Patterson-UTI (NASDAQ: PTEN) closed its merger with Seventy Seven Energy Inc.

Stockholders of Seventy Seven Energy are entitled to receive 1.7851 shares of newly issued Patterson-UTI common stock in exchange for each share of Seventy Seven Energy. Patterson-UTI issued approximately 47.5 million shares pursuant to the merger.

Concurrent with the closing of the merger, Patterson-UTI repaid all of the outstanding debt of Seventy Seven Energy totaling $472 million ($403 million net of cash from Seventy Seven Energy). Additionally, Patterson-UTI has entered into an agreement with its lenders by which the available commitment under its revolving credit facility was increased to $632 million through September 2017, and to $490 million through March 2019.

Patterson-UTI Chairman Mark S. Siegel said, “For Patterson-UTI, this is the most significant transaction since the merger of Patterson and UTI, and … gives us one of the largest and most modern pressure pumping fleets in the industry.”

Andy Hendricks, Patterson-UTI’s Chief Executive Officer, commented, “This merger combines two highly complementary companies and further enhances our position as a leader in both drilling and pressure pumping. We are beginning the merger integration process, and I am pleased with the plan that we and Seventy Seven Energy have developed. While implementing this plan, our focus will continue to be on the safety and quality of our field operations.”

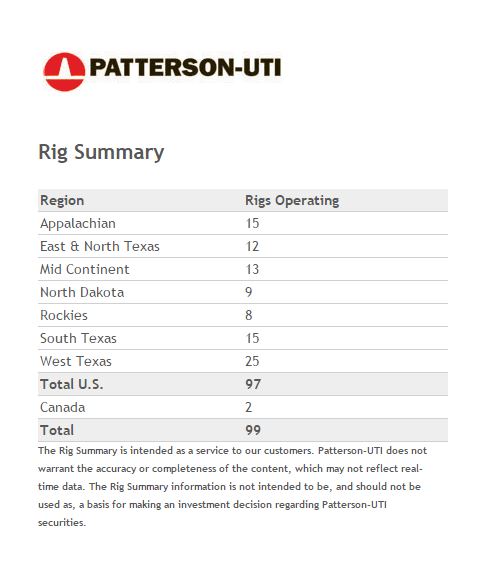

Patterson-UTI operates contract drilling and pressure pumping services in the continental United States and western Canada. The company offers drilling rig pipe handling technology and it has non-operating working interests in oil and natural gas assets that in Texas and New Mexico.