Companies in the Wattenberg can’t accurately evaluate the performance of wells that are continuously choked back or temporarily shut in due to lack of pipeline capacity

Producers forced to constrain production

During their recent Q1 earnings calls, Bart Brookman, president and CEO of PDC Energy (ticker: PDCE), Lynn Peterson, chairman and CEO of SRC Resources (ticker: SRCI) and Wouter van Kempen, chairman, president and CEO of DCP Midstream (ticker: DCP), along with other officers from these companies, discussed takeaway problems in the Wattenberg and some of the infrastructure growth that’s on the drawing boards.

Extraction Oil & Gas (ticker: XOG) Chairman and CEO Mark Erickson summarized the situation his company faces: “We continued our rapid pace of production growth with both our total equivalent production and our crude oil volumes hitting new quarterly records, despite facing an extremely difficult midstream operating environment impacted significantly by both high line pressures and freeze-offs on a third-party system.”

Extraction said it estimates that high line pressures and freeze-offs negatively impacted its first quarter net production by approximately 13 MBOEPD, including 8,000 BPD of crude oil. The company also said that as the first new plant comes on, “a significant increase in Extraction’s base production is expected as constraints are lifted.”

The following are excerpts regarding takeaway constraints are from several operators’ Q1 conference calls. [Responses to analyst questions by company officials are noted with the company’s ticker symbol.]

PDC Energy management team comments

PDCE: Given the challenging midstream situation in Wattenberg, we were very pleased our corporate production was 5% above fourth quarter 2017 levels.

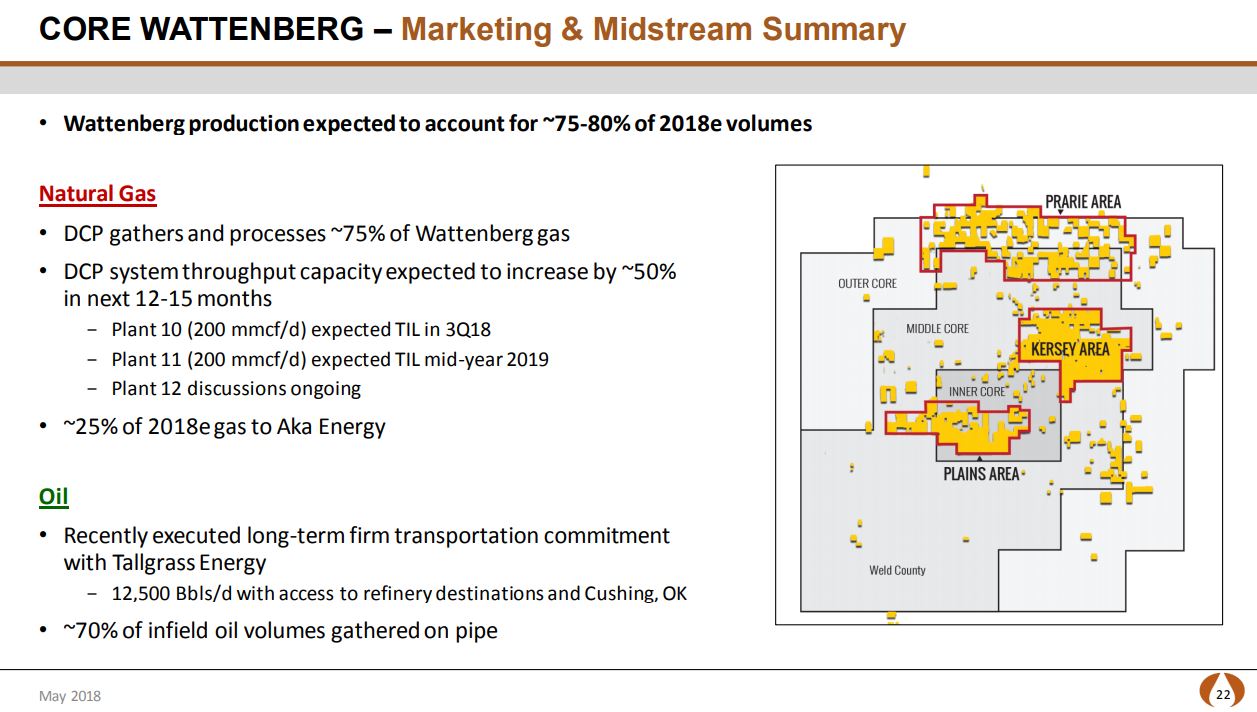

For reference, our Wattenberg assets are projected to produce about 75% to 80% of our total natural gas and crude oil in 2018.

