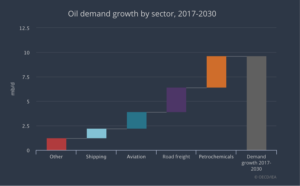

Petrochemicals are set to account for more than a third of the growth in world oil demand to 2030, and nearly half the growth to 2050, adding nearly 7 million barrels of oil a day by then.

They are also poised to consume an additional 56 billion cubic metres (bcm) of natural gas by 2030, and 83 bcm by 2050.

Petrochemicals – components derived from oil and gas that are used in all sorts of daily products such as plastics, fertilizers, packaging, clothing, digital devices, medical equipment, detergents and tires – are becoming the largest drivers of global oil demand. Bigger than cars, planes and trucks, according to a major study by the International Energy Agency.

“Our economies are heavily dependent on petrochemicals, but the sector receives far less attention than it deserves,” said Dr Fatih Birol, the IEA’s Executive Director. “Petrochemicals are one of the key blind spots in the global energy debate, especially given the influence they will exert on future energy trends. In fact, our analysis shows they will have a greater influence on the future of oil demand than cars, trucks and aviation.”

The Future of Petrochemicals is part of a new IEA series shining a light on “blind spots” of the global energy system.

Ironic: a fossil fuel-derived product that is required for renewable energy systems to work

Petrochemicals are particularly important given how prevalent they are in everyday products.

IEA said that “they are also required to manufacture many parts of the modern energy system, including solar panels, wind turbines, batteries, thermal insulation and electric vehicles.”

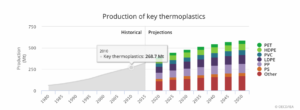

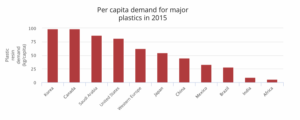

Demand for plastics – the key driver for petrochemicals from an energy perspective – has outpaced all other bulk materials (such as steel, aluminium, or cement), nearly doubling since 2000. Advanced economies currently use up to 20 times more plastic and up to 10 times more fertiliser than developing economies on a per capita basis, underscoring the huge potential for global growth.

The dynamism of the petrochemical industry is also driving new trends around the world.

Shale gas revolution put U.S. as petrochem leader

After decades of stagnation and decline, the United States has re-emerged as a low-cost location for chemicals production thanks to the shale gas revolution, and it is now home to around 40% of the global ethane-based petrochemical production capacity. Meanwhile, the Middle East remains the lowest‑cost center for many key petrochemicals, with a host of new projects announced across the region.

Sharply increasing plastic consumption in emerging economies

While substantial increases in recycling and efforts to curb single-use plastics are underway, especially in Europe, Japan and Korea, the impact these efforts can have on demand for petrochemicals is far outweighed by sharply increasing plastic consumption in emerging economies.

Despite near-tripling in plastic waste collection by 2050, the limited availability of cost-effective substitutes for oil feedstock means that oil demand for petrochemicals remains resilient.