New company Altus Midstream will provide midstream ops for Apache’s Alpine High

Apache Corp (ticker: APA) and Kayne Anderson Acquisition Corp (ticker: KAAC) announced today they will combine midstream assets, forming a $3.5 billion pure-play Permian midstream player. The combined company, called Altus Midstream, will be publicly traded.

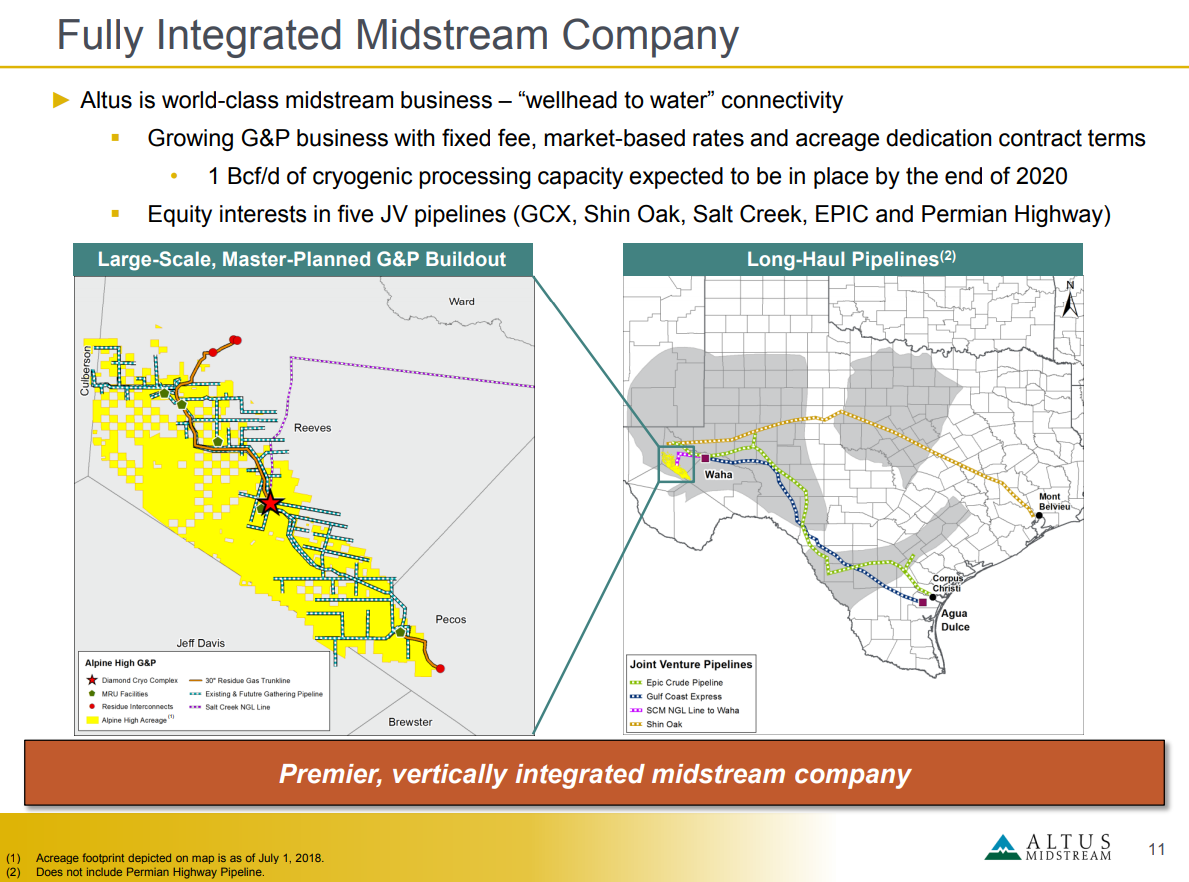

Altus’ primary asset will be Apache’s Alpine High gathering and processing systems, which Apache has already constructed to support its Permian operations. The company has 380 MMcf/d of gas processing currently in service, a number that is expected to increase significantly in the coming years. Altus expects to have 1 Bcf/d of capacity in service by the end of 2020. Altus will also own significant gathering pipelines, with various interests in regional and long-haul pipelines.

Altus’ growth plans are ambitious but they must be to have a prayer of keeping up with Apache’s plans for Alpine High. The company is currently producing 32 MBOEPD from the play but expects that to grow to around 170 MBOEPD in 2020, a fivefold increase in only about two years.