First of all, our gas is gathered and processed by our midstream providers. DCP is projected to process about 75% of our Wattenberg gas in 2018 while Aka Energy [Group] along with offloads to Anadarko is expected to process about 25% of our gas.

Our marketing arrangements with both DCP and Aka are based on percent of proceeds contracts which allocate a certain percent of the revenues from natural gas and NGLs to the midstream provider in exchange for their gathering, compression, processing, and marketing of the natural gas and NGLs.

From where we sit today, we believe we are now well-positioned for the long-term in the Wattenberg with the recent DCP Plant 10 and Plant 11 expansions which are on track to increase DCP’s capacity by nearly 50% by mid-2019.

Additionally, discussions continue on Plant 12 for midstream infrastructure growth in the basin. We continue to work closely with DCP to define our long-term volume growth from Wattenberg so they can best plan for future midstream expansions and takeaway capacity from the basin. And then finally on the crude oil side, effective May 2018 we recently entered into a five-year firm oil transportation agreement with Tallgrass Energy. The key terms include 12,500 barrels per day delivery on their Pony Express Pipeline to various refinery destinations into Cushing, Oklahoma.

Q: I just wanted to follow-up on the Plant 10. When Plant 10 comes online or ramps up, how do the volumes get prioritized between different operators? And on that, when Plant 11 and Plant 10 is on, does it resolve the line pressures completely or situation of line pressure completely in 2019? And could you also comment on the talks that are progressing with respect to DCP?

PDCE: Looking at Plant 10 and the idea that we’re expecting it to come on in the third quarter, we’re seeing our volumes ramp up according to the plan that I described which is fairly significant increases by quarter, well I guess linear if you want to call it that. And the idea of the allocation between operators is it really is the strongest wells get into the system and that’s across all the operators. At this point we do have some management of the system flow. But I think once they turn Plant 10 on that management approach where they’re managing the different companies to the volumes will go away and it’ll be back to the normal operating procedures which really lets anybody – the strongest wells get in the system is the best description.

Also, the wells more in the center of the field have an advantage because they’re, many times, closer to the compressor stations. When you put Plant 11 on with it, we would expect pressures to come down and that’ll be a tremendous benefit to the wells particularly as we have a significant number of the old vertical wells shut in at this point and they’re obviously waiting for that lower line pressure to come on. We expect to see them come on with Plant 10 but we feel like we’ll get full flow when Plant 11 comes on.

PDCE: let me just speak a little bit to the discussions with DCP. And I think the thing that we really like about the ongoing relationship with them is that we are meeting frequently really at all levels in the organization, and we spend a lot of time putting together various projections of what our future growth looks like in the Wattenberg. We give them a range of projections and volumes so that they can then take that, and along with other work that they do with other producers in the field they get what they believe to be more of an aggregate view of the growth from the basin on acreages that are connected to their system. And so from that, they’re able then to do all of their hydraulics and all of their different modeling with the plants and processing and compression within the field and then put forth their plan for takeaway from the basin in their plant design and construction. I would classify this relationship as very strong and very much working together to the benefit of both parties in the basin.

PDCE: With respect to line pressures, we definitely expect them not only to come down with Plant 11 but Plant 12 and Plant 10. All three plants will have an impact on line pressure. The key right now is that we’ve got very high line pressure, I would call it, in the Wattenberg and that Plant 10 is critical to bringing those line pressures down and obviously making our guys’ lives easier out there. It’s a complex project when you have the pressures that we’re dealing with right now.

I will also say that those other plants, and Lance will comment more on our ability to get in them or whatever, but I will tell you irrespective of who ends up putting gas on there, it does help us because it takes gas off of these other systems. So if it’s not us and it’s someone else, definitely has an impact on our wells because that gas doesn’t have to go in through a DCP or Aka or an Anadarko type system.

