Pioneer expects to place ~260 horizontal wells on production in 2017

-

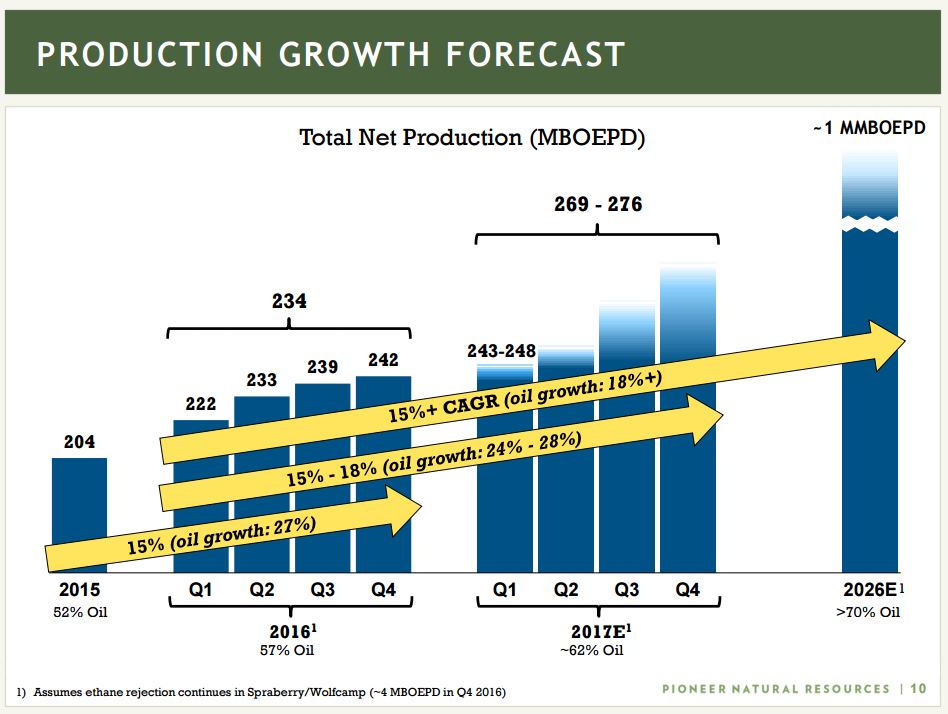

Pioneer produced 234 MBOEPD in 2016, up 15% from prior year

-

One of the best years in Pioneer’s 20-year history: Dove

-

Exported 525,000 barrels of Permian basin oil in Q4 2016

-

Looks to ship two 525,000 barrel cargoes to Asia in Q1

-

2017: $2.5 billion D&C CapEx targets 18 Spraberry/Wolfcamp rigs, 20 Eagle Ford completions—9 DUCs, 11 new wells—all to be funded from 2017 projected cash flow and cash on hand

-

Expects IRRs 50%-100% for 2017 program at $55 oil, $3 gas

-

Growth path target is 1 MMBOEPD production in 2026

-

Spending within cash flow starting in 2018, generating free cash flow thereafter

-

Pioneer added 205 MMBOE of proved reserves in 2016

Pioneer Natural Resources (ticker: PXD) reported a fourth quarter net loss attributable to common stockholders of $44 million, or ($0.26) per diluted share. The company said noncash mark-to-market derivative losses of $142 million after tax were offset by an income tax benefit attributable to tax credits for research and experimental expenditures related to horizontal drilling and completion innovations of $13 million, resulting in adjusted income (income adjusted for noncash mark-to-market derivative losses and unusual items) for the fourth quarter of $85 million after tax, or $0.49 per diluted share.

“This summer will be the 20th anniversary of Pioneer’s creation. We look back at 2016 as one of the best years in that 20-year history where we met virtually all of our financial and operating goals for the year,” Pioneer President and CEO Tim Dove said on today’s Q4 earnings call.

Q4 and full-year 2016 and other recent highlights included:

- producing 242 thousand barrels oil equivalent per day (MBOEPD), of which 59% was oil; quarterly production grew by 3 MBOEPD compared to the third quarter of 2016, and was at the top end of Pioneer’s fourth quarter production guidance range of 237 MBOEPD to 242 MBOEPD; the seventh consecutive quarter of production growth since the oil price collapse in late 2014;

- producing 234 MBOEPD in 2016, an increase of 30 MBOEPD, or 15%, from 2015; oil production increased by 28 thousand barrels of oil per day (MBPD), or 27%, from 2015; oil production was 57% of Pioneer’s total 2016 production compared to 52% in 2015;

- fourth quarter and full-year 2016 production growth was driven by the Company’s Spraberry/Wolfcamp horizontal drilling program; total Spraberry/Wolfcamp production increased 36% year-over-year, with oil output increasing 42%;

- reducing production costs per barrel oil equivalent (BOE) by 29% in 2016 compared to 2015; decrease driven by cost reduction initiatives and growth of low-cost Spraberry/Wolfcamp horizontal production;

- delivering 232% drillbit reserve replacement in 2016 by adding proved reserves of 205 million barrels oil equivalent (MMBOE) from discoveries, extensions and technical revisions of previous estimates at a drillbit finding and development cost of $9.59 per BOE (excludes negative price revisions of 58 MMBOE and net proved reserves added from acquisitions and divestitures of 3 MMBOE); the Company’s proved developed finding and development cost was $9.11 per BOE, reflecting the addition of proved developed reserves totaling 213 MMBOE from (i) discoveries and extensions placed on production during 2016, (ii) transfers from proved undeveloped reserves at year-end 2015 and (iii) technical revisions of previous estimates for proved developed reserves during 2016 (excludes negative price revisions);

- protecting 2016 cash flow and margins through attractive oil and gas derivative positions that provided incremental cash receipts of $680 million;

- maintaining a strong balance sheet with cash on hand at year end of $3 billion (includes liquid investments); net debt to 2016 operating cash flow at year end was 0.2 times and net debt to book capitalization was 2%;

- increasing the northern Spraberry/Wolfcamp horizontal rig count from 12 rigs to 17 rigs during the fourth quarter, as expected;

