On September 2, 2014 we reported on the acquisition of 6,230 gross acres (3,862 net) in the Midland Basin area of the Permian Basin by Callon Petroleum Company (ticker: CPE). The properties were purchased for $212.6 million in cash and are near CPE’s existing operations in Carpe Diem and Pecan Acres in Midland County, Texas. The sale is effective May 1, 2014 and the company will assume operatorship upon closing of the transaction, which is expected to occur in early October 2014.

The company’s strategic rationale for the acquisition includes the following benefits:

- Increases Callon’s footprint in the Permian Basin to 18,062 net surface acres, but when considering the multi-zone nature of the leasehold, CPE’s “effective” position jumps to approximately 100,000 net “effective” acres.

- Adds production of 1,465 BOEPD net (68% oil), estimated from Q2’14, from legacy vertical wells, bringing the company’s total production up to an estimated 6,745 BOEPD net.

- Strengthens the company’s visible growth potential with the addition of 188 horizontal drilling locations in the Wolfcamp B, and Lower and Middle Spraberry zones; and an additional 250+ locations from Wolfcamp A, Cline, Clearfork and Jo Mill zones. Pro forma, Callon’s horizontal drilling inventory rises to 1,097 locations, providing a strong multi-year growth runway.

Since the acquired acreage is 100% held by production, and is located in close proximity to some of CPE’s most promising existing leasehold, the strategic rationale is strong. In this piece, we offer further perspective on what the acquisition means for potential valuation.

Production Growth

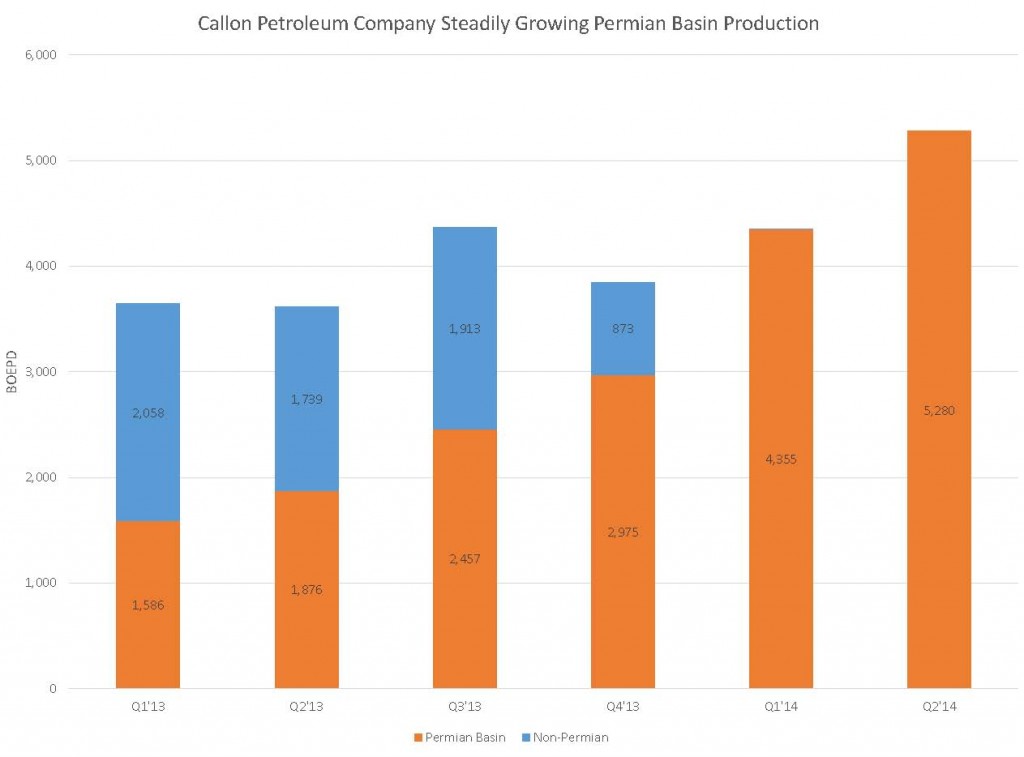

Now that Callon is a Permian pure-play, we can compare its production to other onshore Permian E&Ps. The chart below illustrates CPE’s total production over the past six quarters. Production from the Permian Basin is shown in the orange bars, illustrating a consistent uptick in volumes driven by Callon’s ongoing oil drilling program.

Since Q1’13, Callon has growth production from the Permian Basin at a robust 27% compounded quarterly growth rate, up to 5,280 BOEPD before the acquisition. Ordinarily, increases at this clip would put CPE squarely in “growth company” territory, however, investors can be excused for not recognizing this earlier because the onshore production increase was partially masked by production coming from the company’s legacy Gulf of Mexico assets. But Callon fully divested its GOM assets in Q4’13, making production from its core onshore Permian Basin assets more transparent.

