“It will get to a point where it’s actually artificial intelligence that’s drilling our wells for us, with us observing” – Tim Dove, CEO, Pioneer Natural Resources

There are a lot of smart E&P companies rambling around West Texas, the place that has dominated the energy spotlight for the past year or two. Ask anybody who’s been looking at shale: it’s all about the Permian basin.

The basin is booming. It’s crushing most of the others in production numbers, dollars being paid per acre to enter, ability to offer significant stacked pay and strong economics with oil in the $40s-$50. But fast growth comes with plenty of headaches. How are these operators viewing and solving problems they have in common as they step on the Permian accelerator?

Analysts burned up the phone lines on this week’s Q1 earnings calls, asking a lot of questions that brought out sometimes startling viewpoints from some of the top E&P CEOs whose companies are smashing records in the too-hot-to-touch Permian.

Oil & Gas 360® looks at some of the most thought provoking exchanges from this week’s Q1 earnings calls.

How will you source water in the Permian?

Pioneer Natural Resources (ticker: PXD) President and CEO Tim Dove

Q – Jeffrey L. Campbell: On water investment, while the cost savings certainly shouldn’t be ignored, isn’t it fair to see your water effort as necessary to secure supply for future growth? In other words, that it’s an important exercise in risk management?

A – Timothy L. Dove: Well let me put it this way: Water is perhaps the most misunderstood and undervalued aspect of the impediments that the industry could face. As Joey said, when we are today sourcing 350,000 barrels a day, if nothing changes to how we do things, 10 years from now that’s 1.4 million barrels a day. Today we represent 8% of the Permian rig count. So when you start doing the math, you realize, oh my gosh, we’re in a difficult situation to be able to source that kind of water. Which means we’re going to have to go, as I mentioned, more towards the recycling of produced water that also comes back to us after the frac. And so that has to be in our thoughts long term. But I think being ahead of this is tantamount to substantial risk avoidance going forward. We are just not going to be put in a position where we have that kind of impediment that’s unsolvable. We’re solving it ourselves.

How does a company build a contiguous acreage position in the Delaware?

WPX Energy (ticker: WPX) Sr. VP and Chief Operating Officer Clay Gaspar, Sr. VP Business Development Bryan Guderian

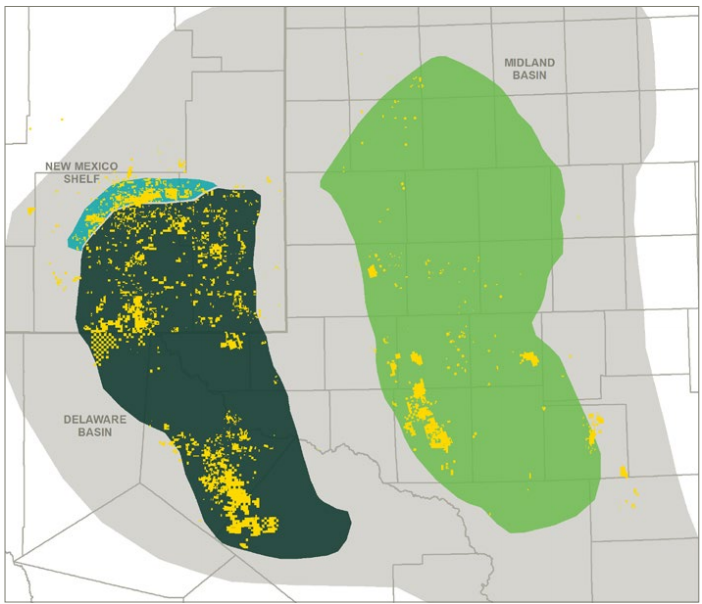

Kashy Harrison: So, can you update us on just what the A&D market looks like right now in the Delaware for – specifically for acreage swaps to help you build a more contiguous acreage position in the region?