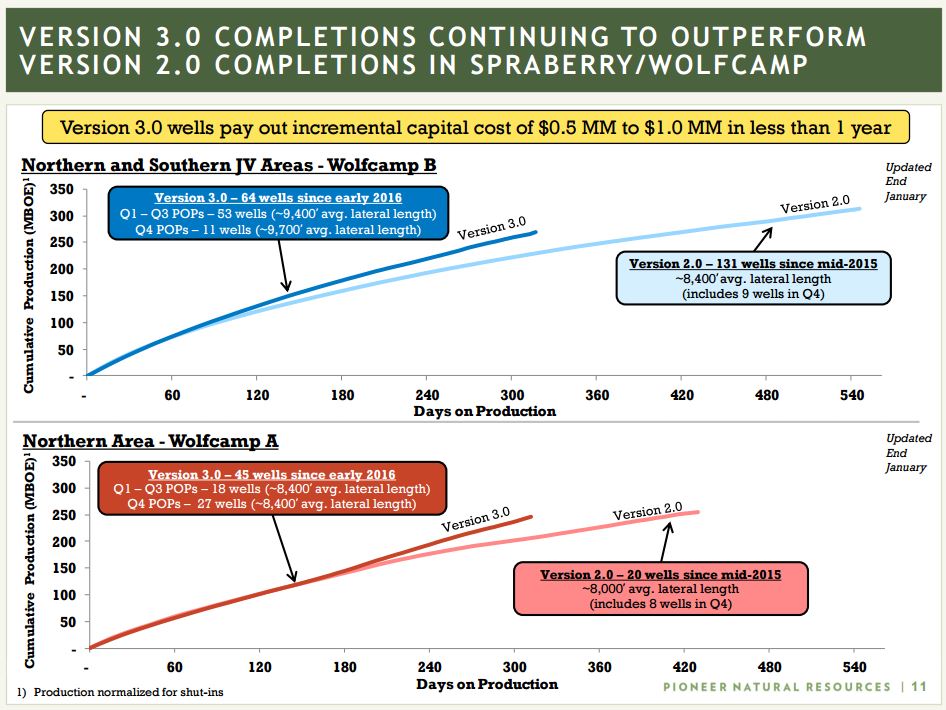

- placing 66 horizontal wells on production in the Spraberry/Wolfcamp during the fourth quarter, as expected, with continuing strong performance; 38 wells benefited from Pioneer’s Version 3.0 completion optimization design; Version 3.0 wells are continuing to outperform earlier wells that utilized the Version 2.0 completion optimization design;

- continuing to realize significant capital efficiency gains in the Spraberry/Wolfcamp where the Company’s completion optimization program and the extension of lateral lengths are enhancing well productivity, while drilling and completion efficiency gains and cost reduction initiatives are driving down the cost per lateral foot to drill and complete wells;

- signing an agreement with the City of Midland to upgrade the City’s wastewater treatment plant in return for a dedicated long-term supply of water from the plant; and

- exporting 525,000 barrels of Permian oil during the fourth quarter; expect to export two 525,000-barrel Permian oil cargoes to Asia during the first quarter.

Pioneer’s 2017 plan, capital program

- planning to operate 18 horizontal rigs in the Spraberry/Wolfcamp during 2017; of these, 14 rigs will be in the northern area (13 rigs currently operating with an additional rig to be added in March) and four rigs will be focused in the northern portion of the southern Wolfcamp joint venture area (Pioneer has a 60% working interest in the joint venture); completions in both areas will be predominantly Version 3.0, with some wells testing larger completions during the year;

- planning to complete 20 wells in the Eagle Ford Shale, which includes nine drilled but uncompleted wells and 11 new drills (Pioneer has a 46% working interest); the objective of the limited new well program is to test longer laterals and higher-intensity completions;

- transferring West Panhandle gas processing operations from the Company’s Fain plant to a third-party facility in March;

- forecasting production growth in 2017 ranging from 15% to 18% compared to 2016 (approximately 62% oil content compared to 57% oil content in 2016); Spraberry/Wolfcamp production growth is expected to be the primary contributor, with growth ranging from 30% to 34% in 2017 compared to 2016 (oil growth expected to increase by 33% to 37%);

- expecting internal rates of return for the 2017 drilling program, including tank battery and saltwater disposal facility investments, ranging from 50% to 100% assuming an oil price of $55.00 per barrel and a gas price of $3.00 per thousand cubic feet (MCF);

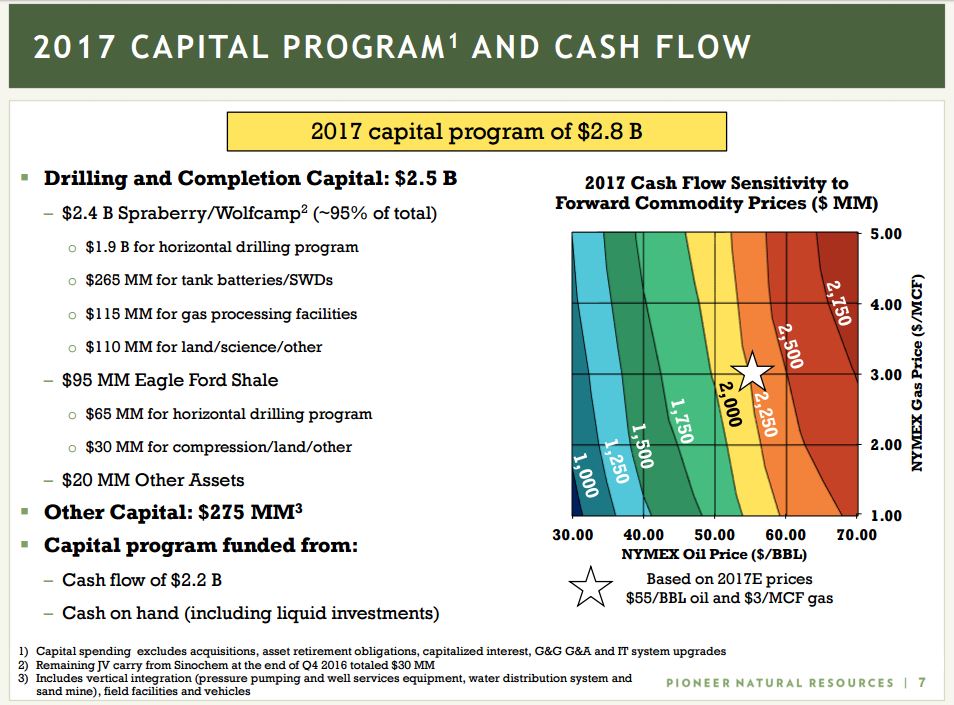

- planning capital expenditures for 2017 of $2.8 billion, which includes$2.5 billion for drilling and completion activities and $275 million for water infrastructure, vertical integration and field facilities; this capital program assumes that further efficiency gains will offset the Company’s estimated cost inflation of 5%; Pioneer’s vertical integration operations mitigate the impact of the 10% to 15% cost inflation forecasted for the industry in 2017; the 2017 drilling and completion capital of $2.5 billion is $0.6 billion higher than 2016, reflecting (i) the higher Spraberry/Wolfcamp rig count for 2017, (ii) a reduced southern Wolfcamp joint venture drilling carry benefit in 2017, (iii) an increased number of higher-cost Version 3.0 completions in the 2017 Spraberry/Wolfcamp drilling program, (iv) additional tank batteries, saltwater disposal facilities and gas processing facilities related to the increased 2017 drilling activity in the Spraberry/Wolfcamp and (v) additional drilling activity in the Eagle Ford Shale in 2017;

