Turner formation is one target of a multiple stacked pay opportunity

While the Permian has cemented its foothold as the heart of modern unconventional oil and gas operations in the U.S., it is far from the only basin generating headlines.

Denver-based Anschutz Exploration, a private E&P, has seen very strong results from its Powder River Basin operations in Wyoming.

Anschutz is the largest private E&P in the PRB, and the fourth-largest overall, with over 385,000 net acres. The company recently announced that its first wells targeting the Turner formation, a sandy formation below the Niobrara, tested at record rates.

The Theo Fed and Remi State showed 24-hour IP rates of 3,193 BOEPD and 3,123 BOEPD respectively, with nearly all production composed of oil. The wells sustained impressive production rates through longer periods, with strong 30- and 90-day volumes. Anschutz reports the Theo Fed generated an IP30 of 2,187 BOEPD and an IP90 of 1,721 BOEPD, while the Remi State had an IP30 of 2,141 BOEPD.

While some of the headlines out of the Permian boast of 3,000 BOEPD wells, the oil cut is a major differentiating factor for the Powder River Basin. In the Delaware Basin, for example, Concho reports its wells produce around 70% oil, while in the Bakken, Oasis is producing around 80% oil. The two Anschutz Powder River Basin wells—Theo Fed and Remi State—produced 87% oil and 90% oil, respectively, a proportion far beyond wells in the other basins.

Newer wells may be even more productive

Oil & Gas 360® discussed the well results in an exclusive interview with Anschutz President and COO Joe DeDominic, who said that the company may have even more impressive results upcoming.

The Theo Fed and Remi State wells had lateral lengths of 6,872 feet and 8,072 feet, respectively, but the company is now targeting even longer laterals. “We’ve now drilled three wells that have 10,000 foot laterals,” DeDominic commented. “We’ve got one that is drilled-uncompleted, one that we’re running pipe on and one that just TD’ed.”

If these longer wells are able to achieve the same productivity per lateral foot as the Theo Fed achieved, they would break the records for 30-day IPs to the multiple.

2018 development will follow up on these results

Anschutz is currently running a two-rig drilling program, and in 2017 the company drilled 12 operated wells, six in the Frontier formation, four in the Niobrara and two in the Turner. Anschutz will primarily focus on following up its Turner success this year, with one rig devoted to drilling Turner wells throughout the year. DeDominic estimates the company will drill 12 or 13 Turner wells, plus a horizontal targeting the Mowry, one horizontal targeting the Niobrara, and several vertical wells.

The PRB has established infrastructure, massive stacked pay

Operating in the Powder River Basin has certain advantages, DeDominic noted. The oil rate is among the highest in the country, which significantly improves economics. “It’s a basin that has seen a lot of drilling in the past,” DeDominic said, “there is infrastructure, from an operational and takeaway standpoint. In our whole program for 2017, every single well that we completed was hooked up to gas and oil pipelines for transport out of the basin within three days of flowback. There’s capacity, and the marketing and transport are extremely good.”