A – Bryan K. Guderian: Sure. I think I’d just start out by saying the availability of acreage for transaction continues to surprise us. The buy-side resilience, I think, continues to surprise us as well. So, near-term, our focus is really what we would call kind of blocking and tackling. We have our footprint in place. We’re really nicely blocked up in Stateline and some of the nearby areas there. We have some other acreage that is a little bit more one-off, but we see really nice opportunities dealing with probably four or five different trading partners in and around Stateline, and in particular, the northern part of the Texas side of our position. And we’ve had some great success already dealing with those folks to block up and drill longer laterals.

Kind of along those lines, we are also finding that there is still some additional acreage, generally smaller tracts, some expirations, still opportunity to bolt-on and add to those positions in small ways. The same is probably true up in New Mexico, although I would say that, given the Federal lands and some of the larger tracts that we deal with in New Mexico that has not been as much of a focus for us recently.

Looking more broadly across the basin, there are a number of fairly sizeable deals that are in the market currently or that we expect to come to market. I’m going to say that they tend to be a little more fringy. There are a couple of deals over in the eastern side of the basin that we would anticipate being marketed this year. I won’t go into names because I don’t know the exact status of those, but likewise still I think some opportunities over on the west side of the basin and obviously we took advantage of one with our Taylor Ranch acquisition.

And then, I would expect to continue seeing some private equity monetization. I think we all realize, we’re probably in the seventh or eighth inning of that process, but, again, the availability of acreage as much as we think we know about the basin, things continue to come to market, but more in small packages at this point.

And I think back to sort of the theme of our story, we’re going to stick to our knitting. We really like the footprint that we have. And so, our primary objective is bolting on and adding efficiency to the position that we already have.

A – Clay M. Gaspar: And I’ll just add just a little bit to that, Bryan, we have a lot of small trades, stuff that’s way below the radar you never hear about. In fact, we have 25 active discussions going on right now. Bryan mentioned four big counterparties right around Stateline, but throughout our acreage, I mean, our number one goal in land is to shore up and block up our core positions. That allows so much for infrastructure, efficiency around being able to scale up, certainly drilling the longer laterals. And so many of these deals, it might be a 640 for 640 or 320 for 320. It is mutually beneficial and helps all parties. I can tell you sometimes it’s a two for one acreage swap, sometimes it’s a one for two.

But those are really relatively small deals that are still very accretive to our overall portfolio. So, 135,000 acres today, really happy with the position we have, incredibly happy with our entry costs, and where we stand today. The last thing we want to do is do something to disrupt that and something that would be dilutive to our overall portfolio. So the way we create the most value in the shortest amount of time are these relatively small deals that happen every day kind of below the radar. So we’ll continue our efforts on that.

Concho Resources (ticker: CXO) Chairman of the Board, Chief Executive Officer and President Tim Leach

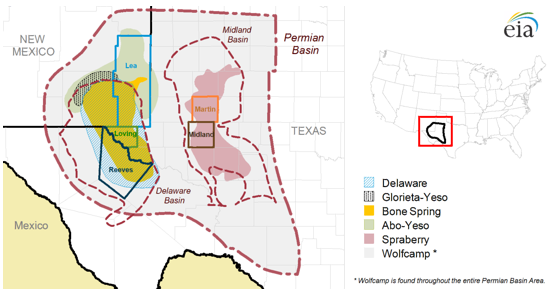

Q – Brian Singer: There have been a couple of acquisitions of assets that would seemingly show up on your maps in Lea and Eddy County. And as a company that’s been very, very active in consolidation, I wonder if you could just talk about your interest in consolidation and why maybe sometimes it does or doesn’t make sense for operators that have acreage in the region to be consolidated in that acreage versus new entrants?

A – Timothy A. Leach: All right. Well, as we’ve highlighted, having big, blocky acreage positions with high ownership is very important to development. So I think you’ll see a lot of trading going on between the big operators to block up their acreage.

