First multi-well pad yields average of 2,120 BOEPD per well

PetroQuest Energy (ticker: PQ) has announced the results of its first multi-well pad in the Cotton Valley, showing encouraging results.

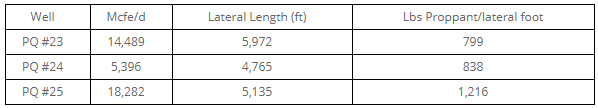

The three wells drilled in this pad had a combined 24 hour IP of 38,167 Mcfe/d, split between 27,697 Mcf of gas, 1m678 bbl of NGLs and 67 bbl of oil. Two of the three wells, PQ #23 and PQ #25, were completed in the E-berry bench of the Cotton Valley, one of PetroQuest’s primary target zones. The other well, PQ #24, was the company’s first horizontal well targeting the E bench. Unfortunately, PQ #24 experienced difficulties with the directional drilling tools, which meant much of the well was off target. Considering the issues encountered, PetroQuest considers the initial rate of the well quite encouraging.

Varying completion intensity, collecting microseismic will support next gen completions

PetroQuest varied the intensity of its frac jobs in the pad to allow comparisons between frac size and productivity. While the results are still early, it appears that larger fracs give stronger returns. PetroQuest reports that PQ #25 used the largest volume of proppant per lateral foot and has the highest IP rate of any of its Cotton Valley wells.

Production data from these wells, when combined with microseismic data collected during the fracturing process, will be used to drive a new completion generation for PetroQuest’s Cotton Valley wells.

So far this year, PetroQuest has drilled and completed five wells, and plans to drill and complete four more by the end of the year. Three further wells will be in progress at year-end.

Production guidance increasing

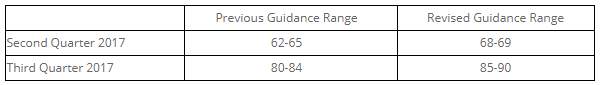

These newly-drilled wells, including this three-well pad, have shown strong results so far. These results have led the company to increase its production guidance for Q2 and Q3. At the moment, PetroQuest has about 6 MMcfe/d of production shut-in due to repairs to a third-party pipeline in the Gulf. Q3 guidance assumes this production will be restored at the beginning of August.

Charles T. Goodson, Chairman, CEO and President of PetroQuest commented on the results of the company’s three newest wells, saying “One of our stated goals for 2017 was to double daily production from approximately 50 MMcfe in December 2016 to approximately 100 MMcfe by the end of 2017. With the operational success, continuous improvement and production growth we have had to date, we are making great progress toward this goal, which should ultimately benefit our relative leverage.”

PetroQuest CEO Charles Goodson is presenting PetroQuest Energy, including an update of the company’s Cotton Valley results, at EnerCom’s The Oil & Gas Conference® 22 in Denver, Colorado, at the Westin Downtown Denver. The conference runs Aug. 13-17, 2017. For registration details please visit the conference website.

Analyst Commentary

From Johnson Rice:

PetroQuest announced better than expected initial production rates from its first 3-well Cotton Valley pad in East Texas. The three wells were drilled with an average lateral length of ~5,000’ and were designed to test a combination of varying landing zones and proppant concentrations. They came on-line at a combined IP24 rate of 38.2 mmcfe/d (72.5% gas, 26.4% NGLs, 1.1% oil). Importantly, these wells were drilled in a virgin portion of its acreage position. The #23 and #25 wells, drilled in the E-Berry formation (the primary target to-date), came on at rates of 14.5 mmcfe/d and 18.3 mmcfe/d, respectively, with the #25 well utilizing 1,200+ pounds of proppant per foot (versus its normal completion intensity of ~800 pounds per foot). With the #25 well coming on-line at one of the highest rates in any portion of the Cotton Valley, PetroQuest plans to utilize 1,200+ pounds of proppant in its upcoming wells as well as test tighter frac stages and perf clusters. With the next two wells being drilled with 6,600’ laterals and higher intensity fracs and expected to begin completion operations in early August, additional operational catalysts are likely over the coming months. While the #24 well experienced a problem with its MWD tool, resulting in roughly half of the 5,000 lateral being drilled out of zone, it still came on-line at a rate of 5.4 mmcfe/d, which would be in-line with its type curve when adjusted for the lateral length drilled in zone. With the #24 well testing a new formation (the E sand), these results are encouraging and point to another potential development zone being prospective. As a result of these wells coming on-line at higher rates than expected and sooner than expected, PetroQuest also increased its 2Q/3Q production guidance by ~5 mmcfe/d, to 68-69 mmcfe/d and 85-90 mmcfe/d, respectively. As a result, PetroQuest remains on track to at least meet its targeted exit rate of 100 mmcfe/d. We view these well results and the anticipated growth of the remainder of the year to result in strong stock price outperformance, highlighting PetroQuest as an attractive way to gain exposure to an improving Cotton Valley development program.

From Roth:

As a result of better than expected production from existing wells, as well as performance from the latest three well pad at PQ’s Cotton Valley properties, PQ is increasing its previously issued mid-points of its production guidance as follows: for 2Q 2017: previously: 63,500 Mcfe per day to 68,500 Mcfe per day, for 3Q 2017: previously: 82,000 Mcfe per day to 87,500 Mcfe per day.

The increased production guidance is well above our estimate for 2Q 2017 which is 63,449 Mcfe and higher than our estimate for 3Q 2017 which is 80,746 Mcfe per day. With this revised guidance, PQ remains on track to register impressive production growth of 76% from 4Q 2016 to 4Q 2017.