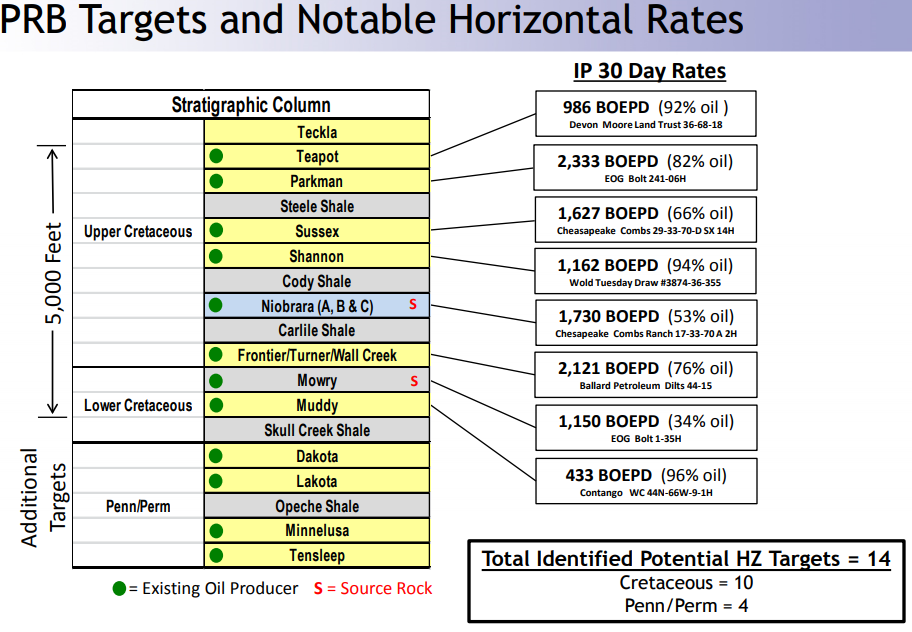

The Powder River Basin also has extensive stacked pay, as the Turner is far from the only potential target. The familiar Niobrara formation is only one of a number of hydrocarbon-bearing formations, as plays like the Frontier, Mowry and Parkman all have potential. In total, Anschutz reports there are 14 identified potential targets for horizontal wells, stretching over 5,000 feet of formations.

The public companies are targeting the play as well

Several public companies seem to share a similar view, with extensive Powder River operations of their own.

