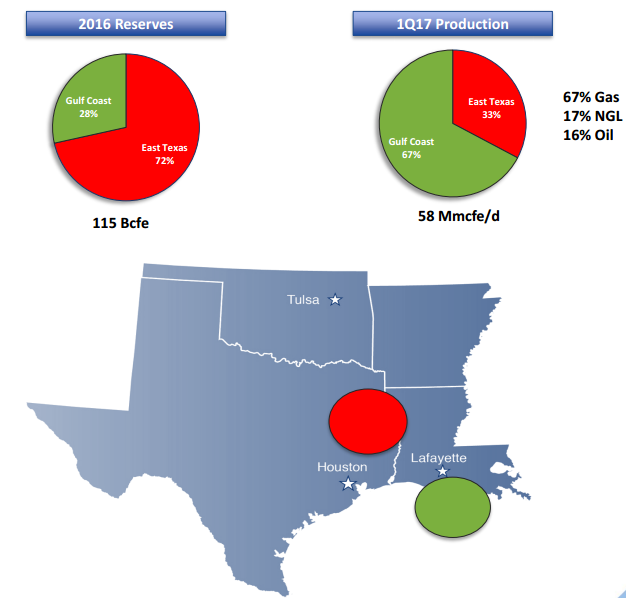

Between its East Texas and Gulf of Mexico assets, PetroQuest (ticker: PQ) produced 5.225 Bcfe during Q1, 2017 at an average rate of approximately 58 Mmcfe per day. The company’s 2016 reserves value was reported at approximately 115 Bcfe, 72% of which was located in the East Texas assets and the other 28% in the Gulf Coast assets.

PetroQuest expects that its average production will increase to approximately 100 Mmcfe per day by the end of Q4, 2017—fueled by the drilling and completions in the Cotton Valley. The growth is also stimulated by the recompletion of the company’s Ship Shoal 72 field in the Gulf of Mexico, which it expects to begin production in July.

PetroQuest is expecting an increase in estimated earnings before interest, tax, depreciation, and amortization (EBITDA). The company reported an estimated 2017 EBITDA of $58.5 million, with an estimated capital expenditure of approximately $40 million. This is complimented by its sizeable cash-flow growth in Q1, 2017; which grew by 156% to $9.2 million from $3.6 million.

Activity in the Cotton Valley

PetroQuest holds 52,000 gross acres within the Cotton Valley—with an estimated 600 gross, 300 net future drilling locations. The Cotton Valley is also host to other major producers such as XTO Energy, Anadarko Petroleum Corp, Range Resources, and BHP Billiton.

As of May, PetroQuest expected its Cotton Valley asset to begin producing with the activation of a three-well pad in June. The company also expects three other Cotton Valley wells to come online during Q4, 2017. In total, the company had two wells producing, three being completed, and three planned wells remaining as of May.

Response to downturn, reduction in debt

PetroQuest reduced its debt to $296 million, down 30% from $425 million between December 31st, 2014 and March 31st, 2017.

The company engaged in asset sales that totaled $300 million, and entered into a joint venture in the East Texas acreage. To combat lower oil prices, PetroQuest dropped its cash costs by 38%, or $8.6 million.

PetroQuest Energy Inc. is presenting at EnerCom’s The Oil & Gas Conference® 22

PetroQuest will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.