Effective Rig Count drops to 2,771: Permian oil growth slowing

EnerCom has released its latest Effective Rig Count, examining the state of drilling activity in major shale basins.

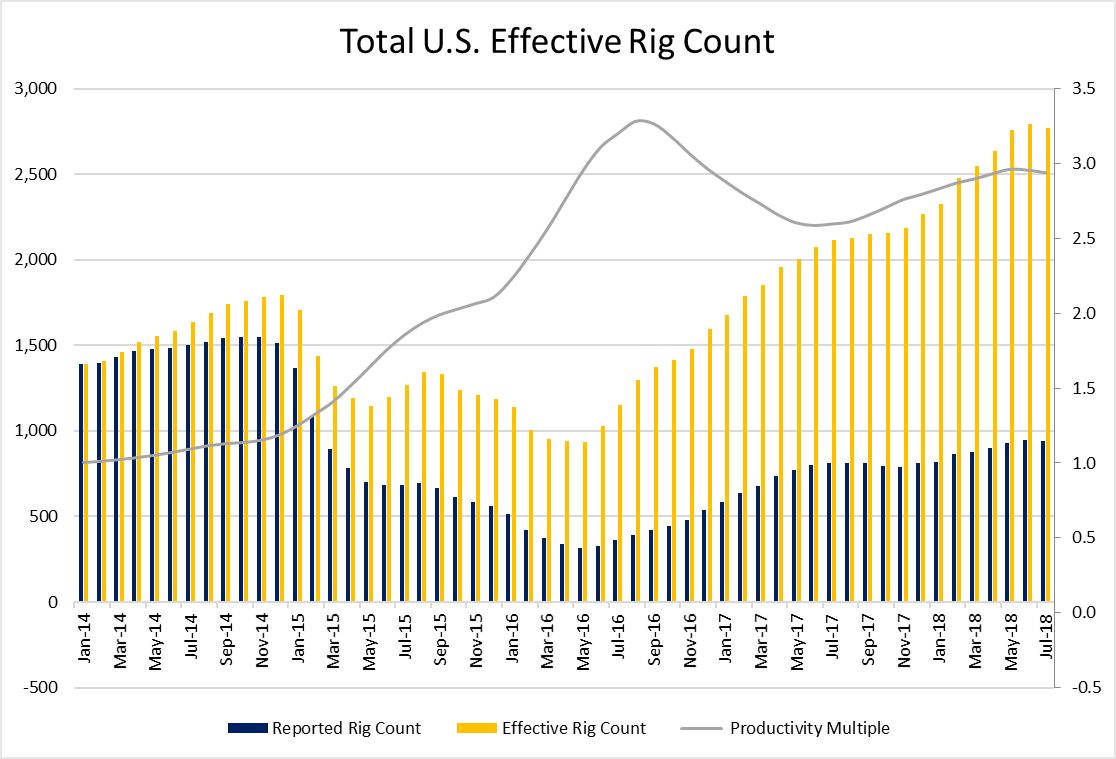

The Effective Rig Count fell to 2,771 in July, marking the first decline in the EERC since the downturn bottomed out in May 2016. The EERC expresses current activity measured in terms of rig production efficiency that was generated in January 2014, demonstrating how far the industry has come since the beginning of the downturn.

While reported rig counts in most basins are currently well below those seen in 2014, total production and production growth outpaces pre-downturn levels. The downturn forced E&P companies to become more efficient, improving drilling targets, completions designs and overall techniques. These improvements mean modern oil and gas operations are significantly more effective than those of 2014, a fact the Effective Rig Count illustrates. An EERC of 2,771 means it would take 2,771 rigs from January 2014 to replicate the current production level. This is in contrast to the reported rig count, which is only 942.

The drop in total EERC was primarily due to a decrease in per-rig productivity, which combined with a slight drop in reported rig count.

Most basins saw increases in productivity, but efficiencies are declining in the Permian. Takeaway constraints are finally becoming noticeable in the overall output of the Permian, and the productivity in the basin is dropping. These constraints will continue to impact productivity until additional pipeline infrastructure is constructed, meaning the basin will grapple with these problems until at least mid-2019. Despite this recent decline, however, the Permian is still the third-most improved major shale basin in the U.S., as operations are currently yielding 3.0 times more production than in early 2014.

Permian oil growth slowing

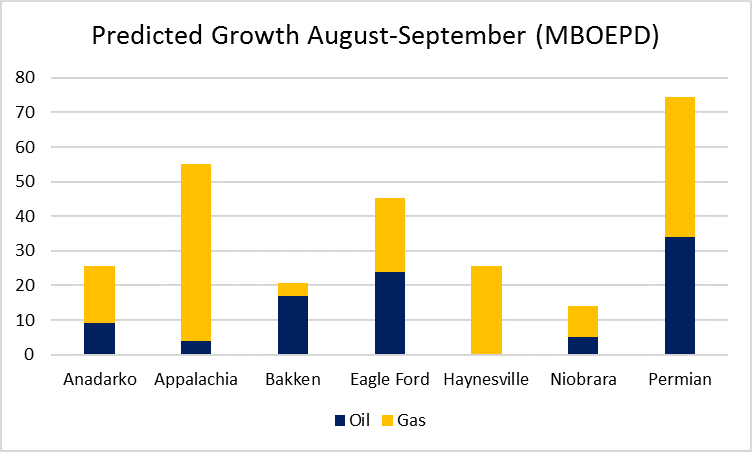

The takeaway problems in the Permian are weighing on total production growth in the basin and the U.S. The EIA estimates the basin will add 34 MBOPD from August to September. While the basin still has the greatest expected oil production growth, 34 MBOPD is well below previous monthly estimates of Permian growth which consistently exceeded 70 MBOPD. In total, the U.S. is expected to add 93 MBOPD in September, the smallest national growth since a sharp weather-related drop in the Eagle Ford forced output to decline in January.

Growth in gas production has been much less affected by Permian takeaway difficulties, and is in line with previous months. The U.S. is expected to add just over 1 Bcf/d of natural gas production in September, with all basins showing steady growth. Appalachia leads the country in growing gas production as usual and is expected to reach 29.4 Bcf/d in September, up 306 MMcf/d from August.

Niobrara DUC count continues to fall

Drilling still outpaces completions in most major shale basins, and the total DUC count rose once again. The EIA estimates that are now 8,033 drilled uncompleted wells in the major basins, up 165 from last month. The increase in DUC count was primarily driven by the Permian and Eagle Ford, which added 167 and 32 DUCs, respectively.

The Niobrara continues to deplete its DUC inventory, completing an estimated 40 more wells than were drilled in the basin last month. The basin has seen DUC counts fall consistently through much of the year, with a total decrease of nearly 260 DUCs.