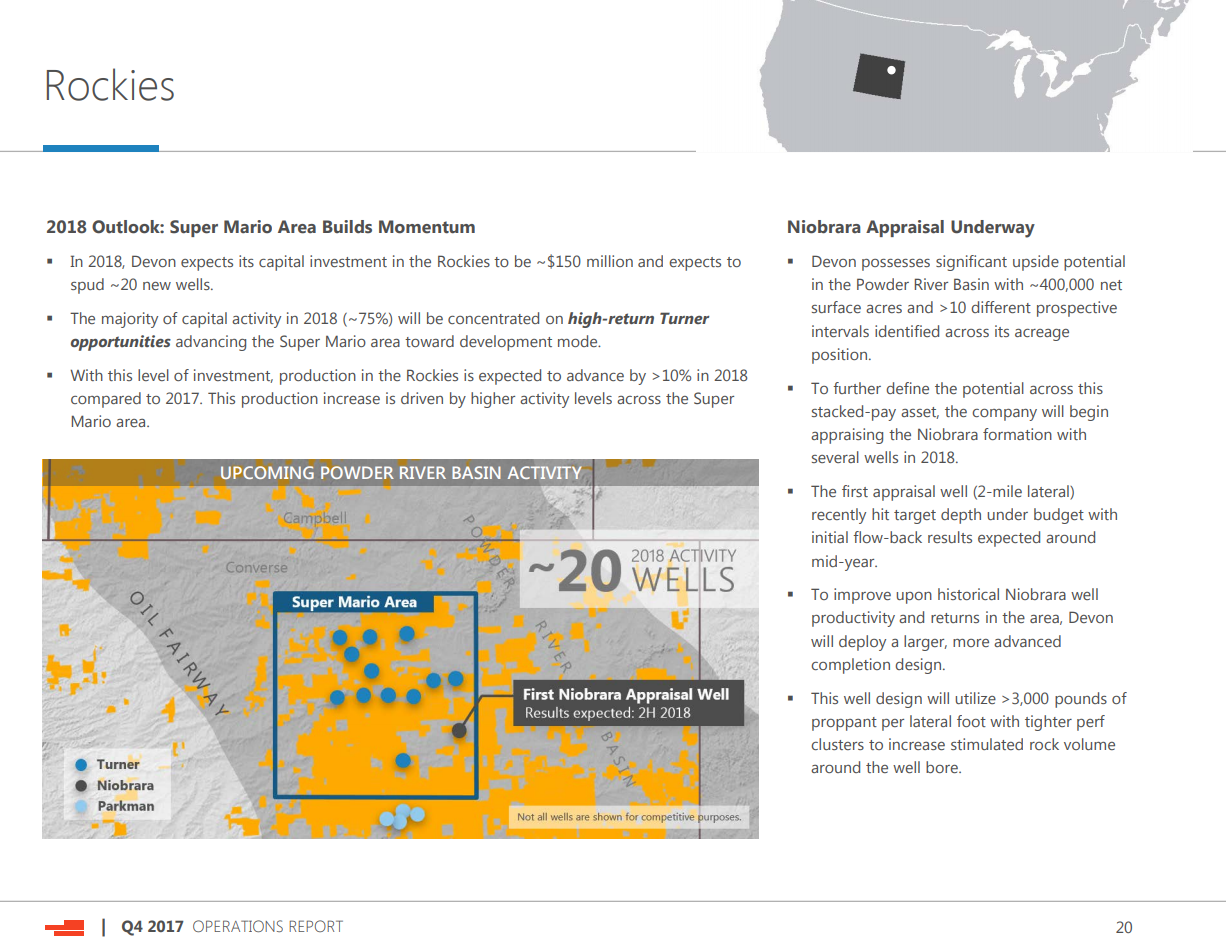

Devon Energy (ticker: DVN) is the largest acreage holder in the basin, with 470,000 net acres. Devon has similar plans to Anschutz in 2018, and expects to spud 20 new wells primarily targeting the Turner formation.

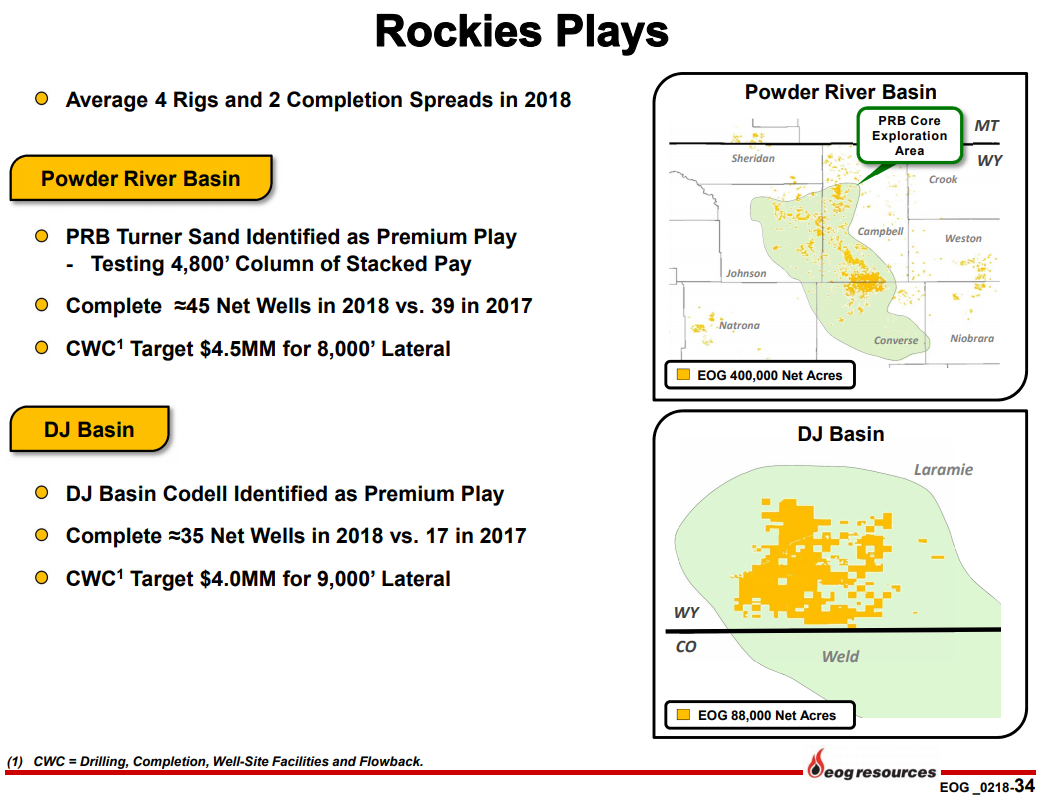

EOG, the second-largest acreage holder in the basin, is also targeting the Turner formation, and considers the area “premium pay.” EOG is targeting an average drilling cost of $4.5 million for the play.

Chesapeake, one of the other major players in the PRB, is currently targeting the Turner sandstone, but reports there are multiple potential targets for future development. The company plans to run a four-rig program for most of 2018, and may increase this to a five-rig program if conditions are favorable.