When things come up for sale, we have a very high bar on since we have so much opportunity. Things that are contiguous to properties we already own, things that allow us to extend our lateral length are much more valuable to us than kind of scattershot acreage. And also, I’d say with the inventory we have today, it depends on what price you have to pay to get acreage and whether or not we’d be interested in it. So, we’re in a good position to evaluate does making acquisitions add value to our company. And we are very, very focused on these big, blocky, machine-like development projects we’re going to have in the future and making sure that we have all the blocky acreage we need for those things. So, I think we’re in good shape.

As we’ve said in the past, we look at everything in the Permian Basin because it’s our backyard. And so, it’s not unusual for us to be in data rooms and things like that, but we’ve been very picky on what makes sense for us to buy.

Is new technology still coming?

Concho Resources (ticker: CXO) Chairman of the Board, Chief Executive Officer and President Tim Leach

Q – Scott Hanold: It sounds like you hinted that better well targeting helped improve some of the results in the recent couple quarters, and I think big data is something that others are talking about. Can you all talk about some of the initiatives you all are doing in terms of doing better formation targeting?

A – Timothy A. Leach: Yeah. Well, we certainly, like we commented in the start, we drilled over the last five years more wells than anybody else has out here. And so, I think we’ve got more proprietary data than anybody else has.

We’re right in the middle of big data and all the rest of the processes to make our wells better. That includes landing zones and many, many other things. I think we have an advantage because of how many wells we drilled and how much data we have. We have really, really big data. And so I think that’s one thing that’s driving our success, and we talked early on about the steep learning curve that companies would be on, and we kind of paid our dues to get up the learning curve, and I think it’s an advantage.

Q – Scott Hanold: And just to make sure I heard you right, did you say you’re about like “halfway through,” so there’s a lot more room for improvement?

A – Timothy A. Leach: Well, I wasn’t trying to give you a calibration on it, but yes, I mean, we are seeing constant improvements in the way our wells are performing.

Pioneer Natural Resources (ticker: PXD) President and CEO Tim Dove; Executive Vice President, Business Development & Geoscience Chris Cheatwood

Q – Charles A. Meade: I wanted to ask if you could perhaps elaborate a bit more on some of these technology initiatives that you have. And really what I’m curious about is, if you could maybe talk about which of these initiatives are going to have the biggest near-term impact? And then maybe in contrast to that, maybe not, but which ones are more critical for you delivering on this 10-year path that you have?

A – Timothy L. Dove: It’s going to take a couple hours to answer that one.

A – Chris J. Cheatwood: I’ll tell you the biggest thing is not the technologies themselves, but it’s the change in the way we work. Because right now we produce 250,000 BOEs a day. We’re going to one million. We have 3,600 employees. We’re not going to have 15,000 employees when we get to 1 million in 10. So all of these technologies kind of add up to be what we call people multipliers, work multipliers, however you want to look at them.

But I’ll single out a couple of them that I think are going to be – well, obviously the automation I think can really help us in that area, reducing field visits, things like that. But you notice I spent a little time on the drilling system. I think that one is just going to be huge for us. And to kind of describe, because I figured I would get this question this morning. Really what we’re building is like a traction control system for your car. You know, we’re always trying to drill wells faster, live out there on the edge so we can reduce the drill times, but often we push it past the edge, and we produce non-productive time, a.k.a. like a train wreck well.

Machine learning to eliminate ‘train wreck wells’

Well, what we’re trying to build here is a system where we can – it’s like pushing the traction control button on your car that keeps you from sliding off in the ditch if it’s an icy day or something like that. But what’s even more exciting about this is with the capabilities of machine learning, not only are we going to go to a level of prediction to get a warning, we’re going to get to a level of prescriptive analytics where it’s going to be telling us what to do. And ultimately the artificial – and as it learns over wells and number of wells and number of feet, will be to a point where it’s actually artificial intelligence that’s drilling our wells for us, with us observing.

And what that’s going to do is just narrow the outcomes on these wells. So instead of, hey, we drilled a record well for $3.5 million and then we have a train wreck that’s $8 million, we’ll start narrowing in on, hey, we’re averaging around $4.5 million or something like that for drilling the wells. So does that kind of give you a glimpse of what we’re after there?

