PDC: core strength in the core Wattenberg

PDC Energy (ticker: PDCE) has a strong position in the Wattenberg field in the D-J basin, and it’s looking to further develop its acreage in the Delaware Basin.

With 95,500 net acres in the Wattenberg and approximately 2,600 existing locations there, PDC has built a powerful foundation in Colorado. PDC has identified an additional 1,800 potential drilling locations in the Wattenberg. PDC reported a proved reserves value of 305 MMBOE which provides for significant potential in the Wattenberg.

As of Q1, 2017, PDC has drilled 29 wells—of which four are Standard Reach Laterals (SRL), 11 are Mid-Reach Laterals (MRL), and 14 are Extended Reach Laterals (XRL). PDC has also managed to turn-in-line 40 wells in Q1, bringing that production to market.

PDC said its plans include spudding 139 wells and turning-in-line 139 wells in the Wattenberg in 2017.

PDC said that it is testing between 100 ft. and 140 ft. completion intervals on some of its pads in the Wattenberg, and the company specifically reported that its Chestnut pad was outperforming the average 490 MBOE SRL type curve, using a 170 ft. completions interval.

And then there’s the Delaware

PDC, a long time DJ-focused operator, surprised the industry last August, just after the EnerCom conference, by announcing a $1.5 billion acquisition that made it a significant Permian player. In the deal, PDC got 65,000 Delaware basin acres for $1.5 billion.

After its Permian acquisition, PDC wasted no time setting aside $225 million for drilling and completions targeting some of the 785 identified horizontal locations on the asset. The company said it planned to spud 31 new wells in 2017.

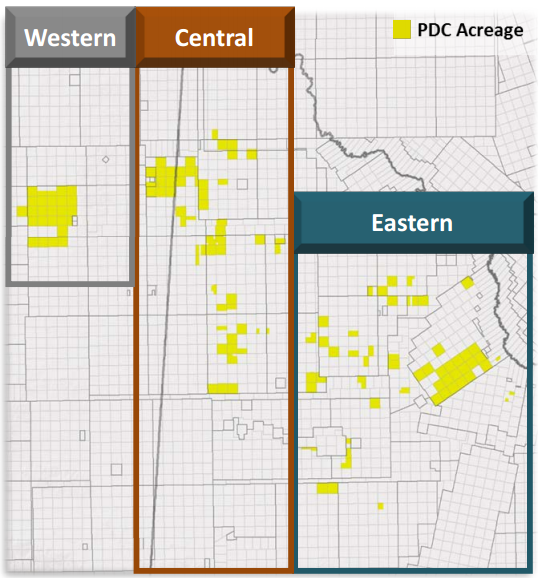

Twenty-two of the new wells will be in the Eastern portion of the Delaware acreage. PDC has planned 7 spuds in the Central Delaware and 2 in the Western Delaware. According to the presentation, PDC also intends to put 23 wells on production, 14 of which are XRLs.

In addition to drilling and completions activities, PDC has allocated $35 million towards midstream infrastructure in the area with a focus on the addition of salt-water disposal wells and capacity, drilling water supply wells, constructing frac-pits, and installing gas gathering lines.

PDC said it plans to put $30 million towards leasing, seismic and technology studies in its Delaware acreage.

Within the Wolfcamp A interval, PDC noted that three wells were performing at approximately 25% above the type curve for the region, and that 11 more spuds are planned for the Wolfcamp A in 2017. The Kenosha well, an approximately ~10,000 ft. lateral currently in flowback as of June is one of the wells performing above initial expectations.

In the Wolfcamp A/B interval, both the Liam State, an XRL in the Wolfcamp B, and the HSS State, a MRL in the Wolfcamp A, are performing above the type curve expectations.

PDC Energy: Presenting at EnerCom’s 22nd The Oil & Gas Conference™

PDC Energy will be presenting at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22, please visit the conference website.