Union strike costing Brazil $25 million lost revenue per day: Reuters

Management of Petrobras (ticker: PBR) indicates there are no changes in its plan to sell $15 billion in assets by year-end 2016, despite a union strike that is restricting production levels.

Brazil’s state-owned integrated oil company intends to sell as much as $58 billion overall by 2019, with the proceeds aimed at paying down its net debt of $101.3 billion. Union workers are protesting the plan, saying the asset reductions would cost additional jobs in an industry that has cut an estimated 200,000 positions worldwide since the commodity downturn. Reuters believes each strike day costs Brazil daily revenue losses of at least $25 million, while the Brazil Oil Workers Federation estimates oil production has dropped by as much as 25% (or about 500 MBOPD).

Petrobras, meanwhile, is undeterred by moves from its labor force and is taking its asset sale drive on the road. Management has meetings scheduled in the United States, Canada, China, Mexico and the United Kingdom, all in hopes of finding “strategic partners” to expedite projects and raise capital.

Q3’15 Results

Petrobras is methodically moving past the black eye of its kickback scandal, but the low oil price environment and depreciating real are doing the company no favors. PBR reported a net loss of $1,062 million in its Q3’15 release, hampered by a 50% year-over-year decline in oil spot prices. Average prices for Brent crude also declined by 19% compared to the previous quarter. Meanwhile, the value of the Brazilian real has depreciated against the dollar by 56% and 15% compared to Q3’14 and Q2’15, respectively.

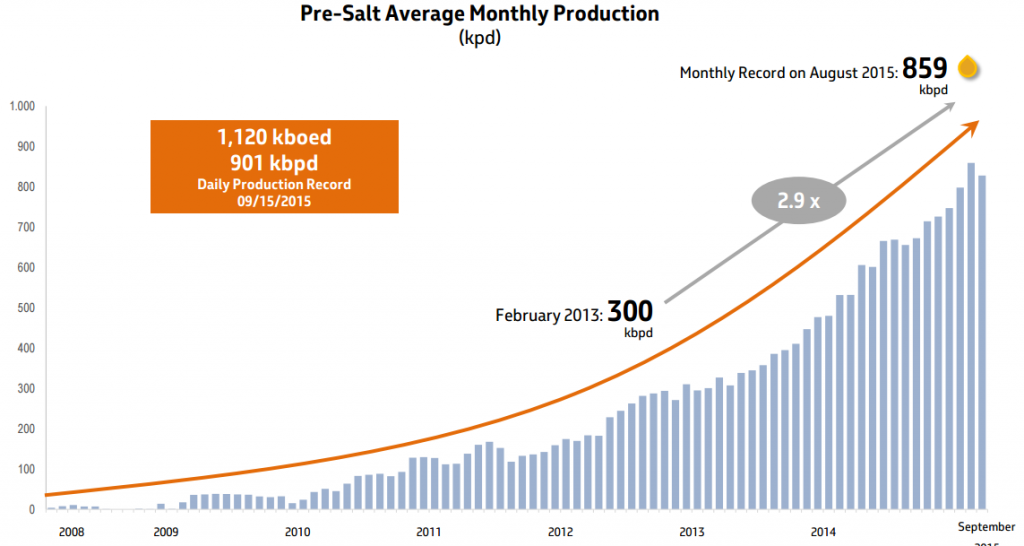

Quarterly production averaged 2,800 MBOEPD, and PBR’s volumes for the first nine months of 2015 are 8% higher than the same period from 2014. Its exploitation of the offshore pre-salt formations continue to climb and set a daily production record of 1,120 MBOEPD in September. The company is producing nearly three times as much from the formation compared to February 2013. Additional help is on the way, as PBR intends to connect 20 new wells in Q4’15, bringing the yearly total to 72.

Although the debt mountain appears to be daunting, PBR has reduced its indebtedness by $4.9 billion since year-end 2014. Its 2015 capital expenditures are also going to be about $2 billion less than expected, based on progress on contract renegotiations and operational efficiencies. Investors gave the company a vote of confidence in June 2015 – roughly $13 billion of potential investment was received when the company issued a rare “century bond” for $2.5 billion. Management anticipates tapping the markets again within the fiscal year to solidify its 2016 financials. Petrobras has issued 30 debt offerings since 2011.