Q – Charles A. Meade: Yeah. Chris, that’s a good metaphor with the traction control and really a great vision. I guess it’s going to take you guys, hopefully you’ll get there sooner than later, but I appreciate that color.

A – Chris J. Cheatwood: We’ve got it running right now, so, not the artificial intelligence, but we’ve got the predictive analytics right now.

A – Timothy L. Dove: And Charles, and one way to think about it is, every 1% of NPT, non-productive time, if you look at a $2.5 billion capital budget is worth $25 million. Every time you can move 1% lower on NPT, it’s big money especially if you can do it several percent.

What’s your best thinking for current frac design?

WPX Energy (ticker: WPX) Sr. VP and Chief Operating Officer Clay Gaspar

Q – Michael A. Glick: Clay, could you maybe give us the latest and greatest on your completion design and landing zones in the Delaware?

A – Clay M. Gaspar: Yeah. We have lots of landing zones and it’s – I’ll try and summarize it relatively quickly. For our development mode, which is Wolfcamp A, upper, lower, and then the X/Y, I would say state-of-the-art, probably standard is 2,500 pounds per foot. I can tell you we’ve pumped 3,000 pounds, we’ve pumped well over 4,000 pounds on jobs, and we’re continuing to evaluate that. As you well know, that’s not the only knob that we turn. Cluster spacing, how tight those clusters are, we’re currently in the ballpark of 30 foot cluster-to-cluster, four clusters per stage. That is something we continue to evaluate. We look at size of the perforations. This is not sexy stuff that we talk about in slides and all those things.

But just how much pressure drop you’re getting through each perforation determines your diversion to the other zones. There’s things like that that we’re really starting to fine-tune on and continue to make really good progress. As we move into the D to the other zones, it’s a whole new set of trials that we need to understand in the Wolfcamp D, in particular. That’s where we’ve tried even significantly more sand. We have a lot more volume to touch. And so, there we’re able to really put the sand to it and see if we can reach out and grab more reservoir rock for each well that we’re drilling.

So, one note on the Section 22 wells, we went back to our – essentially our prior standard, which was 2,000 pounds per foot. I can tell you there was a lot of internal debate around that. We feel like 2,500 is probably better. That’s why it’s current state-of-the-art. But what we needed to do in understanding this spacing test was how do we compare it to the most inventory that we have kind of like-for-like, and most of the wells that we’ve drilled are 2,000 pounds per foot. And so that was a really important decision that we made to really understand what does well interference in this tight spacing really do. We don’t want to change too many variables on this test. So, state-of-the-art, 2,500 pound, 30 foot per – between clusters. And I would say we are still – lots of room to continue to improve and work on that.

