A weak peso and increased interest expenses continue to hurt PEMEX

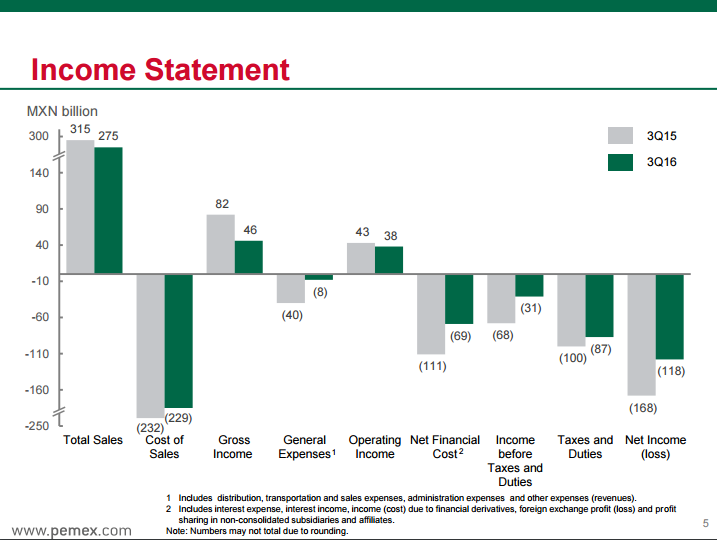

Mexican state-owned oil major PEMEX reported its third quarter earnings Friday, showing a smaller net loss this quarter than last year. The company’s net income loss for the quarter was 118 billion pesos ($6.25 billion), according to the company’s quarterly materials, 29.4% less than in Q3 2015.

According to PEMEX, the decrease in net loss during the quarter was primarily due to a 10.7% decrease in operating income, and a 12.2% decrease in taxes and duties, due to a decline in crude oil production and price of the Mexican crude oil basket, and to changes in the calculation of the company’s Profit-sharing Duty, it said in its financial report. The company’s bottom line was still hurt by a depreciating peso, and an increase in its interest expenses, however.

Total hydrocarbon production for the company averaged 3.0 MMBOEPD with crude oil production decreasing 5.6%, according to PEMEX. Total sales were also down approximately 12.4% from the same period last year, totaling US$14.1 billion.

The company announced that it would release its plan for 2017-2021 next Thursday in a separate presentation. When asked about financing through the end of the year during the company’s conference call, PEMEX’s management said that it “finished [its] financing needs for this year,” and is beginning the “pre-funding effort for 2017.”

Mexico is involved in a rebooting of its languishing energy industry, partly by opening tracts of oil and gas acreage to foreign investment. Pemex is the primary owner seeking partners for larger OCS drilling projects in the Gulf of Mexico.