PDCE: The only thing I’d add to that is that with Discovery and Outrigger projected and actually being in the basin with their gas plants and processing, I mean, what it provides is for those producers that have the ability to provide gas to those plants, just as Scott has said, to get gas off of other systems to where it improves the ability for those that are on, for example, the DCP system and other systems to produce gas from our wells. So more capacity for plants in the basin is helpful through the entire basin and all the producers in the area.

PDCE: And I think as we look at our capital allocation and our rig pace, we obviously look at our cash flow-positive overspend levels. We anticipate we’re going to be cash flow positive next year. We look at our operating pace for our operating teams. And as I said earlier, we try to balance that against – having a consistent frac fleet kind of balanced with the rigs so you’re not bringing in frac fleets and then releasing them. We also prefer consistent rig pace over substantial periods of time because I think our drilling teams get into a routine.

Then we turn and we look at midstream capacity, and obviously we’ve got to give consideration to that. It’s part of the reason we backed off on rig counts in the Wattenberg as we waited for expansions. And then we put that all in a bucket and look at the balance sheet strength and then we look at the growth of the company, and we’ve been very fortunate the last few years. That formula has resulted in us growing the company substantially year after year.

[NOTE: In April 2018, PDC entered into a firm oil transportation agreement with Tallgrass Energy to transport 12,500 gross operated Wattenberg barrels per day via pipeline to Cushing, Oklahoma and area refineries.]

Q: Just kind of surprised actually that you did an agreement with Tallgrass. I thought there was quite a bit of excess capacity on the oil side of the DJ. Any thoughts about the factors behind that decision?

PDCE: From our standpoint couple things that kind of come into mind for the Tallgrass opportunity. Number one, it’s a long-term, five-year contract for us and it locks in some prices that are very competitive of what we’re receiving today. We like what we see today.

We thought let’s go ahead and lock that in for five years in that same type of a range. And then keep in mind, too, that 12,500 barrels a day is really just a slice of our overall gross operated oil production as you get out over the next five years within Wattenberg. So we just thought it’d be good to go ahead and put in a slice in because we like the price. It’s just 1% of our future production from the Wattenberg and just wanted to lock that in. It’s just part of how we put forward our risk management from the pricing side.

SRC Resources management team comments

SRCI: Everyone is acutely aware of the challenges we and several operators face with the current lack of gas processing capacity. We anticipate that the second quarter of 2018 will be similar to the first quarter and production should be consistent with the first quarter levels. However, we feel comfortable that our results put the company in a position to meet our stated guidance for the full year.

Despite the inability to fully produce our wells, our team was able to generate EBITDA of $116 million, which exceeded our drilling and completion capital expenditures of $111 million. When you look at our first quarter results, you can see that the impact of processing constraints in nearly every facet of our operations from production to per-unit lease operating expenses. As these constraints get resolved over the coming quarters, we expect our financial performance to continue to be very strong.

There has been significant focus on the precise timing of individual gas processing projects in the basin. While the exact timing is important, it’s much more important to appreciate the magnitude of the processing capacity additions that we will benefit from shortly.