Shoring-Up the Balance Sheet with Equity

Today, CPE announced an equity offering to sell up to 12.5 million shares of common stock with 1.88 million available for over-allotments. The offering, inclusive of the greenshoe, represents 26.1% of the 40.8 million common shares outstanding prior to the capital raise and would increase total common shares outstanding to 55.2 million.

On Monday, September 8, 2014, CPE shares closed at $9.30. Even if we assume Callon completes the offering at a conservative $9.00 per share, we estimate the deal will inject approximately $129.3 million of fresh capital onto the balance sheet, providing the company options to manage its capitalization and potentially accelerate its drilling program. The company’s press release announcing the deal mentioned the use of proceeds, combined with the planned $250 million senior secured second lien term loan, would be fund the Permian Basin acquisition, and if the acquisition is not closed, to fund its oil drilling program and general corporate purposes, which may include other leasehold acquisitions, repayment of indebtedness and working capital.

Valuation Perspectives

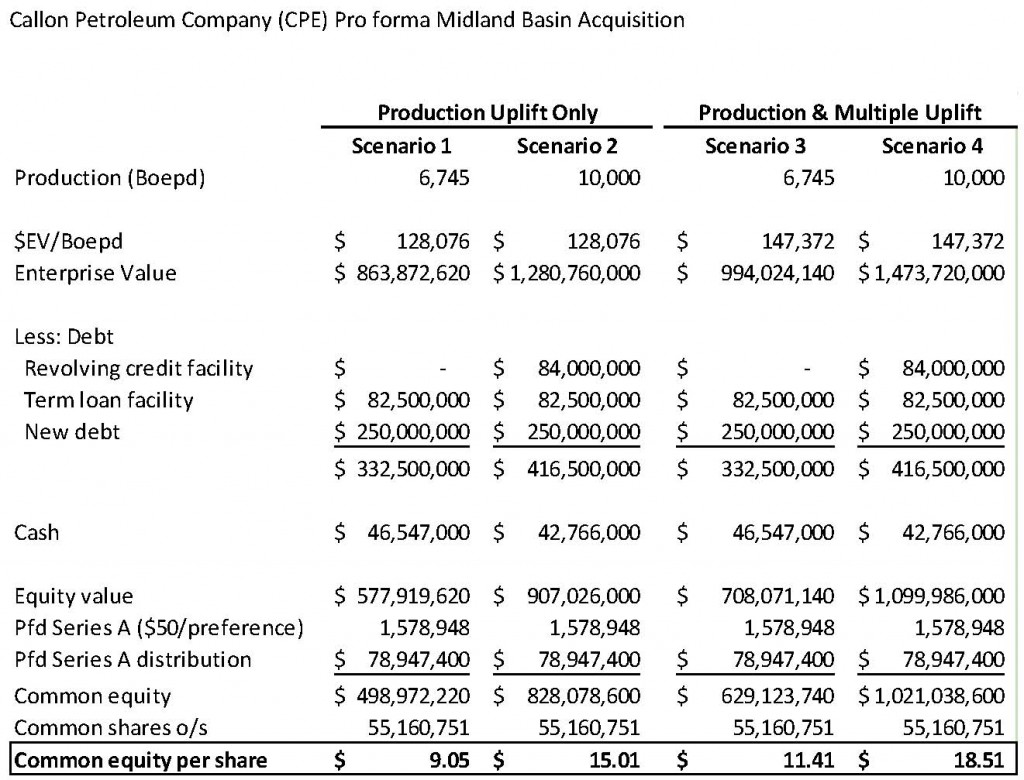

We analyzed four scenarios to provide some perspective on what the acquisition could mean for valuation. The table below summarizes four scenarios, pro forma for the anticipated equity raise, assuming all the shares are sold at $9.00 per share.

We recognize that there are two potential sources of valuation uplift from the acquisition. First, the acquired assets increase CPE’s production by 6,745 BOEPD, as shown in Scenarios 1 and 3. Second, now that Callon’s drilling inventory has been strengthened, it provides greater comfort that Permian Basin production growth will continue into the foreseeable future and that the company’s valuation should see some uplift on a flowing barrel of production basis to be more in-line with Permian peers.

Scenario 1. Scenario 1 shows CPE’s potential equity valuation at the estimated current production rate of 6,745 BOEPD, using Callon’s Enterprise Value to flowing barrel of oil equivalent ($EV/BOEPD) of $128,076 as of August 22, 2014, as adjusted for debt, cash and the liquidation preference on the Preferred Series A stock. In this scenario, we assumed the company would pay down all of its debt with the net proceeds from the equity offering. In Scenario 1, Callon’s net asset value available to common shareholders is $9.05 per share.

Scenario 2. In Scenario 2, we employed the same methodology as Scenario 1, except we used the company’s forecasted 2014 exit rate of 10,000 BOEPD. Instead of increasing the revolver debt by the expected increase in capital expenditures, we assumed capital expenditures in the second half of 2014 would be financed by proceeds from the equity offering. Callon reported capex of $127.2 million through the first six months of 2014, as compared to its $215.0 million budget for the full-year. Assuming the rest of the year’s capital investment is financed by a portion of the proceeds raised from the equity offering, we reduced cash by $87.8 million. In this scenario, we estimate the value attributable to common shareholders to be approximately $15.01. We note that the company did not guide to higher capital expenditures in 2014, as the addition of the third rig to the drilling program had been previously announced.