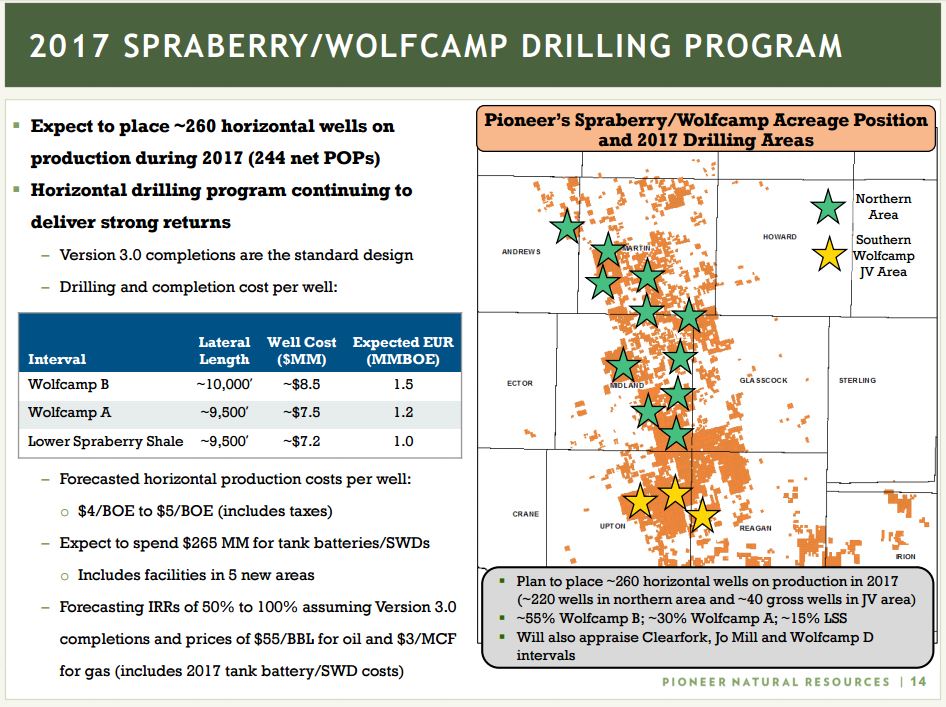

Pioneer Natural Resources (ticker: PXD) President and CEO Tim Dove

Q – Scott Hanold: You all have obviously been deliberately increasing concentrations and intensity of the fracs that you’re doing on your wells. When do you think is a point at which you can step back and say, okay, we understand whether we need to go to 5,000 pounds or hold back to 3,000 pounds on formation X, but in formation Y we’re going to do this? I mean is that something that is still a few years away, or do you think you can accomplish that in say the next 12 to 18 months?

A – Timothy L. Dove: I think you have to look at it along the lines of each zone, right. Each zone is a question mark because we’re testing various different zones, but in particular when it comes to the version past 3.0, most of those are still focused on the Wolfcamp B. Actually, I mentioned there’s going to be three wells that are going to be of that ilk that are going to be drilled in the Lower Spraberry Shale. But, so we will not have done a lot of post 3.0 fracs on other zones other than Wolfcamp B this year. Now, what that’ll tell you is we’ll know something about Wolfcamp B. But I think it’s going to be in the fullness of time that we test the bigger fracs across the spectrum. Like Joey mentioned, even in the Jo Mill, you’re seeing good well performance, but a lot of that was version 1.0 and 2.0 wells. And so, even in the Jo Mill, we’re going to have to see how these 3.0 fracs do, but, or and then further to that, as we go past 3.0.

But I think it’s going to take a long time. It’ll take many moons to get to be to the point where we really understand where we get diminishing returns. Ultimately that’s when your cutoff point is, right, when you realize oh, we pumped 3,500 pounds of sand per foot and it did just as well as 3,000 so you’ve got to call it a day there. The other factor that’s involved, of course, is the more we pump, the more logistics we encounter in terms of strains on the system, whether it’s water or sand or what have you. And that always has to be considered. But really when it all comes down to fruition, it’s when do we see diminishing returns? We won’t know that on several zones for many more years.

Where do you see U.S. crude exports going?

Pioneer Natural Resources (ticker: PXD) President and CEO Tim Dove

Q – Michael Anthony Hall: I’m just kind of curious on your perspective on the export market actually. You guys are a leader in helping open that up and helping take some barrels off the U.S. markets. Sounds like you plan to continue to press on that. How do you see that playing out for Pioneer? But also broadly over the coming year, and are you aware of any physical constraints on the ability to export at the Gulf?

A – Timothy L. Dove: I really am confident in this area of the business is going to be expanding rapidly as we go through time. If you look back really over the last few months, this is just a developing market scenario. And it’s developing to the point where there’s cargo’s going various different places. So for example, in the February, March timeframe, the biggest importer of our crude oil out of the United States was China. And that’s significant because of all the additional refining capacity that’s been put into China and they can take anything in terms of quality. So we really think China has a lot of potential.

But if you look, as I mentioned, the cargos that are going out in the second quarter, they’re going to, in this case, Wales on the one hand, Italy on the other. And then we’ve had cargos in the past going to Canada and Venezuela. So what you’re seeing is a burgeoning world market, looking for the style of U.S. crude that basically is excellent for the generation of transportation fuels. It’s very high quality oil.

