from 2015 to 2017.” Concho bumped its 2015 capital spending program by 15% to $3 billion, with $2.7 billion earmarked for the drill bit. Synergy expects to invest between $200 and $225 million in FY2015, paralleling its FY2014 CapEx budget.

Over the past few years more than a few E&Ps have turned away from natural gas, seeking higher returns from producing oil and liquids. It’s ironic, though not unexpected, that the oil plays have been hit the hardest by crude’s 22% drop since August, compared to a 2.1% drop in the price of natural gas.

Looking at Single Well Economics

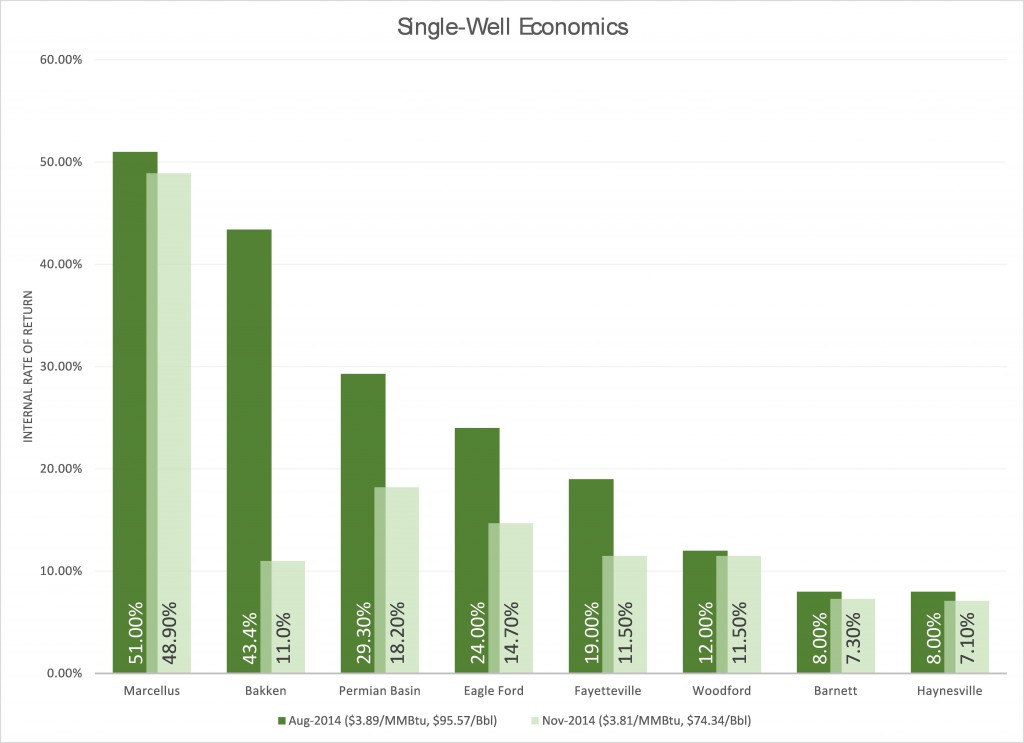

The new realities of lower commodity prices are best explained by analyzing the impact on single-well economics. The chart below illustrates the deterioration in returns on drilling projects in the most active oil and gas plays in the United States. This chart compares the internal rate of return for projects based on commodity prices in August 2014, just before The Oil & Gas Conference ™ 19 in Denver, and the twelve-month strips as of November 13, 2014.

Returns on drilling in oil plays like the Eagle Ford and Bakken have dropped from the 20%+ range down into the teens, precariously close to the weighted average cost of capital for many operators. The deterioration in Bakken well economics stands out. Against the prevailing price environment, average single-well IRRs are nearly one-quarter of what they were in August, a drop of 32%.

Several Bakken operators communicated that their drilling project in the Williston Basin required well head prices ranging between $65 and $68 per barrel, depending on the company. Those in the core of the basin enjoy more robust economics resulting from stronger recoveries while those with assets farther away from the core having lower returns.

In the Bakken, which produces a high quality light crude, even if they can generate a return that is nominally higher than their cost of capital some operators may be speculating if it is worth producing this premium asset at today’s commodity prices.

Many management teams are looking at their rig and service contracts to see how quickly they could cut a rig to right size their operations to the rapidly changing oil price market. In the short run, this might not be such a bad thing for the OilService companies that could use this time to perform needed maintenance on idle equipment.

OilService Under Pressure, But It Depends

The conventional wisdom, based on experiences in past cycles, is that when commodity prices fall into a new, lower range, E&P operators come back to their OilService cousins and demand price cuts. Many expect OilService companies to cut prices to maintain market share, and improve the economics of drilling projects at prevailing prices that are approximately 30% lower than they were mid-summer.

