PetroQuest Energy (ticker: PQ), a micro-cap E&P focused on the Midcontinent and Gulf Coast regions, enters fiscal 2015 with its production volume and booked reserves at the highest in company history. Fiscal 2014 volumes of 118.7 MMcfe/d and reserves of 397 Bcfe (77% gas) represent respective increases of 14% and 23% compared to 2013. The company estimates it replaced approximately 320% of its production in 2013.

The company is scheduled to discuss its Q4’14 earnings release in a conference call on March 5, 2015.

Thunder Bayou Moving Forward as Planned

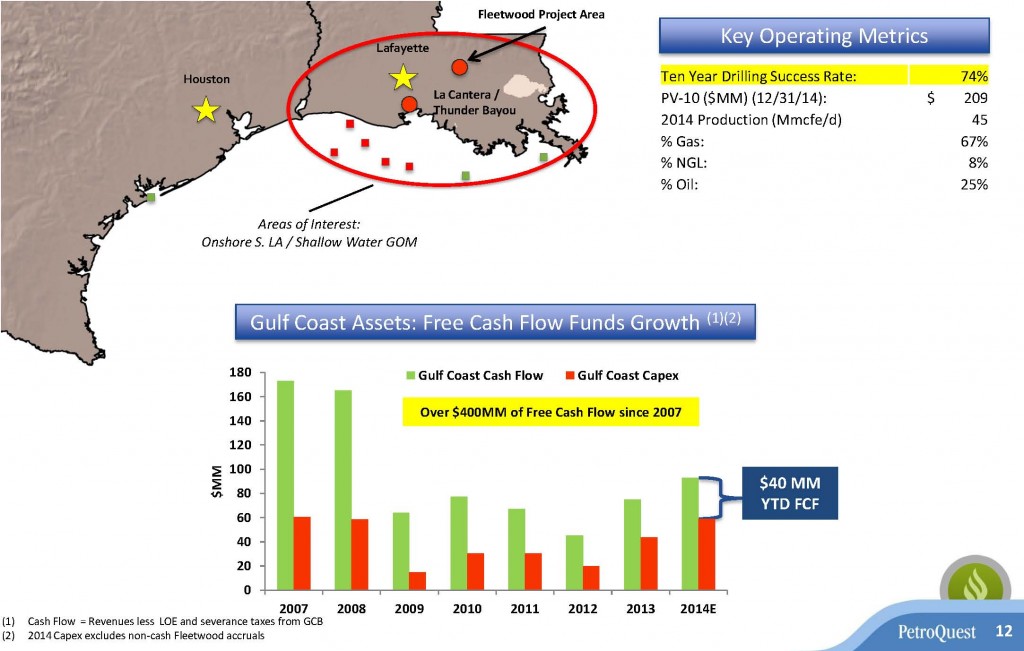

Source: PQ TOSC Presentation

PQ’s Thunder Bayou prospect is scheduled to come online in Q2’15 and is expected to return a gross volume of more than 30 MMcf/d. The high impact well, drilled to 21,500 feet, encountered 490 gross feet of pay, as announced in December. The company holds 50% working interest and 37% net revenue interest (NRI) in the well, which Ryder Scott assessed to have 3P reserves of 130 Bcfe.

The company has experienced previous successes in the region via its La Cantera project, located two miles south of Thunder Bayou. The three wells placed online in La Cantera averaged initial production volumes of 41 MMcfe/d. PQ has held a 15% NRI in the projects, which is less than half of its interest in Thunder Bayou. The La Cantera has proven to be a valuable piece of PQ’s portfolio since it was completed in March 2012; it has returned more than 70 Bcfe from the Cris R2 sand and more than $60 million in net field level cash flows.

Navigating the Environment

PQ is scaling back on its drilling program in 2015 and has allotted a capital budget of $60 to $70 million. In the release, Charles Goodson, President and Chief Executive Officer of PetroQuest, said: “Due to the challenging current commodity price environment, we have made the strategic decision to substantially reduce our 2015 drilling activity in order to preserve liquidity… We believe that achieving production growth despite significant capital reductions is a solid goal given the current market conditions.”