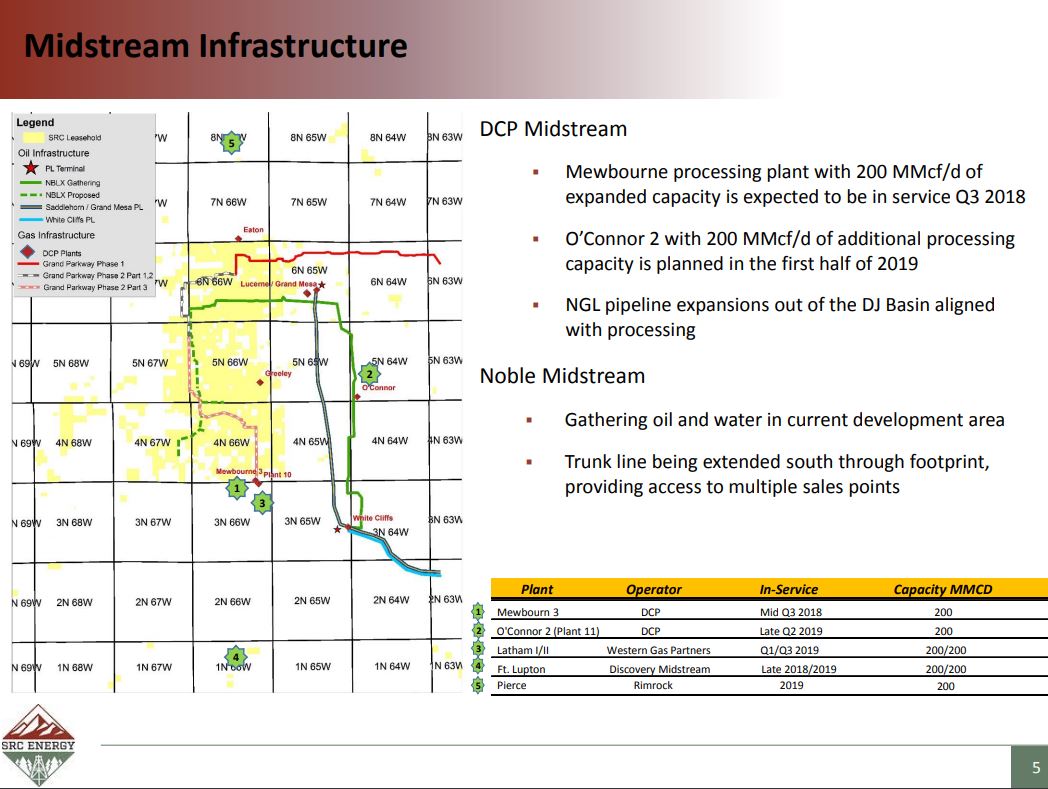

Starting in the third quarter of this year, Mewbourn 3, or Plant 10, with 200 million of capacity, will begin processing gas for SRC and others. At the same time, construction on the O’Connor Expansion or Plant 11 will be in progress as DCP has recently obtained necessary permits to begin construction. When completed in the summer of 2019, it will add another 200 million of processing capacity.

I would ask that all of our listeners tune in to DCP’s investor call on May 8, 2018 for details as to specific timing of projects, as well as plans for increased takeaway for both residue gas and NGLs.

Concurrent with these two DCP projects, there is an approximate 1 Bcf per day of additional processing capacity that is expected to be added through 2018 based on projects under construction and currently announced projects. All-in, these additions will nearly double the natural gas processing capacity in the Wattenberg Field by the end of 2018.

It has been a challenge to evaluate the performance of our wells during this time as they are continuously choked back or temporarily shut in.

However, from the limited data, we are able to gather from the early performance of the new pads, we feel comfortable that these wells are performing in line with internal expectations.

Q: On processing capacity, not to beat a dead horse, but just curious on your thoughts next year once DCP’s Plant 11 comes on, if you think at that point you may be in a situation where you could run comfortably three rigs and not have to worry about being at full capacity?

SRCI: I think this is one thing we’re looking at as a company. And again, it’s not only DCP’s capacity but it’s the other ones that are coming in as well. So, again, I think when we look 12 months down the road or roughly a year from now, I think that the basin is going to be in pretty good shape.

Q: You talked about the progression of DCP and they’ve done a great job accelerating the O’Connor Plant and plans beyond that. How do you see SRCI benefiting from the additional Bcf a day of non-DCP capacity or do you see that creating more of an easier environment in sort of the 4Q to first half of 2019 timeframe versus what you experienced this year and late last year?

SRCI: I think that’s probably true. I mean there’ll be offloads between the different processing plants. You’ll have different blocks of acreage. You’ll probably go to some of the smaller gas plants. So, I think overall, it just relieves the entire base and that’s why I think it’s important to not only talk about the effort that DCP has given here, but also what’s being done by Western Gas and some other companies.

So, I think when we look at as a team here, we’re pretty excited as we go into 2019. I think we’re going to have a little bit of congestion leaving 2018 into the first part of 2019, but I think it opens up pretty wide at that point. We are pleased with where we’re at and progress has been made.

Mike and I were on Mewbourn plant location a week ago and progress is being made, and it’s a lot of work that goes into these. I think they stated they had 400 construction workers on site. So, that’ll give you a little idea of the magnitude of these projects.