- funding the 2017 capital program from forecasted cash flow of $2.2 billion and cash on hand;

- maintaining derivative positions that cover approximately 85% of forecasted 2017 oil production and 55% of forecasted 2017 gas production;

- forecasting net debt to 2017 operating cash flow to remain below 1.0 times; and

- high-grading Pioneer’s Permian acreage position by (i) agreeing in January to sell approximately 5,600 net acres in Upton and Andrews counties for $63 million (before normal closing adjustments) and (ii) evaluating offers to sell approximately 20,500 net acres in Martin County; also opening a data room to sell approximately 10,500 net acres in the Eagle Ford Shale.

President and CEO Timothy L. Dove said, “Despite experiencing another year of downward pressure on oil prices, the company’s focus on execution, improving capital efficiency and maintaining a strong balance sheet allowed us to meet or exceed all of the company’s financial and operating goals for 2016 and deliver one of the best years in the Company’s 20-year history. The key drivers of this strong performance were the continued success of Pioneer’s horizontal drilling program in the Spraberry/Wolfcamp and the outstanding efforts of our employees.

“As we enter 2017, we are well positioned to drill high-return wells, grow production and bring forward the inherent net asset value associated with this world-class asset.”

PXD’s 10-year production guidance: ~1 MMBOEPD by 2026

“I am excited about Pioneer’s vision to grow production from 234 MBOEPD in 2016 to approximately 1 million barrels oil equivalent per day in 2026. We expect to achieve this vision by continuing to drill high-return wells that will deliver organic compound annual production growth of 15%+ and compound annual cash flow growth of approximately 20% over this 10-year period. This assumes an oil price of $55.00 per barrel and a gas price of $3.00 per MCF. In addition, we expect to maintain our net debt to operating cash flow ratio below 1.0 times and improve corporate returns. We also expect to spend within cash flow beginning in 2018 and generate free cash flow thereafter.”

Spraberry/Wolfcamp

Pioneer is the largest acreage holder in the Spraberry/Wolfcamp, with approximately 600,000 gross acres in the northern portion of the play and approximately 200,000 gross acres in the southern Wolfcamp joint venture area. Pioneer’s contiguous acreage position and substantial resource potential allow for decades of drilling horizontal wells with lateral lengths ranging from 7,500 feet to 14,000 feet.

The Company implemented a completion optimization program during 2015 in the Spraberry/Wolfcamp that combines longer laterals with optimized stage length, clusters per stage, fluid volumes and proppant concentrations. The objective of the program is to improve well productivity by allowing more rock to be contacted closer to the horizontal wellbore. In 2013 and 2014, the Company’s initial fracture stimulation design (Version 1.0) consisted of proppant concentrations of 1,000 pounds per foot, fluid concentrations of 30 barrels per foot, cluster spacing of 60 feet and stage spacing of 240 feet. Beginning in mid-2015, the Company enhanced its fracture stimulation design (Version 2.0), which consisted of larger proppant concentrations of 1,400 pounds per foot, larger fluid concentrations of 36 barrels per foot, tighter cluster spacing of 30 feet and shorter stage spacing of 150 feet. The Version 2.0 design increased the cost of a completion by approximately $500 thousand per well. Beginning in the first quarter of 2016, Pioneer commenced testing further-enhanced completion designs (Version 3.0), which included larger proppant concentrations up to 1,700 pounds per foot, larger fluid concentrations up to 50 barrels per foot, tighter cluster spacing down to 15 feet and shorter stage spacing down to 100 feet. The cost of this design added $500 thousand to $1 million per well compared to Version 2.0.

The Company placed 66 horizontal wells on production in the Spraberry/Wolfcamp during the fourth quarter of 2016, as expected. Of the 66 wells, 38 wells utilized the Version 3.0 completion design. Pioneer has now placed a total of 109 Version 3.0 wells on production since early 2016 (64 Wolfcamp B wells and 45 Wolfcamp A wells) compared to 151 wells that have been placed on production since mid-2015 utilizing the less-intense Version 2.0 completion design (131 Wolfcamp B wells and 20 Wolfcamp A wells). Production from the Version 3.0 completion optimization wells is continuing to outperform the Version 2.0 wells. The incremental capital cost to complete the Version 3.0 wells of $500 thousand to $1 million per well is paying out in less than one year at current prices.

The drilling and completion cost per perforated lateral foot for all horizontal wells placed on production (includes completion-optimized wells and non-optimized wells) in the Spraberry/Wolfcamp area averaged$817 per foot in the fourth quarter of 2016, a decrease of 25% from the first quarter of 2015. This decrease reflects the Company’s cost reduction initiatives and efficiency gains, and includes the use of more expensive Version 2.0 and Version 3.0 completion designs over the past 18 months (incremental $500 thousand per well and incremental $1.0 million to $1.5 million per well, respectively, compared to Version 1.0 completions). During the fourth quarter, Pioneer’s horizontal drilling and completion costs averaged $8.5 million for Wolfcamp B interval wells, $6.4 million for Wolfcamp A interval wells and $6.4 million for Lower Spraberry Shaleinterval wells. These wells had average perforated lateral lengths ranging from 8,200 feet to 9,500 feet.