Altus is sole publicly traded pure-play Permian company

Altus will be the only publicly traded pure-play Permian midstream company, as all other Permian-focused midstream companies are private. Three publicly traded firms have greater gas processing capacity, but all are diversified, and their Permian operations are only a small portion of the overall company.

Company will be C-corp, not MLP

Kayne Anderson Acquisition will contribute $952 million in cash to Altus, as the SPAC raised $380 million in its IPO and $572 million in a private placement of shares. This cash will be used to fund initial investments. Apache will own 71.1% of the company, with the ability to add another 3% if certain targets are met. The transaction is expected to close in Q4, at which time KAAC will trade on the Nasdaq under the name Altus Midstream Company and a new ticker. The new company will have no debt at closing.

Altus will be structured as a C-corp., as investors continue to turn away from the MLP structure. Many major E&P companies have spun off midstream assets over the past decade, but most of those transactions created MLPs. It is likely that if this transaction occurred several years ago Altus would also be an MLP. FERC rule changes, tax changes and investor preferences have prompted MLPs to transition away from the structure, and additional consolidation is possible.

Kevin McCarthy, chairman of the board of directors of KAAC, stated, “We are very excited to partner with Apache to form Altus Midstream. This transaction fits all the criteria we outlined at the time of KAAC’s initial public offering and creates a pure-play, Permian-focused midstream c-corp. We believe investors will appreciate the clear alignment of interests between Altus Midstream and Apache as well as the company’s investor-friendly structure. Altus Midstream does not have incentive distribution rights and is well positioned to execute on its growth plans.

Apache CEO and President John Christmann outlined the company’s goals in forming Altus in a conference call, saying “From the beginning, Apache’s primary objective for this transaction was to fund future midstream capital requirements while retaining as much ownership in the assets as possible, thereby benefiting from a long-term value uplift as we execute on our upstream plans at Alpine High.”

“Cash proceeds will not be distributed to Apache for pre-effective date investment. This transaction is about long-term value not near-term cash. Altus Midstream will hold the equity options in multiple transportation projects that will move hydrocarbons from the Permian Basin to various points along the Texas Gulf Coast.”

“These options provide Altus Midstream valuable exposure to the full midstream value chain from the Permian to the Gulf Coast. We conducted an extensive competitive process and received many attractive offers to fund our midstream capital at comparable valuations.”

“We chose this alternative for several key reasons. It clearly recognizes the early value of the Alpine High midstream assets. It brings Apache together with the world class midstream investor. It utilizes a C-corp. structure bringing clarity to shareholder reward and to corporate governance and it brings access to the largest pool of future available capital.”

“For Apache, this transaction immediately funds nearly $170 million in planned midstream capital for the fourth quarter this year as well as all future midstream expansion capital at Alpine High. The transaction also enables Apache to strategically control and direct the ongoing infrastructure build-out to meet the needs of the upstream development at Alpine High.”

Q&A from APA conference call

Q: I just wanted to pick up on the last point here as far as the opportunity for third-party business, and how meaningful could that be. How much focus will there be on that part of the business going forward? And do you have kind of the financial capacity to take on more CapEx there, or how do you see that balance between the core mission with Alpine High with Apache here in those other opportunities?

Brian W. Freed: That’s one of the key reasons we took this path to have that increased flexibility to be able to pursue that third party business. So we are actually already in active discussions with third parties to do gathering and processing within the basin. Then additionally we think we have a public currency that will allow us to selectively pursue M&A opportunities and be a natural consolidator in the basin. So something that we plan to aggressively pursue.

Q: And then just want to see as far as Apache’s long-term kind of objective here with this new entity, is there kind of a targeted ownership level over time that makes sense. Would APA look to sell down, or do they like this level, and will APA be consolidating the debt for this entity? How does that relationship work?

John J. Christmann IV: Clearly from the outset our goal has been – first has been to move future CapEx into our new vehicle which we’ve successfully done. We think this is the optimal vehicle for midstream going forward, so we’re excited about that. We wanted to maintain as much exposure, which is over 71% today with the ability to raise that through the performance metrics. Our initial plans, we see this thing growing significantly in value over the next several years, and so we want to be in a position to appreciate and participate in that.

Stephen J. Riney: The ending of your question there about consolidating, so we will exercise control over the board of this entity, so we will control the company and therefore it will be fully consolidated with Apache’s balance sheet, and then we’ll show a minority interest for the minority shareholders – share of the company.