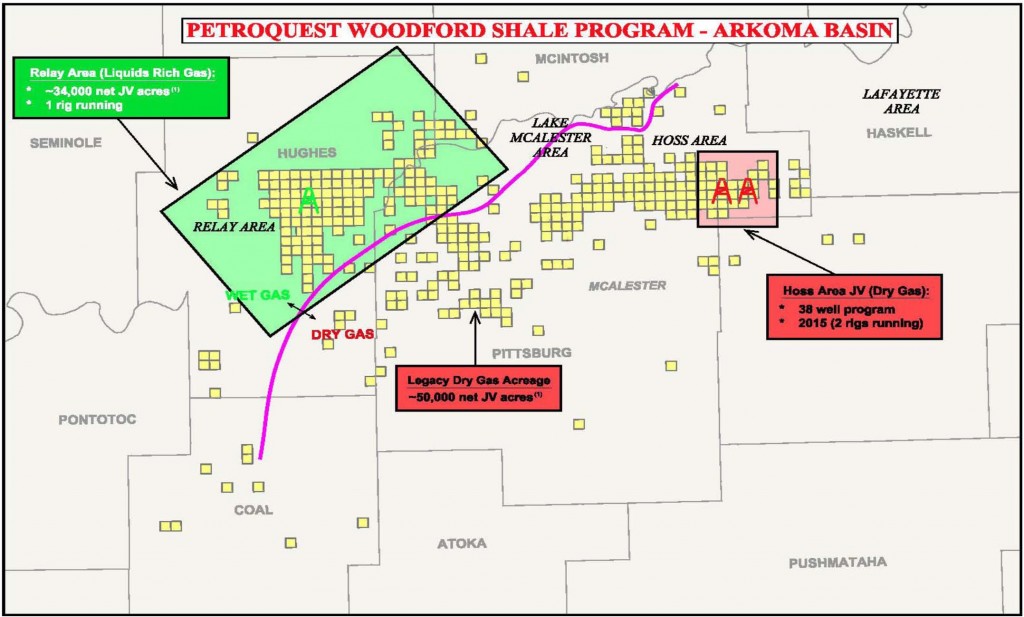

Source: PQ TOSC Presentation

Despite the reduction, PQ still expects to increase production by 5% to 10% compared to 2014’s average of 118.7 MMcfe/d. The forecast does not include the benefits of ethane processing, which would add another 6 MMcfe/d to its volumes. The company has momentarily stopped the processing aspect due to the weak commodity pricing, but will revisit the method once prices recover. The bulk of the production increase is expected in Q2’15 – when production from Thunder Bayou and three new Cotton Valley wells are added to the mix.

Goodson presented the company and discussed upcoming operations at EnerCom’s The Oil & Services™ Conference in San Francisco last week. The conference webcast and the company’s investor slides may be reviewed here.

2015 Gameplan

The Gulf Coast will receive 40% of expenditures in 2015, while its East Texas and Woodford assets will receive 35% and 25%, respectively. Its three Cotton Valley wells (average working interest of 84%) in East Texas will be completed within three months, and future operations in the region will be deferred until commodity prices recover.

PQ plans on running three rigs in its Woodford properties throughout 2015, with one in its West Relay field. The West Relay recently added 10 new wells to production (average NRI of 34%) that averaged peak 24-hour rates of 3,629 Mcf/d and 568 BOEPD of liquids. An additional eight wells in the area (average NRI of 13%) are in the early stages of flowback. The remaining two rigs will operate in its Hoss field joint venture in the Woodford, where PQ holds 20% NRI. Its first two well pad achieved a peak 24-hour rate of 2,400 Mcf/d per well.

PQ’s New Website Unveiled

PetroQuest Energy recently launched a new website that features an interactive operations map and a more streamlined investor relations section. The site, created by EnerCom, may be accessed at www.petroquest.com.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.