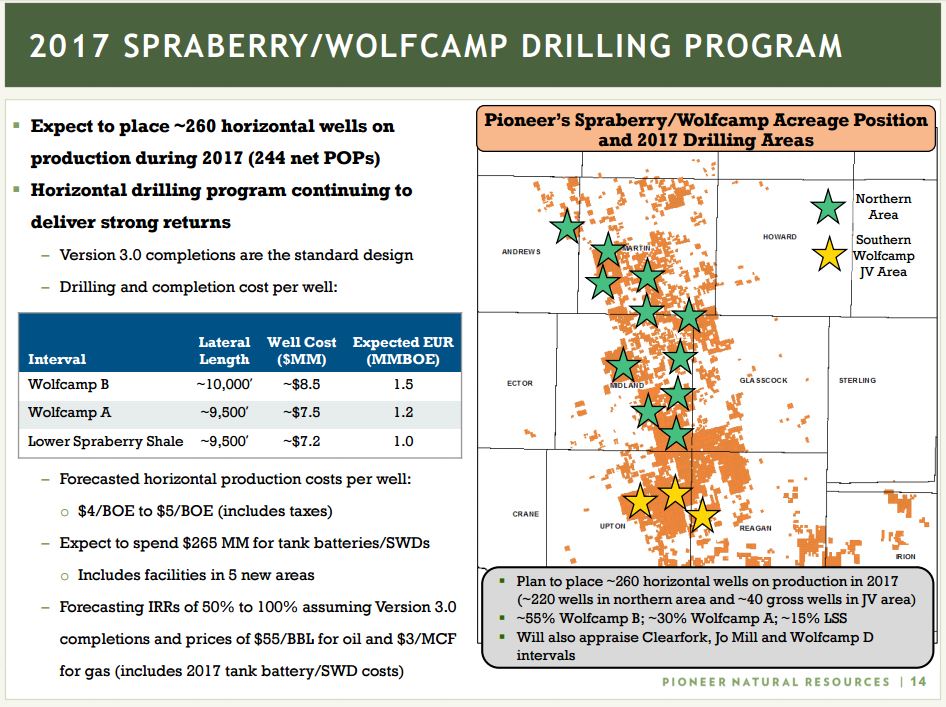

Pioneer expects to place approximately 260 gross horizontal wells on production in the Spraberry/Wolfcamp during 2017. Of these wells, approximately 220 gross wells will be in the northern area and 40 gross wells will be in the southern Wolfcamp joint venture area (results in 244 net wells after recognizing Pioneer’s 60% interest in the wells in the southern Wolfcamp joint venture area). Approximately 55% of the wells will be in the Wolfcamp B, 30% in the Wolfcamp A and 15% in the Lower Spraberry Shale. The Company also plans a limited appraisal program for the Clearfork, Jo Mill and Wolfcamp D intervals during 2017.

As a result of the strong performance of Version 3.0 completions compared to Version 2.0 completions, the 2017 drilling program in the Spraberry/Wolfcamp will utilize predominantly Version 3.0 completions. The Company expects estimated ultimate recoveries (EURs) for the wells planned in the 2017 program to average 1.5 MMBOE for Wolfcamp B wells, 1.2 MMBOE for Wolfcamp A wells and 1.0 MMBOE for Lower Spraberry Shale wells. The expected costs to drill and complete these wells are: Wolfcamp B – $8.5 million for a 10,000-foot lateral well; Wolfcamp A – $7.5 million for a 9,500-foot lateral well; and Lower Spraberry Shale – $7.2 millionfor a 9,500-foot lateral well. Production costs for Pioneer’s horizontal Spraberry/Wolfcamp wells are expected to range from $4.00 per BOE to $5.00 per BOE (includes production and ad valorem taxes).

The drilling program in the Spraberry/Wolfcamp is expected to deliver internal rates of return (IRRs) ranging from 50% to 100%, assuming an oil price of $55.00 per barrel and a gas price of $3.00 per MCF. These returns, which include tank battery and saltwater disposal facility costs, are benefiting from ongoing cost reduction initiatives, drilling and completion efficiency gains and well productivity improvements.

The Company’s Spraberry/Wolfcamp horizontal drilling program continues to drive production growth, with total Spraberry/Wolfcamp production growing by 8 MBOEPD, or 5%, in the fourth quarter of 2016 compared to the third quarter of 2016. Oil production grew 8% in the fourth quarter and represented 69% of fourth quarter Spraberry/Wolfcamp production on a BOE basis. The Company continued to reject ethane during the fourth quarter due to weak market conditions, which negatively impacted production by approximately 4 MBOEPD.

For the fourth quarter of 2016, Pioneer placed 66 horizontal wells on production, up from the 46 wells placed on production in the third quarter. Sixty-four wells were in the northern area and two wells were in the southern Wolfcamp joint venture area. For the full year, 195 wells were placed on production in the northern area and 41 wells were placed on production in the southern Wolfcamp joint venture area.

Pioneer’s forecasted 2017 production growth rate for the Spraberry/Wolfcamp ranges from 30% to 34%, with oil production increasing 33% to 37%. This reflects the Company placing approximately 260 gross wells (244 net wells) on production in 2017. In the first quarter, the Company expects to place approximately 45 wells on production, which is weighted to the second half of the quarter, compared to 66 wells in the fourth quarter that were evenly distributed over the quarter. The Company assumes that it will continue to reject ethane throughout 2017 based on continuing weak market conditions.

Spraberry/Wolfcamp Vertical Integration and Gas Processing

Pioneer is focused on optimizing the development of the Spraberry/Wolfcamp, which includes ensuring that certain infrastructure and services are available. These include the build-out of a field-wide water distribution system, optimization of the Company’s sand mine inBrady, Texas, construction of additional field and gas processing facilities, and maintaining the Company’s pressure pumping equipment.

The Company is constructing a field-wide water distribution system to reduce the cost of water for drilling and completion activities and to ensure that adequate supplies of non-potable water are available for use in the development of the Spraberry/Wolfcamp field. The 2017 capital program includes $160 million for expansion of the mainline system, subsystems and frac ponds to efficiently deliver water to Pioneer’s drilling locations. The Company recently signed an agreement with the City of Midland to upgrade the City’s wastewater treatment plant in return for a dedicated long-term supply of water from the plant. The 2017 program includes $10 million of engineering capital to begin work on this upgrade. Pioneer expects to spend approximately $110 million over the 2017 through 2019 period for the Midland plant upgrade. In return, the Company will receive two billion barrels of low-cost, non-potable water over a 28-year contract period (up to 240 MBPD) to support its completion operations.

Pioneer’s sand mine in Brady, Texas, which is strategically located within close proximity (~190 miles) of the Spraberry/Wolfcamp field, provides a low-cost sand source for the Company’s horizontal drilling program. The 2017 capital program includes $30 million to complete an optimization project for the Company’s existing sand mining facilities. This project will improve yields and reduce the Company’s overall cost of supply. The 2017 capital program also includes $45 million for upgrades and maintenance to the six pressure pumping fleets that the Company plans to operate during 2017.