Q: I guess just looking at the divergence between oil and gas growth for first quarter where gas is actually up and oil volumes were down, just seemed kind of counterintuitive given the talk around line pressures. I was wondering if there was anything that may have impacted oil for the quarter or just kind of what was going on there.

SRCI: Mike can jump on this too but I think one of the things that’s impact us as you shut wells in for a little bit of time, you bring them back on, they’re going to produce a little more gas upfront. That’s one of the things we’ve encountered. Mike, go ahead.

SRCI: Yeah. I think even though we’re up in the oilier area, just leaving the – it’s a balancing game and keeping wells that are online on line and not getting into the real high GOR wells but keep the moderate ones. As you produce them, the GOR goes up a little bit on those wells. But we want to keep those producing so we don’t continue to cycle them on and off. So just the natural decline brings up the GOR a little bit, but that’s all part of keeping our well performance intact.

Q: Got it. And then I guess, looking at the 2018 plan, it’s remaining in that lower GOR legacy position. I guess, when do you guys sort of anticipate allocating some capital to that Greeley Crescent II newest acquisition? Does that sound like it’s going to be a 2019 event or…?

SRCI: As Mike said, sometimes we change our timing because of where certain of the issues are located. But we’ve got to let Noble Midstream get their system built out. We’ve got to keep trucks off the road up here. We’re trying to be really good stewards of what we’re doing and citizens of the community. So there’s so much that goes in. And if you look back, it’s only been, what, five months since we bought the package. So, it takes a little while to get it all done.

DCP has announced a comprehensive integrated expansion strategy in the DJ Basin, and the company’s top executives discussed it during the Q1 call.

DCP Midstream management team comments

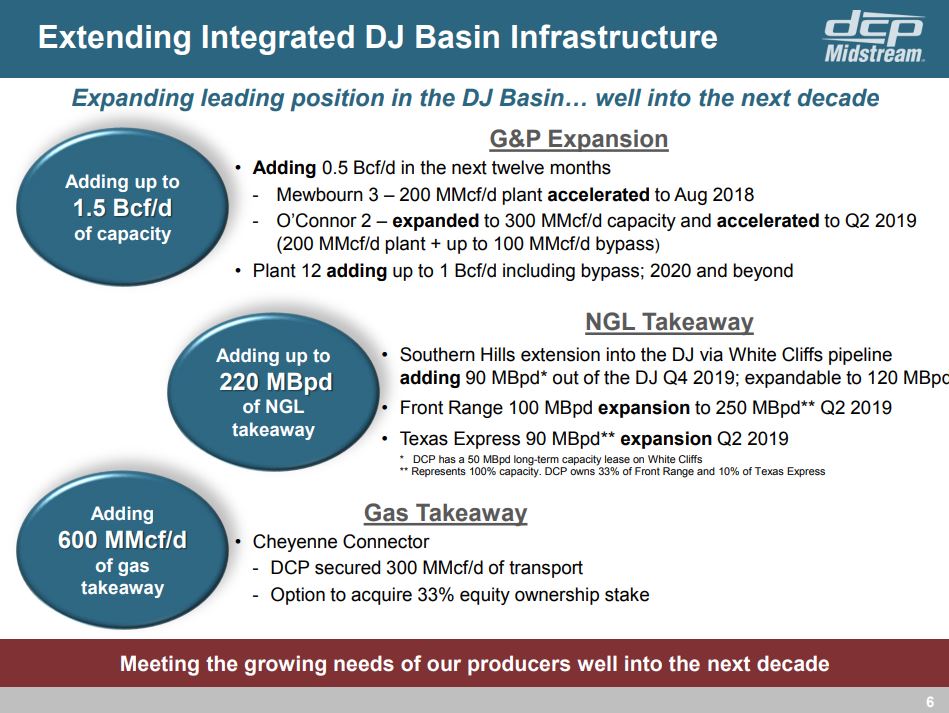

DCP: Our tremendous multi-year growth program in the DJ Basin will dramatically increase our existing capacity by adding up to 1.5 Bcf per day. We’re accelerating our Mewbourn 3 and O’Connor 2 plants and adding Plant 12 to the base. Additionally, DCP is playing a critical role in adding up to 220,000 barrels per day of NGL takeaway and 600 million cubic feet per day of gas takeaway to the basin.

