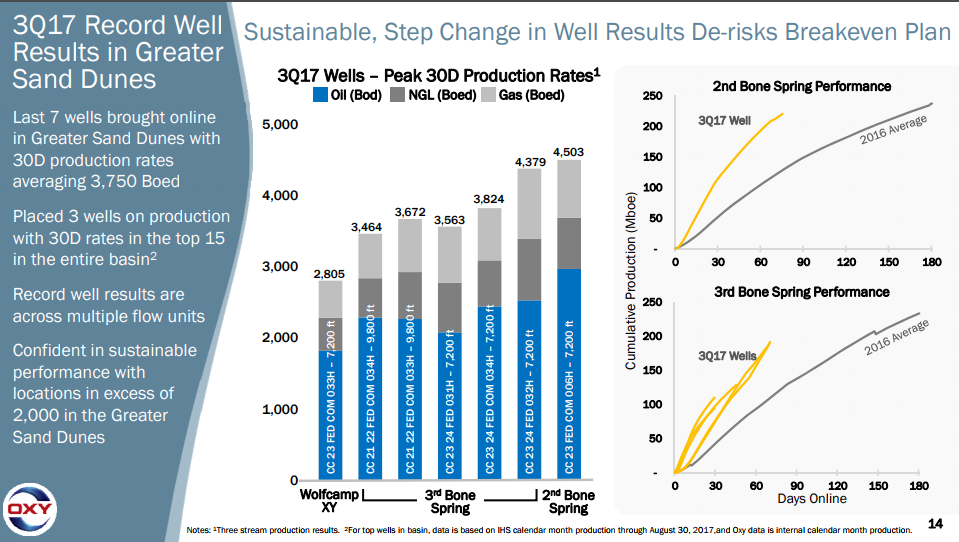

4,500 BOEPD 30-day IP

Oxy (ticker: OXY) released third quarter results today, showing net income of $190 million, or $0.25 per diluted share. This income was achieved despite the effects of Hurricane Harvey, which hit Oxy particularly hard. The company has extensive chemical operations in the Gulf, and Harvey reduced incomes from this business segment by $70 million. In addition, average production from the company’s Permian operations were decreased by 1 MBOPD.

Oxy reports multiple company records coming from its Permian operations. Five 3rd Bone Spring wells had an average 30-day IP of 3,780 BOEPD, and one 2nd Bone Spring well had a 30-day IP of 4,500 BOEPD. Each of these is well above the 2016 average, and according to Oxy three of the wells are among the top 15 IP30s in the entire basin. Oxy is currently running five rigs in the Greater Sand Dunes, and expects to increase that count to six or seven in 2018.

Oxy’s EOR properties in the Permian have also been growing well. The company reports that average production from its Permian EOR reached 153 MBOE in Q3, which is 7 MBOE higher than in Q2. This is in part due to the company’s acquisition of $600 million in EOR interests in June, and the improvements Oxy has since made. Since gaining ownership at the San Andres CO2 unit, for example, average gross production has grown by 2,300 BOE.

OXY President and CEO Vicki Hollub remarked “Even with the financial impacts from Hurricane Harvey, we showed significant progress across all our segments toward our pathway to breakeven after dividend and production growth. We are particularly excited by our achievements in the Permian Basin. Our teams delivered basin-leading well results across multiple development areas and benches in Permian Resources and realized immediate operational improvements from our recent acquisition in the EOR business. These efforts further de-risk our breakeven plan.”