Pioneer owns a 27% interest in Targa Resources’ West Texas gas processing system and a 30% interest in WTG’s Sale Ranch gas processing system. These investments (i) improve Pioneer’s contract terms for field gas processing, (ii) ensure the timely connection of Pioneer’s new horizontal wells and (iii) provide the Company with opportunities to benefit from third-party processing revenues. During 2017, the Company expects to spend $70 million for system compression and new connections and $45 million for new gas processing capacity additions.

Eagle Ford

In the liquids-rich area of the Eagle Ford Shale play in South Texas, Pioneer is planning a limited horizontal drilling program in 2017 that will be focused in Karnes, DeWitt and Live Oak counties. The program, which is expected to begin in the second quarter, includes completing nine wells that were drilled in late 2015/early 2016 and drilling and completing 11 new wells.

The objective of this drilling program is to test longer laterals with higher-intensity completions in the new wells. Lateral lengths will be extended to 7,500 feet from the previous design of 5,200 feet, with cluster spacing reduced from 50 feet to 30 feet. Proppant concentrations will be increased from 1,200 pounds per foot to 2,000 pounds per foot. The cost of drilling and completing the new wells is expected to be $8.5 million per well. The Company expects EURs averaging 1.3 MMBOE for the new wells with IRRs ranging from 40% to 50%, assuming an oil price of $55.00 per barrel and a gas price of $3.00 per MCF.

Pioneer’s production from the Eagle Ford Shale averaged 27 MBOEPD in the fourth quarter, of which 33% was condensate, 33% was NGLs and 34% was gas. The 2017 drilling program is expected to moderate the production decline Pioneer has experienced in the field since it stopped drilling there in early 2016. While the year-over-year decline is still forecasted to be approximately 40%, the decline from the fourth quarter of 2016 to the fourth quarter of 2017 is expected to be shallower at 20% since the production from the 2017 program is heavily weighted to the second half of the year.

Pioneer’s acreage position in the Eagle Ford Shale is approximately 59,000 net acres, all of which is held by production. This excludes the 10,500 net acres that are currently being marketed for divestiture.

West Panhandle Operations

Production in the West Panhandle field during the fourth quarter of 7 MBOEPD was lower than planned as a result of continuing mechanical problems at Pioneer’s Fain gas processing plant. The Company will be transferring its West Panhandle gas processing operations to a third-party facility beginning in March. Due to the ongoing operational uncertainty at the Fain plant, the Company is estimating first quarter 2017 production of approximately 7 MBOEPD, which is consistent with actual results over the past six months when the plant was experiencing similar mechanical problems.

2017 Capital Program

The Company’s capital budget for 2017 is $2.8 billion (excluding acquisitions, asset retirement obligations, capitalized interest and geological and geophysical G&A and IT system upgrades), in line with the Company’s preliminary forecast of $2.7 billion to $2.8 billion. The budget includes $2.5 billion for drilling and completion activities, including tank batteries/saltwater disposal facilities and gas processing facilities, and $275 million for water infrastructure, vertical integration and field facilities.

The following provides a breakdown of the drilling capital budget by asset:

- Spraberry/Wolfcamp – $2.4 billion (includes $1.9 billion for the horizontal drilling program, $265 million for tank batteries/saltwater disposal facilities, $115 million for gas processing facilities and $110 million for land, science and other expenditures);

- Eagle Ford Shale – $95 million (includes $65 million for the horizontal drilling program and $30 million for compression, land and other expenditures); and

- Other assets – $20 million.

- The 2017 drilling and completion capital of $2.5 billion is $0.6 billion higher than 2016 reflecting:

- the higher Spraberry/Wolfcamp rig count for 2017 ($224 million);

- a reduced Spraberry/Wolfcamp joint venture drilling carry benefit in 2017 ($137 million);

- additional tank batteries and saltwater disposal facilities related to the increased 2017 drilling activity in the Spraberry/Wolfcamp ($95 million);

- additional gas processing compression, hookups and new gas processing capacity additions required in the Spraberry/Wolfcamp to support the increased drilling activity ($70 million);

- an increase in the number of higher-cost Version 3.0 completions in the 2017 Spraberry/Wolfcamp drilling program ($65 million); and

- additional drilling activity in the Eagle Ford Shale in 2017 ($35 million).

The 2017 capital budget is expected to be funded from forecasted operating cash flow of $2.2 billion (assuming average 2017 estimated prices of $55.00 per barrel for oil and $3.00 per MCF for gas) and cash on hand (including liquid investments). Net debt to 2017 operating cash flow is forecasted to remain below 1.0 times.

Fourth Quarter 2016 Financial Review

Sales volumes for the fourth quarter of 2016 averaged 242 MBOEPD. Oil sales averaged 143 MBPD, NGL sales averaged 44 MBPD and gas sales averaged 328 million cubic feet per day.

The average realized price for oil was $46.13 per barrel. The average realized price for NGLs was $16.76 per barrel, and the average realized price for gas was $2.59 per MCF. These prices exclude the effects of derivatives.

Production costs averaged $8.20 per BOE. Depreciation, depletion and amortization (DD&A) expense averaged $16.04 per BOE, benefiting from fourth quarter reserve additions associated with (i) successful drilling activities and (ii) production cost reduction initiatives, which had the effect of adding proved reserves by lengthening the economic lives of the Company’s producing wells. Exploration and abandonment costs were$23 million, including $1 million of acreage abandonments, $3 million of seismic purchases and $19 million of personnel costs. General and administrative expense totaled $89 million and included $8 million of incremental charges associated with performance-based compensation. Interest expense was $46 million. Other expense was $65 million, including (i) $33 million of charges associated with excess firm gathering and transportation commitments, (ii) $8 million of losses (principally noncash) associated with the portion of vertical integration services provided to nonaffiliated working interest owners, including joint venture partners, in wells operated by the Company and (iii) $7 million of stacked drilling rig charges.

The Company recognized an income tax benefit of $13 million during the fourth quarter associated with tax credits for research and experimental expenditures related to ongoing drilling and completion innovations on horizontal wells.

First Quarter 2017 Financial Outlook

The Company’s first quarter 2017 outlook for certain operating and financial items is provided below.

- Production is forecasted to average 243 MBOEPD to 248 MBOEPD.