Scenarios 3 and 4. In these scenarios, we used the same capex and balance sheet assumptions, only we applied the median $EV/BOEPD of $147,372 for seven peer companies with operations in the Permian (i.e., Approach Resources (ticker: AREX), Concho Resources (ticker: CXO), Diamondback Energy (ticker: FANG), Laredo Petroleum (ticker: LPI), Pioneer Natural Resources (ticker: PXD), Resolute Energy (ticker: REN) and Cimarex Energy (ticker: XEC) ) to the Callon Petroleum pro forma production volumes. Factoring in both the incremental production and the higher valuation multiple, Scenarios 3 and 4 value CPE’s common shares at $11.41 (today) and $18.51 (based on 2014 exit rate), respectively. We are not convinced the market would apply the higher valuation to today’s production volumes immediately, as the incremental production from the acquired assets is from legacy vertical wells, ostensibly in decline.

Financial Risk

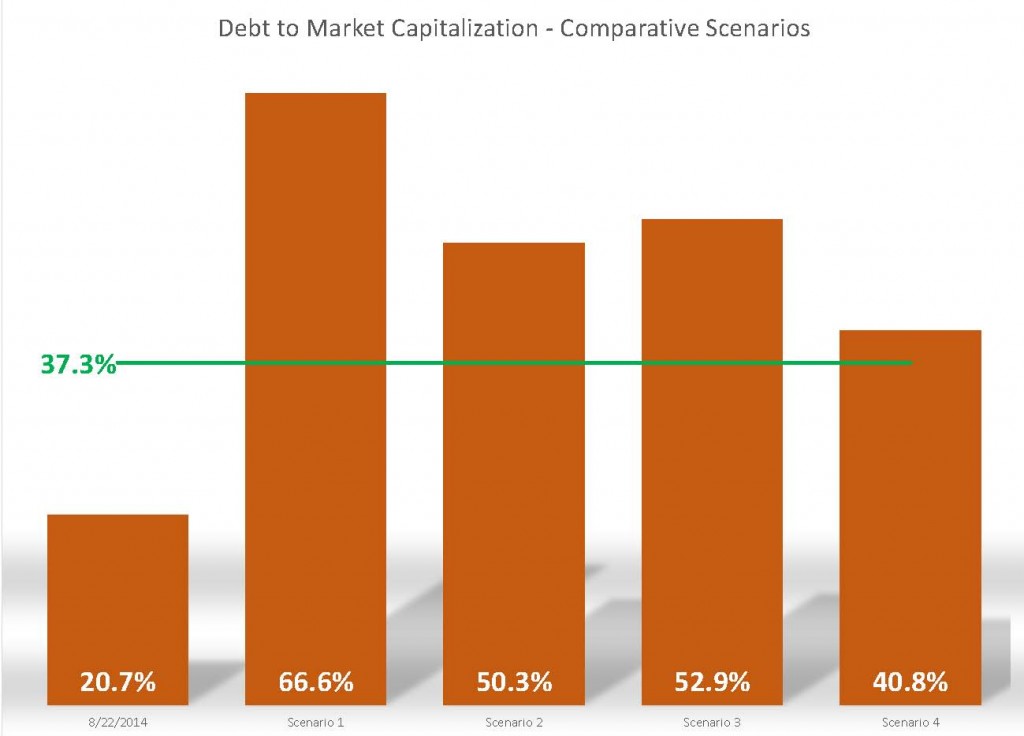

Financial risk is a factor that investors will take into consideration. In the short-term, the debt used to finance the acquisition will increase Callon’s debt load. The table below assesses the company’s financial risk as measured by debt to market capitalization at August 22, 2014 prior to the acquisition and pro forma, given the four scenarios described above.

Prior to the acquisition, on August 22, 2014 Callon’s debt to market capitalization was approximately 20.7%, which was below the 37.3% average for the seven peers mentioned previously (green line in chart above). Under every scenario we analyzed, the new debt pushes CPE’s debt to above-average levels when compared to peers. Our findings demonstrate that once debt exceeds approximately 45% of market capitalization, equity investors have a difficult time assigning a share price to cash flow multiple greater than 5.0x, to account for both higher than average risk and the deduction from a company’s net asset value.

Proceeds from the new equity offering, however, have the potential both to reduce financial risk and to give Callon the financial resources, cash and liquidity that it needs to accelerate the company’s Permian Basin oil drilling program. The near-term dilution will reduce per-share value in the short run, but if the capital can be put to use quickly and effectively, the market is likely to reward the acceleration of cash flow and value, making the increase in relative leverage a short-lived event. Given CPE’s track record of growing production from the Permian Basin at a 27% compounded quarterly rate, we believe the market will take a favorable view of Callon’s most recent move to get bigger in West Texas.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.