We’re expanding NGL takeaway capacity up 220,000 barrels per day through the Southern Hills expansion via White Cliffs and the Front Range and Texas Express expansions. Lastly, we are in anchor ship in Cheyenne Connector, the 600 million cubic feet per day gas takeaway pipeline that is in development.

On the gathering and processing side, we are adding up to 1.5 Bcf of capacity, with 0.5 Bcf coming online in the next year. We are accelerating the target in-service date of Mewbourn 3, a 200 million a day plant to August 2018. This is our second acceleration of this facility, as we continue to exceed our timelines to ensure we provide our customers with needed capacity.

As a benefit of our producers’ significant agility and therefore remarkable production following the downturn, we expect this plan to ramp up very quickly. In response to these anticipated volumes, not only are we also Accelerating and O’Connor 2 in-service date to Q2, 2019, we are expanding its capacity by 50% to 300 million a day, with up to 100 million a day bypass. Additionally today, we are announcing a new plant in the DJ. We have secured land and file permits for Plant 12 to further meet the projected needs of our customers. Plant 12 will have up to 1 Bcf a day of capacity, including bypass and is expected to begin initial phases of operations in 2020.

To remind you, let me quickly explain what a bypass does. Adding a bypass to a plant is a very capital efficient way to increase overall capacity without actually processing the gas. At the tailgate of the plant, we plant unprocessed gas from the bypass with the processed gas from the plant, while still meeting residue pipelines base. Overall, we are pleased to announce these strategic growth projects in the DJ will almost tripled our capacity in the Basin and this program will clearly establish DCP the largest fully integrated Midstream service provider in the DJ for years and years to come.

But that’s not all. In tandem, with advancing our upstream processing growth, we are increasing our downstream footprint with a multi-pronged approach to ensure our customers can rely for DCP to deliver throughout the full value chain. NGL takeaway capacity in the basin will increase by up to 220,000 barrels a day, via an expansion of the Front Range and Texas Express pipelines and an exciting new opportunity we announced yesterday with Southern Hills via White Cliffs. We finalized a long-term 50,000 barrel a day capacity lease from the White Cliffs Pipeline. This crude pipeline will be converted to a 90,000 barrel a day NGL pipe with the ability to expand to 120,000 barrels a day.

Let me put this in prospective for you. This is a huge win-win. All volumes from the new White Cliffs NGL pipe are dedicated to flow into and through Southern Hills, giving us the opportunity to not only fill up all available capacity on Southern Hills, but also to potentially expand the pipe in the future. This is a highly, highly attractive capital efficient opportunity to add new volumes and increased utilization on Southern Hills. And as a result, our Southern Hills pipeline will basically extend from the DJ Basin, all the way to the Gulf Coast market centers of Mont Belvieu, Sweeny, and beyond. And this project is expected to be in service in Q4 of 2019.

Additionally, the Front Range and Texas Express Pipelines will be extended by Q2 of 2019, adding another 100,000 barrels of NGL takeaway capacity to the DJ.

Finally DCP has secured half of the capacity of the 600 million a day Cheyenne Connector, adding 300 million per day of gas takeaway to our portfolio. The Cheyenne Connector is another important step in extending market access to serve our customers and we maintain the option to acquire 33% equity ownership stake in this project. All in all, we are talking about a massive, massive game changer in the basin, as we continue to provide comprehensive solutions to fully support our customers continued success and record production.

Q: On the White Cliffs conversion for NGL takeaway capacity – I was wondering if you can talk about the economics from DCP’s perspective, does it make sense to redirect some of the volumes from your other takeaway options towards the White Cliffs option, do you receive better economics or said differently, is that going to be the cheapest route to get from the DJ to Mont Belvieu versus the existing options?

DCP: I think the White Cliffs project is a true win-win project. We’ve been talking with many of you that we were looking at basically 4 or 5 different opportunities and options to take our NGLs out of the DJ Basin into different areas. And I spoke with you all that we were going to most likely, 2 of those. Front Range and Texas Express and one other. And the one other was White Cliffs. As you know, Southern Hills has open capacity. We have about 60,000, 65,000 barrels a day of open capacity. For us, it was really important to what the other solution was going to be, is that Southern Hills was going to be part of that solution. So our base case initially was, we were going to extend Southern Hills from basically Kansas into the DJ Basin, that was probably about a 350-mile lay that we had to do. So could make that $350 million to $400 million in cost. We were also talking with White Cliffs about — with Sand Group about repurposing their line.