- Production costs are expected to average $7.75 per BOE to $9.75 per BOE. DD&A expense is expected to average $15.50 per BOE to $17.50 per BOE. Total exploration and abandonment expense is forecasted to be $20 million to $30 million.

- General and administrative expense is expected to be $80 million to $85 million. Interest expense is expected to be $45 million to $50 million. Other expense is forecasted to be $60 million to $70 million and is expected to include (i) $35 million to $40 million of charges associated with excess firm gathering and transportation commitments and (ii) $10 million to $15 million of losses (principally noncash) associated with the portion of vertical integration services provided to nonaffiliated working interest owners, including joint venture partners, in wells operated by the Company. Accretion of discount on asset retirement obligations is expected to be $4 million to $7 million.

- The Company’s effective income tax rate is expected to range from 35% to 40%. Current income taxes are expected to be less than $5 million.

Proved reserves

The table below shows Pioneer’s year-end 2016 proved reserves by asset in MMBOE:

| Spraberry/Wolfcamp | 556 | |||

| Raton | 85 | |||

| Eagle Ford Shale | 45 | |||

| Other | 40 | |||

| Total | 726 | |||

Pioneer’s Q4/YE earnings release is available here. Pioneer’s 2016 reserves release is available here. Pioneer’s Q4 2016 presentation is available here.

Pioneer Q4 2016 conference call

In discussing his company’s 2017 drilling plans in the Permian basin, Pioneer CEO Tim Dove said, “The version 3.0 completions will be the predominant way the wells are completed. It’s based on the success that we’ve already seen in the program to date. We will be at the same time beginning to process the planning for larger completions during 2017. I don’t have a number for you yet of whether that’s version 3.5 or version 4.0. But the fact is we’re going to recover more sand in a lot of these wells, higher fluid volumes. We’ll be continuing to test cluster and stays length spacing in addition to furthering our well spacing tests. So this is important, particularly important scenarios where we are drilling only 7,500-foot laterals. Our preference, of course, is to [drill] 10,000-foot laterals but their ties with the lease configuration limits us to approximately 7500-foot laterals.

“This is where the larger completions could make a lot sense going forward. We’ll begin with 10-plus wells in that category of something in excess of 3.0. We are going to grow production substantially from the Permian growth engine. Production expected to grow 30% to 34% this year, as compared to last year. Again, oil production being the predominant amount of the increase.”

Also on the call, Pioneer’s EVP of Permian operations J.D. “Joey” Hall recapped wells that were put on production in 2016.

“In Q4, we popped 66 wells and averaged 188,000 BOEs per day and ended the full year with 236 POPs at an average production rate of 171,000 BOEs per day,” Hall said. “This represents 36% growth over 2015 with oil growth at 42%. Looking into 2017, we are expecting an average production rate for the full year between 222 and 229,000 BOEs per day resulting in a growth rate of between 30% and 34% over 2016 with oil growth being between 33% and 37%. Looking specifically at Q1, we planned to pop 45 wells which is lower than the 66 wells we popped in Q4. And this is simply the cyclical nature of the 17 rig program with 125 to 150-day spud to POP cycle times. There simply just times when multiple rigs get in sync with one another and it forces you at times to go through POP frenzies and other times to go through POP droughts.

“And also, whenever you have a changing rig count, it adds to this complexity. For example, our lowest rig count was in Q3 of 2016. So whenever you’re changing rig count, it just tends to get cyclical. As an example, when I look back at 2016 we had as many as 27 POPs in one month and as few as nine in another. Offset shut in due to frac operations work similar. There are times when you have a very high percentage of production shut-in, and other times when you have almost none. Example here during 2016, there were months when we only had a couple thousand barrels a day shut-in, while there were others when we had over 20,000 barrels shut-in. So when you look at things over the full year, the law of averages works in your favor when you shrink things down to quarters and months. The law of average just doesn’t work and there are going be larger swings and pops in production. So with that, we’re look forward to a great year in 2017 for the Permian team.”

Pioneer Q4 conference call Q&A

Q: What are your thoughts on the Permian takeaway and emerging bottlenecks on that front and what have you done to protect PXD against potential takeaway bottlenecks and if they do materialize what level do you think disks could move to?

PXP: Well, I think if you take a look at it right now and just do the math in terms of what we believe to be the current takeaway capacity, the surplus, we think it’s something like 300,000 to 400,000 barrels of oil per day. That said, of course, there have been a few expansions that have been already announced including BridgeTex and Cactus. Those total about 150,000 barrels a day. So even if Permian volumes were to grow 400,000 to 500,000 barrels a day which is probably the top end in terms of how we view it, in 2017 into 2018 it looks like we have sufficient takeaway to be able to be ready for enterprises 450,000-barrel line which is going to come on as currently estimated, second quarter 2018. The fact is there’s lots of other expansions and new builds under consideration that total maybe another 500,000 barrels a day by 2019.

So this is something we continually work on. We’re working – our door in the market is like a revolving door in terms of pipeline companies wanting to come in and work with us in terms of moving volumes down their pipelines. So we’re very confident that this is really not an issue. In fact, we’ll be look forward to taking advantage of some potentially-reduced rates going forward that would allow us to be even more economic in terms of exports for example. So we do not see an issue here.

Q: How does the acreage quality of the 2017 program compare in your mind versus 2016? And should we expect over the next decade that you drill the best portions of your acreage first then work your way down?

PXD: In terms of the campaign for 2017, there’s been very specific areas we have not been drilling prior to now simply because typically two reasons. One is we didn’t have seismic over the area. Seismic is needed in order to make sure that we can have some definition regarding the ability to avoid geologic risks such as faults or carts or whatever the case may be. And so therefore the ability to make sure we get off good completions. The second thing is, we have not yet done any drilling yet in our major units. That’s because a lot of land negotiations had to take place where we could consolidate all the interest and work with the parties that are partners to make sure we have a go-ahead plan that makes sense. These are areas, incidentally, when I talk about the units, that were the subject of some of our very best vertical wells for years.

And we’ve seen a strong correlation between how the historical vertical wells tie to new horizontal production. In other words, good rock begets good rock. And so we’re looking forward to some of these new areas. On your second question, Brian, I would simply say, we don’t see any degradation at all in terms of quality of this asset going forward. People talk about what we’re drilling, the core, the core, but we’re really not. We’ve been focused on the Wolfcamp B.

But the Wolfcamp B is basically prolific over a huge swath of the acreage. Some 600,000 plus acres in the core. And so we don’t see really any anticipated reduction.