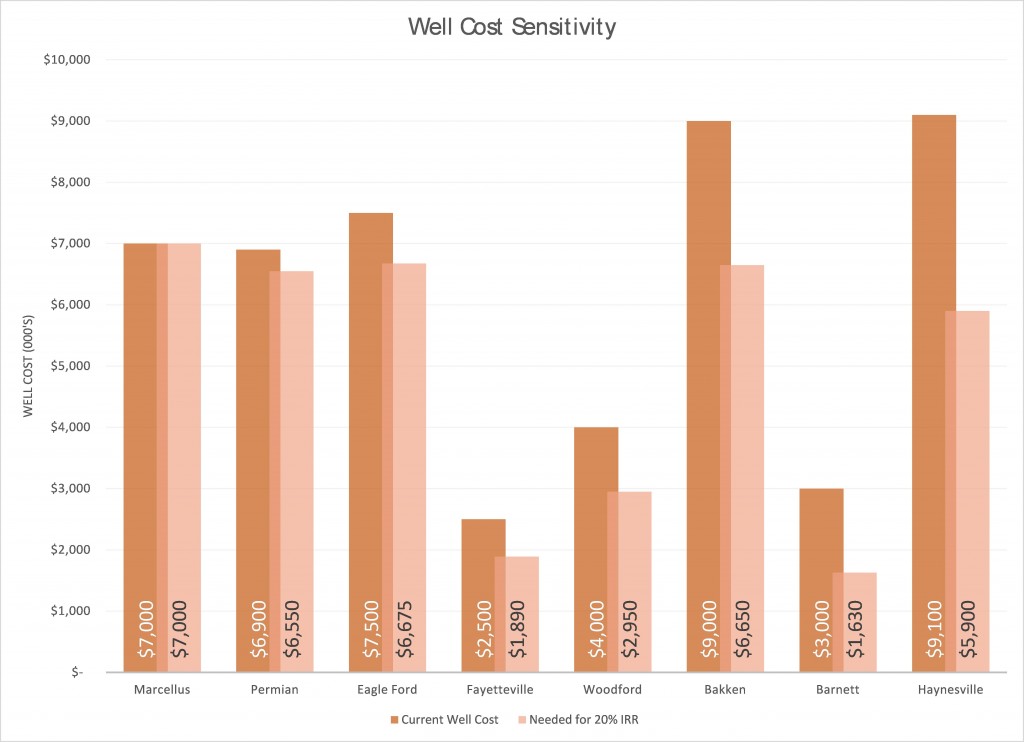

The chart below illustrates the well costs needed in each of the plays noted above to achieve a 20% IRR. In the oil-weighted plays the required cost reductions are not insignificant.

In the Bakken, a 26% reduction in average well cost is needed to achieve 20% returns at prevailing commodity prices. However, Permian wells which are more weighted to natural gas liquids and natural gas, still enjoy robust economics using twelve-month strip prices.

The variation in how different plays are being affected by the current price environment along with other factors may challenge some of the conventional wisdom on how operators will interact with OilService companies, with increasing well productivity among them.

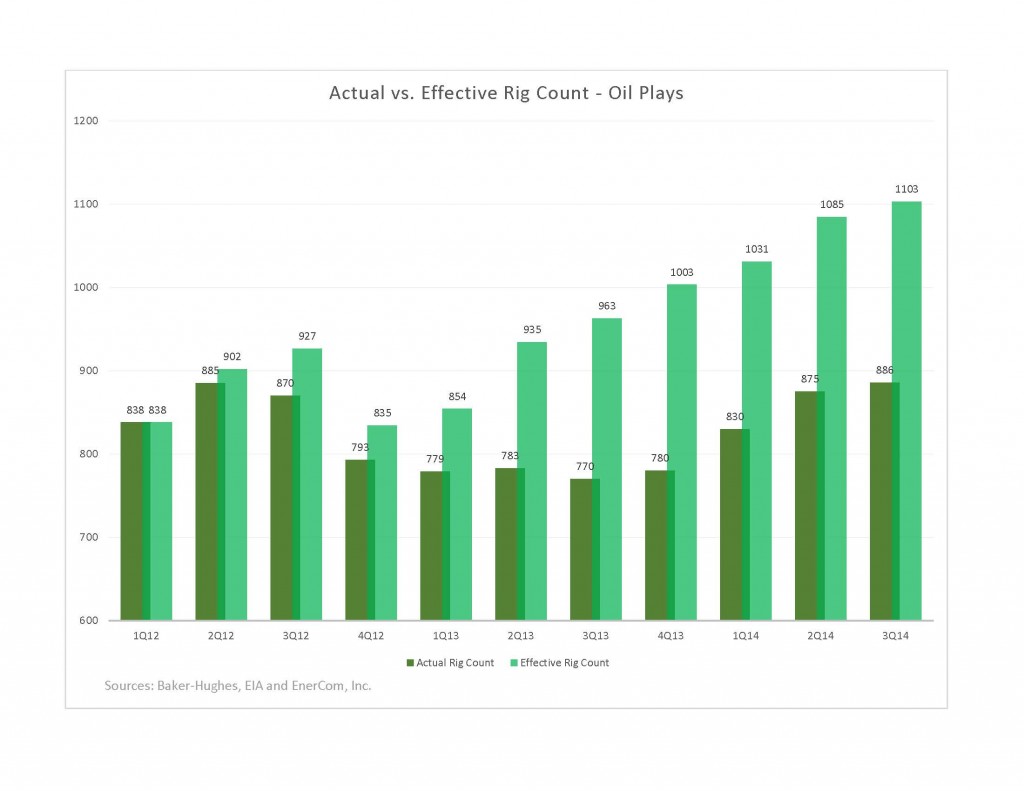

The industry is getting better at drilling and completing horizontal wells, which speaks to the concept of the “effective” rig count. Giving credit to the reduction in drilling days from spud to total depth, the rig fleet can effectively drill more wells without adding more rigs.

Another factor driving productivity is this: not only are wells being drilled faster, which also reduces drilling days and total cost of drilling, the industry is getting better at completions. Pioneer Resources had announced it will spend approximately $3.1 billion for drilling and completion in 2014. Although the company has not announced 2015 spending plans, a new slide deck detailing the company’s Eagle Ford optimization program shows improvements on completion designs. PXD’s early data indicates at 20-30% improvement in EURs with minimal increases in cost. An increase in EUR of that magnitude has a material impact on returns, meaning that so long as operators can recover more resources with the same investment (dayrate), then drilling contractors and pressure pumpers may be in a better position than they have been in past down cycles.

Late in the trading day, WTI was trading at $75.46, Brent at $79.02.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.