Version 3.0+ testing future completion designs – ability to swing water is a ‘huge game changer’

Pioneer Natural Resources (ticker: PXD) announced second quarter results today, showing net income of $223 million, or $1.36 per share. These results significantly exceed the company’s losses in both Q1 2017 and Q2 2016 of ($42 million) and ($268 million), respectively.

Pioneer produced 259 MBOEPD in Q2, up 4% from the 249 MBOEPD produced in Q1. This growth was primarily driven by Pioneer’s Spraberry/Wolfcamp properties, which grew by 12 MBOEPD in the past quarter.

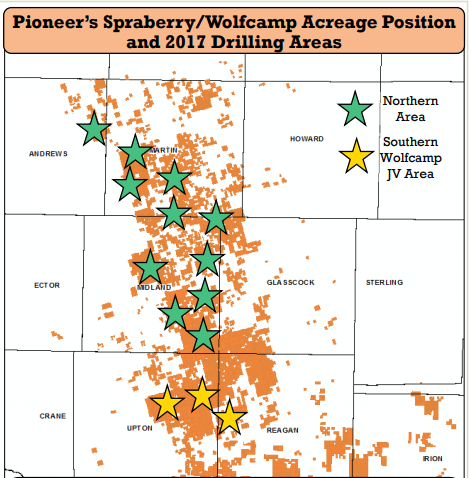

Pioneer owns about 800,000 acres in the Midland basin, which is the current focus of the company’s operations. The current capital plan calls for $2.4 billion in drilling and completion capital in 2017, $2.3 billion of which will be spent in the Permian. 61 new Midland wells began production in Q2, adding to the 38 wells brought on production in Q1. Current plans call for placing a total of 230 wells on production in 2017, using 18 rigs in the Midland basin.

Pioneer is currently testing several new completion designs that it collectively calls “Version 3.0+” which involve higher proppant and water loading. In total, the company will test a minimum of 15 such wells in 2017, which will give valuable information on future completion designs.

Pioneer said it encountered unforeseen drilling difficulties in its Permian activities, due to unexpected pressure changes in shallow formations. This meant wells brought on production fell behind schedule. Pioneer has decided not to accelerate activities to catch up to its original operations plan, meaning the total production and new wells in the Midland area will be lower than originally planned. However, Pioneer has changed its well casing design to respond to the different pressure regime, meaning this problem should be resolved.

Modern completions on Eagle Ford DUCs outperform earlier wells by 20%

Pioneer also has operations in the Eagle Ford, where the company owns about 59,000 net acres. The company completed four drilled uncompleted wells in Q2 in the Eagle Ford, taking advantage of several wells that were drilled during the worst of the downturn in early 2016. Pioneer plans to drill and complete a further 11 new wells, and complete 5 more DUCs. The DUCs that have already been completed utilized more intense completions, and are outperforming older offset wells by about 20%.

Pioneer President and CEO Timothy L. Dove commented on this quarter’s results: “The company delivered another strong quarter, with solid earnings, production at the top end of our second quarter guidance range, continued impressive horizontal well performance in the Spraberry/Wolfcamp and reduced production costs. We are drilling high-return and highly productive wells primarily as a result of our successful completion optimization program. In particular, we are seeing encouraging results from the larger Version 3.0+ completions in the Midland Basin.

“Operationally, we fell behind on our completions due to unforeseen drilling delays. To maintain efficient operations, we have chosen not to accelerate activity in order to catch up in the second half, especially in light of the current commodity price environment. Our current rig count remains the same, but we are deferring 30 Spraberry/Wolfcamp completions that were planned for this year into 2018. This will result in a reduction in 2017 capital spending of approximately $100 million and production growth closer to the low end of our guidance range of 15% to 18% for 2017. This decision is consistent with our longer-term objective to grow production efficiently by maintaining a steady pace of activity, spending within cash flow, maintaining a strong balance sheet and improving corporate returns.”

Q&A from PXD Q2 conference call

Q: 3.0 plus completions look encouraging. Any color, you have the water infrastructure in place in 2018 to handle a full year’s 3.0 plus completions that require additional buildout? Or just maybe color when you’d be in a position if that were to become your base completion? Or discussion of limiting factors? I’ll leave it there.

PXD: Sure. As you know this year we’re spending quite a bit of money on our capital water related products, and I think it’s also true we will do the same next year. This year I think we’re spending $160 million on water projects, sort of early penciling in $150 million a year for next year. The idea this year in particular was to build the mainline construction up from the South to the North to connect the entire field.

That’s a huge game changer to be able to swing water, in addition to which we’re adding more subsystems, more frac ponds and so on as we build out the system. The answer is yes. And we were factoring in the possibility that we would go 3.0+, which we’ve got to get a better name than that I realized, but 3.0+ we’ve got to change. If we change to that in a considerable fashion, you’ve got up the water anti, but I think we can do that no problem.

Q: I wonder if I could just ask you little bit more about this over-pressure issue. Is this a localized issue? Is it across the entire play? And what makes you comfortable that this won’t recur, particularly if you continue with increasingly larger frac loads as you go forward?

Timothy L. Dove: Well, first of all, the fact is we think the recurrence of this has been stymied by the fact we’re using this four-well casing – four-string casing design on the wells. I mean, what we were, of course, experiencing is trying to use three-string casing was a noble effort, but when you have subtle worsening of the pressure issue then, basically, we found ourselves having too many high-cost wells and delays as a result. So we took the remedial action of putting the four-string casing design in place and it, in and of itself, has solved most material parts of any issue we’re going to have going forward. Now it comes with the days and it comes with a little bit more cost, but I think that solution is in place.

One way we will be able to help solve our own issues is related to the fact that we’re going to be utilizing a lot of our own produced water in drilling and so on. But in terms of where this occurs, there’s various over- and under-pressure situations across the basin and, in particular, where we’re focused we see it more in areas of Martin County and Midland County.

Not every area. It just depends on where you are in the counties. And we typically don’t see it as much where you don’t have as many vertical wells drilled. In particular, the area of what we call the SWAT or the southern Wolfcamp JV area. We don’t see this as much. So it happens principally, though, in areas where we’re doing quite a bit of drilling. And so since we’re a concentrated driller over an adjacent leasehold that’s definitely one of the issues that we have forced ourselves into is, basically, going to four-string casing

Q: Okay. So you would characterize the issue as solved now? Or is there a risk of this becomes an ongoing issue, as I say, as you continue to test bigger fracs?

Timothy L. Dove: This one’s solved.