Now what we would say to you is, some of the zones we’ll be drilling as you get out 10 years from now may include less Wolfcamp B. That’s why we’re doing a lot work here to further assess the Wolfcamp A, the drill mill, even at point where we progress at Lower-Spraberry shale. And also the Middle Spraberry shale. And you see some of the data we put out here is actually relatively conservative in that regard, because we don’t have as much well control, Joey mentioned it in his comments. I think what we’re going to be doing is focusing on all these key zones. And we’re going to have 10 years of good quality drilling, I’m pretty confident just looking at the extensive aerial extent of the acreage.

Q: Is there a benchmark on ROE or ROCE that you’re targeting?

PXD: First of all, the metrics that are really critical to us, needless to say, are the metrics on drilling. And you can see this year, we have very strong metrics. We realize that when the upstream companies make 50% to 100% rates-of-return on the wells, it has to do with the high quality rock and the cost efficiencies that we’re generating but we’re also the ones taking the risk on drilling the wells and completing the wells also. So that return metric has been something we’ve seen from time to time.

At a minimum we’ve seen through the years a return to the upstream of 35%. And so I would say that as we look forward, we will be looking towards return metrics that would be well in excess of 35% to be able to prosecute the plan efficiently. When it comes to ROCE and ROE metrics, this is more complicated, because it refers to past drilling campaigns, past results and the effect of price on those. What I’m going tell you is our objective is, our objective is to substantially improve our ROE and ROCE numbers from where they have been. That’s the goal. And that will reflect the fact that we’re drilling high return wells. So that’s our number-one focus. We have very specific goals for hitting ROE and ROCE targets every year.

Exports certainly are notable now having even two cargoes in this first quarter. Again, what are you thinking for the rest of the year to that? How much more to that grow per quarter? I don’t know. I’m not going to hold you per quarter. And then just wanting the differentials on that. How does that differ versus what you’re just receiving here in the States?

PXD: I think the expectation is based on our production continuing to grow. We would be exporting probably at a similar ratable quantity as we are doing here in the first quarter. It’s simply the case that we believe that there’s an incremental value attached to these light sweet barrels going into international markets. And I mentioned earlier that this first quarter set of cargoes are going to Asia. We see opportunities in Europe and South America, Asia and so on to take these barrels into more transportation style refinery complexes. And toward that, I think it will be continuing part of our plan but I would expect it to be ratable this year. But I think as our production goes up and we execute this case of going to 1 million BOE per day we need to be an exporter of 700,000 barrels a day when the time comes.

Q: Exports certainly are notable now having even two cargoes in this first quarter. Again, what are you thinking for the rest of the year to that? How much more to that grow per quarter? How does that differ versus what you’re just receiving here in the States?

PXD: I think the expectation is based on our production continuing to grow. We would be exporting probably at a similar quantity as we are doing here in the first quarter. It’s simply the case that we believe that there’s an incremental value attached to these light sweet barrels going into international markets. And I mentioned earlier that this first quarter set of cargoes are going to Asia. We see opportunities in Europe and South America, Asia and so on to take these barrels into more transportation style refinery complexes. And toward that, I think it will be continuing part of our plan but I would expect it to be ratable this year. But I think as our production goes up and we execute this case of going to 1 million BOE per day we need to be an exporter of 700,000 barrels a day when the time comes.

Q: Maybe just some additional context how you see the Eagle Ford fitting in the portfolio longer term? And what you had hoped to achieve with the tests this year if successful? Does it set it up for a potential sale? And if so, what would be the first I guess use of capital there? Best use of proceeds?

PXD: Yeah, Michael, let me comment about the first of those points. First of all, as you look back at the plan we prosecuted in Eagle Ford through many years, at least last couple years we were drilling through 2014, 2015. We were heavily choking back the wells just with the idea that would improve their EURs, and in doing so, we’ve matched the fact that as we got a little bit too far down spaced we were actually destroying value by having reduced the EURs. So that dawned on us as we got into the analysis in 2016. And that’s why these next tests are so critical because we’re going to, as Ken mentioned, get out to the point where these wells are more widely spaced. We’re going to put bigger style fracs on these wells that we ever have in the Eagle Ford. Now others have successfully. But again, more of the Permian vernacular 3.0 style completion. And therein lies the proof of the pudding. We’re going to have to see what that means.

If these wells perform as we suggested in our comments, that means there’s 1,000 well inventory of these very high quality, high return wells. That changes the whole view of the asset if we can actually prove that. So we’re going be evaluating this through the year, and look at these well results. And the well results will dictate where we go with Eagle Ford, including the potential to just ramp up a drilling campaign. So we’ll be evaluating that as the year goes on.

Q: I wonder if I can ask a follow-up in the Eagle Ford. I mean, clearly, the potential for an improvement as you just laid out is one thing but the growth potential of the Permian relative to the Eagle Ford obviously stands out. What – are you looking more about moving Eagle Ford to kind of maintenance level of production with a view to potential disposal or is it truly going to drive capital relative to the Permian?

PXD: Well I think the proof’s in the pudding on that, Doug. I think if we can achieve the kind of returns that Jim mentioned which would at a minimum compete in a lot of areas in the Permian on certain zones. It could actually have a longer life in terms of drilling. The main thing we want to do is prove up technically that we have these questions answered. That we have the puzzle effectively unlocked in terms of how to improve value there. And we’re going keep all the other matters out in front of us as to how we might proceed. I mean it’s clear Permian is a behemoth but Eagle Ford has been a great asset for us and a great growing asset for us for many years and this is a chance to get it back into that mode. So we’re simply executing the plan and then we’ll decide where that leads us in terms of the next set of decisions.

Q: I guess you called out the margins in that table you put in the slide deck. It’s kind of underlines the relative incremental cash margin you get from the Permian relative to Eagle Ford. That’s really what was behind my question.

PXD: I think you’re right about that. I mean Eagle Ford in our area as you know is roughly a third oil, a third gas and a third NGLs. So it’s already a bit behind the eight ball economics-wise as it relates to the last two categories. That said, we’re expecting some improvement in ethane prices as the crackers continue to be built out in the Gulf Coast. You’ve seen substantial amount of improvements in ethane simply because of the burgeoning export market for both it and propane. Natural gas is a bit on the come obviously if we can get a relatively higher gas price well into the upper 3s. The analysis changes materially because of the amount of gas in these wells. So this is something that can be part of the analysis. We have to look at what the outlook is for all three of these commodities.