And I think this is one of those industry where industry comes together and is doing the right thing. If you think about this what is happening, is we are building about 25 miles or so of pipe in Colorado to connect into the White Cliffs system.

At the other site on the Cushing side, what we’re doing is we’re extending Southern Hills from Cushing to Penova. There actually is already pipe in the ground there that we have, and that’s about 45 miles. So for us, it is a massively, massively capital efficient way to do this. And like you’re really talking about pennies on the dollars compared to the alternative of extending Southern Hills. So it’s a great outcome for White Cliffs because they will -and Sand Group and their partners because they’re going to be able to fully utilize their pipe. For us, it is a tremendously good solution because it’s very low capital. We are going to utilize and fill up that extra 60,000, 65,000 of capacity that we have on Southern Hills, and now this gives us an opportunity to potentially also expand Southern Hills into the future. And from an economics point of view, Front Range and Texas Express continues to be a great project, and we’re flowing a lot of barrels on that.

Let me maybe give you an example, Shneur. We have the largest compressor fleet in the industry. Historically, what would happen when you go through a downturn, like 2015 or 2016, people start pushing maintenance up, spending a little less. And that was really not a smart decision. During ’15 and ’16, we actually started spending much more money on preventative maintenance, and what that resulted into is that major failures on our compressors have gone down by over 70% over the last 3 years. So actually, spending a little bit more upfront and then not running into major failures that cost you much, much more down the line is one example of how we continue to take our cost down.

Q: Are you able to share any flavor as far as the duration of those commitments to Texas Express and Front Range? If that’s kind of just near-term things that can roll or is it really later you get the contracts there?

DCP: Front Range and Texas Express commitments go well into the next decade. They were long-term commitments when we put kind of one of the anchor shippers on that pipe. And we continue to love that pipe. It’s great to have that outlet. It’s great to have this new outlet. In the end, I think the way you got to think through this and what is really important and what we’re trying to do here is you want to make sure that you don’t get into a place with the DJ Basin, where basically the Permian is today. Whether a shortage of all kind of capacity, you can’t take your gas out. People will think about do we need to start flaring, producers thinking about flaring or having to shut in.

You may see the same on the NGL side over time. So you have all these problems and bottlenecks that are created.

What we are doing in the DJ Basin is to alleviate all of those in one big fell swoop deep into the next decade. It’s a Cheyenne Connector that we’ve been working on. We knew that additional gas takeaway capacity was absolutely needed out of the DJ Basin talking to our producers. We knew that we were going to do something like Plant 12. That’s why we worked together with our partners on the Cheyenne Connector, adding 600 million a day of gas residue capacity that’s expendable to — up to 1 Bcf, that’s why we worked with our partners on expanding Front Range and Texas Express. But you want to have multiple outlets, and that’s why we came to the solution of basically de facto extending Southern Hills all the way into the DJ Basin in a very capital efficient manner.

And then on top of that, massive processing capacity that we’re announcing by, once again, taking Mewbourn and accelerating it, by increasing and accelerating O’Connor, while filing permits, having all the land available and having the opportunity to build a plant that is up to 1 Bcf.

So we can give our producer customers a very integrated one-stop shop solution to continuing to grow the DJ Basin, which is an unbelievably attractive basin. So that’s really, I think, how you should take a look at this — from a much broader, strategic point of view.

Comments from Extraction Oil & Gas Management Team

Q: Could you give some color, as you look into the future, on the plant expansions and the build-out?

And in terms of timing, that should be sufficient for managing through the continued growth plan in 2019 that you guys have in your internal plans laid out?

XOG: After DCP comes on early Q3, we expect to see a third-party midstream plant come on. And then as you look forward over the next couple of years, we’re seeing almost a doubling of the existing capacity in the basin.

With our diversified acreage position, our ability to go to multiple plants, we’ll look at systems that may potentially be constrained, we’ll be staging our production into those systems as they get expanded and we’ll be actively developing and targeting systems that have available capacity.