Drilling Program Shifting to Plug-n-Perf Completions

PDC Energy (ticker: PDCE) may be, generally speaking, in the early stages of its development of the Wattenberg Field. However, its rapid growth while maintaining a sturdy balance sheet can be matched by few in the industry. Only two companies in the coverage universe of Capital One Securities are in position for 35% growth in 2016 while exiting the year with a net debt/EBITDA ratio below 2.0x. Denver-based PDC Energy is one of them.

The company reported average volumes of 47,017 BOEPD in its Q3’15 earnings release, setting a personal record and representing respective increases of 27% and 84% compared to Q2’15 and Q3’14. The production results have PDC management expecting to “meet or slightly exceed” the high end of its total 2015 output of approximately 41,905 BOEPD on average, or 15.0 MMBOE cumulatively.

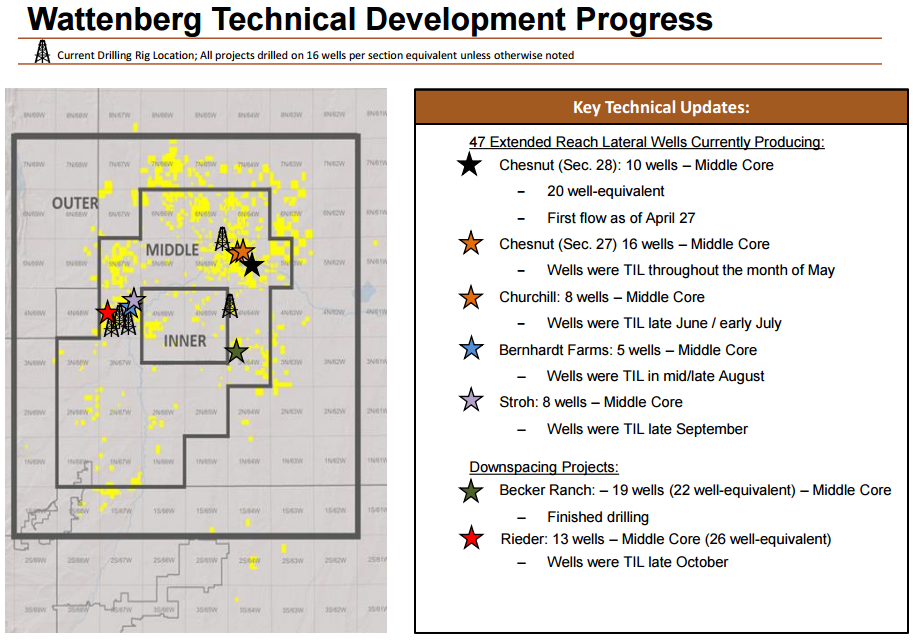

Its core focus of the Wattenberg Field contributed to 93% of the volumes (the remainder was supplied by the Utica), and the company continues to trim the price tag on well completions. Standard and extended reach laterals are slated to cost $2.9 and $3.9 million apiece, respectively, down approximately $0.2 million apiece compared to the prior quarter. Drilling days also decreased by one, adding to the margin improvements. PDC “fully expects” to land within its 2015 guidance range of $520 to $550 million.

“As proud as we are of the production growth experienced this quarter, the fact that we were able to do so in such an efficient manner from a capital standpoint is what’s really exciting,” said Scott Reasoner, Senior Vice President of Operations for PDC Energy, in a conference call following the release.

Plug-n-Perf Now the Preferred Completion Choice

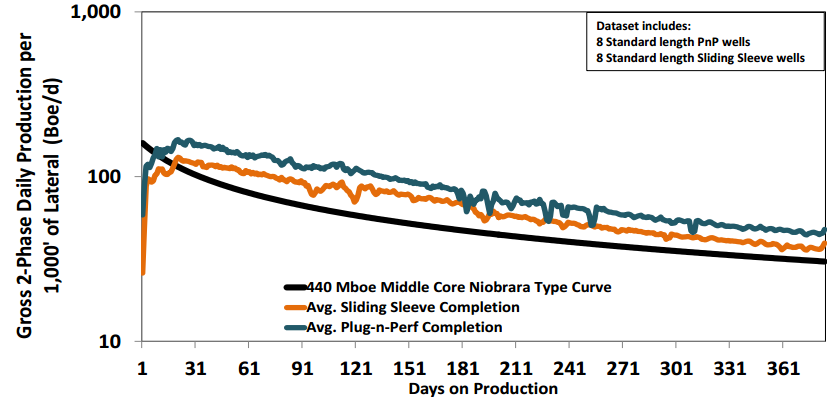

PDC expects to spud 40 to 50 wells in Q4’15, while turning anywhere from 30 to 35 of those wells to sales. The plug-n-perf completion method is gaining precedence over its prior sliding sleeve approach, as 10 wells using the plug-n-perf will be turned in line in Q4’15 – effectively increasing that completion number by 33% to about 40 overall.