That’s just simply not as much of a factor in Permian drilling where we drill wells as I mentioned earlier. 75%, 80% in the first production of the wells is oil with a balance being gas and NGL. So there’s not as big of an issue in Permian but it is an issue for Eagle Ford. We need to continue to watch that.

Q: What drove the 10-year guidance you introduced today? I know the paint was still drying on the industry’s three-year guide at this strip. Is there sufficient confidence in long-term development plan? Is there some acknowledgment of future production plateau level and a realization for a longer-term, obviously a decade, transition from a growth to a distribution company? Or any more meaning there as we think about that longer-term guide?

PXD: Evan, that’s a great question. I think a lot of our thinking about this topic was evolving in 2016 when we saw the effects of going from 1.0, to 2.0, to 3.0 version wells, and the types of returns we’re dealing with. And then thinking forward as to what type of a plan we could execute going forward that would be efficient. We landed on the opportunity to – if you look at the 15% growth rate, and in doing so, actually spend within cash flow, and-or generate positive cash flow above capital in the planned period. That’s a game changer, and it has to do with the fact that we have an essentially infinite supply of wells to drill if you think in the PV-10 sense that are very high-quality wells in the center of the basin.

Not many people can say that. And so, it’s just simply a matter that our asset base can deliver this kind of result. We would never have come out and talked about ten years, if we wouldn’t think was eminently doable. We’ve got a lot of people who are focused on this now. We’ve got a lot of work to do to prosecute that plan. But I’ve got a lot of confidence in it. It doesn’t really have to do with doing towards a disbursement model, as you called it, or some related word. It has more to do with the fact that this is how we want to execute the process orientation of our company moving forward. We can go faster. We can go slower. But it’s with an eye one the ball towards the long-term goal, and it has more to do with assets than anything else.

Q: Is there a plateau level in the – as you think of it today, in a full field development? Or is it just too early to assess where that might be?

PXD: I think you’re a long ways away from that. If you look at the campaign that we’re talking about over ten years. And in fact, if you take look at some of the modeling we’ve done, you would say we’re about at a point where we’ve drilled about 25% of our inventory of currently a minimum of 20,000 wells after 10 years. So we can keep growing. The question in our case is only a matter how much capital we want to put to work. This is not a question of can you accomplish it? The question is what do you want to spend on it? And in doing so, what do you want to spend to make sure you continue to be efficient? Those are our main areas of focus.

Q: So to the long-term target, could you talk about the risk and non-risk inventory assumptions that you’re making in that? Thank you.

PXD: Well, we’ve put out the 20,000 locations available to drill. That’s already a risk number by zone. And it has to do with issues pertaining to making sure we shave down the EURs to give us some conservatism. We also eliminate a certain percentage of locations that we feel like would be undrillable because of the lateral lengths or other issues such as surface-related issues. So the 20,000 inventory is essentially already risked. If you look at our internal math on this, we can easily calculate 35,000 locations. Now some of those will depend upon pricing of course as you get into some of the other zones. We have essentially here an unlimited supply of high quality wells. So you don’t – I don’t anticipate seeing degradation over the 10-year plan.

Q: What are the oil price assumptions, service cost inflation assumptions that you’re making in all this?

PXD: The base commodity deck is 55 and three through the plan period. Essentially is what is amounts to.

Q: With the basic inflation number, I guess, right?

PXD: Well, the basic inflation you’ll see this year. We’re still at $55. You shouldn’t see much inflation above what we’re seeing today. Because it’s obviously at a point where it’s substantially lower than the peak costs in the 2010 through 2014 time frame. So we’re assuming as I said earlier just from hearing industry discourse about 10% to 15% this year which would affect us by 5% which we’re going to offset by efficiencies. But that’s to get you up to the 50 to 55 case. I think that we’re in the 50 to 55 case through the plan period that margins stay essentially where they are today.

Q: Yeah, that’s impressive. Then again sort of to what you just said what efficiency assumptions would you make on that long-term view. Are you kind of just baking in current performance or are you actually assuming that you get better and better over time?

PXD: Yeah, we’re baking in zero performance enhancements which doesn’t make any sense if you look at how well we’ve done on that. But it doesn’t make sense to make those assumptions until we have those in the bag. To give you an idea by the tenth year of the model that we run, we would expect to be running, let’s just say 65 or 70 rigs. It would be our intention that by the time we get to the tenth year we would be running, say, 45 rigs, because of those efficiencies. None of that’s baked in.

Q: Can you just remind us why others can’t replicate what you’re doing. Thank a lot, Tim.

PXD: Paul, it’s simply a fact that we point to substantial inventory. Meaning essentially endless inventory of very high quality, high return wells in the Midland Basin where we don’t have to add more acreage, we don’t have to get into the land grab business and we can just execute on our plan. Most people when they look at the next three to five years they have to put together a plan to say how they’re going create the locations to make that happen. We have the location, we have the people we have the where with all. So it’s simple for us to say this is something we can execute, it won’t be simple to execute because there’s a lot of moving parts but I believe we have the capability of pulling it off.

Q: When we’re looking at the current plan where you’re going to operate six of the seven pressure pumping fleets this year, longer term, with the plan once you get beyond the seven to utilize third party or potentially consider expanding your fleet?

PXD: Great question, John. I think as you know when we not got into pressure pumping it was at that time when prices were crazy and you couldn’t get services on time back in the upturn. At that point in time we never wanted to be 100% vertically integrate in pressure pumping. I think that still stands today. We always talked about being say two thirds or 70% vertically integrated to protect ourselves from cost increases. And basically make sure we can execute on our plan. I see that going forward, but that’s an optionality for us. That’s a lever we can pull. That we can operate these fleets very efficiently.

In fact, we’ve put our fleets up against any in the industry in terms of their competitiveness and efficiencies. But we still have to just evaluate where we want to put capital. As we go forward that will be the tradeoff. It’s sort of a buy versus rent deal when it comes to frac fleets.

So we’re going get through this year. we’ll make decisions then as we get to later part of this year what we would add whether it be internal equipment or outside parties as we get into next year. We are that we are executing with – we will be executing shortly with one outside pressure pumping fleet in Permian. Our work in the Eagle Ford will also be done by outside parties.

Pioneer Natural Resources is presenting at the EnerCom Dallas oil and gas investment conference on March 1, 2017. EnerCom Dallas features approximately 40 oil and gas company and oilservice technology company presentations, plus commodities market experts. EnerCom Dallas will be held at the Tower Club, Downtown Dallas, March 1-2, 2017.