And as we look forward, and in particular over the next several years, we’re going to be exporting hundreds of thousands of barrels and maybe many millions of barrels a day from the United States as we just process the Permian growth plan, which is going to be mostly all this light sweet oil. Today there are new facilities being built on the Gulf Coast as we speak. There are export volumes being moved of course out of Corpus Christi. We’re actually looking at moving volumes into some of the domestic markets, but some can be exported in areas north of there, out of Houston, for example.

So there’s really going to be a lot of opportunity for this business to really dramatically increase in terms of scale and scope. It’s going to make the United States a geopolitical power when it comes to energy. There’s no doubt about it. And you can make a case we’re going to be one of the main exporters. And the world is looking for sources of supply that are on the one hand of high quality oil but also secure. As you know, the Middle East has controlled a lot of the Far Eastern supply for a long time, and Far Eastern countries are interested in taking more secure supplies than have to go through the Strait of Hormuz. So therefore, I think we have a big advantage going forward. And as those facilities are developed, we’ll have more VLCCs going to Asia. So I really see and I’m expecting big things here.

When did you switch into manufacturing?

Concho Resources (ticker: CXO) Chairman of the Board, Chief Executive Officer and President Tim Leach

Q – Arun Jayaram: You’re the second major operator who’s talked about this multi-zone development or this manufacturing-style development which I think is interesting. I just wonder if you can maybe talk about the evolution to this. I think of the Permian today is being kind of these two to three well pads, but what will the oilfield of tomorrow kind of look like in the Permian as you move to this kind of new development style?

A – Timothy A. Leach: I think it’s a really big theme going forward and it’s a big theme that’s going to imply a bunch of additional efficiency and a bunch of additional recovery because there project areas will be where you go in and fully developed or close to fully developing a section at a time, which is going to complete change the style. Over the last decade, we spread our capital out and tested many different zones and many different geographical locations trying to find the sweet spots of the Permian Basin.

Well, that phase is kind of ending. I think we’ve got the answers we need. And so, you’re going to see intense development on individual sections where it’s several hundred million dollars of investment and 30-plus wells a section and it’s going to imply very intense infrastructure which we have, but also high recovery but also high recoveries because it’s the most efficient way to put the wells on the ground and optimize the returns. So, I think that’s how we continue to drive really good metrics and really good value creation in this industry.

How do you calculate rig cadence in the growth formula?

Concho Resources (ticker: CXO) Chairman of the Board, Chief Executive Officer and President Tim Leach; Executive Vice President and Chief Financial Officer Jack Harper

Q – David R. Tameron: The focus has been on the process going forward. So you mentioned a couple of things like maybe more 2-mile laterals, some landing zones. What else – I’m just trying to think of it from a process standpoint. How do we look at this versus what you’ve done? What type of efficiencies do we see, like what’s the rig cadence look like? I’m just trying to feel out some more details of what development looks like versus what you’ve been doing the last year or so?

A – Jack F. Harper: It’s a combination of a lot of things. You’ve seen us move the lateral length up where our average well length will be over 8,000 feet this year, and that’s up 1,000-plus feet from last year. The percentage of wells on pads is going from 50 to over 60 this year and probably more relevant is the size of the projects or the pads has increased year-over-year. So, the number of wells per project area has increased. And so, the whole idea, not to overuse the word efficiency, but is increased efficiency. But as far as the rig cadence and completions, that may change that modestly, but really, what we’re after is to spend the dollars in the most efficient manner.

A – Timothy A. Leach: I would also add that we mentioned trying to optimize both the recovery and the rate return. And these big pads where you hit all these zones at the same time achieve that. I mean, you get the efficiency by being able to price out hundreds of stages at the same time and also bring on all those wells when the bottom hole pressures at the optimal spot. So, it implies longer lead times. It implies bigger, more intensive projects for infrastructure. And I think since we have multiple core areas in the Permian Basin, we’re one of the unique companies that can do all of that and still deliver predictable kind of growth.