“As far as plug-and-perf, we continue to see a sizable uplift in these wells,” Reasoner said. “We will provide more details in specifics when we release our 2016 budget, but we have gained the confidence needed to include this completion design on the majority of our drilling program.”

PDC management explained a plug-n-perf pad in its Middle Core Wattenberg acreage realized uplift of 15% to 25% compared to the sliding sleeve technique. “Based on what we see right now, we’re going to be doing most of our wells next year using plug-and-perf,” added Reasoner. The 440 MBOE type curves for the Middle Niobrara target of those completions do not take into account PDC’s recent technological advancements, which management hinted could lead to a boost on estimated ultimate recoveries. A newly used fracturing service is supplying additional returns of 5% to 10% on average.

PDC management explained a plug-n-perf pad in its Middle Core Wattenberg acreage realized uplift of 15% to 25% compared to the sliding sleeve technique. “Based on what we see right now, we’re going to be doing most of our wells next year using plug-and-perf,” added Reasoner. The 440 MBOE type curves for the Middle Niobrara target of those completions do not take into account PDC’s recent technological advancements, which management hinted could lead to a boost on estimated ultimate recoveries. A newly used fracturing service is supplying additional returns of 5% to 10% on average.

Results are also incoming on a 22-well equivalent downspacing test on its Becker pad, with all 19 wells expected to be turned in line by the end of November. A 26-well equivalent downspacing test on the Rieder pad was completed and turned in line in late October. Management admits the full results of the tests, including sensitivities related to decline curves, may not be available for as many as 180 days after first production.

2016 Roadmap is Set

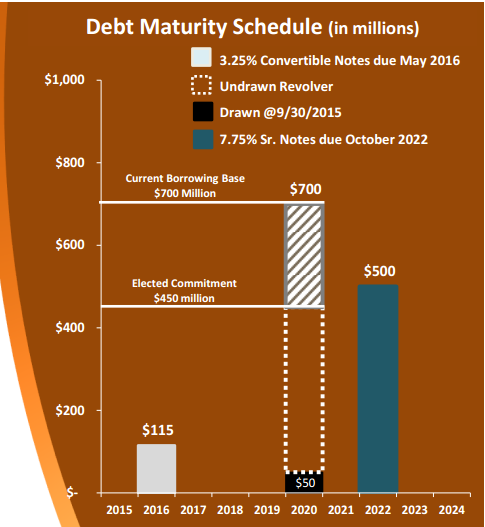

PDC bolstered its near-term balance sheet in a news release on October 1, 2015, reaffirming its $700 million borrowing base and extending it’s the maturity of its revolving credit facility to 2020. PDC’s elected commitment on the borrowing base is $450 million, of which $62 million is drawn. Taking into account the commitments, total liquidity for as of September 30, 2015, was approximately $392 million (or $642 million, taking into account the full borrowing base) and the company expects to exit 2015 with a debt-to-EBITDAX ratio of approximately 1.5x.

We foresee the fourth quarter and 2016 to be cash flow neutral or slightly cash flow positive,” said Bart Brookman, Chief Executive Officer of PDC Energy. “The company will maintain ample liquidity to execute our business plan and operational flexibility to speed up or slow down based on market conditions.”

We foresee the fourth quarter and 2016 to be cash flow neutral or slightly cash flow positive,” said Bart Brookman, Chief Executive Officer of PDC Energy. “The company will maintain ample liquidity to execute our business plan and operational flexibility to speed up or slow down based on market conditions.”

That includes the opportunity for acquisitions, which PDC will evaluate in a very selective fashion. Management did not rule out the possibility of entering a new play, but guided analysts and stockholders that any opportunities must line up with Wattenberg economics, which are obviously held in very high regard by the company. Lance Lauck, Senior Vice President of Corporate Development, explained: “We technically are going to pursue those opportunities that make sense to us. But at the end of the day, we’ve got a pretty high threshold to overcome when you look at the returns in the Wattenberg field.”